There is an old axiom within investment circles that companies with high ‘insider’ ownership – management with genuine skin in the game – are more likely to be successful because the goals of those running the business and its shareholders are fully aligned.

This is why the market responded with disgust and disillusionment when three key directors of one-time ASX darling DroneShield (ASX: DRO), including the CEO and chairman, ran for the exit last November by offloading over $70 million worth of their shares.

The severity of this insider sell-down triggered a sharp decline in the share price – 60% in the weeks that followed - which shaved $2 billion off the value of the stock.

Having sold down 100% of their holdings, the only stakes these directors retain in the company are through unvested options and performance shares (big deal).

Droneshield's overhang

While the company has fessed up to its disclosure mistake - the erroneous announcement of a "new order" for $7.6 million that was, in fact, a previously disclosed contract - and implemented several governance reforms to restrict management's ability to "sell out" in future, investor trust in the stock has clearly been tarnished.

Admittedly, the stock has more than doubled since plummeting to $1.71 late November.

However, the stock is still trading around 40% down on its early-October peak of $6.60.

On a more comforting note for retail investors, while some institutional investors followed the CEO and three directors out the door, the top 20 shareholders in the stock – predominantly institutions – control around 41% of the stock.

Nevertheless, without that critical buy-in by the people running the business, it will be hard for the market to look at Droneshield the same way it did before last November.

This overhang may go some way to explaining why Droneshield is the ASX’s ninth most shorted stock.

Another defence-related stock with strong insider ownership

Meanwhile, if you’re still attracted to stocks with strong insider ownership and growing exposure to the defence sector, why not take a look at Mayfield Group (ASX: MYG)?

While the exposure of management to Droneshield’s share price is now negligible, individual insiders within Mayfield – those close to the business – control over half of its ownership (52%).

Admittedly, unlike Droneshield, Mayfield is not a pure-play defence stock, however, its exposure to military spending is growing.

Mayfield’s top 20 shareholders - including Sydney-based private equity and investment firm Nightingale Partners, which own 42% - hold 90.96% of shares on issue.

Nightingale Partners is controlled by Jens Neiser who previously served as a non-executive director of Mayfield, while the company’s CEO Andrew Rowe holds 3.8% of total shares outstanding.

Overall, the company’s top four shareholders control around 50% of the company which suggests they wield a major influence on the business.

Given that Mayfield has a market capitalisation of around $361 million, these four individuals control around $180.5 million of the company’s shares.

Do stocks with insider ownership outperform?

If you are dubious about the value of owning stocks in which management have their own money at stake, think again.

High insider ownership can reduce the "free float" (shares available for public trading), leading to lower liquidity and increased price volatility if a large insider decides to sell.

But research shows that founder-led companies - where insiders typically hold large stakes - tend to outperform the S&P 500 index across various sectors, not just technology.

Analysis of over 4,000 trades reveal that following recent insider purchases can generate significant "alpha" (excess return), with one study finding such stocks beat the S&P 500 by 17.6% over a one-year period.

Has Mayfield Group outperformed?

Due to a number of meaningful structural tailwinds in energy, infrastructure and more notably defence spending, the stock has surged 296% in one year and around 23% in the last month.

While the stock is by no means a household name, it specialises in critical electrical infrastructure, including switchgear, protection systems, turnkey installations and long-duration engineering support across utilities, defence, industrial operations and major renewables.

While the stock has benefitted from significant upgrades to transmission lines and renewable energy generation, it is also a beneficiary of a rise in defence spending, with higher demand for secure energy systems and engineered electrical solutions.

To the uninitiated, Mayfield listed on the ASX in late 2020, specifically completing a "backdoor listing" in December 2020 by reversing into Stream Group Limited.

Late last year, Mayfield applied to the ASX for quotation of 631,907 ordinary fully paid shares under the code MYG, following the full payment of previously unquoted partly paid securities.

While the move will increase the number of the company’s quoted securities on issue - modestly enhancing its free float and liquidity for shareholders - the announcement did not disclose any broader strategic or operational implications.

Last October, Bell Potter expected Mayfield to deliver 19.8% EPS compound annual growth (CAGR) over FY25-28 underpinned by:

• the acquisition of BE Switchcraft (FY26 pro-forma EBIT accretion of $1.8 million assuming no growth in FY26)

• a growing work-in-hand (WIH; currently $115 million), providing good visibility on near-term revenue delivery, with strong conversion of current prospect opportunities (totalling $850 million) to drive upgrades to revenue forecasts, and

• further EBITDA (earnings before interest, tax, depreciation and amortisation) margin expansion due to operating leverage from 9.7% in FY25 to 10.6% by FY28.

FY25 result

The company announced strong results for the full year FY25, with earnings of $11.5 million - up 73% on FY24 – based on revenue of $118.1 million, a 37.9% increase from FY24.

Other noteworthy numbers for FY25 were:

• Net profit after tax (NPAT): $6.8 million, a 32% increase from FY24 ($5.1m)

• Profit before tax: $9.9 million, more than doubled from the previous year

• Cash: $16.9 million, and

• Dividends: 8.3 cents per share, including a 5.3 cents special.

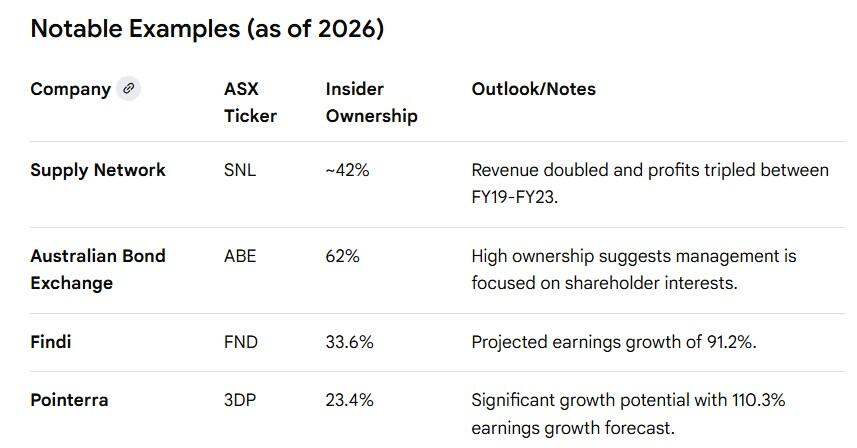

Other notable examples of ASX stocks with strong insider ownership include: