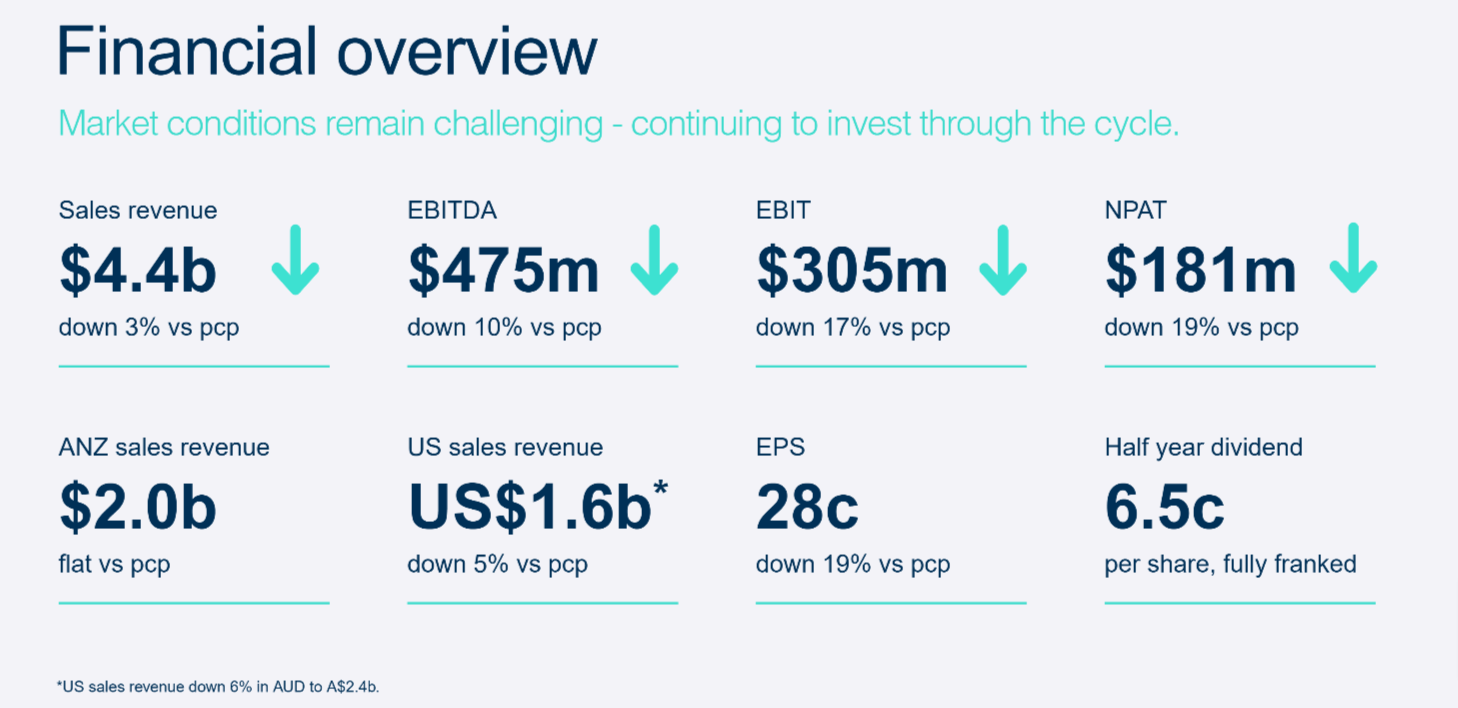

Reece Group announced its HY25 financial results, highlighting a challenging first half. Sales revenue declined by 3% to $4.4 billion, EBIT dropped 17% to $305 million, and EPS fell 19% to 28 cents.

Despite these headwinds, the company maintained its commitment to growth, allocating a capex to sales ratio of 2.9% and declaring an interim dividend of 6.5 cents per share.

CEO Peter Wilson attributed the softer performance to mortgage rates and affordability issues impacting the sector.

“Our performance for the first half reflects the challenging trading environment in both regions as mortgage rates and affordability continue to create near term headwinds in our sector," Wilson said.

“Despite the softer first half we continued to invest in the business, expanding our branch network, lifting store standards and enhancing our core capabilities.

“While we know the short term will have its challenges, the current environment is one Reece has seen before. Like we always do, we’ll look beyond the cycle to protect and grow the business.

“Over the last half we’ve taken the opportunity to reset our leadership team and refresh our Board. These changes will enable us to leverage deep industry and market knowledge across the Group and drive long-term value.”

Operationally, Reece faced difficulties across its regions. In ANZ, sales revenue was flat at $1.980 billion (HY24: $1.972 billion), while EBITDA and EBIT decreased by 12% (HY24: $307 million) and 17% (HY24: $233 million), respectively.

The US region saw a 5% drop in sales revenue to US$1.596 billion, with EBITDA down 6% and EBIT down 15%.

Despite these challenges, Reece expanded its network with 14 new branches in ANZ and 18 in the US.

Looking ahead, Reece remains focused on its strategic priorities, investing in people, training programs, and digital capabilities.

The company's efforts to build a resilient business are evident in its expanded employee share purchase scheme and acquisition of digital product agency Shadowboxer.

Reece aims to navigate the current environment while positioning itself for future growth.

At the time of writing, Reece Ltd's stock price (ASX: REH) was $21.95, with a market cap of approximately $14.18 billion.