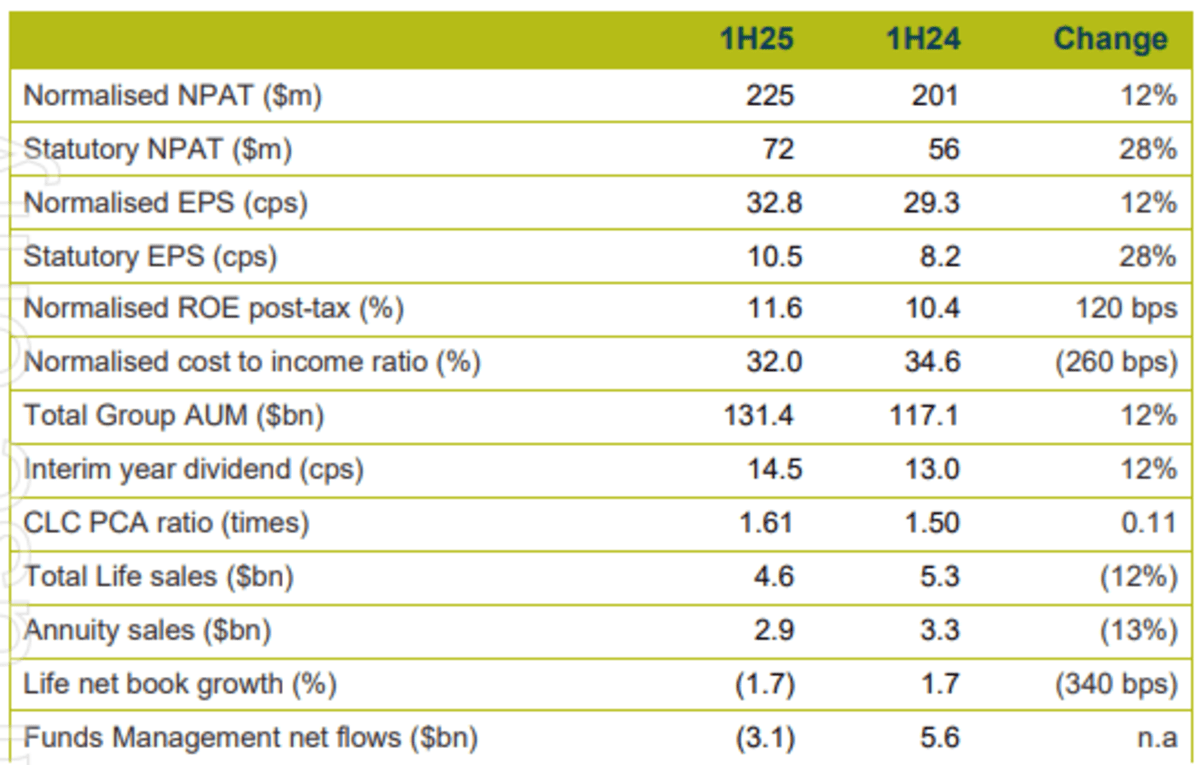

Challenger has announced a 28% jump in statutory net profit after tax to A$72 million for the first half of the 2025 financial year (H1 FY25).

The investment management and financial services company said normalised net profit after tax (NPAT) increased 12% to $225 million on revenue which rose 4.4% to $1.569 billion in the six months to 31 December 2024.

The company said the increase in normalised NPAT was driven by higher earnings from the life and funds management businesses and action to structurally reduce the expense base.

The statutory net profit includes the impact of commercial office property revaluations and accounting valuation changes on life risk liabilities.

Challenger said normalised NPAT was its preferred measure of profit because it removed the effects of changes in the value of assets and liabilities supporting its life business and one-off and non-recurring significant items.

Challenger, which offers retirement income products like annuities, declared a fully franked 14.5 cents per share interim dividend, up 12% on the previous corresponding period, to be paid on 18 March to shareholders on record on 26 February.

The company also reaffirmed its FY25 normalised net profit after tax guidance of between $440 million and $480 million, with the mid-point of the range representing 10% growth on FY24.

“In the first half of 2025, Challenger reported a strong result as we delivered against our financial targets and executed our growth strategy,” Managing Director and Chief Executive Officer Nick Hamilton said in an ASX announcement.

He said record retail lifetime and Japanese annuity sales contributed to total sales from the life business of $4.6 billion while the value of active management was demonstrated as funds under management increased 3% to $121 billion.

“Challenger enters the second half of the financial year in great shape. We have a business with strong fundamentals that is achieving our targets and will generate long term sustainable growth,” Hamilton said.

Challenger (ASX: CGF) shares closed one cent lower at $6.13 on Monday, capitalising the company at $4.2 billion.