Given that they’re continuing to struggle with large discounts, it’s hardly surprising that Morningstar's latest research found that most of the 80-odd ASX listed investment companies – aka LICs - have underperformed the ASX 200 Total Return Index since the start of 2025.

With LIC’s typically charging 1% to 1.5% of their of the net assets as a management fee, frustrated investors may choose to off-load underperforming LICs within the next 6-12 months in favour of low-cost and better performing exchange traded funds (ETFs).

The latest industry pulse noted shares of asset managers are likely to remain volatile, as investor sentiment remains vulnerable to U.S. tariffs and macroeconomic uncertainties.

As income without excessive risk becomes harder to find amid falling interest rates, it’s understandable why investors may look to equities-focused LICs to fill that gap.

But in light of myriad macroeconomic headwinds, Morningstar’s research forecasts modest returns for LICs in the medium term after they achieved double-digit gains last year.

Lumpier growth despite more rate cuts by the Fed

While equity markets appear buoyed by the prospect further rate cuts by the U.S. Federal Reserve, Morningstar equity analyst Shaun Ler reminded investors that this won’t necessarily translate into performance for traditional active managers.

"Flow growth for our coverage deteriorated for the third quarter going into June 2025," he said.

“We expect medium-term flows to be lumpier than levels seen in the last 12 months as the tariff relief rally fades and U.S. stagflationary risks rise.”

Challenger (ASX: CGF) and Insignia Financial (ASX: IFL) were the consistent outperformers, with the former benefitting from improved product sales and operating margins while the latter was being priced for an anticipated acquisition by an external suitor.

Unsurprisingly, Morningstar’s report highlighted the need for active managers to strongly sell their points of difference to investors or risk being overlooked for passive ETFs that can replicate them at low-cost.

"Firms specialising in less commoditised segments - such as private credit or specialised fixed income strategies - are relatively better positioned to grow," the Morningstar report noted.

Downward pressure on fees

Given the difficulty many LICs have justifying high fees amid unsatisfactory performance, many traditional active managers continue to face market share losses.

While some firms like Pinnacle Investment Management (ASX: PNI) have tried to withstand fee pressures by shifting focus to higher-margin asset classes, the broader trend on fees remains downward as competition from passive funds continues to exert fee pressure.

"We anticipate continued fee compression across all covered firms' investment strategies through to fiscal 2030," the report read.

Unsurprisingly, active managers are currently facing a shake-out with underperforming firms at risk of either losing funds under management or facing closure.

In the year to July, more than 12,000 Australians lost $1 billion due to three major collapsed or frozen investment schemes: First Guardian, Shield Master Fund and Australian Fiduciaries.

The corporate regulator attributed the blame to salespeople pressuring customers to invest in specific products.

LICs hurtle towards obsolescence

To attract and retain flows, active managers must consistently deliver above-average returns, which Morningstar notes is becoming increasingly difficult to achieve.

"The rise of passive investments, whose basic value proposition is index tracking at a low cost, has made active managers who fail to outperform their benchmarks increasingly obsolete,” the Morningstar report said.

The report also noted that even an LIC like GQG Partners (ASX: GQG) which has a stronger long-term track record, faced near-term challenges, demonstrating the difficulty of consistently outperforming.

"Barring lasting, significant performance improvements, firms will be forced to pursue more defensive measures such as realigning compensation or forging external partnerships to defend market share and earnings," the Morningstar report concluded.

LICs V ETFs

It’s no secret that ETFs are continuing to take market share from LICs and other investment products.

In August, there were 388 ETF products with a market cap of $299 billion - up 36% year-on-year.

By comparison, the 80-plus LICs and Listed Investment Trusts (LITs) - collectively known as listed investment vehicles - have a market cap of $55 billion, around 20% that of ETFs.

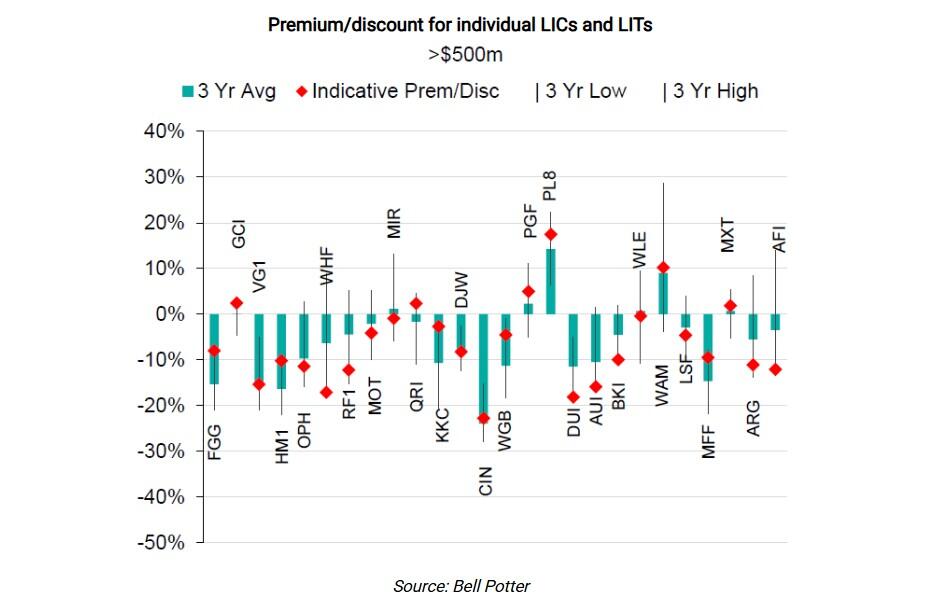

According to Bell Potter, LICs trade close to their widest discounts to net tangible assets (NTA) in history.

While fixed income LICs now trade at a small premium to NTA - a big turnaround from much of the previous five years - in equities, mid and small LICs have the widest discounts to NTA.

Unsurprising in light of recent market jitters, it’s private equity LICs are the most unloved of all investment categories.

Standout LICs

Interestingly, it’s the two largest LICs, Australian Foundation Investment Company (ASX: AFI) and Argo Investments (ASX: ARG) stand out, with NTA discounts near three-year highs.

Both stocks have been hindered by below benchmark performance over one, five, and 10 years.

With the market awash with funds, as hybrids mature looking for a new home, more investors are piling into equity income LICs, and having read the market tea leaves more players have entered the market.

Newer equity income products to hit the market, including WAM Income Maximiser (ASX: WMX) and Whitefield Income (ASX: WHI).

Meanwhile, The Plato Income Maximiser (ASX: PL8) now trades at an 18% premium to NTA.

Some of the other Wilson funds have also proven popular with the premium driven by a strong reputation for delivering income and an ongoing commitment to marketing (see table).

Why the discount

So exactly why are LICs on average continuing to trade at large discounts to NTA? And if they’re so mouth-wateringly cheap, why aren’t investors stepping up to buy these discounts?

Accordingly to Ophir’s Andrew Mitchell and Steven, lower interest rates have been associated with higher premiums to NTA and higher interest rates have been associated with higher discounts to NTA.

So what is the connection between rates and LIC NTA premiums and discounts?

“Basically, we have shifted from an interest rate world of 0% during COVID in 2020 and 2021 where the ‘TINA’ (There Is No Alternative to equities) moniker was in play and many saw shares as the only investment choice to “TIARA” (There Is A Reasonable Alternative) where fixed income and even cash investments have become more attractive again,” they said.

Interestingly, the narrowing of NTA discounts in recent months coincides with RBA cuts to interest rates and seems to lend credence to Mitchell and Ng’s assumptions.

While interest rates are an important driver, the other factors they mentioned, especially size, liquidity and investment performance, also play crucial roles.

The difference between LICs and ETFs

While LICs and ETFs may be available over similar investment asset classes they are completely different on many fronts.

it is important to remember that they are different structures and as such can provide different outcome for investors; both positive and negative.

The vast majority of ETFs available in Australia today by both number and value passively track an index of sorts, while LICs are actively managed.

This means that an LIC investment manager knowing they have a stable capital base can buy, hold or sell underlying investments at their discretion to assist in meeting their investment objectives.

When deciding whether to invest in a managed investment, such as an LIC or ETF, the cost of running the investment is one of many important considerations.

While ETFs are predominantly passive in nature, active management requires considered decision making, while typically comes at a price.