Attention has turned again to Japan’s significant on-selling of Australian liquefied natural gas (LNG), prompting a wave of criticism about the consequences for energy markets and our resources policy. Yet could one of our close allies actually be doing Australia's LNG industry a favour?

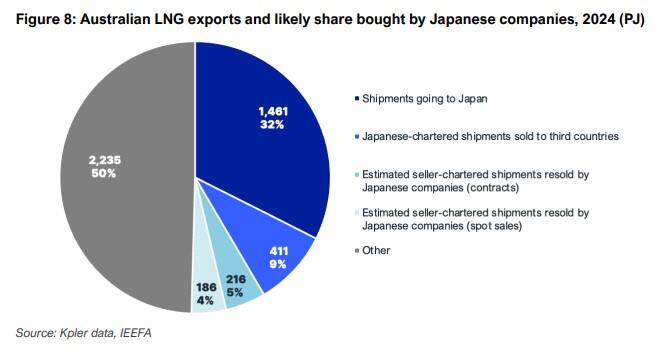

An Institute for Energy Economics and Financial Analysis (IEEFA) briefing note late last month estimated that Japanese trading houses resold an estimated 627-812 petajoules (PJ) of Australian-produced LNG in 2024.

"This compares with 511PJ of domestic gas consumption in Eastern Australia in 2024 (excluding gas used for LNG production)," says the IEEFA - which astonishingly surpasses the entire gas consumption of the East Coast during the same period.

That's triggered fresh concerns over Australia’s ability to secure its own domestic energy supply while exporting vast quantities of gas to overseas markets, only for that same fuel to be resold by third parties at a profit.

Half our LNG exports resold

Analysts from IEEFA have been voicing this for a while now, and the organisation's data showed around 41% of Japanese LNG re-sale volumes came from Australia last year to the tune of A$14 billion.

The majority is ultimately destined for Taiwan and South Korea - both priority markets for Australian exporters.

“Taiwan and South Korea present the highest value of Australia’s major LNG markets at A$979 and A$1,086 per tonne of LNG respectively, compared with an average export value of A$921 per tonne," says the IEEFA.

However, upon further investigation that 41% is more like 50%.

“Based on our estimates, Japan resells about half as much Australian LNG to third countries as it imports for its own consumption,” says the IEEFA.

“This analysis also reveals that Japanese companies may be buying much more of Australia’s LNG than previously understood.

"In addition to the 32% of LNG going to Japan, Japanese companies likely purchase between 14% and 18% of Australian LNG to resell to other countries.

“This would mean that Japan buys up to half of Australia’s LNG.”

This implies that Japanese companies are not only absorbing discounted Australian gas under long-term contracts - but also capturing market share in Asia by re-selling the gas, often at higher spot market prices.

It's illegal to buy tickets to events and on-sell them for profit here in Australia. Just sayin'.

Japan's LNG strategy

Japan’s entirely legal trading behaviour comes at a time when local shortages and price volatility are key political issues. It spent US$41 billion on LNG imports in 2024 - up from US$30 billion in just nine years.

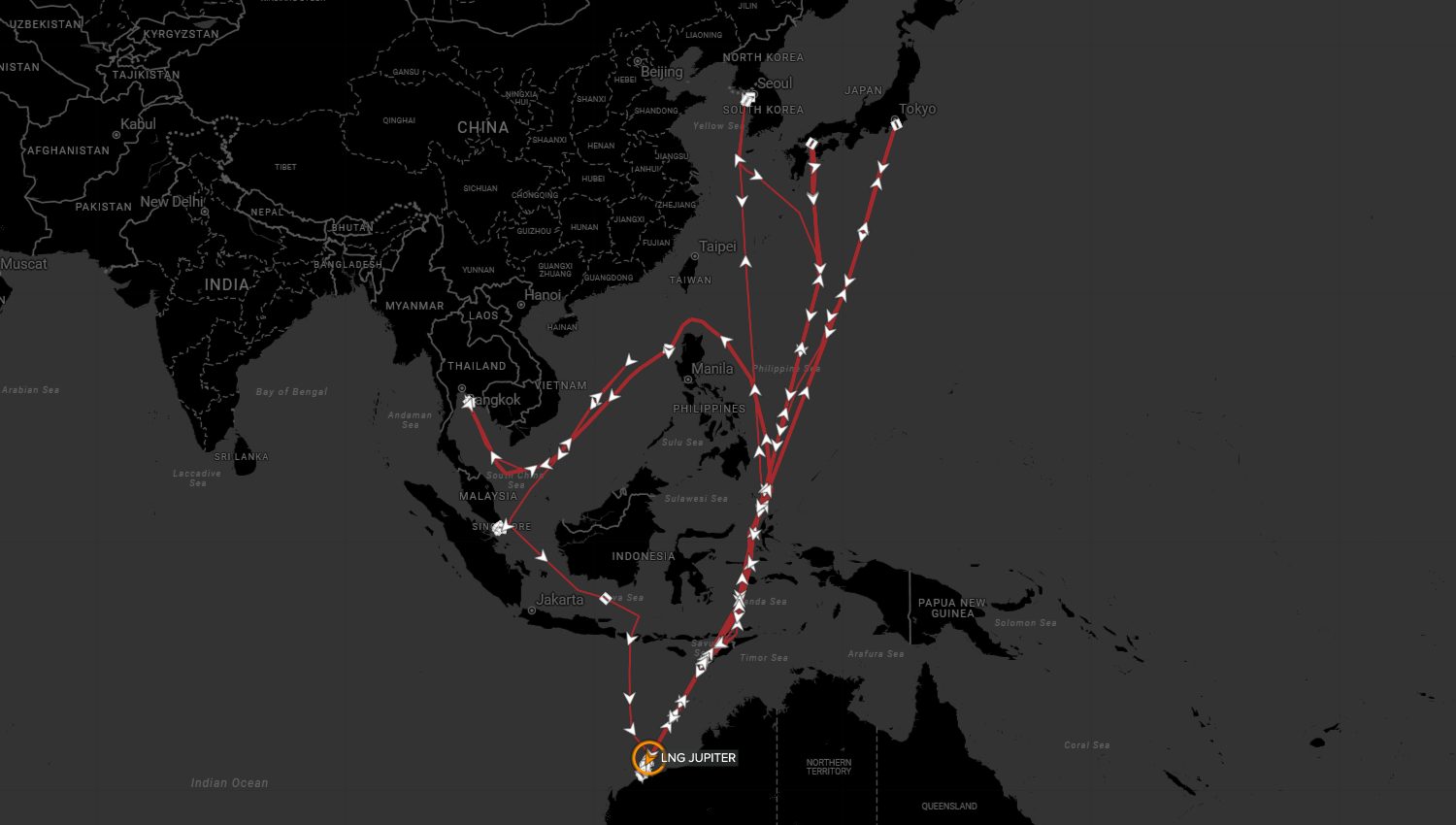

Its ‘re-export’ activities are not just opportunistic, but represent a calculated transition towards becoming a regional gas hub, leveraging its legacy contracts and infrastructure to gain commercial advantage.

The whole thing raises questions about the structure of existing LNG contracts, often lacking destination clauses that would prevent the resale of fuel to unauthorised or unintended markets.

Japan’s Ministry of Economy, Trade and Industry (METI), with a directive to boost regional influence, has a 2030 target for Japanese companies to transact at least 100 million tonnes of LNG each year.

“Although Japan’s domestic LNG demand has fallen 25% since 2014, the fixed target implies that companies should continue investing in new LNG supplies while reselling more volumes overseas," IEEFA wrote.

“About 43-45% of LNG shipments are transported on vessels chartered by sellers [and the rest] appears to be dominated by non-Japanese intermediaries.”

For Australia, the strategic implications of this practice are profound, since the same volumes of gas now fuelling third countries’ economies via Japan could otherwise have supported domestic supply or been marketed directly by Australian producers.

Yet could Japan's LNG trade practices actually be a good thing?

North West Shelf

The lion's share of LNG that goes to the land of the rising sun comes from Western Australia's North West Shelf (NWS).

Global energy producers Chevron, BP, BHP and Japan's MIMI are in a JV with local starlet and operator Woodside (33%) at the mammoth, untapped Browse gas field there - which could feed all of the country's domestic gas needs for almost the next two decades.

In a boon for those companies, the Australian government, somewhat contentiously, provisionally extended extraction rights at the NWS for another 40 years until 2070 just last week.

Yet Australian projects - often high cost and politically exposed - may struggle to maintain their market positions without significant contracts or government support.

Locking in gas contracts could be further complicated by a growing LNG supply glut - driven by expansionist policies from both the Qataris and the Americans.

Australia’s energy strategy now has to reckon with regional trading dynamics and geopolitics as much as local supply and demand.

The issue reeks of another ‘stuck between a rock and a hard place’ situation - akin to the Australian government's looming decision over the Port of Darwin.

Find out more: Port of Darwin decision to test diplomatic balancing act

Speaking of balance, Japan's on-selling could be seen as a natural segway to contractual trading in an oversupplied market, but one that highlights Australia's policy gaps.

With LNG markets roiled by new players and shifting demand, all parties - Japanese buyers, Australian sellers and governments - must navigate these competing priorities or be caught holding an empty gas pipe.