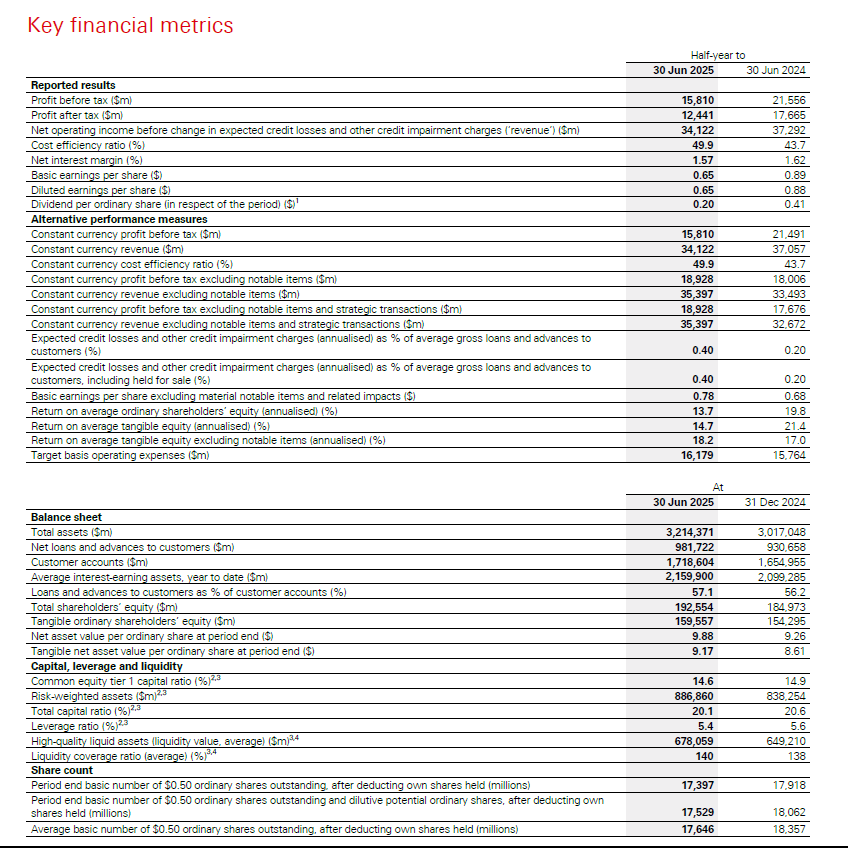

HSBC Holdings plc reported a 30% drop in profit after tax to US$12.4 billion in the first half of 2025, with revenue down 9% to $34.1 billion.

The decline was largely due to the non-recurrence of $3.6 billion in gains from prior disposals in Canada and Argentina, and $2.1 billion in impairment losses tied to its stake in Bank of Communications.

Despite these headwinds, constant currency profit before tax excluding notable items rose to $18.9 billion, and the bank maintained a 14.7% return on tangible equity.

HSBC reported profit before tax of $6.3 billion and revenue of $16.5 billion, both slightly below the prior period’s $6.99 billion and $16.67 billion, respectively.

Key metrics reflect a tougher operating environment. Net interest margin fell 5 basis points to 1.57%, while expected credit losses rose to $1.9 billion, driven by pressures in Hong Kong’s commercial real estate sector and broader economic uncertainty.

Operating expenses increased 4% to $17.0 billion due to restructuring and technology investments. The CET1 capital ratio dipped to 14.6%, within HSBC’s target range of 14–14.5%.

Segment performance was mixed. Commercial and Institutional Banking posted $6.4 billion in profit before tax, up from $6.1 billion, while the Hong Kong and UK segments saw slight declines. International Wealth and Premier Banking contributed $2.1 billion, down from $2.3 billion. HSBC has reaffirmed its strategic goals, targeting a mid-teen RoTE through 2027 and projecting $42 billion in net interest income for 2025. It also expects credit losses to remain around 40 basis points of average gross loans.

Shareholder returns remain strong, with $9.5 billion distributed via dividends and buybacks in 1H25. A second interim dividend of $0.10 per share was approved, and a new $3 billion buyback was announced.

CEO Georges Elhedery highlighted HSBC’s focus on simplification, agility, and customer-centric growth, aiming for $1.5 billion in annualised cost savings by 2027.

Elhedery said: “We’re making positive progress in becoming a simple, more agile, focused organisation built on our core strengths. In the first half, we continued to execute our strategy with discipline and each of our four businesses sustained momentum in their earnings with each growing revenue. This gives us confidence in our ability to deliver our targets. We continue to navigate this period of economic uncertainty and market volatility from a position of strength, putting the changing needs of our customers at the heart of everything we do.”

Total assets rose to $3.21 trillion, and comprehensive income reached $21.0 billion, supported by $6.4 billion in foreign exchange gains.

At the time of writing, HSBC Holdings plc (LON: HSBA) shares were trading at £971.60, up £11.80 (1.23%) today. It has a market cap of around £170.26 billion.