It is tempting to judge your stock-picking success on the rise or fall of the stock price at any given moment but it is important to remember that capital gains – the difference between the purchase price and what the stock is worth now – are not a complete picture of how your shares have generated returns within your portfolio.

Ironically, while some investors are fixated exclusively on share price, another cohort - typically income-focused investors – can be singularly focused on income derived from myriad forms of corporate activity and virtually ignore share-price movements.

A more definitive picture

However, a more complete way to gauge how a stock has performed over a specified time frame is to take what is called a total returns snapshot.

It is not brain surgery -total return typically refers to the return from all sources, including capital gains and the all-too often overlooked income from dividends - and/or or other distributions to you the shareholder – within a single metric.

This more holistic measure is also useful when wanting to compare investment returns among dividend-paying stocks, and how they rate with their non-dividend-paying counterparts.

It can also help compare investment results when a stock has been in your portfolio for several years.

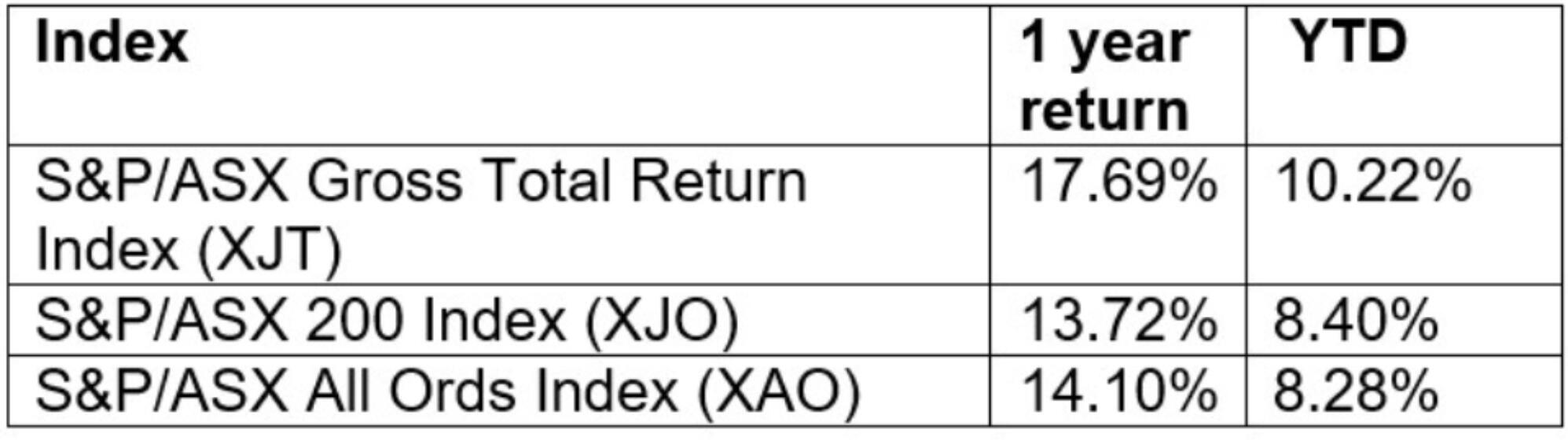

Compare these indices

(As of end of trading 11 August 2025)

Total returns: the workings

While calculating total returns is not hard, there are a number of steps to getting the numbers you are looking for:

Capital gains: You paid $20 for a stock and it is now trading for $30, which means your capital gain is $10 per share.

Income: Next you need to add the dividends plus other distributions the stock has paid over your entire holding period.

By combining capital gains with income received you wll be able to work out the total return as a dollar amount.

There are three steps to seeing the total return expressed as a percentage:

- Take the dollar amount of total return you calculated.

- Divide by the price you paid for the investment.

- Multiply the result by 100.

Here are the steps to annualise the total return:

Take the percentage total return you found in the previous step (written as a decimal) and add 1.

Then, raise this to the power of 1 divided by the number of years you held the investment.

Then you need to subtract 1.

Confused? Here’s the total return formula for added guidance.

Annualised total return equals the total return plus one, raised to the power of 1 over the number of years, then subtracting 1.

A classic example

You bought shares in BFN Ltd on 2 January 2 2023 and sold them on 2 January 2025, and you want to determine your total return on your investment.

Here’s the detail you need.

You bought shares for $22.60.

Two years later, you sold those shares for $25.50.

Over the two-year holding period, BFN Ltd paid eight quarterly dividends, which added up to $0.92.

The workings

Armed with the information above, we can firstly calculate your total returns:

Capital gain on each share: $2.90 per share i.e $25.50 - $22.60.

Adding the $0.92 in dividends to your capital gain of $2.90 and your total return was $3.82 per share.

Now we need to work out what the total return is as a percentage:

Divide the $3.82 total return by the purchase price [for each share] $22.60, and then multiply by 100.

This gives you a total return of 16.9% over two years.

Why total return is an important metric for investors

Clearly, one of the key benefits of understanding total returns is that it removes the temptation to fixate solely on price movements that can lead to misguided investment decisions, potentially causing you to sell profitable positions based on incomplete information.

Here are four reasons why total return matters:

- Performance insight: By considering capital gains and income, total returns give you a clearer picture of how your stock is performing and for investors in exchange traded funds (ETFs), which can pay dividends, this is especially important.

- Comparative power: Whether you’re evaluating Australian ETFs or global ones, total return gives you a level playing field on which to compare their performance; accounting for market growth and income.

- Long-term planning: Understanding total return helps ensure your investments are on track for long long-term goals like retirement. Focusing on total return gives you a more accurate picture of how your portfolio is growing relative to future needs.

- Risk vs. reward: Total return is a reminder of whether the returns you are getting are worth the risk you are taking. This is especially important for ETF investors looking for a diversified portfolio that balances growth and income.