In light of plans by the Australian government to introduce additional taxes on superannuation balances above A$3 million for the 2026/27 tax year onward, Azzet (with the help of Optimum Pensions) decided to unpack how the new tax will work and alternative options for retirees with superannuation balances that place them in the highest tax bracket.

How the new tax will work

Firstly, let's look at the workings of the Division 296 tax proposals, now being referred to as the Better Targeted Superannuation Concessions (BTSC), measure up.

Currently, earnings on pension accounts within the super environment are generally tax-free, subject to the Transfer Balance Cap when the account is first commenced.

Earnings on superannuation in accumulation accounts (less deductions and franking credits) get taxed at 15%.

The proposed new tax (referred to as BTSC tax) will mean an additional 15% tax is payable on superannuation earnings that are attributed to the proportion of a person’s balance over $3 million, and a further 10% tax is payable on earnings attributable to the balance in excess of $10 million.

Here are two examples: one for a person with $4.5 million in super and the other for someone with $12.9 million in super on 30 June 2027.

Example one

- The Total Super Balance from her two superannuation funds comes to $4.5 million at the end of the 2025-27 tax year.

- She had a total of $400,000 realised earnings calculated by her two funds (adjusted for elements such as contributions and pension phase income using methods closely aligned with existing tax concepts).

- The portion of her $4.5 million balance above the $3 million threshold is 33.33%.

- Her BTSC tax liability is therefore $15,000 (15% x 0.3333 x $300,000).

Example two

- The Total Super Balance of $12.9 million, and $840,000 realised earnings at the end of the 2026-27 tax year.

- The proportion of her balance above the $3 million threshold is 76.74% and the proportion above $10 million is 22.48%.

Her BTSC tax liability is therefore $115,581 calculated as follows:

- 15% x 0.7674 x $840,000; plus a further

- 10% x 0.2248 x $840,000

It is a personal tax obligation, payable by the individual, but the person can elect to pay it from their superannuation balance.

‘Non-super’ lifetime income: an overlooked option

A frequently overlooked option for what’s now considered ‘excess super’ is to take advantage of Australia’s new ‘non-super’ lifetime income products.

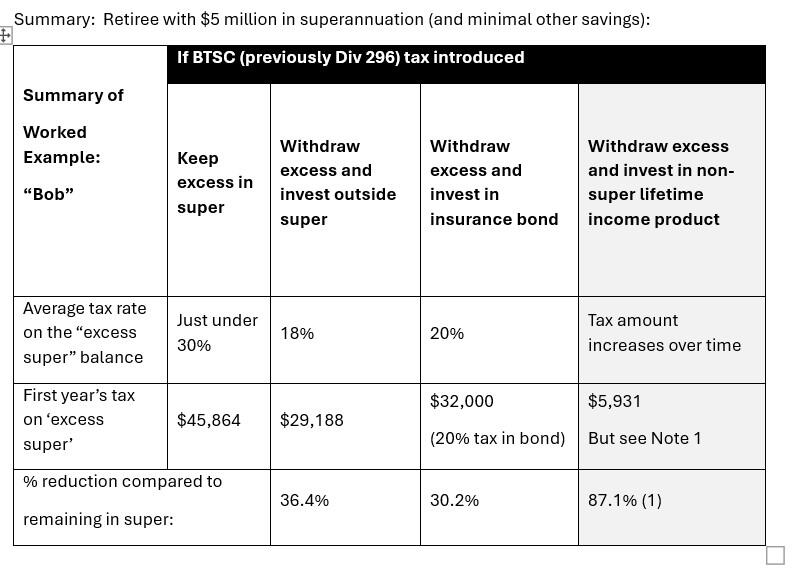

The following example shows how it’s possible for a retiree with $5 million in super to slash the tax bill on their excess super in the first year by 87% compared to leaving it where it is.

Like a salary without the work

According to David Orford, managing director of Optimum Pensions, income products provide income with the regularity of a salary without having to work.

What retirees are doing when they allocate some savings to a non-super lifetime product, adds Orford, is teeing up a sustainable income stream for the rest of their lives and a second person if they include a reversionary beneficiary.

“This generally reduces the need to spend from the retiree’s other assets and helps create confidence, stability of income, spending power and happiness,” he says.

Other options: Where else could your excess super move to?

However, superannuation is not the only option for retirement savings.

Other options include withdrawing the excess and using one or more of the following instead:

- Invest outside of super: If retirement savings are moved outside the superannuation system. then the investment earnings on that money - such as bank interest, dividends, rental income and capital gains – are taxable at the individual’s marginal tax rate.

However, many retirees find that their marginal tax rate falls significantly once they stop receiving a salary.

This means their investment earnings may be taxed lightly, as they can use the lower tax brackets before moving into higher rates.

Currently, taxable income up to $18,200 attracts no tax, income up to $45,000 is taxed at 16%, then 30% applies up to $135,000, 37% up to $190,000 and 45% beyond that.

The 2% Medicare Levy is paid in addition.

Retirees aged 67 or more may also benefit from the Senior and Pensioners Tax Offset (SAPTO) if their income is below an income test.

For example, if bank interest rates were 5% annually, a retiree would need around $900,000 on deposit before the interest pushed them into the 30% tax bracket, and about $2.7 million before reaching the 37% bracket. - Invest in Insurance Bonds: An insurance bond (aka an investment bond or life insurance bond) is an investment held within a life insurance structure.

The life insurer pays tax at a flat rate of 30% on the investment earnings within the fund; however, franking credits on dividends and other tax optimisation strategies can reduce the effective rate well below 30%.

Indicative tax rates as low as 15% or even less are possible for long-term growth-oriented insurance bonds.

This tax on insurance bonds is a life insurance fund tax, and individual investors do not need to declare earnings or pay further tax, provided they meet certain conditions.

If the bond is held for 10 years or more, all withdrawals are completely tax-free-including capital growth. Invest in non-super lifetime income products or annuities: With an annuity, the amount you invest is converted into lifetime income payments that will get paid to you each year for the rest of your life.

The initial level of payments will depend on your life expectancy and the product’s design rules. There are lots of product options available, each often including a large range of investment options to choose from.

There is no tax on the investments supporting these annuities, however, with non-super lifetime annuities, each annuity payment made consists of:• A tax-free Deductible Amount annually (equalling the purchase price divided by the annuitant’s life expectancy from the Australian Life Tables when they purchased the annuity), and represents a return of capital over time.

• The remainder – which gets included in the annuitant’s taxable income, i.e. taxed at the individual’s marginal rate. Note that, as above, retirees have the lower tax bands available before paying more than 30% tax on this.

For lifetime annuity products where payments increase over time, this taxable amount will increase as the Deductible Amount does not change from year to year.

Working example – Retiree with $5 million in superannuation

The investor in this example is a retired male homeowner aged 62. Let’s refer to him as Bob.

Bob has $2 million of super in a pension account and $3 million in an accumulation account.

His $3 million in the accumulation account currently incurs tax on the investment earnings at 15%, although with franking credits and capital gains concessions, his effective tax rate might be 12%.

Under the BTSC tax rules, we refer to his “excess super” as his Total Superannuation Balance of $5 million, less the $3 million threshold. This comes to $2 million.

A. If Bob keeps his excess super where it is

If he earns 8% p.a. on his investment mix, then his total investment earnings would be $400,000, bringing his total super balance at the end of the year to $5.4 million.

The total tax relating to his ‘excess super’ for the year would be:

- Excess super that’s subject to accumulation account taxes: $2 million x 8% x (say) 12% tax = $19,200 tax

- BTSC tax:

- Earnings of $5 million x 8% = $400,000

- Amount above the $3 million cap = ($5.4M – $3M / $5.4M) = 44.44%

- Tax = $400,000 x 44.44% x 15% = $26,664 tax

- Tax on “excess super” = $45,864

Other options for Bob include:

B. Remove $2 million from super and invest outside of super

If Bob moved his ‘excess super’ of $2 million into a non-super environment and generated a return on it of $160,000 (8% p.a.), then part of this return would be treated as taxable income.

The portion of this non-super investment income that is taxable might be, say, three-quarters of the $160,000 income (due to the reduction from the capital gains tax discount, for example).

This comes to $120,000 taxable income.

He would avoid the BTSC tax as well as the accumulation account tax rate on the $2 million withdrawn from super.

His total tax on the ‘excess super’ he withdrew would, in the first year, be calculated by applying the $120,000 firstly to his 0% tax band, then his 16% band and then his 30% tax band.

- Tax on “excess super” = $29,188 (including 2% for Medicare levy)

Note: This comes to an average tax rate of 18.2% of the gross investment return.

For people who already had non-superannuation assets or income, the marginal tax rate on the additional amounts would be at 30%, 37% or 45% tax plus Medicare Levy – depending on which band it falls in.

C. Remove $2 million from super and invest in an insurance bond

If Bob instead moved $2 million of his super and put this into an insurance bond where the internal tax rate within the bond was 30%, then the tax in the first year might be:

- $2 million x 8% x 30% = $48,000 paid by the bond issuer

In practice, if Bob used a similar investment mix to his super, then the internal tax rate is likely to be less than 30%. If he holds the bond for more than 10 years, then he can fully encash – aka converting into money - the bond without paying any further tax personally.

He is able to make withdrawals prior to 10 years, but should carefully check the tax treatment.

If we use an internal tax rate of (say) 20%, then his total tax for the first year would be:

- Tax on “excess super”: $2 million x 8% x 20% = $32,000

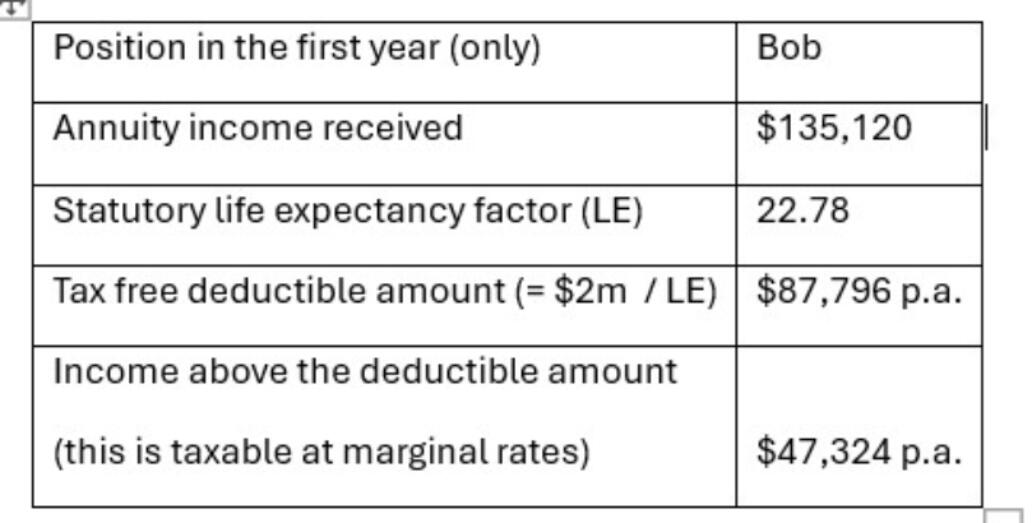

D. Remove $2 million from Bob’s super and invest in a non-super lifetime income product

If Bob withdrew $2 million from his super, he could use that money to buy a lifetime income stream outside of super, assuming he (and/or his reversionary beneficiary) was in good health.

Some insurance companies offer investment-linked versions of this, where the customer can choose an investment mix (e.g. similar investment options to their super) and adjust this over time by switching when they want.

For $2 million, Bob might be offered an annual income from this product type of $135,120 p.a.

This annuity rate is based on an investment-linked lifetime annuity offered by Generation Life, with 5% LifeBooster feature.

There is no tax on the investment income within this product type, but part of the annuity payments received by Bob incur personal tax.

The taxable component equals the income payment less the Deductible Amount, as follows:

Bob's total tax on the ‘excess super’ would be calculated by applying the $47,324 firstly to his 0% tax band, then his 16% band and then his 30% tax band.

- Tax on “excess super” = $5,931 (including 2% for Medicare levy)

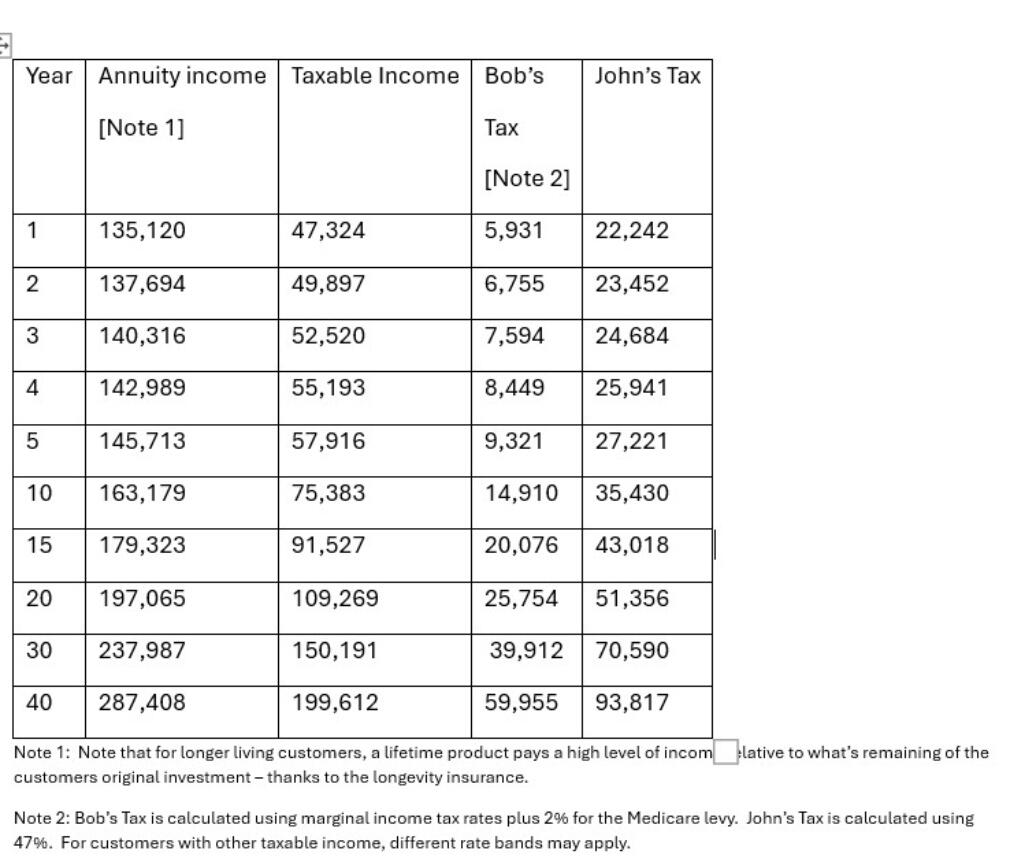

Note: This comes to an average tax rate of 4.4% of the FIRST YEAR’S income payment, but this will increase fairly rapidly. See the example table below.

For people who already had non-superannuation assets or income, the marginal tax rate on the additional amounts would be at 16%, 30%, 37% or 45% tax plus Medicare Levy – depending on which band it falls in.

Working example – retiree on the highest marginal tax rate

In this example, we consider a retired homeowner aged 62. Let’s refer to him as John.

John also has $2 million of super in a pension account and $3 million in an accumulation account.

However, unlike Bob, John has other taxable income, e.g. from other non-super financial resources, which means he is already a highest rate taxpayer.

A. If John keeps his excess super where it is, then the tax on his ‘excess super’ of $2 million would be the same as Bob, $45,864 in the first year.

B. If he removes the $2 million from super and invests it outside super, then part of the returns generated would be treated as taxable income.

If the gross return on this $2 million outside super is the same as Bob ($160,000) and $120,000 of this is taxable, then John’s tax would be $120,000 x the highest marginal rate of 47% = $56,400.

This equates to an average tax rate of 35.3% (less than 47% because of things like the capital gains tax discount etc).

C. Remove $2 million from the super and invest in an insurance bond, then the tax would be the same as Bob. If the effective internal tax rate on the bond were 20% then this would come to $32,000 in the first year.

D. Remove $2 million from John’s super and invest in a non-super lifetime income product. If we assume John buys the same type of lifetime income stream as Bob with his excess super, he would receive the same starting income of $135,120 p.a.

There is no tax on the investment income within this product, but the taxable component in year one would, like Bob, be $47,324.

If John pays tax at the highest marginal rate of 47% then his tax in year 1 is $22,242.

The taxable part of his income payments would increase as his income increases over time.

Note that if John had a higher superannuation balance than this (e.g. in excess of $10 million), then his BTSC tax calculation would have an additional 10% tax on his earnings times the proportion of his balance above $10 million.

How the tax on each product evolves over time

A. Keeping money in super: The excess super amount that remains in Bob or John’s accumulation account would grow with investment income, less any tax that is deducted from the balance, and less any withdrawals they make over time.

But the ‘average tax rate’ applying to this ‘excess super’ might remain a little below 30% up to $10 million and a little below 40% for amounts above that.

B. Invest outside of super: The average tax rate applying to Bob’s excess super moved to outside of super will depend on his marginal tax rate and what tax band he’s in.

This also depends on how his total taxable assets and income sources change over time.

Things that impact this include:

- Good investment returns – that flow through to higher taxable income amounts in the future. This may cause Bob to change into a different tax band.

- Spending – if Bob chooses to spend some of his assets – resulting in less investment income thereafter – then this could cause him to move into a lower tax band.

- Indexation of the tax band thresholds.

If Bob’s amount of non-super savings stayed broadly level in real terms, then he might remain in the same position relative to the tax bands, and his average tax rate on this might remain the same in future years.

For John, however, we assume that he is always a high-rate taxpayer, so the average tax rate applying to his ‘excess super’ if moved to non-super might remain around 35%.

C. Invest in an Insurance Bond: The ‘average tax rate’ applying to the ‘excess super’ that Bob or John moves to an insurance bond is simply a flat rate depending on investment choice and the tax optimisation strategies that are used by the provider.

This could be a maximum of 30% or as low as 15% or less. The actual rate may depend on actual returns generated over time, but isn’t impacted by how much the customer has invested or their broader financial position.

D. Use a non-super investment-linked annuity: The starting income for an investment-linked lifetime income product gets set by the provider based on actuarial assumptions for the customer’s age and sex (life expectancy) and product design.

However, different products increase the income level in different ways.

A common feature with investment-linked lifetime products is known as the “hurdle rate”.

Hurdle rates play a crucial role in how most investment-linked lifetime annuities operate, e.g. as in TIAA-CREF’s products in the USA – one of the largest pension funds in the world.

A higher hurdle rate means a higher starting income is paid, but future income will then rise more slowly – being based on the underlying return on the assets supporting the product relative to the hurdle.

Orford reminds investors that hurdle rate isn’t a fee but a way of bringing forward some of the future expected income to enjoy higher income at the start of retirement and lower income at higher ages, for example, to target an income that broadly keeps pace with inflation.

The product in the example provided has a 5% p.a. hurdle rate (referred to as the ‘LifeBooster’ feature).

If the net return on the assets Bob or John has chosen is higher than the hurdle rate, then the level of annual income payments will increase. For example, if the net return was 7% p.a., then the income might increase by roughly 2% from $135,120 to around $137,694.

If Bob or John’s investment choices generated returns of 7% p.a. after fees, etc then his projected income and projected tax would become:

With a lifetime income product, the annuity payments start to become very high relative to any measure of investment returns on the remaining purchase amount. This occurs because the annuity payment is composed of:

- a return of capital,

- investment income, and

- survivorship credits (which become a high percentage later in life)

It hence becomes meaningless to express tax as a proportion of the ‘balance’ per se.

Conclusion: meaningful tax savings

Given that Labor’s proposed BTSC tax creates a new layer of cost, those with balances above $3 million have good reason to explore alternatives.

The above case studies show that moving some excess funds into options such as non-super investments, insurance bonds, or non-super lifetime income products can deliver meaningful tax savings, especially in the first year.

What’s right for you depends on what tax band you’re in – which depends on your total taxable income outside of super.

“Ultimately, the right approach will depend on each client’s circumstances, goals, and priorities,” says Orford.

“Advisers who understand and can model these strategies will be well placed to help clients optimise their income, protect capital, deliver confidence and navigate the changing retirement landscape.”

Azzet would like to acknowledge the input of Optimum Pensions in the preparation of this article.