General Motors (GM) shares rose almost 9% on Tuesday (Wednesday AEDT) despite the company announcing an 11.8% increase in losses for the fourth quarter of 2025 (Q4 FY25).

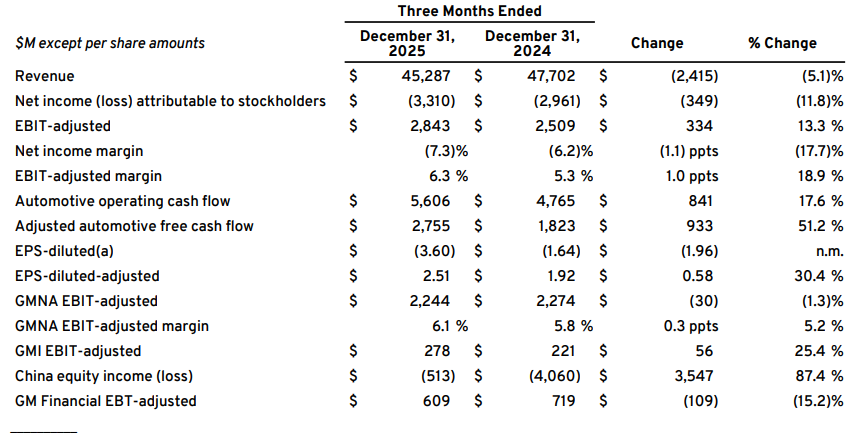

The American car manufacturer said the net loss widened to US$3.31 billion (A$4.74 billion) in the three months ended 31 December from a $2.961 billion deficit in the previous corresponding period (pcp) a year earlier.

Diluted earnings per share (EPS) deteriorated to a loss of $2.51 from a loss of $1.92 in the pcp on revenue, which dipped 5.1% to $45.287 billion.

The share price jumped as adjusted EPS of $2.51, which was 30.4% higher than the pcp, was above analysts’ estimates of $2.20.

GM shares (NYSE: GM) closed $6.96 (8.77%) higher at US$86.30, capitalising the company at $80.83 billion (A$115.8 billion), and they continued rising to $86.50 in after-hours trading.

GM said Q4 net income was marred by more than $7.2 billion in charges due mainly to a realignment of electric vehicle (EV) capacity and investments to adjust to expected declines in consumer demand for EVs.

For the full year, net income plunged 55.1% to $2.697 billion and diluted EPS dived 48.7% to $3.27 as revenue eased 1.3% to $185.019 billion.

The company forecast higher profits in 2026 with net income estimated to be $10.3 billion to $11.7 billion and diluted EPS of 11 cents to 13 cents.

Directors approved a three-cent increase in the quarterly common stock dividend to 18 cents per share and a new $6 billion share repurchase authorisation.

Chair and Chief Executive Officer Mary Barra, the company’s strong cash generation had allowed it to execute all phases of its capital allocation strategy.

“We believe that formula is sustainable, which is why we’re increasing our dividend and planning future share repurchases,” she said in a news release.