There’s a sobering picture emerging from within the electric vehicle value chain - a supply glut of batteries that makes the 1980s oil oversupply a rounding error at the supermarket that's set to crush Chinese manufacturing.

By the end of this year, it's projected that China will be able to churn out enough battery cells to power every new EV sold worldwide, just as Western automakers quietly row back from their lofty electrification promises.

That’s according to BloombergNEF's 2025 Electric Vehicle Outlook, which forecasts global passenger EV sales to hit just 30 million by 2027.

Electric nightmares

BloombergNEF tracks 7.9 terawatt-hours (TWh) of announced battery manufacturing capability by the end of 2025 - yet projected demand will only require 1.6TWh.

Even if half that never materialises - which it likely won’t given the realities of scaling that level of production - there’d still be enough capacity left over to equip virtually every new car sold worldwide with a 50kWh battery pack.

That's also assuming every single vehicle sold goes electric overnight - which isn't happening.

Oversupply has immediate repercussions for almost 50 Chinese battery manufacturers. They’re facing severe overcapacity as domestic supplies push up to 4X demand this year, meaning most smaller outfits are now in danger of extinction.

The two largest battery makers in the world - China’s BYD and CATL - have already slashed prices to protect their market share.

Outside of China, Ford projects losses of £4.3 billion on EVs this year, up from £4.1 billion in 2024.

Ford CEO Jim Farley bluntly admits large EVs have "unresolvable" issues; because they're heavier, less aerodynamic, and require bulky, expensive battery packs to achieve decent range.

General Motors has quietly walked back its target of producing one million EVs by the end-2025, with CEO Mary Barra conceding they won't have the production capacity in place.

Even though last year GM cut its EV production forecast from 300,000 to 250,000 units.

Meanwhile, Volkswagen is delaying its Scalable Systems Platform and integrating range-extending petrol engines into what was meant to be a pure EV manufacturing architecture.

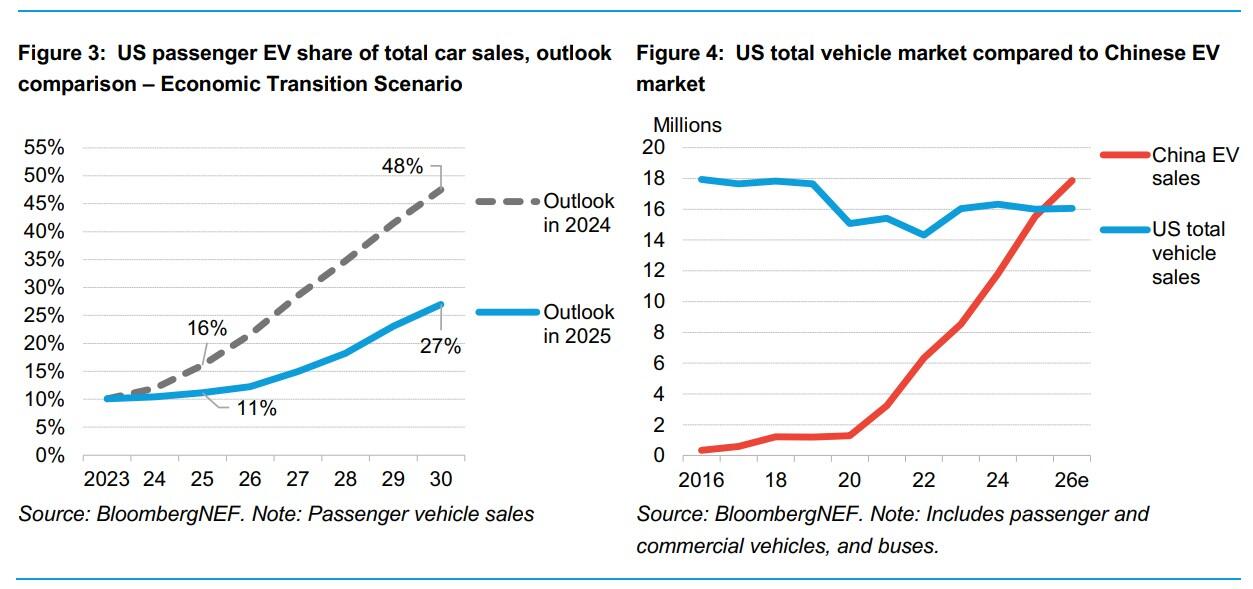

With those three carmakers reluctant to put all their chips into EV production just yet, projections of U.S. EV market share have dropped.

A strategic failure?

The overcapacity isn't accidental - it's the result of China's state-directed industrial policy that has systematically built dominance across the entire battery value chain.

From 70-90% control over critical mineral processing, to a whopping 75% of global battery cell production, China has created what amounts to technological sovereignty in the EV realm.

Stragically aligned to the West, South Korean companies lead in overseas manufacturing capacity with nearly 400GWh of battery output, yet they themselves rely heavily on Chinese materials and components.

This presents Western policymakers with an uncomfortable reality: the green transition they've mandated depends almost entirely on Chinese supply chains.