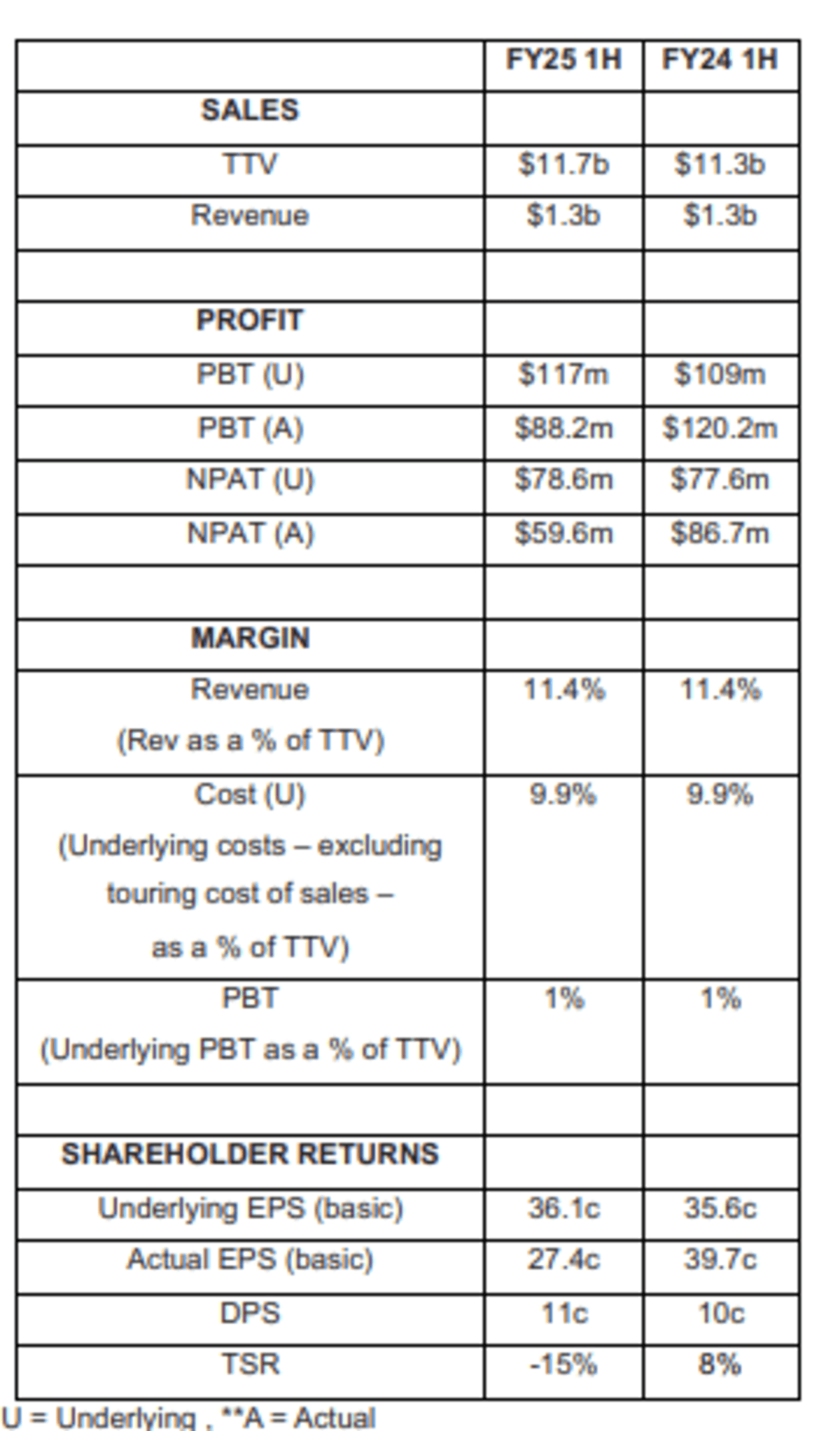

Flight Centre has announced a 31% fall in net profit after tax (NPAT) for the first half of the 2025 financial year (H1 FY25).

Australia’s largest listed travel agency said statutory profit before tax (PBT) fell 27% to A$88.2million, mostly because the previous corresponding period included higher gains on the buy-back and remeasurement of convertible notes.

Underlying NPAT increased 1.3% to A$78.628 million in the six months to 31 December 2024 on revenue that was flat at $1.3 billion while total transaction value (TTV) rose 3% to $11.7 billion.

Underlying profit before tax (UPBT) grew 7% to $117 million in the first half, reflecting a solid second quarter (Q2) rebound from a challenging Q1, during a period of investment in initiatives to achieve sustainable profit growth.

Flight Centre said H1 profit was also impacted by lower income from volume-based supplier payments (super over-rides), a $4 million investment in the cruise sector and a $8 million downturn in Asia.

Directors declared a fully franked 11 cents per share interim dividend, payable on April 17 to shareholders registered on 27 March, up from 10 cents a year earlier.

Chief Executive Officer Graham Turner said the second quarter profit growth rate was more than double the second quarter TTV growth rate, providing good operating leverage and momentum ahead of the key trading months.

“Group-wide, our foundations are solid and we are well placed to deliver stronger (H2) profit as volumes increase during our busier trading period, a seasonal trend we are now seeing,” Turner said in an ASX announcement.

Flight Centre said it continued to target an UPBT between $365 million and $405 million for FY25 and was tracking towards the low-mid section of the range, ahead of the seasonally busiest trading months.

Flight Centre (ASX: FLT) shares closed on Tuesday at $17.72, down eight cents (0.45%), capitalising the company at $3.93 billion.