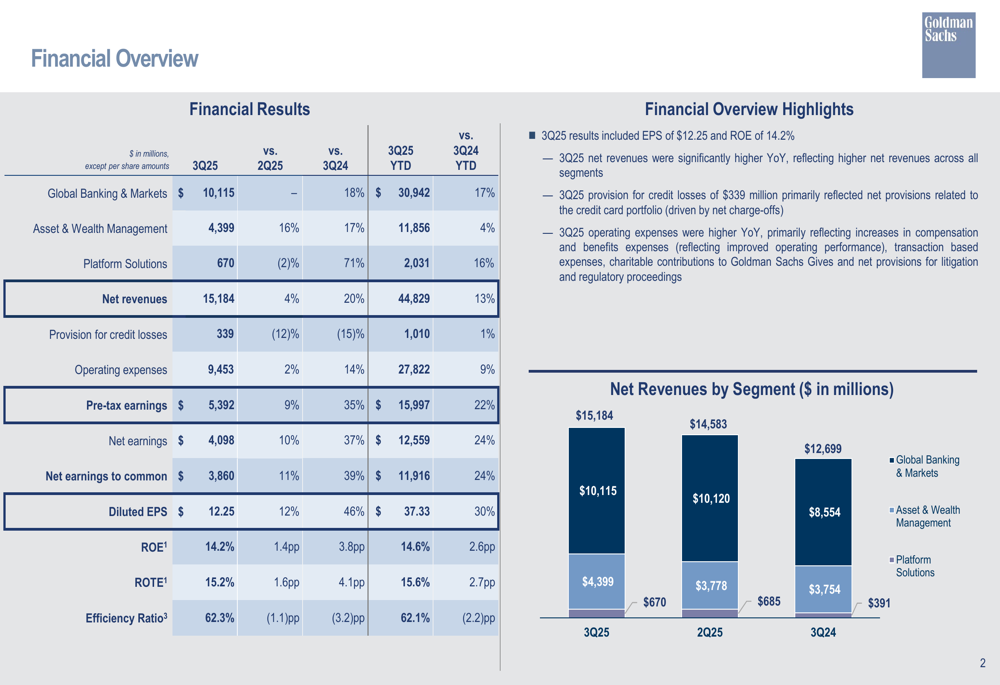

Goldman Sachs delivered earnings of US$12.25 per share for the third quarter, comfortably beating the $11.02 consensus estimate, yet it wasn't enough for Wall Street as the stock fell 2% at close.

Net revenues hit $15.18 billion - the third-highest quarterly figure in the firm's history - up 20% year-over-year, but investors weren't impressed.

The issue wasn't the top-line performance, with investment banking fees surging 42% to $2.7 billion and advisory fees jumping 60% to $1.40 billion as dealmaking activity roared back to life.

Markets revenue climbed across the board, with Fixed Income, Currency and Commodities up 17% to $3.47 billion and Equities rising 7% to $3.74 billion.

The firm's Asset & Wealth Management division hit record assets under supervision of $3.45 trillion, marking the 31st consecutive quarter of net inflows.

What spooked the market was operating expenses, which jumped 14% year-over-year to $9.45 billion, above the $8.98 billion analyst estimate, while headcount rose 5% as the firm expanded to capture market share in a recovering M&A environment.

“[Goldman Sachs] is prioritising the need to operate more efficiently to seamlessly deliver the firm to our clients helped by new AI technologies,” GS CEO David Solomon acknowledged.

The firm's return on equity of 14.2% remains solid but unspectacular for an investment bank hitting record revenues in multiple divisions.

Net interest income of $3.85 billion crushed estimates of $3.00 billion, up 64% year-over-year, reflecting Goldman's expanding loan portfolio.

The investment banking fees backlog remained essentially flat quarter-over-quarter, suggesting the dealmaking pipeline is stable but not accelerating.

Goldman returned $3.25 billion to shareholders through dividends and buybacks during the quarter, but the capital ratios declined as the firm deployed cash into growth initiatives.

Markets wanted efficiency gains alongside revenue growth, but Goldman delivered only half the equation.