Electronic Arts Inc. (NASDAQ: EA) posted a solid start to fiscal year 2026, reporting Q1 net bookings of $1.298 billion — above its $1.275 billion guidance.

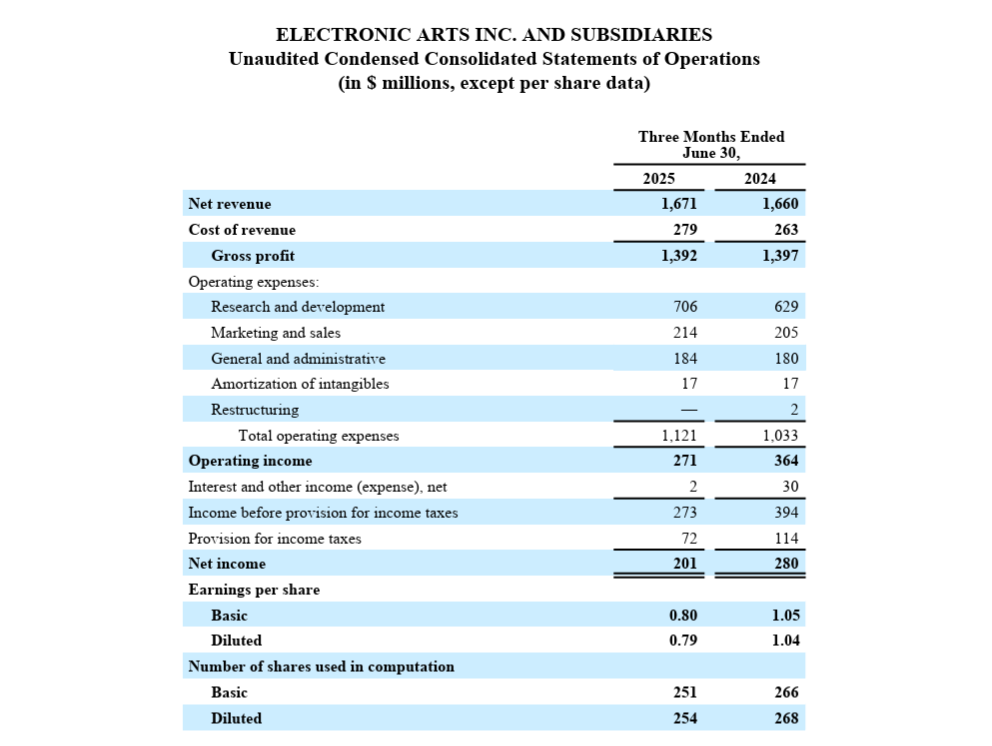

Net revenue rose slightly year-over-year to $1.671 billion, while net income fell to $201 million from $280 million.

Diluted earnings per share came in at $0.79, down from $1.04 in Q1 FY25.

Analysts at LSEG predicted 63-cent earnings per share (EPS) on $1.24 billion in revenue.

EA attributes the performance to strong contributions from EA SPORTS titles, Apex Legends, and record bookings in FC Mobile.

Operationally, EA saw broad-based growth across its portfolio, with EA SPORTS F1 25 and Global Football leading gains.

The company also returned significant value to shareholders, repurchasing 3 million shares for $375 million in Q1, and declaring a $0.19 dividend payable on 17 September.

Operating cash flow for the quarter was $17 million, with trailing twelve-month figures showing $7.474 billion in net revenue and $1.976 billion in cash flow.

Looking ahead, EA reaffirmed its FY26 guidance, projecting net bookings between $7.6 billion and $8.0 billion and net revenue between $7.1 billion and $7.5 billion.

Q2 expectations include net bookings of $1.8–$1.9 billion and EPS of $0.29–$0.46, with marketing for Battlefield 6 driving operating expenses.

EA stock closed at $147.79, down 2.76%, but rose to $149.50 in after-hours trading.

“We delivered a strong start to FY26, outperforming expectations ahead of what will be the most exciting launch slate in EA’s history,” said Andrew Wilson, CEO of Electronic Arts.

“From deepening player engagement in EA SPORTS to gearing up for Battlefield 6 and skate., we’re scaling our global communities and continuing to shape the future of interactive entertainment.”

“We exceeded the high end of our guidance in Q1 highlighting the resilience of our live services and the breadth of our portfolio,” said Stuart Canfield, CFO of Electronic Arts. “With strong fundamentals and a robust pipeline ahead, we remain confident in our full-year guidance and long-term margin framework.”

At the time of writing Electronic Arts Inc's (NASDAQ: EA) stock was trading after-hours at $149.50, up $1.71 (1.16%). At the close, it was $147.79, down $4.20 (2.76%). It has a market cap of around $37.14 billion.

All financial amounts are in U.S. dollars.