Food delivery service DoorDash has announced a controversial new partnership with Klarna, which will allow customers to enter into a buy now pay later plan (BNPL) for food deliveries.

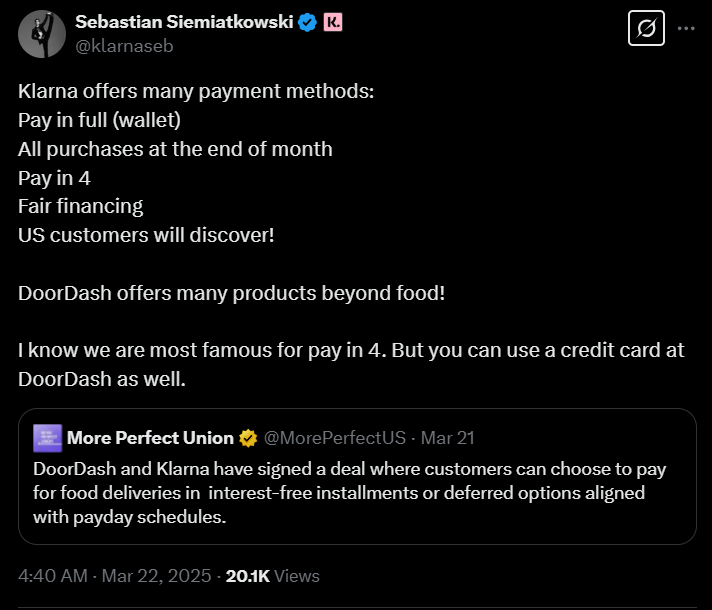

The Swedish fintech group made the announcement last Thursday about being a new payment method for the delivery service, but it has already brought heavy criticism, as Klarna CEO Sebastian Siemiatkowski took to social media to defend the deal.

The BNPL includes options for customers to use their famous Pay-in-4 plans - four equal interest-free instalments, or Pay Later plans which defers payments to a more convenient time, such as payday.

“By offering smarter, more flexible payment solutions for groceries, takeout, and retail essentials, we’re making convenience even more accessible for millions of Americans,” said David Sykes, Klarna’s chief commercial officer.

However, the partnership has also been subject to heavy criticism over the idea of consumers in a cost of living crisis leaning on BNPL options for meals and groceries, with one user on X writing, “these predatory loans should be illegal”.

In Australia, DoorDash already offers a similar option with Afterpay for its BNPL schemes, and Azzet sat down with COO of Payments Consulting Network, Liz Beggs, about how the BNPL sector is making its way to these delivery platforms and what this means for consumers and the market.

“I think Australia's got a bit of a different lens, as it's in a cost of living crisis, so to be able to provide flexibility around payments could be well received," she says.

“In the recent PCN and Power Retail Ecommerce Payments Experience Report, that we just commissioned, 40% of the consumers use flexible payment options in the last six months with the 18- to 34-year-olds as the biggest adopters [of the plans], and what we've found is that 79% of those purchases are retail based, so more discretionary spending.”

But what about the possible financial strain of accumulating too many BNPL plans?

Beggs says customers are getting a “little bit more savvy” and using the plans as a budgeting tool rather than a necessity.

“I think a lot of people are using it as a budgeting tool because of the cost of living crisis… financial strain can occur if customers start deferring payments, for sure, but however, you know, people are still paying most of the time with credit and debit cards, in our consumer report, 75% of consumers are still purchasing using debit and credit cards.”

“Also it's important to note that when customers do apply for BNPL or flexible payment options, they do need to have a credit check completed, so the checks and balances are in place, and also there's going to be more regulation in for BNPL products from June this year, and the BNPL products will require an Australian credit license with some modifications.”

Additionally, Australian DoorDash consumers are unable to make alcohol purchases using Afterpay as a payment method, with individual retailers also offering banners at the top of their pages to opt out of alcohol related marketing to “help create a safer and healthier drinking culture”.

Beggs was reluctant to comment on whether a similar scheme should be implemented for the U.S. market, but said “providers might or may consider limiting quantity or dollar value, but that will be up to them… I think it's a bit self-regulated at the moment.”