Shares in Dell Technologies (NYSE: DELL) were up in overnight trading after the Texas-based company told the market to expect stronger guidance with the company receiving unprecedented AI server demand during the first quarter.

While adjusted earnings per share (EPS) of US$1.55 fell short of US$1.69 consensus, revenue of US$23.38 billion beat expectations and marked a 5% annual increase.

Net income declined 3% to US$965 million, but operating income rose 21% to US$1.17 billion.

New guidance

"We generated $12.1 billion in AI orders this quarter alone, surpassing the entirety of shipments in all of fiscal 2025 and leaving us with $14.4 billion in backlog," Dell's Chief Operating Officer Jeff Clarke said.

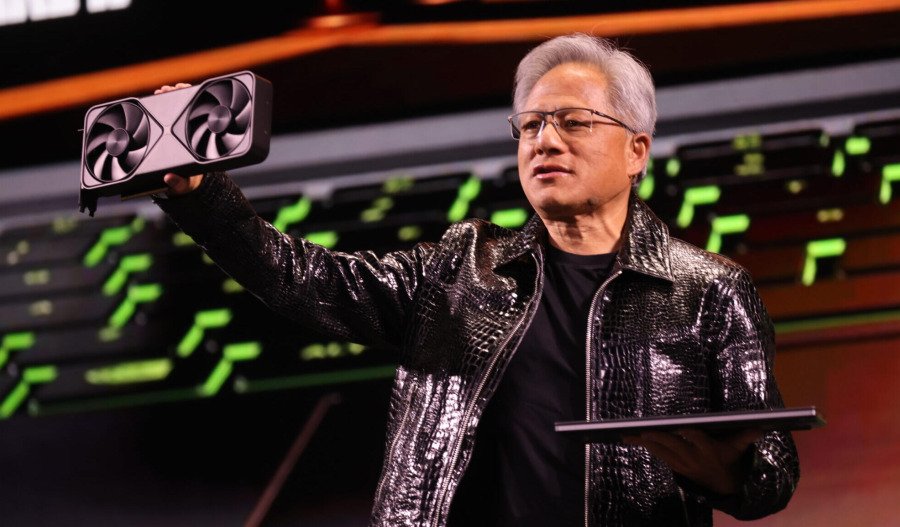

Yesterday’s result follows the U.S. Department of Energy's announcement on Thursday that it would launch a new supercomputer, named Doudna, that will use Dell's and NVIDIA's advanced technology to perform complex computing tasks.

Dell now expects full-year adjusted EPS of US$9.40, up from its previous guidance of US$9.30.

The company reaffirmed its full-year revenue forecast of US$103 billion but lifted its second-quarter revenue outlook to a range of US$28.5 billion to US$29.5 billion — well ahead of analysts’ estimates.

The company also expects second-quarter adjusted EPS of US$2.25.

Order backlog

Management told investors that the company has a US$14.4 billion backlog of confirmed AI system orders, up from US$12.1 billion booked in the quarter.

Built around NVIDIA GPUs and targeted at cloud providers like CoreWeave, these systems are understood to carry higher margins than Dell’s traditional offerings.

The company reaffirmed it expected shipment of US$15 billion in AI servers this financial year, up from US$10 billion in FY25.

Other key numbers

- Dell’s server business reported $10.3 billion in sales during the quarter, up 12%.

- Client Solutions Group (laptop and PC business), recorded $12.5 billion in sales – up 5% as the global PC market recovered.

- Dell also increased its capital returns, spending US$2.4 billion on buybacks and dividends in the quarter — more than double its quarterly average since FY23.

- Cash flow from operations reached a record US$2.8 billion.

Background

Dell designs, develops, manufactures, markets, sells, and supports integrated solutions, products, and services in the Americas, Europe, the Middle East, Asia, and internationally.

The company operates in two segments, the Infrastructure Solutions Group (ISG) and the Client Solutions Group (CSG).

Dell recently announced the launch of the new Pro Max Plus laptop.

Equipped with an enterprise-grade NPU, Pro Max Plus is understood to be a top-tier choice for on-device AI applications.

The stock hit a record high near $179.70/share in 2024 and, as of last night is currently trading near US$113,60.