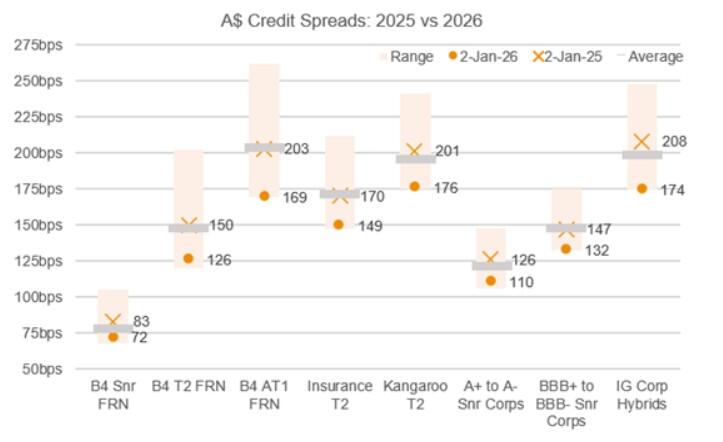

With the Australian dollar (A$) credit spread entering the new year at near multi-year tights – the lowest point in several years – the scene is set for robust demand for $A credit again in 2026.

To put yields on offer into context, Commonwealth Bank of Australia's (ASX:CBA) new three-year senior floating rate notes (FRN) are guiding a yield of 4.4%, in excess of the bank’s gross dividend yield of 4.3%.

Led by high-beta segments – typically swinging more dramatically up and down - like Additional Tier 1 bank hybrids and corporate hybrids – A$ credit spreads started 2026 10-15% tighter year-on-year across the credit spectrum.

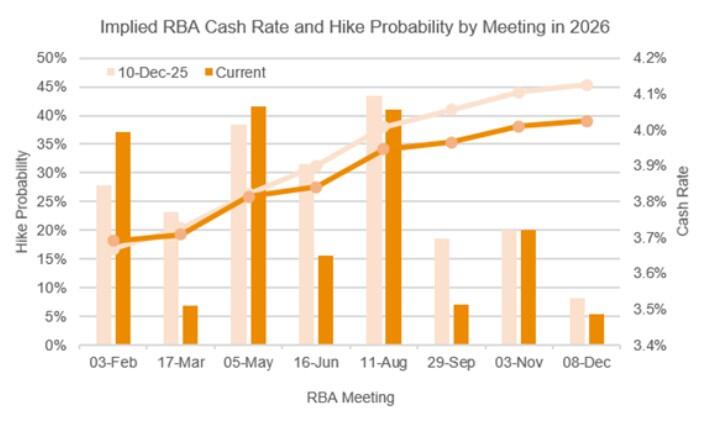

The Reserve Bank’s (RBA) next move on interest rates is makes for an interesting backdrop in the bond market.

Rate hike or reprieve

Australia's inflation rate re-accelerated towards the end of 2025 after falling as low as 1.9% in June 2025.

While the monthly year-on-year change in the consumer price index (CPI) rose to 3.8% in the latest reading at the end of October 2025, the market has been fielding mixed signals about how sticky inflation is.

On the expectation that inflation will remain higher for longer, the market had already placed bets on up to two rate hikes this year: with the first possibly arriving when the RBA next meets on 3 February.

However, the monthly CPI rose 3.4% in the 12 months to November 2025, a decrease from the 3.8% annual rise recorded in October 2025.

Although major banks like CBA and National Australia Bank (NAB) are forecasting a 25 basis point hike next month - to bring the cash rate to 3.85% - the new data may have thrown another spanner into the mix.

Given that the RBA is more interested in underlying inflation, revelations that the "trimmed mean" – the RBA’s preferred measure - fell slightly to 3.2%, down from 3.3% in October, mean it may choose to take a wait and see approach to rate hikes next month.

CBA Reopens A$ Credit Market

Meanwhile, last week CBA officially reopened the Australian credit market for 2026, mandating an an Australian dollar three-year and five-year senior unsecured deal, structured as floating rate note (FRN) and/or fixed interest rate FXD (fixed coupon) tranches.

This marks the first A$ credit deal since NatWest priced a $1 billion dual tranche 3.5-year senior unsecured transaction on 3 December last year.

Given that is consistent with comparable Big Four issuance in the second half of 2025, the deal is expected to attract solid demand.

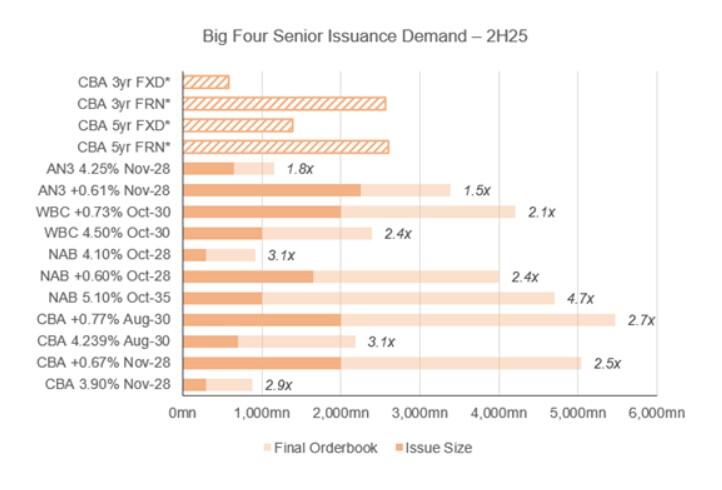

Over the six months to 31 December 2025, the Australian majors issued $13.9 billion of senior paper across 11 separate transactions.

On average, the transactions achieved 6.7 basis points of initial pricing guidance (IPG) tightening across 2.7x coverage to the final orderbook.

Given that CBA is issuing across four tranches simultaneously – an approach that typically dilutes individual coverage results - initial demand is strong.

Driven primarily by FRN demand ($2.56 billion) with a further $580 million in FXDs an initial update suggests the 3-year book totals $3.14 billion, while the 5-year tranches have accumulated $3.99 billion of bids (FRN: $2.60bn; FXD: $1.39bn).

Meanwhile, the Australian Government, through the AOFM (Australian Office of Financial Management), announced plans to issue approximately $125 billion in Treasury Bonds for the 2025-26 fiscal year.

Specific new maturities planned for introduction via syndication during the 2026 calendar year include:

• A new October 2037 Treasury Bond

• A new June 2036 Green Treasury Bond

Notable existing bonds that have been part of regular tender activity in early 2026 include:

• 4.25% 21 April 2026 Treasury Bond

• 0.50% 21 September 2026 Treasury Bond

• 4.75% 21 June 2054 Treasury Bond

Understanding duration

After years of historically low yields, Capital Guard AU expects the transition to a higher-income environment to offer investors renewed potential for more predictable returns from fixed-income assets.

The financial services provider expects this shift to create opportunities across the maturity spectrum, from short-duration instruments offering defensive positioning to longer-dated securities providing attractive yield premiums.

However, the company reminds investors that identifying suitable opportunities requires an understanding of how different structures, such as investment-grade corporates, inflation-linked bonds or floating-rate notes, behave under varying economic conditions.

“Investors should consider how yield curves might evolve through 2026 and whether locking in current income levels aligns with their risk tolerance and time horizon,” the financial services provider noted.

“A thoughtful allocation strategy can help balance income generation with capital stability.”

Capital Guard AU encourages investors to evaluate whether their current duration profile still aligns with their expectations for the rate environment in 2026 and whether any adjustments, such as adding shorter or longer-duration assets, may help strengthen portfolio resilience.

While a thorough understanding of duration allows investors to prepare more confidently for varying market outcomes, the company also reminds investors that liquidity conditions can vary significantly between different segments of the bond market.

These variations often become more pronounced during periods of shifting monetary policy.

“Entering 2026, investors should consider how easily they can adjust portfolio positions if market conditions change, particularly in sectors that historically experience wider bid-ask spreads or reduced depth during volatile periods.”