A new report by the peak advocacy body for the country's profit-to-member superannuation funds, the Super Members Council (SMC) finds that most Australians could have more money to spend in their retirement if they just became a little more financially savvy.

As well as highlighting shortcomings embedded within Australia's superannuation system, modelling within the SMC’s latest report, titled Retirement Revolution, Simpler Smarter Retirement, suggests a typical couple could miss out on $6,500 a year over the course of their retirement due to the complexities of the system.

That means retirees could be up to $136,000 over 20 years, simply by steering clear of easily avoidable mistakes.

Within its report, the peak super body also notes that around 700,000 Australians aged over 65 who were not working full-time still had their super sitting in taxed savings-phase super accounts, which had the impact of lowering their disposable income in retirement.

Misha Schubert, CEO of the SMC, said the report also dispels a long-held myth that most Australian retirees - drawing down higher amounts from super than the minimum amounts required – understood their super.

With around 64% of tax-free retirement account holders withdrawing above the minimum, plus 77% of those with less than $50,000 in super, it’s easy to conclude, adds Schubert, that retirees' understanding of super remains limited.

“A ‘silver tsunami’ of 2.8 million Australians is now racing towards retirement in the coming decade. This demographic influx will double the number of Australians retiring each year from 150,000 to 300,000,” Schubert said.

“And the amount of money these retirees will have in super by age 65 will almost double, too, rising from around $750 billion over the past decade, to almost $1.5 trillion over the next.”

Eight steps to help turbocharge your super

The good news is you don’t need to wait for reforms to super – which typically takes years to eventuate – to make the most of existing regulations.

Cashing out your super: It can be tempting when you’re finally eligible to access your super to withdraw the lot.

However, you need to remember that this is money that is supposed to provide a retirement income, and while there might be the Age Pension to fall back on – assuming you qualify – it won’t come close to the $2,809 per fortnight the Association of Superannuation Funds of Australia (ASFA) suggests a couple needs for a comfortable retirement.

Continuing to park your super in the accumulation phase: By refusing to move your super from the accumulation phase into the retirement phase as soon as you are eligible, you’ll end up paying 15% tax on your super earnings when you could be paying zero.

According to Challenger's analysis of the APRA data, there was $255 billion in the 1.4 million member accounts that could potentially be shifted into the retirement phase.

Admittedly, there might be good reasons why you choose to leave money in an accumulation account, especially if you’re still working and receiving or making contributions.

Then there are those with more than $2 million in super who can’t move it all into the retirement phase.

While ATO data suggests around 500,000 people over 65 had employer contributions into super in 2021, a key reason why people leave money in the savings phase comes down to ignorance of the benefits they’re missing out on.

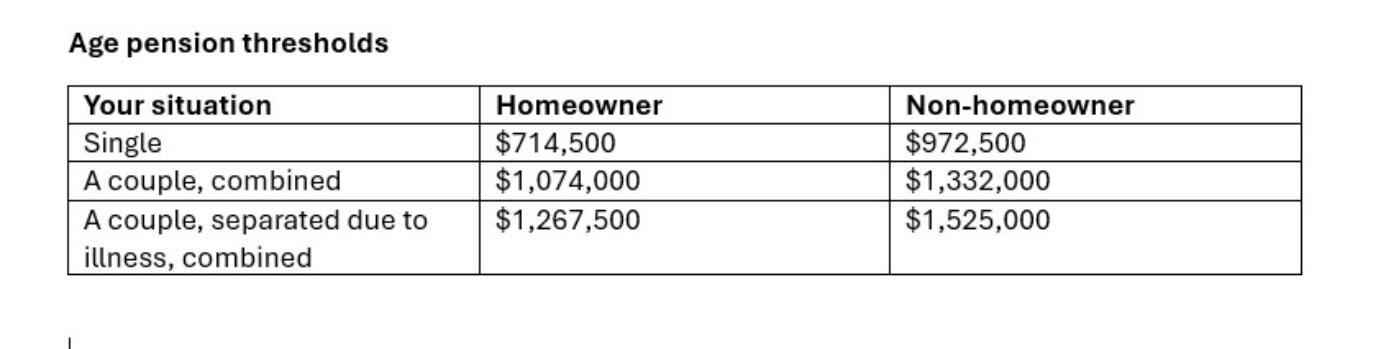

Misunderstanding Age Pension eligibility: It’s true, if you have a decent amount in your super account, you may not be eligible for the full Age Pension.

However, you may still be eligible for a part pension if you have assets below the amounts at any time during your retirement.

It’s easy to forget that as you draw down on your assets over the course of your retirement, you may become eligible to receive a part or even a full pension.

That’s why it’s important to update Centrelink as your balance decreases so you can get any Age Pension entitlements you’re eligible for.

Similarly, with any amount of part pension, you will also be eligible for discounted medical expenses, utility bills and transport, which can greatly reduce your expenses.

There are also income tests you must not exceed.

But these limits may also be higher than you expected. For example, while the income cut-off for a full pension for a couple combined is $380 per fortnight, for a part pension it is $3,934 per fortnight (and $5,095 per fortnight for a couple that is separated by illness).

For a Single, it’s $218 per fortnight for a full pension, and $2,575.40 per fortnight for a part pension.

The amount of Age Pension you are eligible to receive will be the lower amount after applying the assets and income tests.

Not applying for relevant concession cards: Even if you’re not receiving any Age Pension and are ineligible for the Age Pension concession card, there are other seniors’ cards you may be eligible for.

Forgetting to factor in healthcare costs: The Association of Superannuation Funds of Australia’s (ASFA) retirement income standard estimates that healthcare costs - including health insurance, pharmacy, co-payment and out-of-pocket medical expenses and over-the-counter medicines - increase from 15% of weekly expenditure for a 65–84-year-old couple enjoying a comfortable retirement to nearly 20% of weekly expenditure once they hit 85.

That’s why it’s important to keep these costs in mind as you plan for retirement and potentially keep a buffer for any home accommodations you may need.

Low-balling your life expectancy: The latest data from the Australian Institute of Health and Welfare suggests a man aged 65 in 2020–22 could expect to live another 20.3 years (to age 85), while a woman aged 65 in 2020–22 could expect to live another 22.9 years (to age 88).

While most people retiring today at age 65 can expect to live at least another twenty years, half of this group will live beyond age 85.

If you retire at 65 you may need your super and other retirement savings to last for close to thirty years.

So unless you want to live solely on the Age Pension, it’s important to put in place plans for your super to last as long as you do.

The impact of inflation: While it has fallen from its highs of around 8% in 2022, inflation is still with us and could potentially disrupt your retirement plans by eroding the value of money you have worked hard to accumulate.

Sequencing risk: It’s not rocket science; sequencing risk refers to the art of progressively dialling down your exposure to market cycles at a time in your lifecycle when recovering from those losses may become more problematic.

For example, if the year in which you plan to retire coincides with a market downturn, there is a real possibility you will retire with less than you originally planned for, as many retirees discovered during the GFC.

Many ended up delaying retirement and working for longer than they originally intended.

While this isn’t great, it is one way to deal with sequencing risk.

Another way is to shift your asset allocation to a more defensive setting, the closer you get to retirement, to protect your balance from share market risk.