The outlook for the February 2026 ASX reporting season marks a major turning point, with ASX 200 companies expected to deliver 12% earnings growth for FY26. However, what could undermine what’s promising to be the strongest profit growth in four years is the outlook for A$ - currently sitting at three-year highs - which threatens to compromise the earnings of stocks with a growing international footprint.

Admittedly, this phenomenon is far from new, but what’s raising its significance in the eyes of investors is the unprecedented 12% rise of the A$ over the US$ in the last 12 months.

While the A$ is currently trading at a shade over US70 cents, several major banks and economists can see it climbing to between 73–75 U.S. cents within the first half of 2026.

What’s pushing the A$ higher against the US$ is a combination of hawkish Reserve Bank of Australia (RBA) outlook and shifting U.S. policy.

Why is this important to you as an investor in ASX shares?

The devil is in the detail, with a higher A$ creating a negative ‘translation effect’ on the foreign earnings of ASX-listed stocks.

Think of the translation effect this way: Profits generated in foreign currencies are worth fewer Australian dollars when they’re converted for financial reporting.

In addition to margin compression, the A$ value of foreign assets also decreases on the balance sheet, which can potentially impact net asset value and certain debt-to-equity covenants.

It’s true, a lot of ASX-listed stocks have foreign earnings; however, around 45% to 50% of the total revenue generated by S&P/ASX 200 companies alone is derived from foreign sources.

Potential 5 to 7% earnings downgrade

While a 1% increase in the A$ over the US$ is relatively minor, the cumulative impact of a rising currency – especially if the A$ moves above US$0.70 - should not be understated.

A number of companies with a high proportion of their sales offshore entered this report season forecasting revenue on the basis of the A$ sitting at US65 to US67cents.

Going into reporting season, the consensus was for around 8 to 10% earnings growth across the board.

However, with the dollar now above 70 U.S. cents, Andrew Dale, partner, investments, ECP Asset Management, reminds investors that this immediately translates to a 5 to 7% earnings downgrade.

Resources companies aside, Dale also reminds investors that the focus is on tech, industrials, healthcare and consumer-focused companies that tend to be vulnerable to currency movements due to their need to translate offshore earnings back into Australian dollars before reporting.

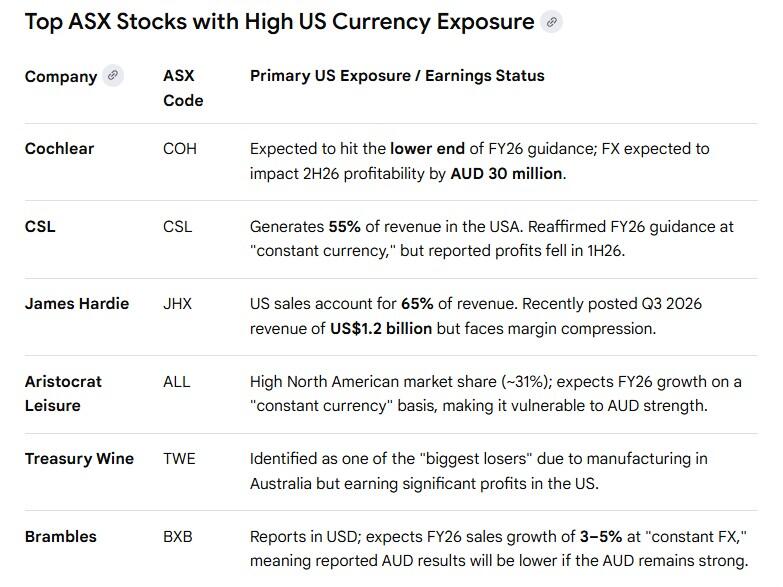

While there’s no shortage of stocks with foreign earnings across the ASX, leading ASX stocks with high U.S currency exposure include the likes of:

Admittedly, the impact of a stronger A$ varies meaningfully across sectors and individual companies, creating a dispersion of winners and losers.

For example, resource companies typically do well when the dollar is high, because commodity prices are often also high at the same time.

But according to the analyst team at Wilsons Advisory, consumer-facing businesses also at risk, including Aristocrat Leisure Ltd (ASX: ALL), Treasury Wine Estates Ltd (ASX: TWE), and Breville Ltd (ASX: BRG), while tech stocks such as Wisetech Global Ltd (ASX: WTC) and CAR Group Ltd (ASX: CAR) are also exposed.

Among the financials, Macquarie Group Ltd (ASX: MQG) and insurer QBE Ltd (ASX: QBE) are exposed, as is Goodman Group (ASX: GMG).

Wilsons' reminds investors that foreign exchange headwinds must be considered within the context of an otherwise broadly positive macro backdrop for offshore earners, with the currency impact to an extent offset by the superior U.S. economic growth outlook and the prospect of multiple Fed cuts this year.

“These companies face near-term foreign headwinds to earnings (when considered in AUD terms), tempering our enthusiasm towards the group at the margin. However, we are sanguine that much of this impact is already reflected in valuations,” the broker noted.

“P/E multiples have generally de-rated materially over the past six months, suggesting currency effects have been at least partially priced in by the market.”