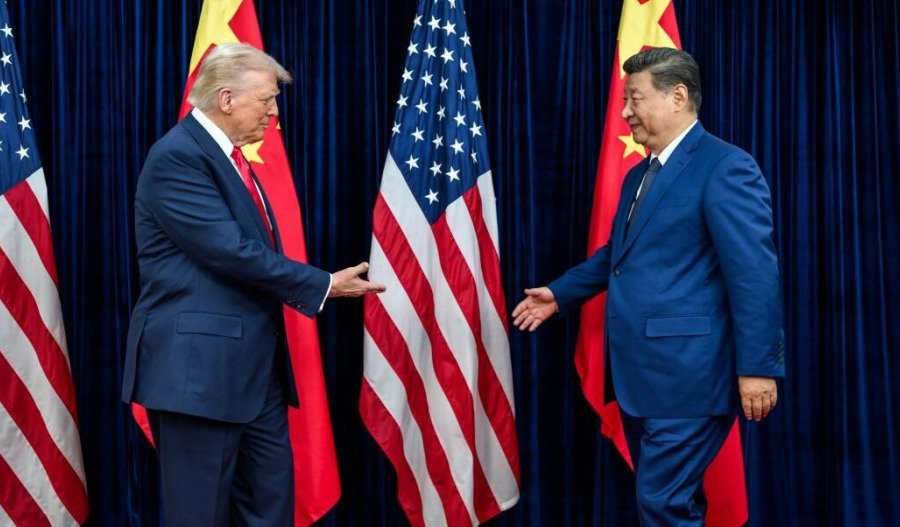

Asia-Pacific markets advanced on Friday as investors welcomed signs of easing trade tensions between Washington and Beijing following a high-level meeting between President Donald Trump and Chinese President Xi Jinping in South Korea.

The leaders agreed to a one-year truce on trade disputes, including the contentious issue of rare earth exports, helping to calm fears of a potential escalation into a full-blown trade war.

By 11:50 am AEDT (12:50 am GMT), Japan’s Nikkei 225 surged 2% to hit a fresh record high, while South Korea’s Kospi 200 climbed 0.4%. Australia’s S&P/ASX 200 rose 0.4%.

Economic data out of South Korea came in far stronger than expected, with industrial production soaring 11.6% year-on-year, well above forecasts of 5.9% and up sharply from the prior 0.9% growth.

Retail sales were flat, easing 0.1% month-on-month after a 2.4% decline previously.

Japan also posted a series of positive data releases. Tokyo’s core CPI rose 2.8% year-on-year, beating expectations of 2.6% and accelerating from 2.5% in the previous month.

Preliminary industrial production jumped 2.2% month-on-month, ahead of the 1.5% forecast, rebounding from a 1.5% fall last period.

Meanwhile, retail sales in Japan edged up 0.5% year-on-year, slightly below the 0.7% estimate but improving from a 0.9% contraction a month earlier.

The country’s unemployment rate held steady at 2.6%, reflecting a resilient labour market.

The Bank of Japan (BoJ) left its policy interest rate unchanged on Thursday, opting to monitor the economic effects of the U.S. tariff policy.

The central bank also raised its GDP growth forecast for fiscal 2025, signalling cautious optimism amid improving domestic conditions.

In Australia, quarterly producer price index (PPI) figures rose 1%, according to fresh data from the Australian Bureau of Statistics, beating expectations of 0.8% and accelerating from 0.7% in the prior quarter.

The stronger print added to signs of lingering inflationary pressure following a spike in consumer price inflation earlier in the week.

Overnight in the United States, Wall Street closed broadly lower after a weak day for technology stocks.

The Dow Jones Industrial Average fell 0.2%, while the S&P 500 slid 1% and the Nasdaq Composite lost 1.6%.

In commodities, Brent crude eased 0.1% to settle at US$64.07 per barrel, while spot gold snapped a four-session losing streak, climbing 2.4% to US$4,024.53 per ounce.

In China, the Shanghai Composite slipped 0.7% from 10-year highs to 3,986.9, and the CSI 300 dipped 0.8% to 4,709.9.

Hong Kong’s Hang Seng Index lost 0.2% to 26,282.7, while India’s BSE Sensex fell 0.7% to 84,404.5.

European markets ended mixed on Thursday. London’s FTSE 100 rose 0.04%, marking its ninth consecutive gain and a new record close at 9,760.1. Germany’s DAX finished flat at 24,118.9, while France’s CAC 40 slipped 0.5% to 8,157.3.