Asian-Pacific markets displayed mixed performance on Wednesday, reflecting cautious investor sentiment amid China's annual Central Economic Work Conference. The event is expected to set economic policies and growth targets for 2024.

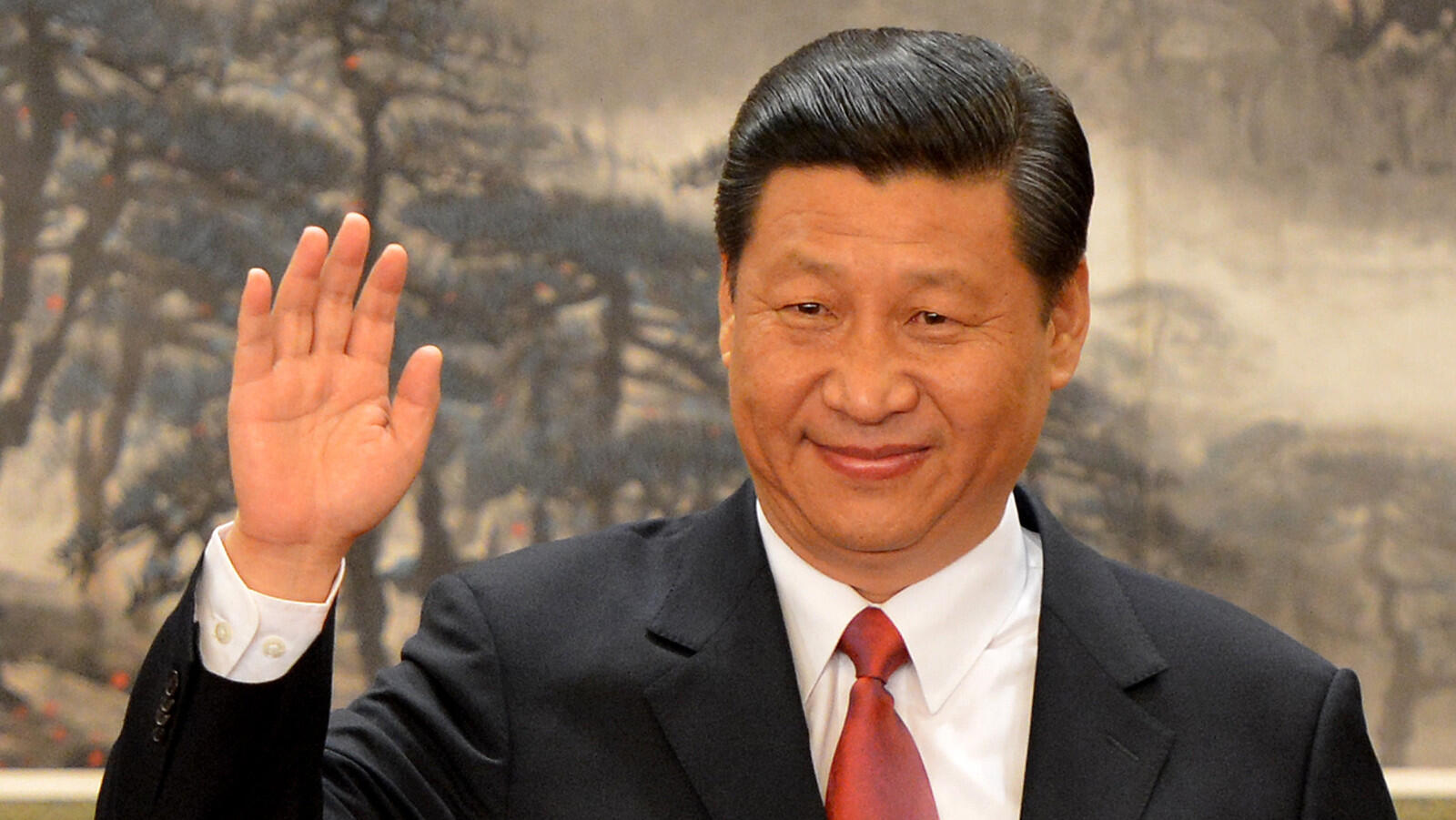

In his speech, Xi Jinping, general secretary of the Communist Party of China (CPC) Central Committee, reviewed the country's economic work, analysed the current monetary situation, and outlined next year's plans.

The meeting noted that China's economy has recovered, with solid progress made in high-quality development.

By 10:25 am AEDT (11:25 pm GMT), Australia’s ASX 200 slipped 0.3%, Japan’s Nikkei 225 fell 0.2%, while South Korea’s Kospi 200 gained 0.3%.

South Korea reported an unchanged seasonally adjusted unemployment rate of 2.7% for November, according to Statistics Korea, providing a stable backdrop for the country’s equities.

Overnight, U.S. markets declined as concerns about technology sector overvaluation outweighed optimism over quantum computing advancements.

The S&P 500 and Nasdaq Composite both fell 0.3%, while the Dow Jones Industrial Average lost 0.4%.

Among the S&P 500 constituents, Walgreens Boots Alliance Inc surged 17.9%, while Alphabet Inc also posted notable gains as its Class A (GOOGL) and Class C (GOOG) shares climbed 5.6% and 5.3%, respectively.

Moderna Inc led the decliners with a 9.2% drop, followed by Super Micro Computer Inc, down 8.2%, and Oracle Corp, which slipped 6.7%.

In the commodities market, Brent crude oil edged down 0.12% to trade at US$72.05 per barrel. Gold prices remained steady at $2,694.19 per ounce.

Chinese markets closed higher, with the Shanghai Composite Index rising 0.6% to 3,422.7 and the CSI 300 added 0.7% to 3,995.6.

However, Hong Kong’s Hang Seng Index dropped 0.5% to 20,311.28.

India’s BSE SENSEX remained flat, closing unchanged at 81,510.05.

European indices closed lower, with the FTSE 100 Index down 0.9% to 8,280.4, Germany’s DAX easing 0.1% to 20,329.2, and France’s CAC 40 declining 1.1% to 7,394.8.