Australia and New Zealand Banking Group (ANZ) has reported a 10% drop in statutory profit to A$5.891 billion (US$3.82 billion) for the year ended 30 September 2025 (FY25).

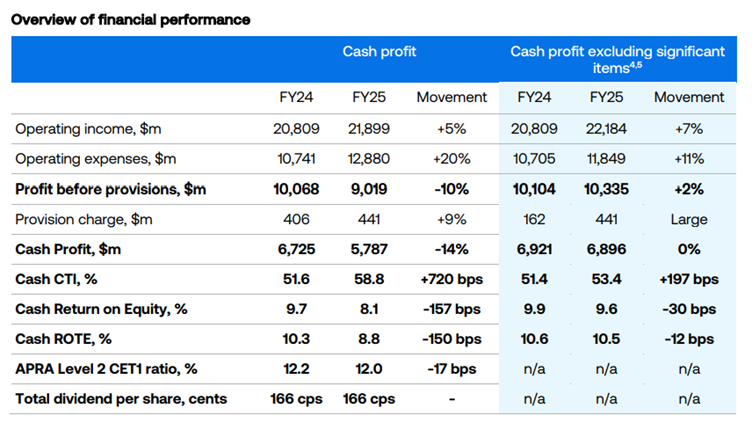

ANZ said cash profit dropped 14% to $5.787 billion on operating income, which rose 5% to $20.809 billion and as expenses increased 20% to $10.741 billion.

If significant items of $1.109 billion, including Australian Securities and Investments Commission (ASIC) settlement and restructuring charges were excluded, the cash profit was flat on the prior year at $6.896 million.

The proposed final dividend of 83 cents per share will be paid on 19 December to shareholders registered on 14 November, making a 70% franked, unchanged full-year payment of $1.66.

Chief Executive Officer Nuno Matos said ANZ’s Institutional and New Zealand division performed consistently well, but the Australia Retail and Business & Private Bank underperformed despite growth in assets and deposits as intense competition and a falling interest rate environment affected margins.

He said ANZ continued to make progress on immediate priorities, including embedding its leadership team and culture reset, accelerating the integration of Suncorp Bank, delivering the ANZ Plus single-customer front-end, simplifying the bank and reducing duplication, and improving non-financial risk management.

The results highlighted ANZ’s strong competitive position, scale markets in market positions in Australia and New Zealand, market leading positions in the Institutional and New Zealand businesses and its well-diversified business benefitting from our strong presence in Asia, the fastest growing economic region in the world.

The bank also had a significant opportunity to improve its performance in Australia Retail and Business & Private Bank while extending its leadership in the Institutional and New Zealand businesses.

“The results we have announced today demonstrate our franchise is strong, but action is needed,” Matos said.

At the time of writing, ANZ shares (ASX: ANZ) were trading $1.01 cents (2.73%) higher at $37.80, making it the smallest of Australia’s Big Four banks with a market capitalisation of $112.81 billion.