American Airlines Group shares jumped after it announced a 24% reduction in losses in the third quarter of the 2025 financial year (Q3 FY25) and raised its full-year profit forecast.

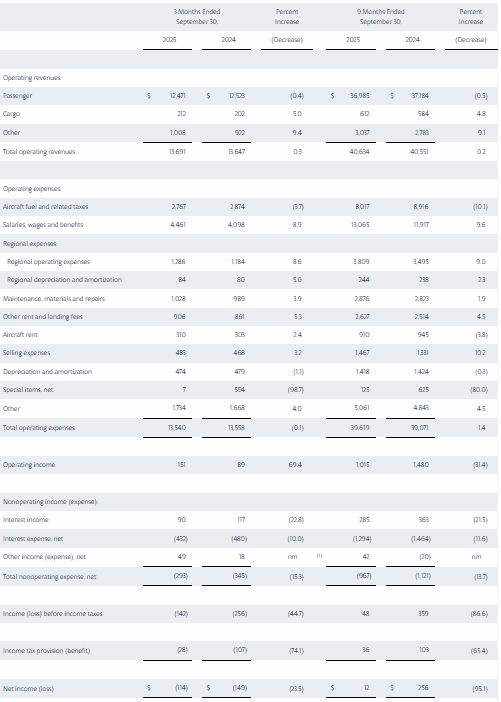

The world’s largest airline by passengers and flights said the net loss in the three months ending 30 September was US$114 million (A$175 million) compared with $149 million in the previous corresponding period (pcp).

The diluted loss per share narrowed to 17 cents from 23 cents in the pcp on operating revenue, which grew just 0.3% to a record $13.691 billion in Q3.

In the nine months to 30 September, net income and diluted EPS fell 95% to $12 million and two cents respectively on revenue, which grew 0.2% to $40.634 billion.

American Airlines said adjusted earnings per share (EPS) were expected to be between 45 and 75 cents in Q4 and between 65 and 95 cents in FY25.

“The American Airlines team is delivering on our commitments,” CEO Robert Isom said in a news release.

“We’ve built a strong foundation, with best-in class cost management and a focus on strengthening the balance sheet.

“Looking forward, I’m confident that continued investments in our network, customer experience and loyalty program will position us well to drive revenue growth and shareholder value in 2026 and beyond.”

Year-over-year unit revenues improved sequentially in Q3, with September producing growth in unit revenue, a measure of its ability to charge more for seats, and premium unit revenue growth year over year continuing to outperform the main cabin.

Operations were resilient in Q3 despite a difficult environment due to significant weather events, the Federal Aviation Administration technology outage in September and associated air traffic control challenges.

“The company remains focused on executing its strategic priorities and delivering on its revenue potential,” American Airlines said.

The company expected that, by end of this year, it would have restored its share of indirect revenue that was affected by its former strategy of prioritising renegotiating contracts with corporate travel agencies and clients while reducing perks and discounts.

“American is now shifting focus to expanding its share of indirect revenue beyond historical levels, which, combined with improved distribution capabilities, is expected to produce meaningful value for the airline,” it said.

The loss per share was lower than the 28 cents that analysts were expecting, according to data compiled by LSEG.

American Airlines shares (NASDAQ: AAL) closed 68 cents (5.62%) higher at $12.77 on Thursday, capitalising the company at $8.43 billion.