Re-live today's live blog coverage of earnings season.

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Ferrari, Brookfield, Transdigm post double digit growth

- Arista, Intesa Sanpaolo, DoorDash set new personal records

- Marriott revenue up, but slices guidance

- AMD extends estimate-smashing streak

- NAB's net profit declines

- Marathon, WK Kellogg report losses

_______________________________________________________________________________________

8:50 am (AEST):

Good morning! Harlan Ockey here to walk you through the day's earnings.

Kicking things off in Milan (or on the NYSE), Ferrari (RACE) has reported double-digit percentage increases in net revenue and profit.

Revenue was EU€1.79 billion last quarter, up 13% year-over-year. Its Cars and Spare Parts segment reported a 10% increase in revenue, while its Sponsorship, Commercial, and Brand segment grew by 32%.

Net profit was €412 million, rising 17%. Its diluted earnings per share were EU€2.30, an 18% increase.

Ferrari shipped 3,593 vehicles last quarter, up 1% year-on-year. Europe, the Middle East, and Africa saw shipments rise by 8%, and the Americas posted an increase of 3%. Shipments to the Asia Pacific region declined, however, driven in part by a 25% drop across mainland China, Hong Kong, and Taiwan.

“In the first quarter of 2025, with very few incremental shipments year on year, all key metrics recorded double-digit growth, underscoring a strong profitability driven by our product mix and continued demand for personalizations," said CEO Benedetto Vigna. "This confirms — once again — our strategy of ‘quality of revenues over quantity’."

The company will add six new models this year, Vigna said, including its first fully electric car.

Ferrari's full-year 2025 guidance includes revenue above EU€7 billion, with earnings per share at or above €8.60. It also projects that the United States' tariff plans could cause an increase in price of up to 10% on certain models.

Read Andrew Banks' full story here.

9:13 am (AEST):

Over to the NASDAQ, Marriott International (MAR) saw revenue per available room increase by 4.1% year-over-year last quarter.

Basic management and franchise fees were US$1.07 billion, rising 7%. According to Marriott, this was largely to due to increases in revenue per available room and units.

Earnings per diluted share were US$2.39, up 24% year-over-year. Marriott's loyalty program also now has almost 237 million users worldwide.

The company added around 12,200 net rooms last quarter, with more than 7,300 in international markets. Marriott now boasts approximately 1.72 million rooms across 9,500 properties.

Marriott's full-year outlook now includes revenue per available room growth of 1.5-3.5%, decreasing from the 2-4% previously projected due to tariff-related uncertainties and a drop in bookings from the U.S. government. Expected net rooms growth is approaching 5%.

“We are committed to growing our global portfolio and enhancing offerings for our guests, Marriott Bonvoy members and hotel owners. Last week, we announced that we have reached an agreement to acquire the citizenM brand, an innovative lifestyle lodging offering in the select-service segment. We are excited about the global growth prospects for this brand, given the unique and differentiated nature of the offering and our successful track record with other acquired brands like AC Hotels,” said Marriott CEO Anthony Capuano.

Andrew Banks has the full report.

9:28 am (AEST):

Staying with the NASDAQ, Advanced Micro Devices (AMD) bested estimates on earnings per share and revenue.

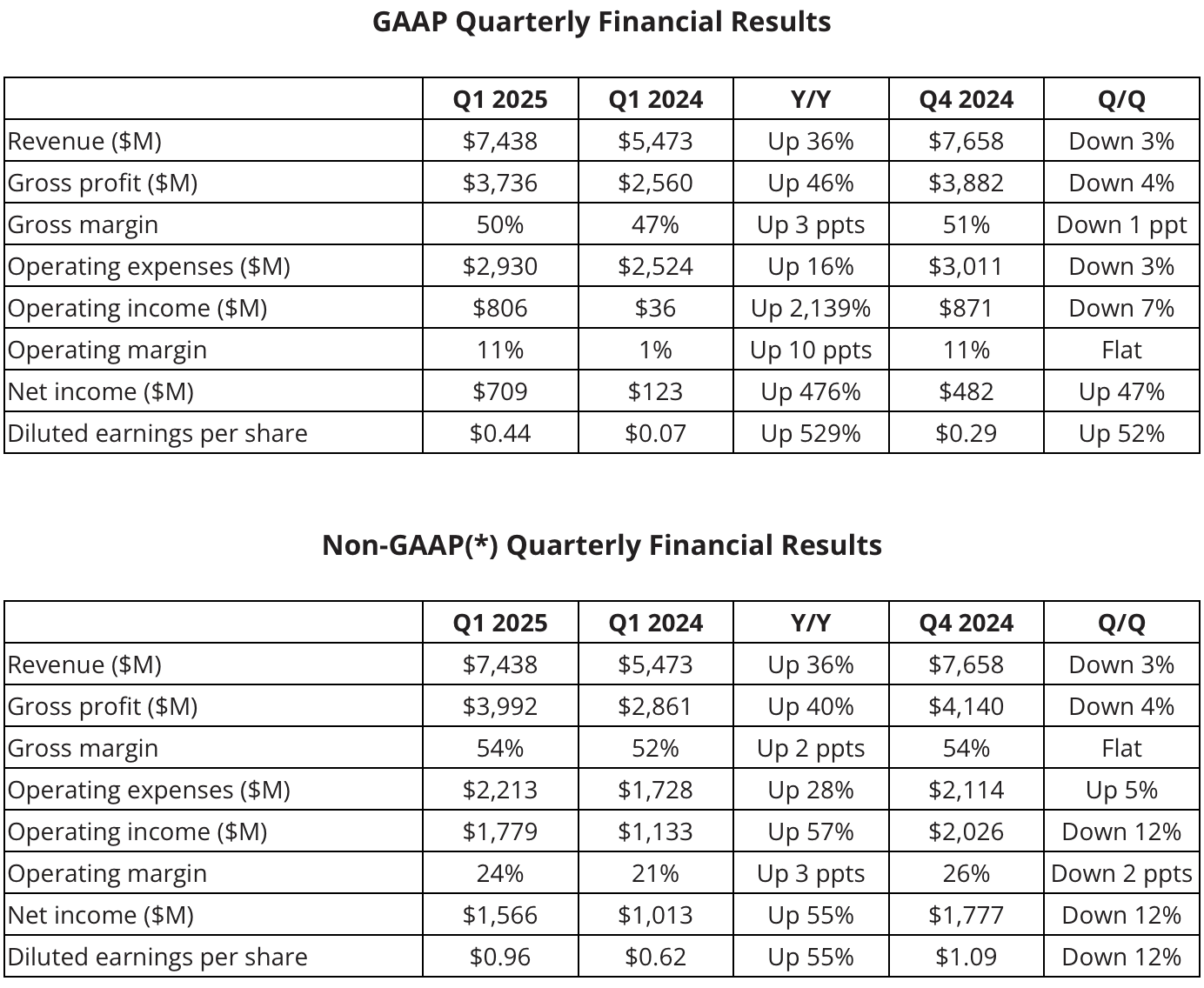

Revenue was US$7.44 billion, up 36% year-over-year and above LSEG estimates of $7.13 billion. Non-GAAP diluted earnings per share were $0.96, rising 55% and passing estimates of $0.94.

“We delivered an outstanding start to 2025 as year-over-year growth accelerated for the fourth consecutive quarter driven by strength in our core businesses and expanding data center and AI momentum,” said AMD CEO Lisa Su. “Despite the dynamic macro and regulatory environment, our first quarter results and second quarter outlook highlight the strength of our differentiated product portfolio and consistent execution positioning us well for strong growth in 2025.”

Its Data Center segment posted US$3.7 billion in revenue, up 57% year-over-year as CPU and GPU sales grew. Client and Gaming revenue rose by 28% to $2.9 billion; while Client revenue was up by 68%, Gaming revenue declined by 30%.

The company's guidance for next quarter projects revenue of around US$7.4 billion, plus or minus $300 million.

Read Cameron Drummond's full story here.

9:40 am (AEST):

At the ASX, National Australia Bank (NAB) has reported a small dip in net profit in the first half of the 2024/25 financial year (H1 FY25).

NAB, one of Australia’s Big Four banks, said net profit after tax fell 2.5% to A$3.407 billion, on revenue which rose 1.1% to $10.282 billion in the six months ended 31 March 2025.

Cash earnings, which it considers a better measure of underlying performance, rose just 0.8% to $3.583 billion as underlying profit growth and lower credit impairment charges were partially offset by a higher effective tax rate. Directors declared a fully franked interim dividend of 85 cents per share to be paid on 2 July to shareholders on record on 13 May, compared with 84 cents in H1 of FY24.

"We are managing our business well in continued challenging operating conditions,” CEO Andrew Irvine said in an ASX announcement.

National Australia Bank (ASX: NAB) shares closed 55 cents (1.53%) lower at $35.30 on Tuesday, capitalising the bank at $108.11 billion, but may be supported in a weaker market when trading resumes on Wednesday as cash earnings were above analysts’ expectations.

Thank you to Garry West for that write-up. Read Garry's full report here.

9:53 am (AEST):

Back to the NASDAQ, Electronic Arts (EA) saw net bookings rise to US$1.80 billion last quarter, beating LSEG estimates of $1.56 billion.

Total net revenue was US$1.90 billion, up from $1.78 billion year-over-year. Full Game revenue increased from $333 million to $437 million, while Live Services and Other revenue rose from $1.45 billion to $1.46 billion.

Net income was US$254 million, compared with $182 million one year ago. Diluted earnings per share were $0.98, up $0.31.

“The incredible success of College Football and the enduring strength of FC drove another record year for EA SPORTS, while The Sims capped FY25 with a historic Q4,” said CEO Andrew Wilson. “As we look to the future, we’re confident in our ability to execute across a deep pipeline — beginning this summer with the highly anticipated reveal of Battlefield, a pivotal step in delivering on our next generation of blockbuster entertainment.”

Its outlook for the fiscal year ending March 2026 projects US$7.6-8.0 billion in net bookings, with $7.1-7.5 billion in net revenue and $795-974 million in net income.

11:11 am (AEST):

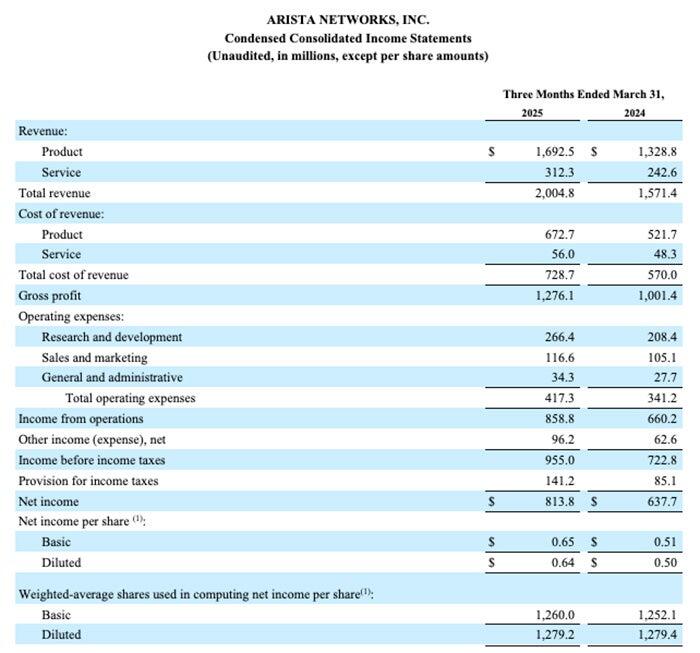

At the NYSE, Arista Networks (ANET) reported a record US$2.01 billion in revenue last quarter, up 27.6% year-over-year.

Product revenue increased from US$1.33 billion to $1.69 billion, and Service revenue grew from $242.6 million to $312.3 million.

GAAP earnings per share were $0.64, up $0.14 and beating Zacks estimates of $0.59. Net income was $813.9 million, growing by around $176 million year-over-year.

Its non-GAAP gross margin was 64.1%, roughly stable from 64.2% one year ago.

“As we enter 2025, AI, cloud, and enterprise customers continue to drive network transformation. We surpassed $2B in revenue for the first time in Q1 2025 despite the unknowns around tariffs," said CEO Jayshree Ullal. "Arista's trifecta of innovation, growth, and profitability is reflected in our results."

The company's guidance next quarter projects revenue of around US$2.1 billion, with a non-GAAP gross margin of approximately 63%.

11:28 am (AEST):

Back to Milan, Intesa Sanpaolo (ISP) posted a record net income of EU€2.62 billion, rising 13.6% year-over-year.

Its Insurance division also posted record-high income at EU€462 million, compared with €455 million one year ago.

Net interest income declined by 8% to EU€3.63 billion, however. Its cost/income ratio was 38%, its lowest ever.

Earnings per share last quarter were EU€0.103, up from €0.088 year-over-year.

Intesa Sanpaolo's CET1 ratio was approximately 13.3%, which rose by around 45 basis points during the quarter.

“In terms of market capitalization, we rank among the leading European banking groups, alongside competitors with significantly larger balance sheets," said CEO Carlo Messina. “Amid market volatility and shifting interest rates, we are facing these challenges from a position of strength, thanks to a resilient, efficient and well-diversified business model.”

The company reiterated its full-year outlook, and expects net income will be “well above” EU€9 billion across 2025.

11:52 am (AEST):

Chloe Jaenicke here to take over the blog for a little bit.

On the NASDAQ, DoorDash (DASH) has generated new quarterly records for total orders, marketplace GOV, revenue and GAAP net income for Q1 2025.

The company’s total orders increased 18% from the same period last year to 732 million and Marketplace GOV increased 20% to US$23.1 billion.

Revenue for DoorDash grew by 21% year on year to $3 billion.

The company’s record-breaking earnings coincide with its £2.9 billion acquisition of Deliveroo, which is expected to create fierce competition with rivals Just Eat and Uber Eats in the U.K..

12:08 pm (AEST):

Brookfield Asset Management (NYSE: BAM, TSX: BAM) reported a 26% year-over-year increase in quarterly fee-related earnings.

The earnings came to nearly US$700 million which Brookfield President, Connor Teskey said is attributable to capital raised by the company in the past 12 months.

“Fee-related earnings grew 26% year-over-year, driven by more than $140 billion of capital raised over the past 12 months,” he said.

“The strength in real estate was remarkable, with $6 billion of inflows to our flagship strategy which, already at $16 billion, is now set to be our largest real estate strategy ever raised.”

Their distributable earnings over the last 12 months were also up 11% over the past months to $2.5 million.

12:26 pm (AEST):

Constellation Energy Corporation (NASDAQ: CEG) reported earnings of US$2.14 per share, which were in line with the Zacks Consensus Estimate.

Its revenues totalled to $6.79 billion, which is an increase of 10.2% from last year’s $6.16 billion and beats the Zacks Consensus Estimate by 14.6%.

Constellation president and CEO Joe Dominguez said the company is also trying to power more AI products that Americans are using in their daily lives.

“We are delighted to partner with America’s leading technology companies as we have done with the relaunch of the Crane Clean Energy Center, and have made tremendous progress on new power agreements that we expect to announce soon,” he said.

“Our generation fleet performed well to start the year with our nuclear plants achieving a 94.1% capacity factor and our natural gas operations attaining a dispatch match rate of 99.2%.

“Our consistent operational and financial performance continues to drive value for our owners.”

12:58 pm (AEST):

Thanks, Chloe! Harlan Ockey back with you now.

At the NYSE, Zoetis (ZTS) saw revenue and net income increase last quarter, and has raised its guidance.

Revenue was US$2.22 billion, rising 1%. While revenue was up by 2% year-over-year to $1.18 billion in the U.S., international revenue remained stable at $1.01 billion.

Livestock division revenue fell by 21% in the U.S. and 4% internationally. Companion Animal revenue rose by 8% in the U.S. and 4% internationally, with the company crediting an increase in sales largely to its anti-parasite and dermatology medications. Dogs & Cats, its largest animal segment, posted 7% revenue growth to US$1.48 billion.

China, Mexico, and Brazil saw the largest drops in revenue, while Canada and Chile reported the largest increases.

Reported net income was US$631 million, rising by 5%. Earnings per diluted share were $1.41, up 8%.

“Zoetis achieved strong results for the first quarter of 2025, driven by demand for our innovative products and our focus on delivering for our customers. It is a testament to our colleagues’ unwavering dedication and excellence in agility that we reported organic operational revenue growth of 9%," said CEO Kristin Peck.

The company's guidance now projects revenue of US$9.43-9.58 billion, up from the previously expected $9.23-9.38 billion, which it said reflected foreign exchange rates and the effect of current U.S. tariffs.

1:40 pm (AEST):

Still with the NYSE, TransDigm (TDG) posted double digit percentage increases in net sales and income, though it missed sales estimates.

Net sales were US$2.15 billion, rising 12% year-over-year, but below Zacks estimates of $2.17 billion. Net income was $479 million, up 19%. Adjusted earnings per share grew by 14% to $9.11, beating estimates of $8.85.

Pro forma revenues for its Commercial OEM (original equipment manufacturing) segment were flat year-over-year, while its Commercial Aftermarket and Defense divisions posted revenue growth of 13% and 9% respectively.

"I am very pleased with the operating results for the second quarter. We continued to see strong performance as we closed out the first half of our fiscal year," stated CEO Kevin Stein. "The consolidated business performed well in the second quarter with revenue growth driven by the commercial aftermarket and defense market.

Stein will retire from the company on September 30, TransDigm said this week, and will be replaced by current co-COO Mike Lisman.

The company's full FY2025 guidance projects revenue of US$8.75-8.95 billion, with net income of $1.93-2.04 billion.

2:19 pm (AEST):

And at the NYSE again, WK Kellogg (KLG) reported a slump in sales and income last quarter, and has cut its guidance.

Reported net sales fell by 6.2% year-over-year to US$663 million, and missed Zacks estimates by 2.45%. Organic net sales dropped by 5.6% to $667 million.

Net income was $18 million, dropping by 45.5%. Diluted earnings per share were $0.20, declining $0.17, and less than half of Zacks' projected $0.41.

The company's cost of goods sold declined from US$504 million to $474 million year-over-year. Operating profit fell from $46 million to $20 million.

“Despite the lower than expected first quarter performance which resulted in revising our 2025 outlook, we continue to make great progress on our strategic priorities, including the supply chain modernization initiative," said CEO Gary Pilnick. "We remain on track to deliver ~500 bps of margin improvement as we exit 2026."

Pilnick said the company would shift its focus towards its granola, organic, and health-forward cereals, as these products saw double-digit growth last quarter.

WK Kellogg has revised its full-year financial guidance down, and now expects an organic net sales decline of 2-3%. Its previous projection was a decline of 1%.

Food companies like Kraft Heinz have also lowered their forecasts in recent days amid tariff-related uncertainties and the contraction of the U.S. economy last quarter. Kellanova, WK Kellogg's international-focussed sister company, similarly lagged behind estimates last quarter.

WK Kellogg's shares fell by almost 11% following the release of its results.

2:50 pm (AEST):

Staying with the NYSE, Marathon Petroleum (MPC) saw a net loss of US$74 million last quarter, as well as a decline in revenue.

Its net income attributable to the company one year ago was US$937 million. Net loss per diluted share was $0.24, compared with $2.58 last year. However, this was above Zacks estimates of an $0.63 loss.

Sales and operating revenues were US$31.52 million, down from $32.71 million the previous year.

"Our first quarter results reflect the safe and successful execution of the second largest planned maintenance quarter in our company's history and strong commercial performance," said CEO Maryann Mannen. "Our Midstream business delivered an 8% increase in segment adjusted EBITDA over the prior year, and executed on our Natural Gas and NGL growth strategies. For our refining business, we are positioned to meet summer demand as seasonal trends are expected to improve margins and we remain constructive on its long-term outlook.

Its Midstream segment was the only major division to see both positive EBITDA and EBITDA growth. Refining & Marketing posted a slide in adjusted EBITDA from US$2 billion one year ago to $489 million, while Renewable Diesel's EBITDA rose from a loss of $90 million in Q1 2024 to a loss of $42 million last quarter.

Marathon will invest into upgrades at its Los Angeles, Galveston Bay, and Robinson refineries this year, and will acquire 55% of BANGL for US$$715 million to reach full ownership of the company.

3:26 pm (AEST):

Moving to the NASDAQ. American Electric Power (AEP) beat estimates on revenue and earnings per share.

Revenue was US$5.46 billion, up by $437.8 million year-over-year and passing Zacks estimates of $5.34 billion. Operating earnings per share were $1.54, growing by $0.27 and besting estimates of $1.39.

Non-GAAP operating earnings grew across segments last quarter. Vertically Integrated Utilities, its largest division, saw a US$49.6 million increase year-over-year to $349.9 million. Total GAAP earnings fell by US$202.9 million, however.

“Our robust operating earnings results this quarter reflect our team’s continued focus on execution and innovation to deliver on our commitments to our customers, communities, regulators and investors," said CEO Bill Fehrman.

The company's 2025 guidance projects operating earnings per share of US$5.75-5.95. "We also reaffirm our projected long-term growth rate of 6% to 8%," Fehrman said.

3:38 pm (AEST):

Looking ahead, we'll see earnings from companies like Disney, Uber, Toyota, Nintendo, and Occidental Petroleum tomorrow.

That's all from me today. Thanks for joining us!