Marriott International posted a solid first-quarter performance in 2025, outperforming analyst expectations, and reflecting resilient demand for travel and lodging worldwide.

The hospitality giant reported net income of $665 million, up 18% year-on-year, with adjusted EBITDA rising 7% to $1.22 billion. Revenue per available room (RevPAR) climbed 4.1% globally, driven by international markets (+5.9%), while U.S. and Canada growth remained steady at 3.3%. Amid a booming recovery in business and leisure travel, Marriott’s ability to capture pricing power and maintain strong occupancy underscores wider industry momentum.

President and CEO Anthony Capuano said, "The combination of continued travel demand, the strength of our brands and our fee-driven business model drove strong financial results in the first quarter.

"Despite heightened macro-economic uncertainty, global RevPAR rose over 4%, primarily driven by higher ADR, and our development momentum remained positive. Our international markets experienced particularly robust growth, with RevPAR increasing nearly 6%, led by double-digit gains in APEC. RevPAR in the U.S. & Canada rose over 3% in the first quarter, although we did see slower growth in March."

Expansion remains a core focus, as the company added 12,200 net rooms, with over 7,300 coming from international markets. Marriott also inked deals for 34,000 new rooms in the quarter, reinforcing confidence in its long-term pipeline. The lodging giant now boasts a development portfolio of 3,800 properties and 587,000 rooms, a 7.4% year-on-year increase. With global hotel chains rushing to meet renewed demand — especially in the luxury and premium segments — Marriott's footprint growth reflects the broader industry's commitment to scale and brand diversification.

"The strong momentum in our development activity continued, with record first quarter signings of over 34,000 rooms, of which two-thirds were in international markets. Conversions remained a key driver of growth, representing around a third of our room signings and openings," Capuano said.

"We are committed to growing our global portfolio and enhancing offerings for our guests, Marriott Bonvoy members and hotel owners. Last week, we announced that we have reached an agreement to acquire the citizenM brand, an innovative lifestyle lodging offering in the select-service segment. We are excited about the global growth prospects for this brand, given the unique and differentiated nature of the offering and our successful track record with other acquired brands like AC Hotels. Our net rooms growth outlook remains strong, and we now expect our full year 2025 net rooms growth to approach 5 percent, assuming the purchase closes before year end."

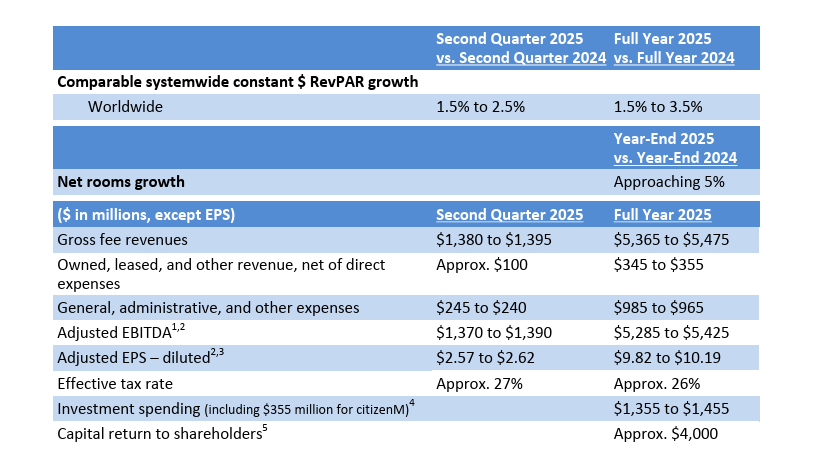

Shareholder returns remain robust, with $1.2 billion returned through dividends and stock repurchases year-to-date. Marriott repurchased 3.9 million shares for $1 billion in 2025, positioning itself for a projected $4 billion in total shareholder returns this year. The move follows similar capital allocation strategies across the global hospitality sector, where major players prioritise investor confidence amid economic shifts.

Looking ahead, Marriott projects moderate RevPAR growth of 1.5% to 3.5% for the full year, balancing optimism with caution due to macroeconomic uncertainties. Adjusted EBITDA guidance ranges from $5.29 billion to $5.43 billion, reflecting steady revenue expansion and disciplined cost management. As international travel surges and urban occupancy rates improve, Marriott’s performance aligns with industry-wide efforts to refine pricing models and enhance customer experience.

Capuano said: "We remain focused on expanding our industry-leading Marriott Bonvoy travel platform and loyalty program membership and on deepening engagement through numerous unique experiences and collaborations. By the end of March, our loyalty program membership base had grown to nearly 237 million members worldwide. "Despite uncertainty about the macro-economic outlook, we are confident that the power of our industry-leading global portfolio, the strength of our Marriott Bonvoy travel platform and loyalty program, our dedicated associates, and resilient asset-light business model, position us very well for sustainable, long-term growth."

With 9,463 lodging properties worldwide, Marriott remains a leader across the luxury, premium, and select-service tiers. Brands such as JW Marriott and Ritz-Carlton continue to see strong RevPAR increases, reinforcing the demand for high-end hospitality. As the sector evolves — integrating technology, sustainability, and exclusivity — Marriott's first-quarter results affirm its competitive positioning in an increasingly dynamic global travel market.

At the time of writing, Marriott International Inc's (NASDAQ: MAR) stock price was US$251.96, up $4.69 (1.90%) today, with a market cap of approxmately $69.38 billion.