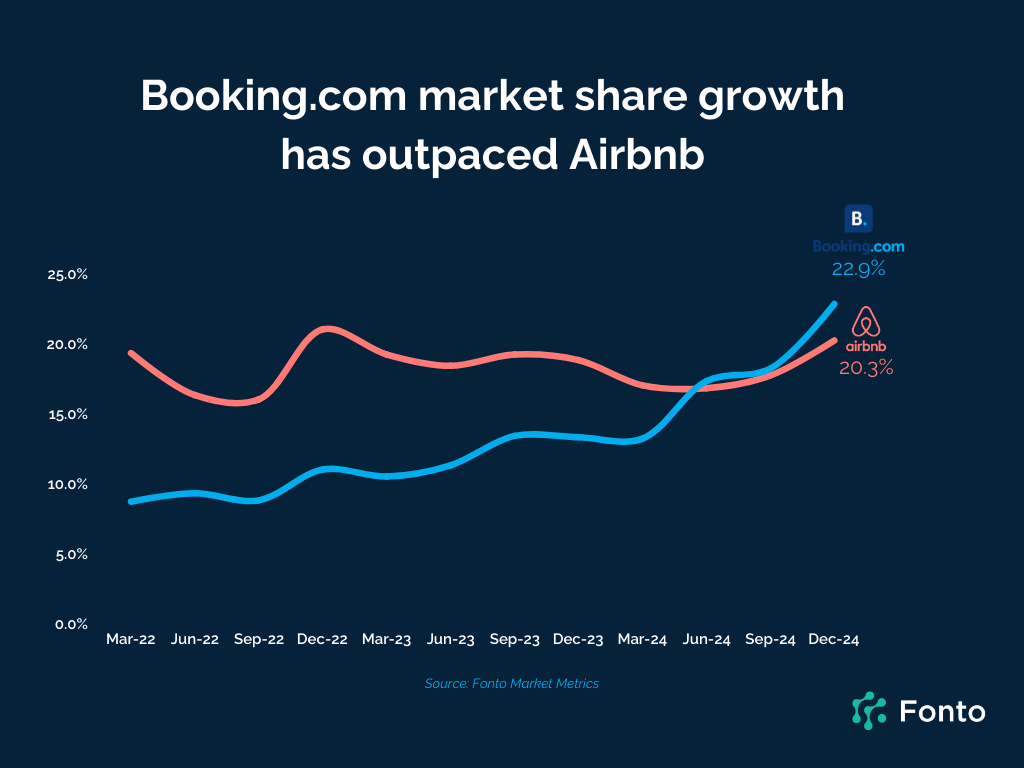

The battle for short-stay accommodation has taken a twist, with Booking.com surpassing the game-changing Airbnb for consumer market share last year, the first time since data was collected in 2021, consumer analyst Fonto shows.

Launched in 2007 in Silicon Valley, Airbnb revolutionised the short-stay market when two hosts welcomed three guests into their San Francisco, and has since grown to welcome over two billion guests across five million hosts in almost every country on Earth.

Yet after a spike in Airbnb offerings during COVID, there's been a shift back by consumers to serviced accommodation offerings - especially in Australia - which now leads consumer transactions, Fonto data shows.

The rise

The increase in Airbnbs from 2019-2022 caused a housing crisis for local populations in tourist destinations during and just after the pandemic.

For example, by 2022, Byron Bay had over 30% of its housing stock listed on the platform, according to University of Wollongong (OUW) Snr Professor Pauline McGuirk.

“There was a downturn in Airbnb because of COVID and that’s stayed down in city centres, but it bounced back in regional and tourist places especially,” McGuirk says, citing median prices of rentals in Byron going up from about $550/week in 2020 to $800/week by 2022.

The fall

By 2023, consumers started to move away from Airbnb’s short-stay model, with trends now showing traditional hotels and motels regaining popularity.

“People preferred Airbnb during COVID because it felt safer and you could socially distance, but after COVID, people no longer need those benefits," UOW School of Business Dr Beo Thai said.

“Consumers now see the inconvenience of Airbnb bookings, with non-transparent pricing, rules around cleaning and still having to pay cleaning fees.

“All of that inconvenience is making these properties less attractive, whereas hotels have service perks like free breakfast, a concierge, loyalty programs, and are often in the city centre.”

Fonto said there has been increased regulatory scrutiny on private short-stay accommodation by various levels of government in Australia, hitting Airbnb with a $15m fine and potential compensation payouts of up to $15 more in late 2023 as it faced misleading pricing accusations from the Australian Competition & Consumer Commission (ACCC).

“In Victoria, the launch of the State Government’s ‘Airbnb tax’ of 7.5% on all short-stay accommodation from January 1 is expected to significantly impact demand and competitive pressures throughout 2025,” Fonto said in its report.

“Similarly, some local councils elsewhere in Australia are applying limitations to the number of days properties can be made available for short stays.

“Byron Bay for example, placed a 60-day annual limit on properties within its council area in late 2024 with other councils considering similar constraints to ease housing and affordability pressures.”

Leading the pack

Fonto says that with these pricing, trust and competitive pressures all coming to the fore, Booking.com steadily grew its market share throughout 2024 to 22.9% for the December 2024 quarter, surpassing Airbnb’s 20.3% share.

That's a third consecutive quarter of market leadership for short stays in Australia by the world's leading online travel agency.

“Additionally, customers with Booking.com spent 5% more on average per transaction than Airbnb during the December 2024 quarter, a significant turnaround from 2022 and 2023 where their average spend per transactions were significantly lower than the competitor," Fonto noted.

“2025 will continue to be a battleground in the category as both brands respond to a shifting competitive environment.”