Re-live our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Porsche, Volvo, Starbucks sales decline

- Adidas, Lufthansa, Honeywell revenue up

- BP profits slump

- AstraZeneca and Novartis post major sales increases

- Spotify earnings surge, but struggle to beat guidance

- General Motors sales up, reassessing guidance amid tariff impacts

___________________________________________________________________________________

8:47 am (AEST):

Good morning! Harlan Ockey here to walk you through the day's earnings.

Kicking things off in Frankfurt, Porsche (PAH3) has seen its total sales drop by 1.7% year-over-year to EU€8.86 billion.

Deliveries fell by 7.9% last quarter, with 71,470 vehicles delivered in total. Deliveries in Germany dropped by a larger 33.5%, to just 7,495 vehicles. According to the company, this is due to an above-average Q1 2024, as well as European regulations creating a supply gap in its 718 Boxter/Cayman and Macan series.

Its gross profit was EU€1.86 billion, down from the previous year's €2.32 billion.

The Macan and Cayenne series remained Porsche's most-delivered models. While the Macan's deliveries increased by almost 3,000 units, the Cayenne's declined by around 8,000.

Porsche has also cut its full-year forecast, and now projects revenue between EU€37-38 billion, down from the previous €39-40 billion.

Andrew Banks has the full story.

8:56 am (AEST):

On the NYSE, Spotify (SPOT) reported a 15% year-over-year surge in total revenue, with 10% growth in monthly active users.

Its revenue last quarter was EU€4.19 billion, in line with its guidance, and the platform now boasts 678 million monthly active users. Subscriber numbers also rose by 12% to reach 268 million.

Spotify's operating income was EU€509 million, a new high, though lower than its previous guidance of €548 million. Gross profit was €1.32 billion, up 32% year-on-year.

"The underlying data at the moment is very healthy: engagement remains high, retention is strong, and thanks to our freemium model, people have the flexibility to stay with us even when things feel more uncertain,” said CEO Daniel Ek. “So yes, the short term may bring some noise, but we remain confident in the long-term story, and the direction we’re heading in feels clearer than ever.

The company's second-quarter forecast includes a profit of EU€539 million, below estimates of €557.5 million.

Garry West has the full story.

9:16 am (AEST):

In Stockholm, Volvo Cars (VOLV-B) saw revenue, earnings per share, and operating income fall last quarter.

Volvo's revenue was SE82.9 billion kr, down from 93.9 billion kr in Q1 2024. Its basic earnings per share were 0.40 kr, dropping from 1.12 kr year-over-year.

Operating income was SE1.9 billion kr, below Q1 2024's 4.7 billion kr. Overall sales were 172,219, falling 6% year-over-year.

These declines are due to a planned inventory reduction at the end of 2024, the company said, as well as adverse currency impacts and macroeconomic turbulence.

Volvo has planned to transition to a fully electric car company, though in 2024 it revised its goal of becoming electric-only by 2030 to 90% electrified sales by that year. Electrified car sales represented 43% of its sales in Q1 2025, 2% above their proportion in Q1 2024. Volvo also launched the fully electric ES90 sedan last quarter, which is expected to reach Australia later this year.

"Over the last few weeks, I have worked with the management team and other colleagues on a plan to make the company stronger and more resilient. While our strategy is clear, we must get better at delivering results," said CEO Håkan Samuelsson. "While we still have a lot to do, our direction going forward is focused on three areas: profitability, electrification and regionalisation.”

The company said it will “empower its regions to better meet the needs of its customers” going forward, including an initial focus on reconfiguring its product lineup in the U.S. and Chinese markets. It also will reduce its investments and lay off parts of its workforce in a bid to lower costs.

Volvo declined to provide guidance for 2025, due to growing economic uncertainties. “As Volvo Cars enters into the year, it sees that tougher market conditions and lower volumes combined with increased price pressure and tariff effects are impacting profitability.” it said.

9:39 am (AEST):

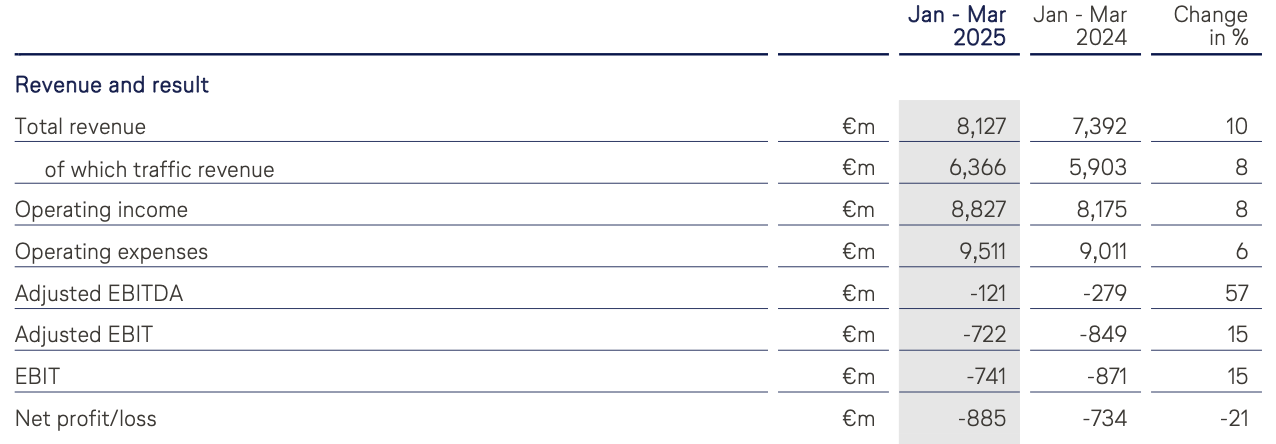

Returning to Frankfurt, Lufthansa (LHA) posted a 10% year-over-year increase in total revenue, as flights rose by 4%.

Its revenue last quarter was EU€8.13 billion, with €6.37 billion representing traffic revenue. Lufthansa reported 204,175 flights, while passenger numbers remained approximately flat at 24.29 million.

The airline saw a net loss of EU€885 million, down 21% year-over-year. Its adjusted loss before interest and taxes was EU€722 million, improving by 15%, and pperating income was €8.83 billion, rising 8%.

“Initial successes of Lufthansa Airlines' turnaround program have already had a positive impact on operational stability. Overall, the levels of punctuality and regularity achieved by the Lufthansa Group’s Passenger Airlines in the first quarter of 2025 surpassed their pre-crisis levels in the first quarter of 2019 for the first time,” the company said.

Lufthansa reiterated its full-year 2025 guidance, predicting a “clear increase” in revenue. However, it has revised capacity growth to the U.S. for its fourth quarter down from 6% to 3%.

9:56 am (AEST):

Still in Frankfurt, Adidas (ADS) reported an 13% growth in currency-neutral revenue to reach EU€6.15 billion.

Its footwear segment saw a 17% rise in revenue last quarter, with apparel and accessories up by 8% and 10% respectively.

Wholesale, own retail, and e-commerce revenues all increased by double digits. While its Latin America, Emerging Markets, Greater China, Europe, and Japan/South Korea markets all saw double-digit sales increases, North America's sales rose by just 3% after the phase-out of Yeezy products last year.

The company reiterated its 2025 outlook, though “the range of possible outcomes has increased”. It projects currency-neutral sales will increase at a high single-digit rate.

Andrew Banks has the full story.

10:04 am (AEST):

Over to the LSE, BP (BP) saw net profits drop to US$687 million from $2.26 billion year-over-year, amid a weak gas market.

Underlying replacement cost profit was US$1.4 billion, also falling from $2.72 billion in Q1 2024.

“In February, we announced a fundamental reset of our strategy - to grow the upstream, focus the downstream and invest with discipline in the transition - and we have already made significant progress. So far this year we have started up three major projects, made six exploration discoveries and have progressed our divestment programme," said CEO Murray Auchincloss.

Read Cameron Drummond's full report here.

10:20 am (AEST):

At the NYSE, Coca-Cola (KO) bested expectations on earnings per share and revenue, though net sales declined by 2% to US$11.13 billion.

Its earnings per share were US$0.73, above estimates of $0.71. Revenue was $11.22 billion, beating estimates of $11.14 billion.

The company confirmed its full-year outlook, projecting 5-6% growth in organic revenue.

Read Frankie Reid's full article here.

11:08 am (AEST):

At the NASDAQ, Starbucks (SBUX) has reported a 1% drop in global comparable store sales, though consolidated net revenues rose by 2% to US$8.8 billion.

North American store sales dropped by 1%, while international sales were up 2%. Overall, sales have now fallen for four consecutive quarters.

Starbucks opened 213 net new locations last quarter, with 40,789 locations overall.

GAAP earnings per share were US$0.41, dropping 40% year-over-year.

“While our financial results are far from Starbucks potential, we are working to build back a better business,” said CFO Cathy Smith. “We are developing new muscles to test, iterate and scale quickly, in service of long-term, durable growth and strong returns on invested capital."

Meanwhile at NASDAQ Copenhagen, Carlsberg (CARL) posted revenue growth of 17.4%. However, organic revenue development dropped by 1.5%, with the end of its U.K. licence partnership with San Miguel.

Total revenue was DK20.12 billion kr., with Western Europe seeing the largest regional increase at 31%.

The company's beer volumes last quarter were 23.3 million hectolitres, falling 1.6% year-over-year. Other beverages, however, reached 10.1 million hectolitres, up 84.5%.

Carlsberg will maintain its previous 2025 full-year outlook, which projects organic operating profit growth of about 1-5%. The company's acquisition of Britvic was also completed last quarter, and it predicts UK£100 million in cost synergies and £83 million in integration costs.

11:25 am (AEST):

At the NYSE, Snap (SNAP) beat estimates on revenue and user numbers, but did not offer guidance amid macroeconomic headwinds.

The company's revenue was US$1.36 billion, above LSEG estimates of $1.35 billion and rising 14% year-over-year. It posted a net loss of $139 million, improving by 54%.

Snap reported a diluted net loss per share of US$0.08, compared with $0.19 one year ago.

Its daily active users grew by 9% to 460 million, beating StreetAccount estimates of 459 million. Average revenue per user was US$2.96, besting estimates of $2.93. The platform reached more than 900 million monthly active users during the quarter.

"Given the uncertainty with respect to how macro economic conditions may evolve in the months ahead, and how this may impact advertising demand more broadly, we do not intend to share formal financial guidance for Q2," said the company. Analysts had projected US$1.39 billion in Q2 revenue guidance.

11:43 am (AEST):

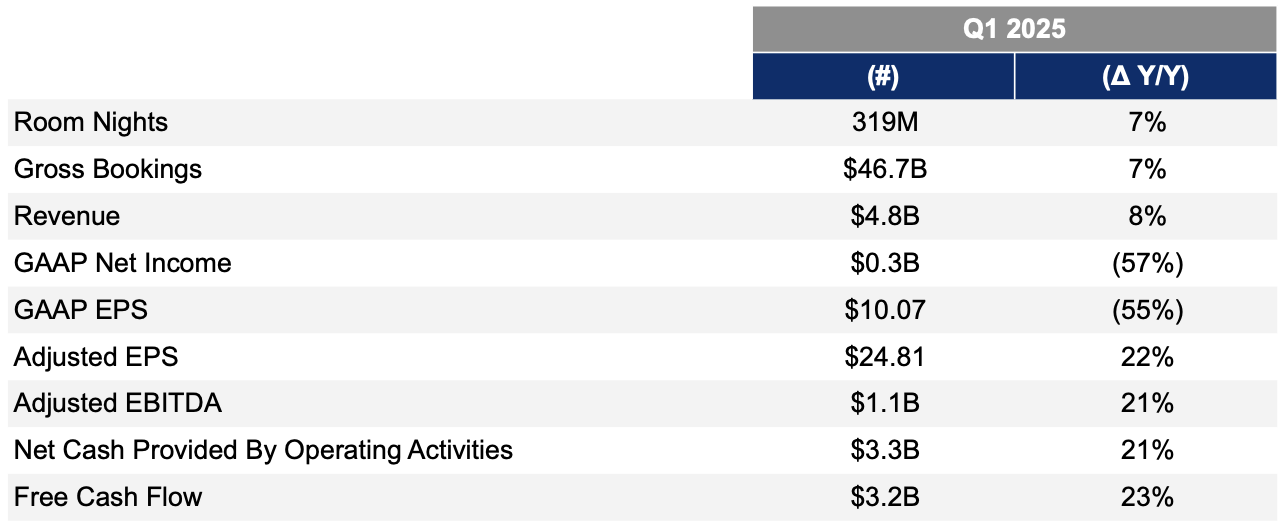

Turning to the NASDAQ, Booking (BKNG) saw revenue and bookings increase, though earnings per share dropped.

Revenue rose by 8% year-over-year to US$4.8 billion. Gross bookings were up 7% to $46.7 billion. Room nights beat the company's own guidance, growing by 7% to 319 million.

However, its GAAP net income was US$300 million, down 57%, and its GAAP earnings per share fell by 55% to $10.07. Non-GAAP adjusted earnings per share were up 22% to $24.81.

"I am pleased to report a good start to 2025 where healthy growth of room nights and gross bookings in the first quarter benefited from our globally diversified business," said CEO Glenn Fogel. "While there is uncertainty in the market around the near-term geopolitical and macroeconomic environment, we remain focused on driving our business for the long term by delivering value to our supplier partners and our travelers and executing on our strategic priorities."

12:00 pm (AEST):

Frankie Reid here, hopping on to cover Harlan for the next hour!

Sticking with the NASDAQ, PayPal (PYPL) for Q1 has reported better-than-expected earnings but fell short on revenue.

Revenue came in at US$7.79 billion compared to the $7.85 billion estimated by Wall Street.

Earnings per share landed at $1.33 adjusted against $1.16 expected.

Transaction margin dollars for PayPal also grew by 8%, marking a fifth consecutive quarter of profitable growth and the company stayed steady on its full-year guidance, pointing to “global macroeconomic uncertainty.”

12:21 pm (AEST):

Heading round to KRX, Samsung Electronics (005930) saw a strong start to the year, with a sales increase of 10% year-on-year.

Return on Equity (ROE) stayed stable at 8% and so did net profit margin at 10%.

Total sales figures came in at KRW 79.1 trillion and a gross profit of KRW 28.1 trillion, totalling a gross margin of 35.5%.

It's net profit, landed at KRW 8.2 trillion, making up 10.4% of their sales.

Andrew Banks with the full story here.

12:38 pm (AEST):

Heading back stateside, the United Parcel Service (NYSE: UPS) beat out estimates for its first quarter profit but is still looking to cut 20,000 jobs.

In addition to job cuts UPS is facing warehouse closures, increased automation of services and sales of assets.

The delivery giant did not provide any updates to its full-year guidance, citing economic uncertainty.

Q1 revenue was reported to have fallen slightly to US$21.5 billion but still beat Wall Street expectations of $21.05 billion.

Stateside domestic segment revenue grew by 1.4% and there was an adjusted profit per share of $1.49 compared with estimates of $1.38.

“The actions we are taking to reconfigure our network and reduce cost across our business could not be timelier,” CEO Carol Tome said on the company's conference call after the report release.

"The world has not been faced with such enormous potential impacts to trade in more than 100 years.”

1:03 pm (AEST):

Thanks so much, Frankie! Harlan Ockey back with you now.

At the NYSE, Visa (V) saw its revenue increase by 9% to US$9.6 billion last quarter. GAAP net income fell by 2% to $4.6 billion, while GAAP earnings per share were up 1% to $2.32.

Its payments volume increased by 8% year-over-year, while its processed transactions were up 9%. Its cross-border payments volume rose by 13%.

GAAP operating expenses were up US$4.2 billion last quarter, growing by 22% due to increased litigation provisions.

Visa’s strong 9% fiscal second quarter net revenue growth was driven by healthy trends in payments volume, cross-border volume and processed transactions. Consumer spending remained resilient, even with macroeconomic uncertainty," said CEO Ryan McInerney.

The company repurchased around 13 million shares of common stock last quarter for US$4.5 billion, with an additional $30 billion multi-year common stock buyback program announced this month.

1:30 pm (AEST):

At the LSE, AstraZeneca (AZN) reported a 10% rise in revenue to US$13.59 billion, with growth across all major regions.

Its reported earnings per share were US$1.88, up 32%. Core earnings per share rose by 21% to $2.49.

“Our strong growth momentum has continued into 2025 and we have now entered an unprecedented catalyst-rich period for our company,” said CEO Pascal Soriot. The company has seen positive Phase III study results for five new treatments so far this year, including medications for breast cancer and hypoparathyroidism.

According to Soriot, AstraZeneca plans to invest in U.S.-based manufacturing and research & development.

The company's full-year forecast projects that total revenue will increase by a high single-digit percentage, while core earnings per share will rise by a low double-digit percentage. It aims to reach US$80 billion in total revenue by 2030.

2:11 pm (AEST):

Back to the NYSE, General Motors (GM) saw its revenue increase by 2.3% to US$44.02 billion, beating LSEG estimates of $43.05 billion.

The company also surpassed earnings per share estimates by US$0.04, reaching $2.78. Its net income was $2.78 billion, down 6.6%.

Net automotive sales were US$39.86 billion last quarter, up from $39.21 billion in 2024's Q1. Its Cruise robotaxi subsidiary posted $1 million in revenue, having been fully acquired by General Motors in February after struggling to turn a profit.

“We believe the future impacts of tariffs could be significant, so we are reassessing our guidance and look forward to sharing more when we have greater clarity,” said CFO Paul Jacobson, though General Motors did not officially revise or withdraw its initial 2025 outlook. Its original guidance projected net income from US$11.2-12.5 billion.

Jacobson also said that the company would adjust production plans in North America to accommodate the U.S.' tariffs, which include 25% tariffs on aluminium and steel as well as major tariffs on Canada and Mexico.

2:39 pm (AEST):

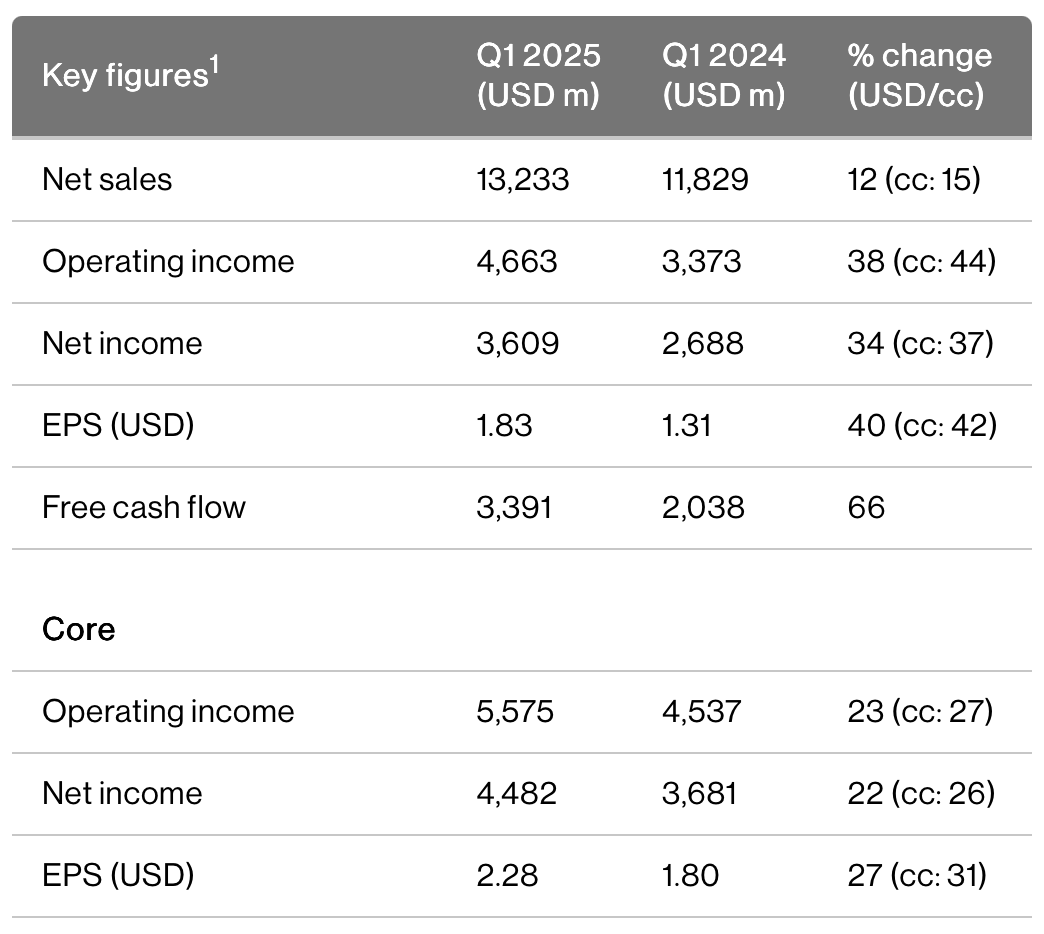

In Zurich, Novartis (NOVN) said net sales grew by 15% on a constant currency basis, rising to US$13.23 billion. This is above the $13.12 billion estimated by LSEG.

Core earnings per share were US$2.28, up 31% in constant currency.

Net income was US$3.61 billion, rising 37% year-over-year in constant currency, and free cash flow grew by more than $1.35 billion to $3.39 billion.

"Our priority brands, including Kisqali, Kesimpta and Leqvio, continue to show strong momentum, which we anticipate will drive our growth through 2030 and beyond," said CEO Vas Narasimhan. The company also saw new drugs like Pluvicto, which treats prostate cancer, approved by U.S. regulators last quarter.

Heart medication Entresto led Q1 growth, with net sales up by 22% in constant currency to US$2.26 billion. Cosentyx, a drug for psoriasis and arthritis, was the second-largest contributor to net sales at $1.53 billion.

The company has raised its guidance for 2025, and now projects net sales will grow by a high single-digit percentage across the year. It predicts core operating income will grow by a low double-digit percentage.

3:14 pm (AEST):

At Frankfurt again, Deutsche Bank (DBK) saw net profit rise by 39% to EU€2.0 billion last quarter. Net revenue grew by 10% year-over-year to €8.5 billion.

Its Corporate bank net revenue was EU€1.9 billion, flat year-over-year, as high deposit volumes were offset by normalising deposit margins. Investment Bank net revenue was €3.4 billion, rising by 10%.

Private Bank revenues grew by 3% to EU€2.4 billion, wihle Asset Management revenues were up by 18% to €730 million.

“We are very happy with first-quarter results which put us on track for delivery on all our 2025 targets,” said CEO Christian Sewing. “Our best quarterly profit for fourteen years, achieved through revenue growth combined with lower costs, demonstrates that our Global Hausbank strategy is working well.”

3:50 pm (AEST):

And back to Zurich, UBS (UBSG) beat estimates on net profit, but came in below projections on revenue.

Net profit was US$1.69 billion, above LSEG analyst estimates of $1.36 billion. However, this is lower than the net profit of $1.76 billion seen one year ago.

Total revenue was US$12.56, below both estimates of $12.99 billion and Q1 2024's $12.74 billion.

UBS' net interest income fell by 16% year-over-year to US$1.63 billion.

“The power and scale of our diversified global franchise, coupled with our continued focus on clients, drove strong business momentum in the quarter and net new inflows in our asset-gathering businesses. As we start to execute on the next critical phase of integration, I remain pleased with the substantial progress we have made so far,” said CEO Sergio Ermotti.

The company projects that its integration of Credit Suisse, which it purchased in 2023, will be “substantially complete” by the end of 2026. The first wave of Credit Suisse's Swiss business migrations will begin in the second quarter of 2025, UBS said, and it completed the sale of Credit Suisse's U.S. mortgage servicing subsidiary in March.

UBS expects net interest income in Personal & Corporate Banking to increase by a mid-single-digit percentage in U.S. dollars over the second quarter. “With a wide range of possible outcomes, the economic path forward is particularly unpredictable. The prospect of higher tariffs on global trade presents a material risk to global growth and inflation, clouding the interest rate outlook,” the company said.

4:20 pm (AEST):

At the NASDAQ, Honeywell (HON) reported that its sales last quarter exceeded its guidance, reaching US$9.8 billion. This represents an increase of 8%.

Its operating income rose by 6% to US$2.3 billion, and earnings per share were flat year-over-year at $2.22.

“For the third straight quarter, we delivered both sequential and year-over-year backlog growth, driven by healthy order rates and continuing customer demand for our differentiated offerings. Despite the volatile macroeconomic backdrop, we maintained segment margin consistent with last year, which is a testament to the value delivered by our Accelerator operating system,” said CEO Vimal Kapur.

“As we look ahead to our planned spin of Advanced Materials and separation of our Automation and Aerospace businesses, we are even more confident about the significant opportunities for value creation and sustained growth as we transform into three industry-leading public companies.”

Aerospace Technologies and Building Automation sales were up by 9% and 8% organically, while Industrial Automation and Energy & Sustainability Solutions sales both fell by 2%.

The company has raised its full-year guidance, projecting that sales will be US$39.6-40.5 billion across 2025. This outlook does not include the impact of its 2024 purchase of industrial pump manufacturer Sundyne, which has yet to close.

And that's all from me today; thank you for joining us this earnings season!