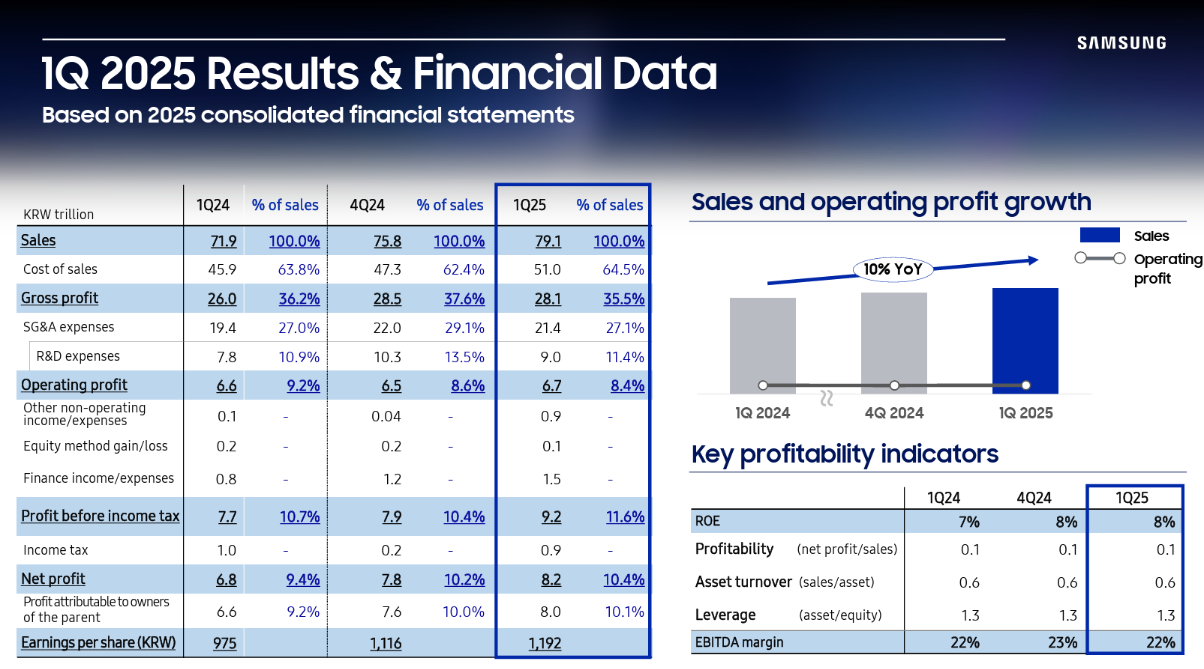

Samsung Electronics had a strong start to 2025, with sales increasing by 10% compared to the same period last year.

The company demonstrated strong growth and profitability in the first quarter of 2025. Their success was driven by robust sales across key segments like DX and memory chips, steady financial metrics, and a solid cash position, ensuring they remain well-positioned for future challenges and investments.

They achieved a total sales figure of KRW 79.1 trillion and a gross profit of KRW 28.1 trillion, resulting in a gross margin of 35.5%.

Their operating profit, which is the money left after covering business costs, was KRW 6.7 trillion, accounting for 8.4% of their sales. Net profit, the amount earned after taxes and all expenses, reached KRW 8.2 trillion, making up 10.4% of their sales.

In terms of profitability, Samsung maintains a stable Return on Equity (ROE) of 8%, which shows how much profit they make compared to shareholders' money. The net profit margin stayed consistent at 10%, indicating healthy earnings relative to sales. Other financial measures, like their asset turnover ratio (0.6) and EBITDA margin (22%), also remained steady, highlighting efficient use of their resources and strong profitability.

Samsung’s Device eXperience (DX) segment, which includes smartphones and TVs, recorded sales of KRW 51.7 trillion, a 9% increase from last year.

Memory chip sales reached KRW 19.1 trillion, growing by 9% year-on-year but decreasing by 17% compared to the previous quarter. Operating profit for the DX segment rose significantly to KRW 4.7 trillion, while Harman, Samsung’s audio and connected car technology subsidiary, achieved KRW 3.4 trillion in sales despite slow seasonal demand.

The company’s financial position remained robust, with total assets growing to KRW 516.4 trillion and shareholder equity reaching KRW 406.6 trillion. Samsung’s current ratio, which shows its ability to pay off short-term debts, stood at a very healthy 247%. Their net cash reserves were KRW 93.99 trillion, reflecting strong liquidity.

When it comes to cash flow, Samsung generated KRW 16.58 trillion from operating activities, showing effective management of day-to-day business operations. At the end of the first quarter, their cash reserves totalled KRW 105.13 trillion. The increase in net cash to KRW 93.99 trillion highlights Samsung’s excellent financial health and ability to invest in future opportunities.

Samsung Electronics' 1Q 2025 financial results highlight sales growth, profitability, and performance across various business segments.

1Q 2025 Financial Results

- Sales increased to KRW 79.1 trillion, a 10% YoY growth.

- Gross profit was KRW 28.1 trillion, with a gross margin of 35.5%.

- Operating profit reached KRW 6.7 trillion, representing 8.4% of sales.

- Net profit was KRW 8.2 trillion, or 10.4% of sales.

Key Profitability Indicators

- Return on Equity (ROE) remained stable at 8%.

- Net profit margin was consistent at 10%.

- Asset turnover ratio held steady at 0.6.

- EBITDA margin was 22%.

Results by Business Segment

- Total sales for DX segment rose to KRW 51.7 trillion, a 9% YoY increase.

- Memory sales were KRW 19.1 trillion, down 17% QoQ but up 9% YoY.

- Operating profit for DX was KRW 4.7 trillion, a significant increase from previous quarters.

- Harman's sales were KRW 3.4 trillion, maintaining growth despite seasonal slowdowns.

Financial Position Summary

- Total assets increased to KRW 516.4 trillion as of March 2025.

- Shareholder equity reached KRW 406.6 trillion.

- Current ratio was 247%, indicating strong liquidity.

- Net cash stood at KRW 93.99 trillion.

Cash Flow Summary

- Cash flows from operating activities totalled KRW 16.58 trillion.

- Cash at the end of the period was KRW 105.13 trillion.

- Net cash increased to KRW 93.99 trillion, reflecting strong financial health.

At the time of writing, Samsung Electronics Co Ltd's (KRX: 005930) stock price was KRW55,650, down KRW150 (0.27%). The company has a market cap of approximately KRW367.48 trillion.