German athletic apparel and footwear giant adidas had a strong start to 2025, with their currency-neutral revenues growing by 13% compared to the same period last year. This boost was mainly because of adidas products' rising popularity, which grew even faster at 17%.

They earned about €6.2 billion in revenue, a significant increase of €700 million from the previous year. Notably, the results didn’t include money from Yeezy products since those were sold off last year, which contributed around €150 million in the first quarter of 2024.

Footwear drove adidas’s growth during the first quarter, with sales increasing by 17%. Popular product lines like Originals, Sportswear, and Running show double-digit growth, reflecting strong demand across various styles. Apparel, which includes clothing like shirts and jackets, also did well, with an 8% increase, thanks to items like Originals and outdoor gear. Accessories like bags and hats saw 10% growth during this time.

Adidas saw strong sales not just in casual Lifestyle products, like its Terrace and Retro Running sneakers, but also in Performance products like running shoes and sports equipment. They launched new models of their popular Adizero running shoes and introduced unique designs for high-performance athletes. Sports categories like Football, Basketball, and Outdoor activities also showed improvement due to upgraded products and innovative designs. Collaborations with celebrities, such as Pharrell Williams and Bad Bunny, help adidas remain trendy and visible to customers.

Sales grew across different markets and types of store. For instance, Latin America and Emerging Markets experienced the highest growth, with revenue rising 26% and 23%, respectively. Even Europe, China, and Japan/South Korea showed strong double-digit increases, and despite a small decline in e-commerce, revenue from physical stores and wholesale grew significantly. Adidas' ability to maintain demand in a variety of regions supported their overall success during the quarter.

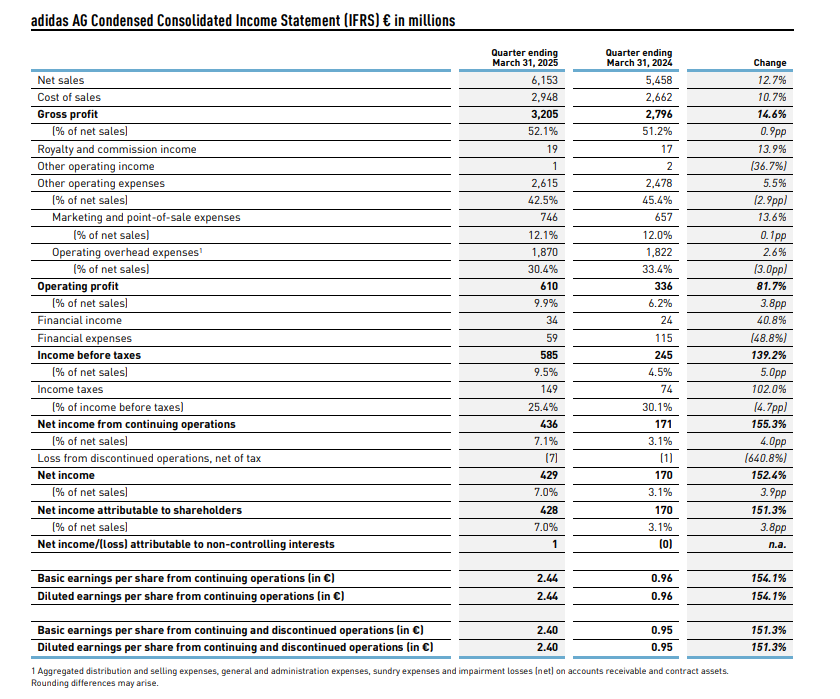

Adidas' gross margin, which shows how much profit they make on each product sold, increased to 52.1%, partly due to lower shipping costs and fewer discounts. Meanwhile, they spent more on advertising to support campaigns like “You Got This” and promote partnerships with brands and sports teams like Mercedes-AMG PETRONAS Formula 1. Marketing expenses went up by 14%, showing how critical branding is to adidas’ growth.

Their operating profit, which is the amount of money made after paying for business costs but before taxes, jumped 82% to €610 million. Income from continuing operations more than doubled to €436 million, showing strong profitability. Even with fewer contributions from Yeezy products, adidas’s performance was solid thanks to their focus on other product lines and lower financial expenses.

Adidas has also improved their financial position. They invested in their inventories, which increased by 15%, ensuring they could keep up with growing demand. Additionally, their cash reserves grew by 32%, and their borrowings dropped significantly. This means they’ve become less reliant on debt and are better prepared to handle future business challenges. Adidas is seeing steady growth in both sales and profits, driven by its strong products and marketing efforts.

Adidas confirmed its outlook for 2025, but acknowledged growing risks due to unpredictable global economic conditions and new U.S. tariffs. These factors have increased the range of possible outcomes for the year. On the positive side, the company’s stronger-than-expected first-quarter results could push them to perform better than anticipated. However, uncertainty about how tariffs will affect adidas directly and indirectly poses a downside risk, adding challenges to their financial expectations.

The company predicts that its sales will grow at a high-single-digit rate in 2025, helped by the success of the adidas brand, which continues to show double-digit growth. The key to this growth lies in adidas offering better and more diverse products, focusing more on what local customers want, and improving relationships with retailers. Additionally, adidas plans to use powerful marketing campaigns to strengthen its brand and drive higher sales.

While adidas is investing more in marketing and sales, it is also making efforts to improve efficiency to save costs and increase profits. Combined with expanding gross margins, these steps are expected to boost operating profit to between €1.7 billion and €1.8 billion in 2025. The outlook does not factor in any revenue or profit from Yeezy products since they were sold off in 2024, signalling a shift in focus toward other product categories and strategies for sustained growth.

CEO Bjørn Gulden said: “I am very proud of what our team achieved in Q1. Double-digit growth across all markets and channels in today’s volatile environment shows the strength of our brand and underlines the great job our people are doing. The operating profit of € 610 million and the 9.9% operating margin prove the great potential of our company. A great quarter!

"In a ‘normal world’ with this strong quarter, the strong order book and in general a very positive attitude towards adidas, we would have increased our outlook for the full year both for revenues and operating profit. The uncertainty regarding the U.S. tariffs has currently put a stop to this.

"Although we had already reduced the China exports to the U.S. to a minimum, we are somewhat exposed to those currently very high tariffs. What is even worse for us is the general increase in U.S. tariffs from all other countries of origin. Since we currently cannot produce almost any of our products in the U.S., these higher tariffs will eventually cause higher costs for all our products for the U.S. market. Given the uncertainty around the negotiations between the U.S. and the different exporting countries, we do not know what the final tariffs will be.

"Therefore, we cannot make any ‘final’ decisions on what to do. Cost increases due to higher tariffs will eventually cause price increases, not only in our sector, but it is currently impossible to quantify these or to conclude what impact this could have on the consumer demand for our products.

"As always, we will try to maneuver through this uncertainty in the most pragmatic, agile and flexible way. We have all parts of the organization involved and will do everything we can to assure that our U.S. retail partners, and our U.S. consumers will get the adidas product they want and to the best possible price.

"We currently see a positive development in all other markets and will of course try to compensate for the uncertainty in the U.S. by delivering even better results in the rest of the world. We therefore stick to our original outlook but admit that there are uncertainties that could put negative pressure on this later in the year.

"The adidas brand is strong, we have great people and enough resources to get even stronger through this uncertain and difficult period.”

Major developments:

- Revenues increasing nearly €700 million to €6,153 million in Q1

- Currency-neutral sales up 13%, driven by adidas brand growing 17%

- adidas brand with double-digit growth across all markets and channels

- Gross margin up 0.9pp to 52.1%; underlying increase even stronger at 1.6pp

- Operating profit improves significantly to €610 million

- Operating margin up 3.8pp to 9.9%, reflecting gross margin increase and strong overhead leverage

- Net income from continuing operations more than doubles to €436 million

- Full-year guidance confirmed with increased uncertainty due to U.S. tariffs and higher macroeconomic risks

The stock price for adidas AG (ETR: ADS) was €210.40 at the time of writing, down €7 (3.22%) today, with a market cap of approximately €37.65 billion.