Welcome to our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Home Depot reports positive Q4 results and mixed 2025 outlook

- U.S. stock markets ended mixed on Tuesday

- American Tower Corporation reports US$2.5 billion in revenue

- Keurig Dr Pepper Inc revenue up 5.3% over the same period last year

- Flight Centre has announced a 31% fall in net profit after tax

- Woolworths reports net profit of A$741 million

- Wisetech Global, Workday and more to come…

____________________________________________________________________________________

8:03 am (AEDT):

Good moring and happy Wednesday! Sienna Martyn here to take you through the first half of the day's earnings.

Up first, we have Home Depot Inc (NYSE: HD) which has released positive earnings results, beating Wall Street sales estimates for the fourth quarter of 2024

The home improvement retailer posted sales of US$39.7 billion, an increase of $4.9 billion, or 14.1% from Q4 2023.

Comparable sales (known as same-store sales) increased by 0.8% ending eight straight quarters of declines.

Earnings per share (EPS) for the quarter came in at $3.02 compared to analysts' expectations from LSEG of $3.01.

Sales for fiscal 2024 came in at $159.5 billion, an increase of 4.5% from fiscal 2023 while comparable sales for fiscal 2024 decreased 1.8%.

“Throughout the year, we remained steadfast in our investments across our strategic initiatives to position ourselves for continued success, despite uncertain macroeconomic conditions and a higher interest rate environment that impacted home improvement demand,” said Ted Decker, chair, president and CEO.

The company offered a mixed outlook for 2025 it expects total sales to grow by 2.8% and projects adjusted earnings per share will decline about 2% compared with the prior year.

At the time of writing this, shares in Home Depot Inc. were trading at US$393.13, up 2.8% from the previous day's close of $382.65. The company’s market capitalisation is $390.68 billion.

8:12 am (AEDT):

Next up lets take a look at the United States market close.

The U.S. stock markets ended mixed on Tuesday (Wednesday AEDT) as weaker-than-expected consumer confidence data added to investor concerns over economic growth and trade policy.

The Dow Jones Industrial Average bucked the trend, rising 160 points or 0.4%, to 43,621.2, the S&P 500 slid 0.5% to close at 5,955.3, marking its fourth consecutive losing session, while the Nasdaq Composite dropped 1.4% to 19,026.4, dragged down by a 2.8% decline in Nvidia.

Markets reacted negatively to the latest consumer confidence survey from the Conference Board, which came in well below forecasts.

Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board noted that the index “registered the largest monthly decline since August 2021”, while the ”expectations Index was below the threshold of 80 that usually signals a recession ahead".

The disappointing report follows last week’s weak manufacturing and retail sales data, adding to fears of a slowdown.

Walmart’s cautious outlook last week further dampened sentiment, raising concerns about consumer spending.

Oliver Gray has the full story here!

8:17 am (AEDT):

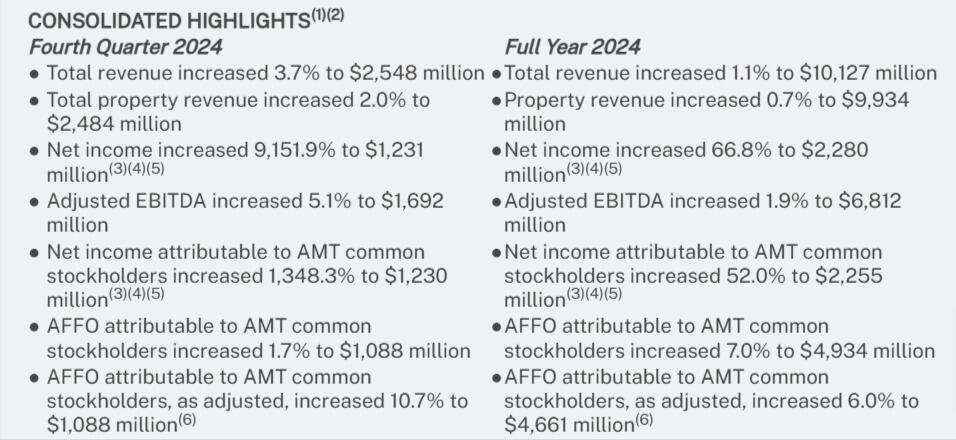

American Tower Corporation (NYSE: AMT) has reported $2.55 billion in total revenue for the quarter ended December 2024, representing a year-over-year decline of 8.6%.

The company recorded EPS just short of Zacks consensus estimates of $2.33.

The real estate investment trust responsible for broadcast communications infrastructure reported EPS reached $2.32 compared to the same period in 2023 at $0.18 per share.

Adjusted EBITDA for Q4 increased 5.1% to $1.69 million.

Steven Vondran, American Tower’s CEO said, “While the macroeconomic environment remains challenging, demand for connectivity across our global platform continues unabated.”

“Our initial expectations for accelerating activity over the course of the year were validated, highlighted by mid-band deployments in the U.S. and Europe, 4G densification and early 5G upgrades in emerging markets, and another exceptional year of leasing,” said Vondran

8:39 am (AEDT):

Keurig Dr Pepper, Inc (NASDAQ: KDP) reported revenue of US$4.07 billion, up 5.3% over the same period last year, narrowly beating the Zacks Consensus Estimate of $4.03 billion by 0.96%.

The soft drink and beverage manufacturer recorded earnings per share of $0.58, compared to $0.55 Q4 2023.

Net sales of U.S. refreshment beverages saw YoY growth of 10.3% to $2.44 billion versus the analyst estimates of $2.37 billion.

While net international sales came in at $499 million with a 0.8% increase year on year.

The company also record GAAP operating income had decreased in the last quarter by 18.8% to $2.6 billion.

Shares in the company were up 2.4% today trading at US$34.94.

9:07 am (AEDT):

Intuit Inc (NASDAQ: INTU) has reported a strong Q4 but provided a mixed outlook for 2025.

The global financial technology platform earned an adjusted US$3.32 per share with sales of $3.96 billion in the quarter.

Analysts polled by FactSet had expected Intuit earnings of $2.57 a share on sales of $3.83 billion.

Intuit earnings rose 26% while sales increased 17% year-on-year.

"We are confident in delivering double-digit revenue growth and expanding margin this year, and we are reiterating our full year guidance for fiscal 2025,"said CFO Sandeep Aujla.

Guidance for the full fiscal year 2025, expects revenue growth of 12-13% up to $18.16 billion to $18.3 billion.

GAAP operating income of $4.649 billion to $4.724 billion was also forecast with expected growth of approximately 28-30%.

"We delivered very strong second quarter fiscal 2025 results as we leverage AI to deliver breakthrough experiences for our customers and increase productivity across our platform," said Aujla.

9:12 am (AEDT):

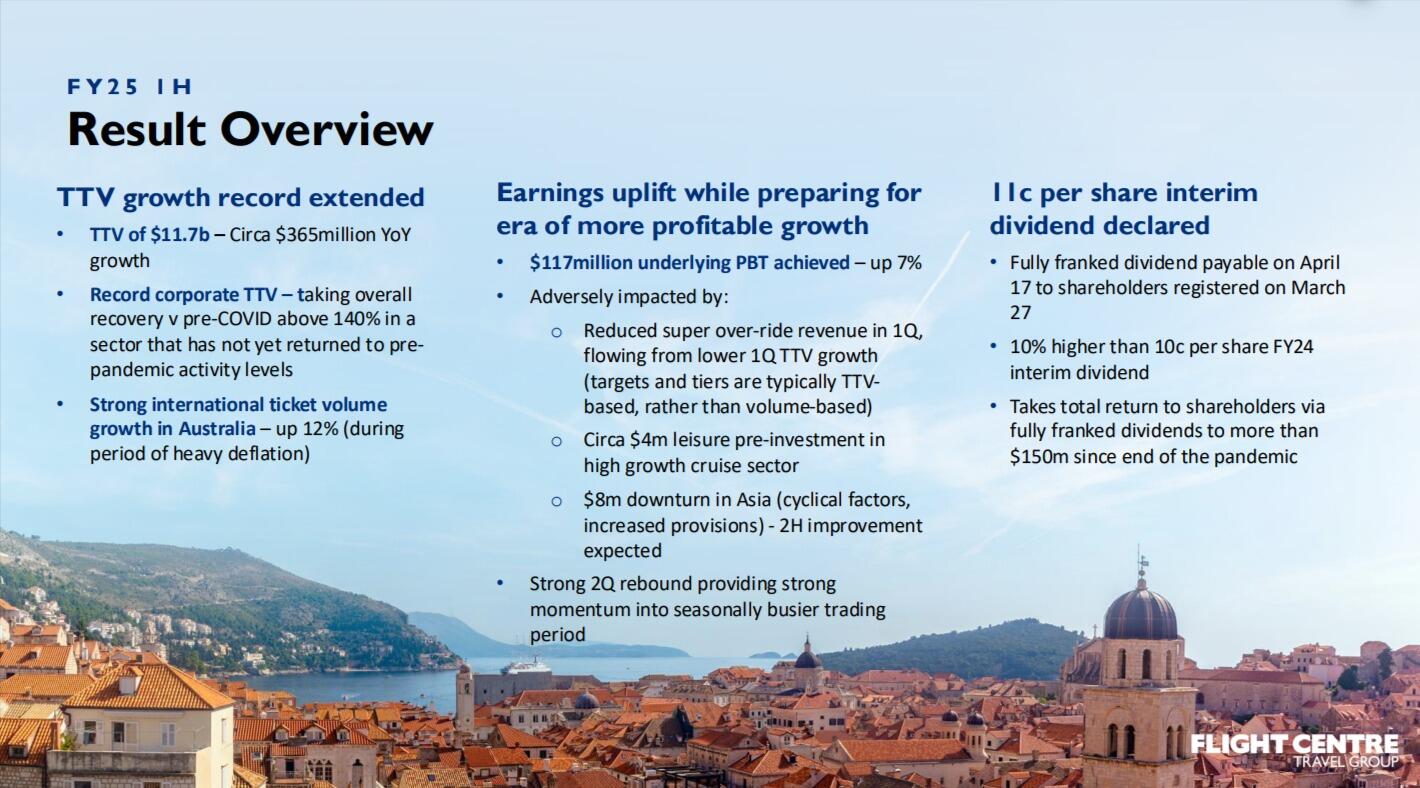

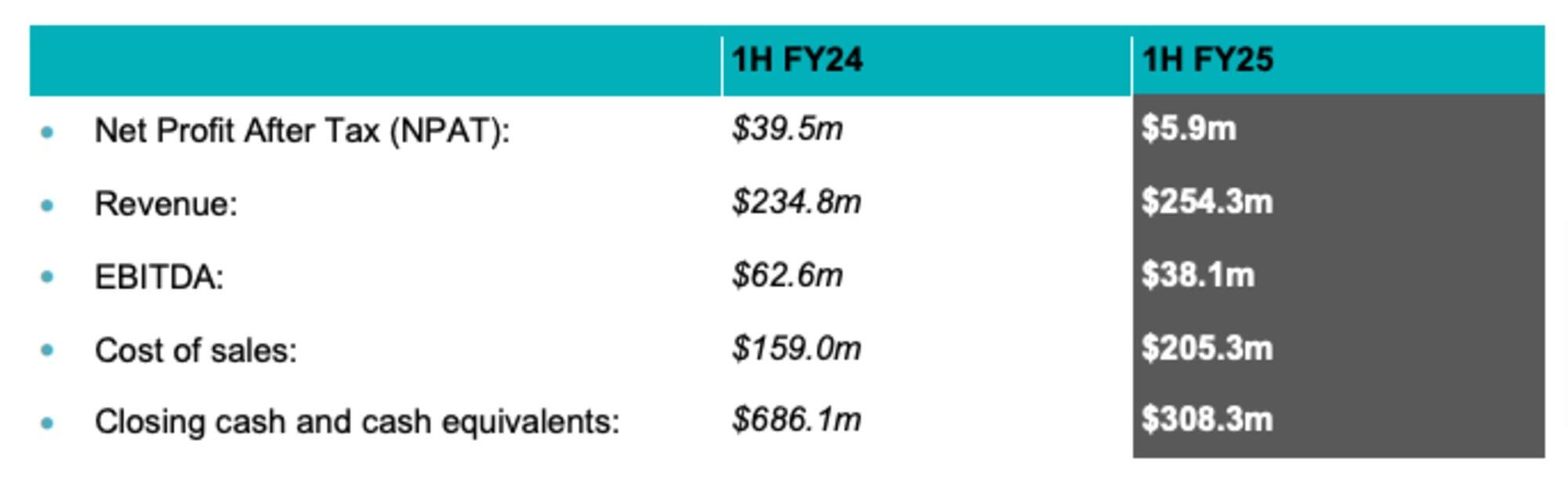

Flight Centre has announced a 31% fall in net profit after tax (NPAT) for the first half of the 2025 financial year (H1 FY25).

Australia’s largest listed travel agency said statutory PBT fell 27% to A$88.2 million, mostly because the previous corresponding period included higher gains on the buy-back and remeasurement of convertible notes.

Underlying NPAT increased 1.3% to A$78.628 million in the six months to 31 December 2024 on revenue that was flat at $1.3 billion while total transaction value (TTV) rose 3% to $11.7 billion.

Underlying profit before tax (UPBT) grew 7% to $117 million in the first half, reflecting a solid second quarter (Q2) rebound from a challenging Q1, during a period of investment in initiatives to achieve sustainable profit growth.

Flight Centre said H1 profit was also impacted by lower income from volume-based supplier payments (super over-rides), a $4 million investment in the cruise sector and a $8 million downturn in Asia.

“Group-wide, our foundations are solid and we are well placed to deliver stronger (H2) profit as volumes increase during our busier trading period, a seasonal trend we are now seeing,” Turner said in an ASX announcement.

Flight Centre (ASX: FLT) shares closed on Tuesday at $17.72, down eight cents (0.45%), capitalising the company at $3.93 billion.

Check out Garry West's full story here!

9:38 am (AEDT):

Caesars Entertainment Inc (NASDAQ: CZR) has reported fourth-quarter earnings of US$11 million.

The casino and resort operator posted revenue of $2.8 billion in the period, falling short of analysts forecasts.

Tom Reeg, CEO of Caesars Entertainment said “Fourth quarter operating results reflect stable conditions in Las Vegas with continued high occupancy and strong ADRs”

On a per-share basis, the hotel and casino entertainment company said it had a profit of 5 cents, exceeding Wall Street expectations for a loss of 15 cents per share.

9:53 am (AEDT):

Woolworths has returned to a bottom-line profit in the first half of the 2025 financial year despite a challenging operating environment which included strikes.

Australia’s largest retailer said net profit after tax in the half year to 5 January 2025 was A$741 million, compared with a $773 million loss in the previous corresponding period.

Woolworths said earnings before interest and tax (EBIT) dropped 14.2% to $1.451 billion on sales which grew 3.7% to $35.9 billion.

The company said the decline in EBIT reflected 17 days of industrial action, value-seeking customer behaviour, supply chain commissioning and dual-running costs and a lower contribution from BIG W in a highly competitive discount retail

segment.

Directors declared a fully franked 39 cents per share interim dividend, down from 47 cents a year earlier, to be paid on 23 April to shareholders on record on 6 March.

CEO Amanda Bardwell said customer ‘metrics’ had begun to improve following a challenging half which was impacted by industrial action and ongoing cost-of-living pressures.

“We remain committed to providing value to our customers in an environment where household budgets remain under pressure and customers continue to shop around,” Bardwell said in an ASX announcement.

Woolworths (ASX: WOW) had closed on Tuesday at $31.56, up 31 cents (0.99%), capitalising the company at $38.55 billion.

Check out the full story from Azzet's Garry West.

9:58 am (AEDT):

Australian shares are set to open lower on Wednesday following a mixed session on Wall Street overnight as investors digested weaker-than-expected consumer confidence data.

By 9:45 am AEDT 10:45 pm GMT) ASX 200 futures were pointing 0.3%, suggesting the index will open at six-week lows of 8,196.

Investor sentiment remained fragile as the latest Conference Board consumer confidence index dropped seven points in February to 98.3 - the steepest monthly fall in over three years—highlighting growing economic concerns amid uncertainty over the Trump administration’s policies.

Meanwhile, in Australia, potential U.S. tariffs on copper could dampen investor confidence, particularly in the resources sector.

Oliver Gray has the full story.

10:26 am (AEDT):

Premium homeware, candle and gift retailer Dusk Group Limited (ASX: DSK) reported half-year results for fiscal 2025 with sales up 12.3% from the first half of 2024.

The company recorded a gross profit up 13.4% to A$56.9 million.

Dusk also announced a fully franked interim dividend of 5 cents per share for H125.

CEO and Managing Director Vlad Yakubson said Christmas period sales which contribute to the overall annual success of the company, exceeded expectations and was s driven by strong product sell-throughs and execution in store.

“We have had a strong start to FY25 with an improved sales performance in the first half reflecting the execution of our product-led turnaround strategy along with a focus on the digital store experience,” said Yakubson.

“The online sales result has been one of the highlights of the overall business performance, being driven by elevated content, digital marketing and the capabilities of our new site.”

10:57 am (AEDT):

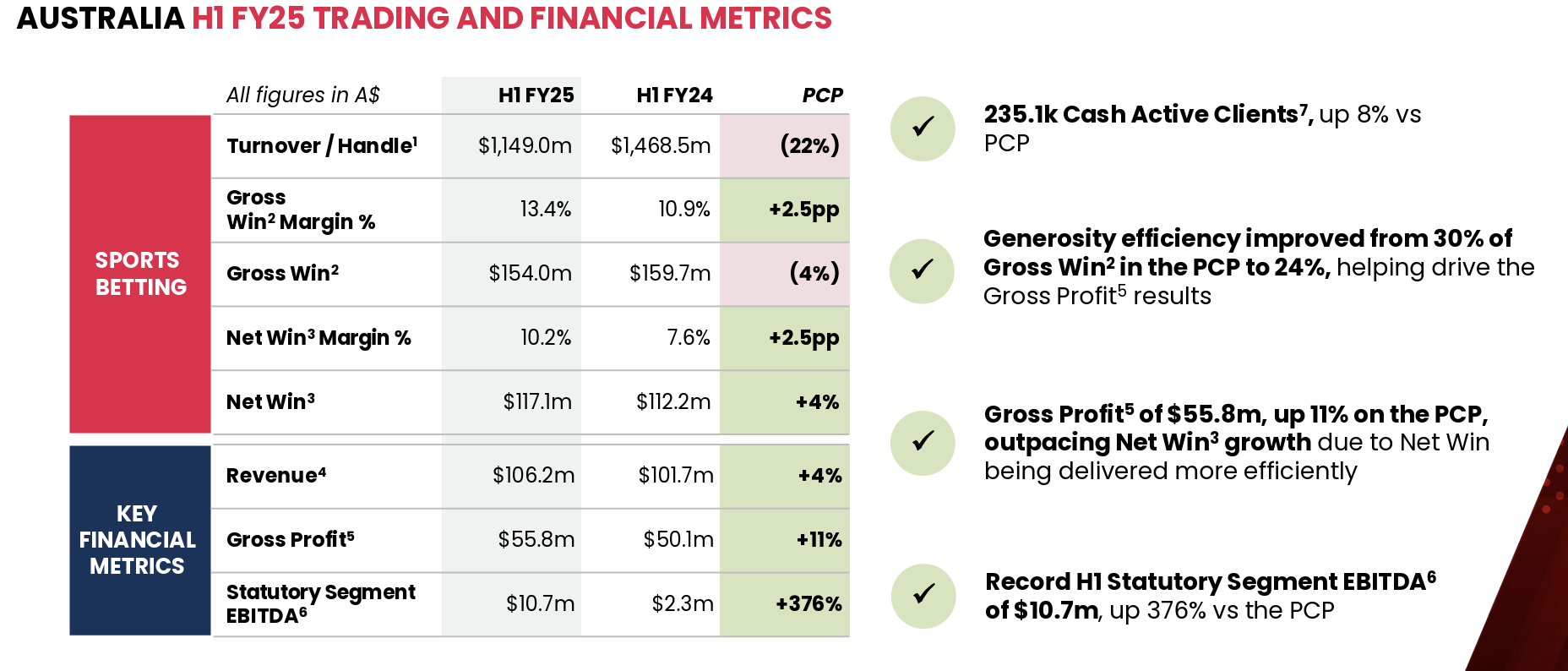

Sports gambling company Pointsbet Holdings Ltd (ASX: PBH) has recorded first-half 2025 revenue up 4% YoY to A$106.2 million from A$101.7 million in the first half of fiscal 2024.

The company recorded a total net win of $135.1 million for H125, up 6% with EBITDA up 75% to $3.3 million.

Pointsbet also announced today that Bluebet Holdings, the operator of wagering platform Betr, has made an offer to acquire the rival business.

The offer has a combined equity value of between $340 million to $360 million, including between $240 million and $260 million in cash, and $100 million to $120 million in the form of its ASX-listed shares.

The latest bid from Bluesbet comes a day after it was announced that Pointsbet had agreed to a $353 million offer from Japanese sports and entertainment giant Mixi, which valued the company’s shares at $1.06 each.

At the time of writing shares in Pointsbet were trading at A$1.10 up 32.5% from yesterday's close.

11:15 am (AEDT):

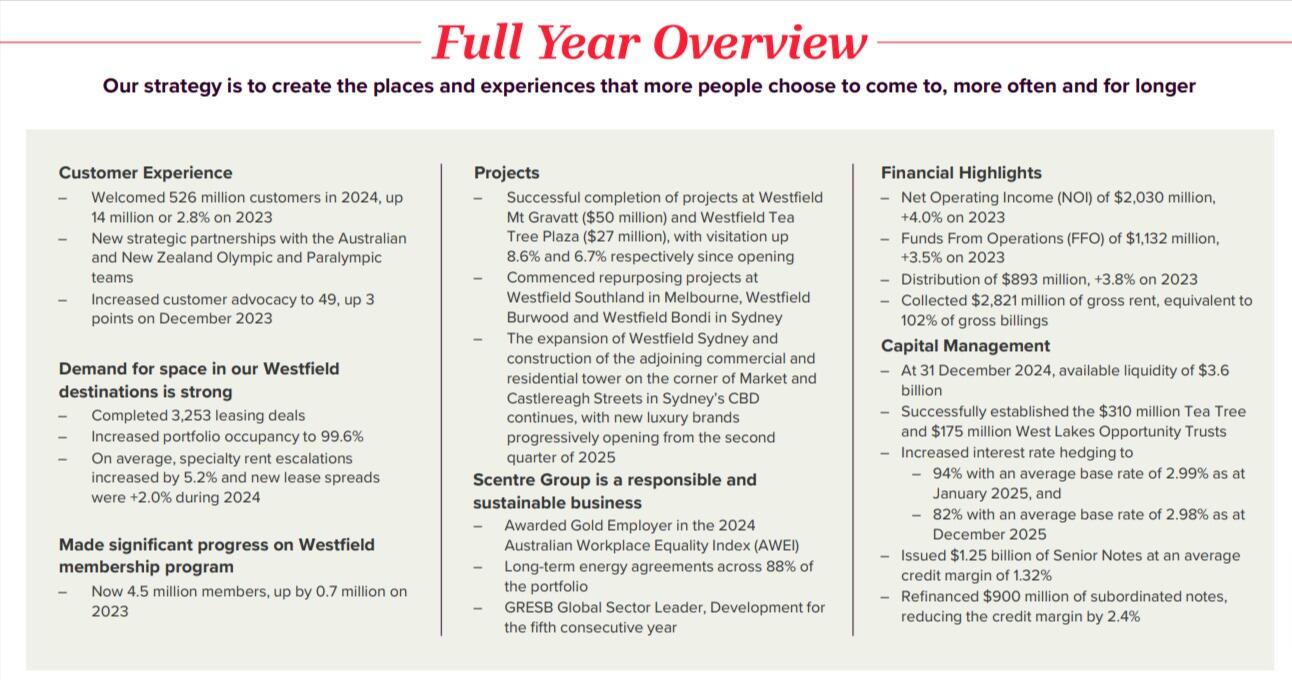

Scentre Group (ASX: SCG) reported a 3.5% increase in Funds From Operations (FFO) to $1.132 billion for the year ended 31 December 2024.

Retail destinations operated by Scentre Group Limited are branded Westfield in Australia and New Zealand.

Corporation activities include ownership, development, design, construction, funds/asset management, property management, leasing, and marketing.

Distributions also rose by 3.8% to $893 million, while Statutory Profit was $1.050 billion.

The year was marked by the tragic attack at Westfield Bondi, in Sydney's eastern suburbs. This had a significant impact on the community, leading to enhanced security measures across all Westfield destinations in Australia and New Zealand.

Scentre Group Chief Executive Officer Elliott Rusanow said: “It was a difficult year following the devastating attack at Westfield Bondi on 13 April 2024. Six innocent people lost their lives and many others were impacted. We extend our deepest condolences to the families and loved ones of the victims."

Read the full story here.

11:25 am (AEDT):

United States futures advanced on Tuesday night (Wednesday AEDT), with investors closely watching Nvidia’s upcoming earnings, set to be released after Wednesday’s closing bell, as a potential catalyst for market direction.

By 10:20 am AEDT (11:20 pm GMT) Dow Jones Industrial Average futures and S&P 500 futures rose 0.2% apiece, while Nasdaq-100 futures added nearly 0.3%.

Market sentiment remains fragile after a weaker-than-expected consumer confidence reading from the Conference Board on Tuesday.

Several companies saw significant moves in after-hours trading.

Freeport-McMoran jumped 4.5% after President Trump launched a commerce probe that could lead to copper tariffs.

First Solar gained 1.7% after reporting an increase of US$6 million in net sales from the prior quarter. despite issuing lacklustre full-year guidance.

Zeta Global Holdings dropped 11.4% after issuing mixed guidance, with first-quarter sales projected below consensus estimates.

Nvidia’s earnings report is expected to be a key focus for markets. The chipmaker is facing increased scrutiny, with investors questioning the sustainability of AI-driven stock gains following the rise of DeepSeek and signs of slowing momentum in high-growth tech names.

Check out the full story from Oliver Gray here.

11:40 am (AEDT):

Freelancing and crowdsourcing marketplace, Freelancer Limited (ASX: FLN) reported mixed 2024 full-year earnings.

Group Revenue came in at A$53.1 million, down 4.2% while freelancer itself recorded revenue down 8.2% at $40.6 million.

Escrow.com however gained 14.5% earning $10.4 million in revenue in 2024.

2024 also delivered gross marketplace value (GMV) of $948.6 million for the company, down 7.1% from 2023.

The company said despite a modest revenue decline largely tied to non-core engineering services, profitability in the second half of the year improved significantly supported by cost efficiencies and strong cash generation.

Freelancer also achieved a dramatic turnaround in customer acquisition, with new client deposits up 18.6% year-on-year, set to flow on and drive future growth.

Strategic AI integration delivered tangible benefits, positioning AI development as the next major wave of projects after web and mobile, and enhancing features that boosted retention by 5% and conversion rates.

12:05 pm (AEDT):

Asian-Pacific markets were mostly lower on Tuesday, tracking Wall Street’s mixed performance overnight, as a weaker-than-expected U.S. consumer confidence data heightened concerns over economic growth.

By 10:50 am AEDT (11:50 pm GMT) Australia’s S&P/ASX 200 dropped 0.2%, while Japan’s Nikkei 225 fell 1.1% and South Korea’s Kospi remained flat.

Wall Street finished in a mixed fashion, as the Dow Jones Industrial Average gained 156 points, or 0.4%, to close at 43,621.2. However, the S&P 500 extended its losing streak to four sessions, slipping 0.5% to 5,955.3, and the Nasdaq Composite declined 1.4% to 19,026.4.

ANZ analysts noted: "The Conference Board consumer survey data follows the weak services PMI and a fall in University of Michigan consumer sentiment last week, and underscore rising concerns about weak growth coupled with a surge in inflation expectations. Inflation expectations are a closely watched metric at the Fed and a de-anchoring of inflation expectations for an extended period would risk undoing the progress on disinflation."

More from Oliver Gray here.

12:09 pm (AEDT):

Workday Inc. (NASDAQ: WDAY) reported better-than-expected quarterly results with revenue increasing 15% year on year, causing shares to pop more than 10% in extended trading.

The makers of human resources and finance software beat LSEG consensus estimates in revenue and earnings per share (EPS).

Revenues came in at US$2.1 billion compared to the forecast of $2.18 billion while EPS came in at $1.92 adjusted versus the $1.78 expected.

“The prior year period benefited from a $1.1 billion release of the valuation allowance related to U.S. federal and state deferred tax assets,” Workday said.

The company is seeing greater demand for artificial intelligence tools.

CEO Carl Eschenbach said on a conference call with analysts, “AI is front and centre in every conversation I have with customers, prospects and partners. They want to move beyond incremental productivity gains. ”

12:22 pm (AEDT):

Bank of Montreal (NYSE: BMO) (TSX: BMO) has reported strong profits in the last quarter, driven by strength in its capital markets business.

The Canadian bank’s net income was US$2,138 million while earnings per share was $2.83, an increase from $1,292 million and $1.73 in 2023.

Adjusted net income was $2,289 million and adjusted EPS was $3.04, an increase from $1,893 million and $2.56 in the prior year.

CEO of BMO Financial Group Darryl White said “With the strength of our deep geographic and business diversification, we are well positioned to compete and grow in this dynamic operating environment.”

“Our balance sheet is strong, and we’re serving our clients with robust capital and liquidity and business strategies aimed at providing trusted advice – just as we have for over 200 years throughout Canada and the United States,” he added.

12:35 pm (AEDT):

That's all from me today. Thanks for following along, over to Chloe Jaenicke to take you through the afternoon!

12:49 pm (AEDT):

Good afternoon, it’s Chloe Jaenicke here to take you through the rest of the day.

Shares in Lynas Rare Earths (ASX: LYC) were down around 4% at the open after the rare earths miner posted a steeper-than-expected drop in its first-half profit which tumbled 85%.

While revenue in the WA company - the biggest non-Chinese producer of rare earths - was up 8% to $254.3 million due to a spike in two rare earth element - neodymium and praesodymium (NdPr) - sales volumes, net profit fell sharply to $5.9 million from $39.5 million in the previous period.

Despite a 23%, and 22% increase in NdPr sales and production volumes respectively, Lynas CEO Amanda Lacaze attributed much of today's result to a drop in the average China domestic price of NdPr (VAT excluded) from US$56/kg in December 2023 to US$49/kg in December 2024 and higher sales costs.

Thank you to Mark Story for the write-up. Read the full story here.

1:04 pm (AEDT):

Engineering group Worely Limited (ASX: WOR) reported a 55.4% rise in statutory net profit to A$216 million from the same time last year.

The company also reported aggregated revenue of $5,989 million, up 6.8% from 1H2024.

CEO and managing director, Chris Ashton said the company has remained strong in spite of economic and political shifts that have forced them to adapt.

“Our performance reflects our strength as a diversified business with breadth of capability, disciplined strategy execution, a global footprint and strong customer relationships,” Ashton said.

“We’ve continued to deliver earnings growth, with earnings growing at a higher rate than revenue.

“This has been underpinned by a deliberate strategy to drive higher margins through a focus on winning higher margin work, driving operational leverage and business productivity, and considered capital investments that support our future growth.”

1:18 pm (AEDT):

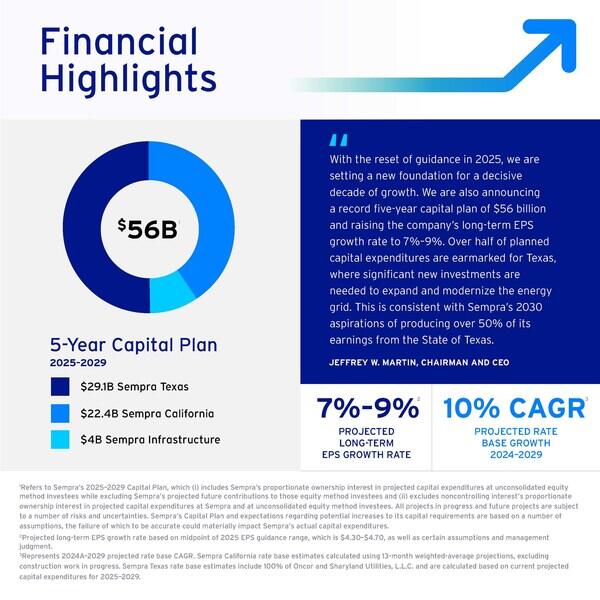

Sempra (NYSE: SRE) reported full-year earnings of $2.97 billion for 2024, an increase from $2.92 billion in 2023.

Despite this, revenue was down with $13.9 billion in 2024 and $16.7 billion in 2023.

Sempra chairman and CEO, Jeffrey Martin, said the company is resetting their 2025 guidance and setting a new foundation for the next decade.

"We are also announcing a record five-year capital plan of $56 billion and raising the company's long-term EPS growth rate to 7%-9%,” Martin said.

“Over half of planned capital expenditures are earmarked for Texas, where significant new investments are needed to expand and modernize the energy grid.

“This is consistent with Sempra's 2030 aspirations of producing over 50% of its earnings from the State of Texas."

1:38 pm (AEDT):

Public Service Enterprise Group Incorporates (NYSE: PEG) declined from 2023’s US$11.24 billion revenue to $10.29 in 2024.

This still beats the Zacks Consensus Estimate of $10.15 billion.

The company also experienced a 35.7% decrease in operating income from $692 million in 2023 to $445 million in 2024.

For 2025, they are planning to make a number of investments that will boost their performance in the long term and aim for a 9% increase in earnings per share from mid-year 2024 in the middle of 2025.

2:14 pm (AEDT):

Perfume parent company, Interparfums (NASDAQ: IPAR) saw an 8% rise in earnings per share (EPS) for 2024 to US$5.12 and 132% rise in Q4 2024 from Q4 2023 to $0.75.

The company also reported revenues of $361.5 million.

According to Interparfums Chairman and CEO, Jean Madar 2024 was their best year yet.

“Among the highlights were: record sales and profits, successful product launches and brand extensions, plus a better-than-expected first year managing Lacoste and Roberto Cavalli (“Cavalli”) brand fragrances,” Madar said.

“Our sales growth of 10% for both the fourth quarter and the full year was broad-based across our portfolio, reflecting strong demand for our key brands worldwide.”

Madar said their top six brands represented around $70 of their net sales, which rose 5% and 4% during the fourth quarter and full year, respectively.

2:31 pm (AEDT):

Axon (NASDAX: AXON) has reported their 12th consecutive quarter of 25%+ revenue growth with US$575 million, a 34% increase from the same time last year.

Along with the growth the company achieved a full-year net income margin of 18.1% and EBITDA margin of 25%.

TASER revenue grew 37% year over year to $221 million, Sensors and other revenue rose 18% to $124 million and Axon Cloud & Service, which accounted for 40% of the company's total revenue, increased 41% to $230 million.

Following this momentum, the company aims to deliver revenue in the $2.55 billion to $2.65 billion range for 2025, reflecting around 25% annual growth.

2:54 pm (AEDT):

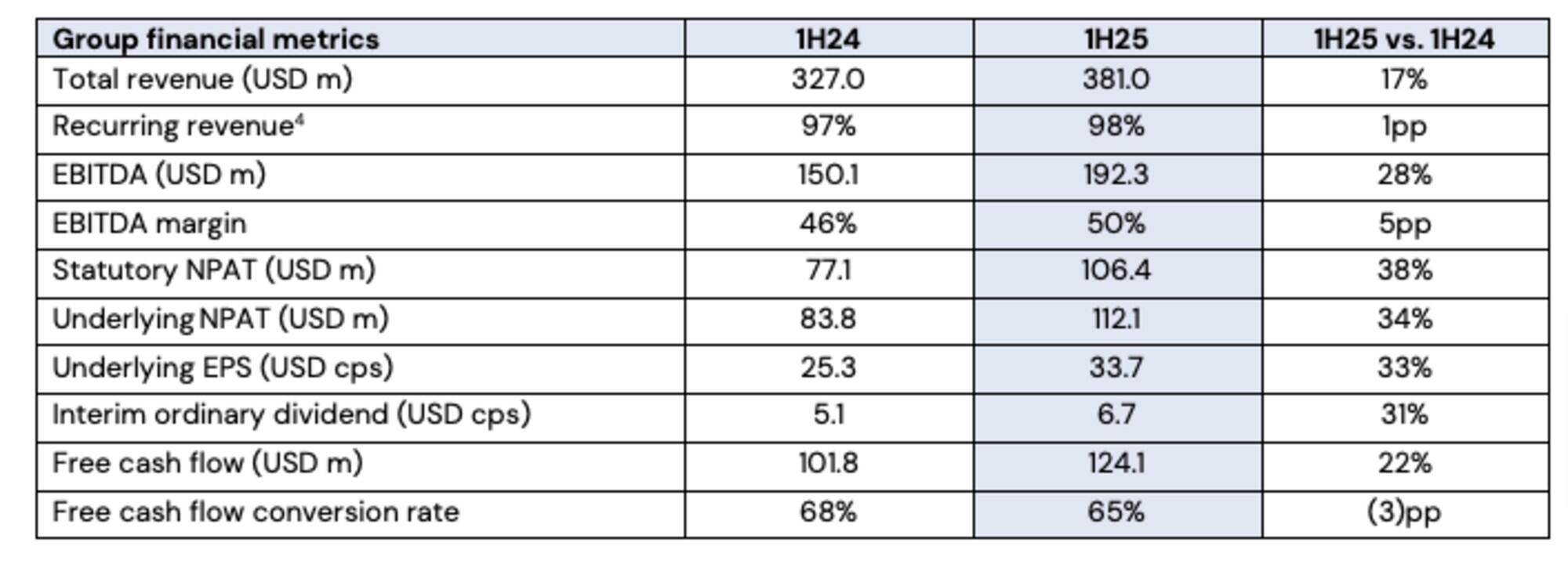

WiseTech (ASX: WTC) saw an impressive 17% year-on-year rise in H1 revenue to US$381 million, which was largely driven by its CargoWise logistics product development.

This comes as WiseTech Global founder, Richard White reclaims his spot as exec chair after a four-month hiatus.

The company's interim CEO, Andrew Cartledge said the company's strong financial results were in line with expectations.

“This was driven by our global teams’ ongoing focused execution of our 3P strategy as CargoWise’s strong momentum continued with a Top 25 LGFF win in Nippon Express as well as strong growth from existing customers,” Cartledge said.

Cameron Drummond has the full story here.

3:18 pm (AEDT):

HelloWorld Travel Limited (ASX: HLO) saw decreases across the board in their 1H 2025 financial results.

Their revenue was down 7.6% to $103.8 million from the same time last year and their underlying EBITDA decreased by 20.2% to $27.2 million.

Earnings per share also dipped by 29.7% to 7.1 cents.

Helloworld CEO, Andrew Burnes said their performance is reflective of cost of living pressures.

“Our performance across the first half reflects a challenging fiscal environment in Australia with the cost of living increases impacting demand for leisure travel and reductions in airfares pushing flight TTV downwards across the period,” Burnes said.

“However, we have continued to invest in our business, growing our technology options and expanding our wholesale product range while enhancing our core capabilities around ticketing and air consolidation.”

3:49 pm (AEDT):

Grocery Outlet Holding Corp (NASDAQ: GO) reported a net income of $2.3 million in the fourth quarter of 2024, in comparison to 12.1 million at the same time last year.

At the same time, net income for the quarter increased by 10.9% to $1.10 billion from Q4 2023.

The same trend can be seen in the full-year results where net income decreased from $79.4 million to $39.5 million and net income increased by 10.1% to $4.37 billion.

Grocery Outlet chairman of the board of directors, Eric Lindberg, said the company delivered solid results.

“We continue to make progress on multiple fronts, and we are keenly focused on key strategic initiatives that will strengthen our foundation and support future growth while ensuring we deliver best-in-class execution for our customers and independent operators,” Lindberg said.

These results come as the company welcomes a new president and CEO, Jason Potter.

4:07 pm (AEDT):

Revenue for Agilon Health (NYSE: AGL) rose 44% to US$1.52 billion in the fourth quarter of 2024, and 40% for the fiscal year to 6.06 billion in comparison to $4.32 billion the previous year.

Members in the company’s Medicare Advantage increased 36% year-over-year to 527,000 members. The platform had 659,000 members overall as of December 31 2024.

For Q4 2024, the company reported a gross profit of negative $38 million, an improvement upon the negative $95 million in the same period last year. For the full year, gross profit was $5 million compared to $70 million in 2023.

4:20 pm (AEDT):

After shareholders called for the business to be sold, EML Payments (ASX: EML) stock was up around 12% in afternoon trading to $0.96, the highest it has been since last September, as reported by Mark Story.

This comes as the company reports better than expected 1H FY25 financial results, with a 15% revenue increase to A$115.1 million and 50% earnings growth to $33.4 million.

EML’s chairman, Anthony Hynes, attributes the strong financial metrics to both customer and interest revenue, a focus on efficiency and market expansion, organisational restructuring and expansion into new markets.

"The business is in a much better cadence and is focused on operational efficiency, customer relationships, growth and empowering our people to be their best under a one EML ethos,” Hynes said.

“We are working rapidly to remove the inefficiencies caused by minimal integration of our global businesses over the last five years.”

That’s all for today! Check back tomorrow for earnings updates from Harlan Ockey.