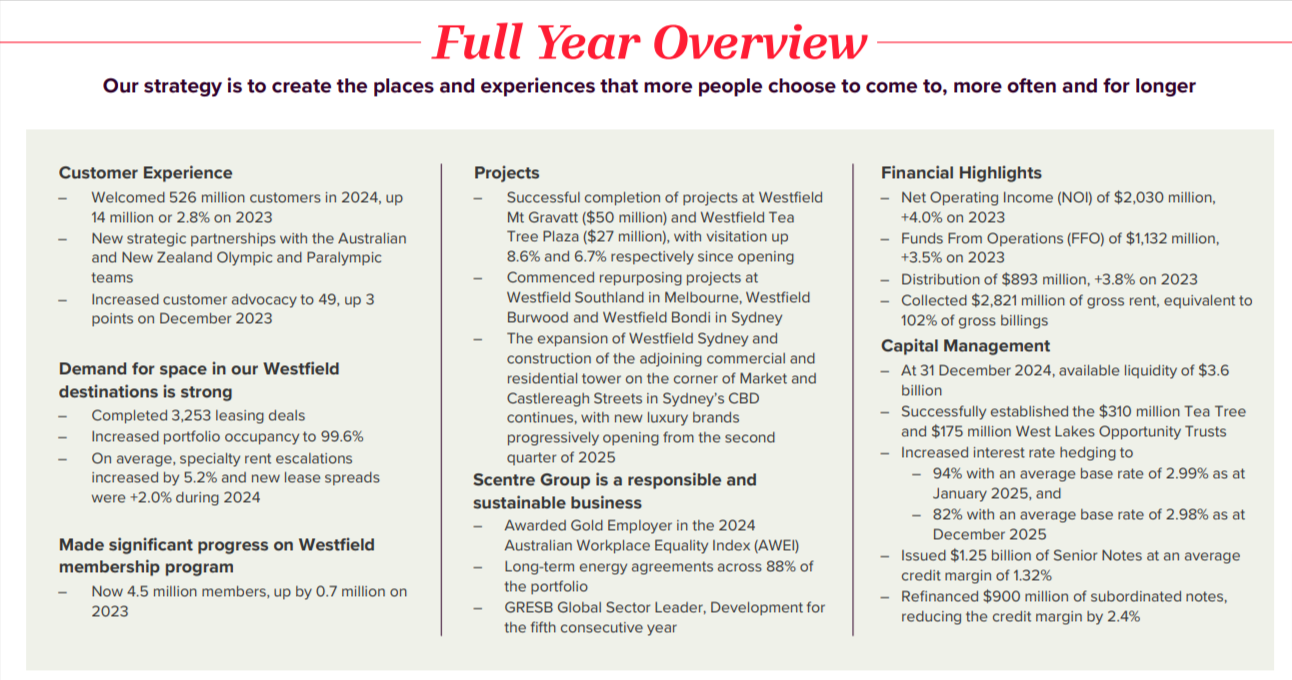

Scentre Group (ASX: SCG) reported a 3.5% increase in Funds From Operations (FFO) to $1.132 billion for the year ended 31 December 2024.

Retail destinations operated by Scentre Group Limited are branded Westfield in Australia and New Zealand.

Corporation activities include ownership, development, design, construction, funds/asset management, property management, leasing, and marketing.

Distributions also rose by 3.8% to $893 million, while Statutory Profit was $1.050 billion.

The year was marked by the tragic attack at Westfield Bondi, in Sydney's eastern suburbs. This had a significant impact on the community, leading to enhanced security measures across all Westfield destinations in Australia and New Zealand.

Scentre Group Chief Executive Officer Elliott Rusanow said: “It was a difficult year following the devastating attack at Westfield Bondi on 13 April 2024. Six innocent people lost their lives and many others were impacted. We extend our deepest condolences to the families and loved ones of the victims."

Despite a challenging year, Scentre Group saw a robust performance with 526 million customer visits, an increase of 14 million from 2023.

The Westfield membership program now has over 4.5 million members.

Business partners achieved record sales of $29 billion, and occupancy rates increased to 99.6%, with 3,253 leasing deals completed and average specialty rent escalations of 5.2%.

Net Operating Income for 2024 was $2.030 billion, a 4.0% increase compared to 2023.

Rusanow credited the strong results to Scentre Group's dedication, who focus on creating extraordinary places and experiences that connect and enrich communities. The group's efforts were pivotal in navigating the aftermath of the Bondi attack and driving growth.

Security remains a top priority for Scentre Group, with heightened measures in place following the events of October 2023 and April 2024.

The group continues to invest in security initiatives, working closely with law enforcement and government agencies to ensure the safety of customers, business partners, and the community. This is despite the resulting increase in operating costs.

The Group also continues to progress its $4 billion future development pipeline. The Group focuses on repurposing space.

During the year the Group completed works at Westfield Tea Tree Plaza in Adelaide and Westfield Mt Gravatt in Brisbane. Visitation is up 8.6% and 6.7% respectively since opening. The Group also commenced projects at Westfield Southland in Melbourne and Westfield Burwood in Sydney.

As at 31 December 2024, the Group had available liquidity of $3.6 billion. In September, the Group completed a tender offer for approximately $900 million of non-call 2026 subordinated notes, which was funded through the issuance of new subordinated notes. In November, the Group issued $1.25 billion of senior notes, extending the weighted average maturity of the debt. The Group has increased its level of interest rate hedge to 94% in January 2025 with an average base rate of 2.99%.

Rusanow said: “Our strategy to attract more people to our destinations and unlock growth opportunities is expected to continue to deliver growth in earnings and distribution."

Subject to no material change in conditions, the Group’s target for FFO is 22.75 cents per security for 2025, representing 4.3% growth for the year. Distributions are expected to grow by 2.5% in 2025 to 17.63 cents per security.

At the time of writing, the Scentre Group (ASX: SCG) share price was down 0.080 cents (2.20%) today at $3.56, with a market capitalisation of approximately $18.52 billion.

Related content