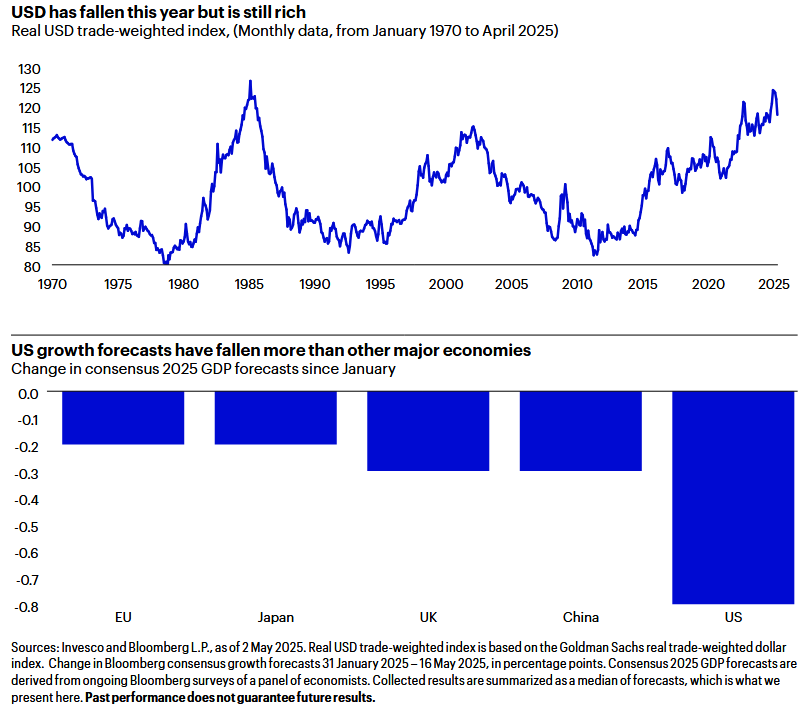

The United States dollar index (DXY) - which tracks the greenback against a basket of six major currencies - has endured a challenging first half of 2025.

After peaking at multi-year highs of 110.2 in January, the index has declined roughly 9.5% year‑to‑date, oscillating around the 98 range as of mid‑June.

A convergence of mixed economic data, mounting fiscal deficits, policy uncertainty under a second Trump administration, alongside a growing shift toward alternative reserve assets, has seen a significant erosion of the dollar’s once‑dominant safe‑haven status.

Mixed Growth Signals and Fed Outlook

The U.S. economic expansion entered 2025 on an uneven footing, with softening economic data fueling market expectations for Federal Reserve rate cuts as early as September.

According to Invesco's midyear investment outlook, the Fed remains in a tough position: “While most of the usual hard data point to keeping rates on hold, soft data point to an impending slowdown that could justify rate cuts.

"It is likely that U.S. rates will stay on hold for a while longer but then be cut aggressively in the event of a significant slowdown in activity.”

The report also notes that while foreign investors have long funnelled surpluses into U.S. dollar assets, this trend may now be reversing, as U.S. growth forecasts decline more sharply than those elsewhere, setting the stage for further dollar weakness in the second half of 2025.

Goldman Sachs has also raised its EUR/USD forecasts, anticipating an added “rate‑cut premium” weighing on dollar‑denominated assets.

Fiscal Deficits and the Triffin Dilemma

Beyond the cycle of monetary policy sits the chronic challenge of U.S. fiscal imbalances, amid expanded entitlements, higher interest costs on outstanding debt, and continued tariff revenues that have failed to fully offset spending increases.

Sprott analysts warn that these deficits will necessitate ongoing Treasury issuance, exerting upward pressure on long‑term yields and undermining currency confidence.

This situation evokes the so‑called Triffin dilemma: the global economy’s reliance on dollar liquidity requires the U.S. to run deficits, yet excessive deficits ultimately weaken the dollar’s attractiveness.

UBS’s Chief Investment Office outlined a range of possible scenarios, noting that “with U.S. government debt high and rising, we believe the U.S. will increasingly turn to financial repression measures to raise revenue, cut the interest burden, and contain yields”.

Trade Policy Uncertainty Under Trump 2.0

Trade policy volatility has re‑emerged under President Trump’s second term. His administration has floated sweeping tariff threats - up to 100% on imports from BRICS nations and other key partners - purportedly to rebalance trade deficits and protect domestic industries.

Such headlines have rattled global markets and even unsettled Treasury auctions, as some institutional buyers balk at the prospect of asymmetric trade barriers.

Within the administration, divisions are apparent. Business‑oriented advisers envision digital dollar innovations - including Treasury‑backed stablecoins under the proposed GENIUS Act - to reinforce the greenback’s global reach.

Conversely, national security officials warn that over-reliance on digital intermediaries might invite de‑risking and fragmentation.

Meanwhile, White House Council of Economic Advisers member Stephen Miran has suggested issuing longer‑dated bonds to “term out” obligations and buttress market confidence — a strategy that would swap short‑term funding needs for extended duration risk but could calm volatility if credibly executed.

The Rise of Gold and “Safe‑Haven 2.0”

As confidence in the dollar wanes, gold has re‑emerged as the premier alternative safe haven. Sprott highlights sustained bullion ETF inflows and a surge in central bank gold purchases, which have lifted gold prices to fresh record highs.

The European Central Bank confirmed that gold has surpassed the euro as the world’s second‑largest reserve asset, accounting for more than 13% of global reserves - a milestone that underscores a growing appetite for real‑asset hedges.

Invesco’s 2025 Mid‑Year Investment Outlook argues that a weaker dollar may catalyse a disinflationary wave abroad, encouraging foreign central banks to cut rates and channel more reserves into bullion and critical commodities.

This feedback loop, where dollar weakness fuels commodity demand, which in turn benchmarks global inflation expectations, could further complicate the Fed’s policy path.

Analyst Forecasts and Market Positioning

Equity and fixed‑income strategists diverge on the depth and duration of the dollar’s slide. Morgan Stanley predicts a further 9% decline in DXY by year‑end, citing decelerating U.S. growth and higher term premia as primary drivers.

In contrast, Barron’s warns that Wall Street’s consensus may be overly bearish; resilient consumer spending data and an unchanged Fed dot‑plot distribution could cap further losses.

Hedgeye founder Keith McCullough noted the importance of getting the dollar call right: marginal mispricings can trigger outsized flows across equities, fixed income, and commodities, amplifying volatility.

In contrast, Wells Fargo’s U.S. Economic Outlook for May 2025 cautions that unexpected inflation surprises or new geopolitical flare‑ups — such as tensions over Taiwan or the Middle East — could prompt a sharp policy U‑turn, providing episodic dollar support.

Forbes contributor Randy Watts argues that while near‑term fiscal and monetary factors favour a weaker dollar, the absence of credible alternatives and the enduring demand for U.S. Treasuries suggest any long‑term slide may be limited.

Barclays concurs that, even under its downside scenario, the dollar will remain the pre‑eminent global currency, albeit with a lower trading range for the coming decade.

Conclusion: Navigating a New Foreign‑Exchange Landscape

The U.S. dollar index’s decline in 2025 reflects more than transient forces. A complex interplay of mixed domestic growth signals, elevated fiscal deficits, trade policy uncertainty, and a conscious shift toward reserve diversification is reshaping the dollar’s role in global finance.

While economists and strategists debate whether this represents a cyclical trough or the start of a lasting rebalancing, one certainty emerges: policymakers and investors must adapt.

Central banks may deepen FX swap lines and reconsider reserve composition. Asset managers need more dynamic currency hedges and diversified allocations across real assets and foreign debt.

Ultimately, mastering the new FX landscape — where dollar dominance remains under increasing strain — will define macro success in the second half of 2025 and beyond.