Recent antics by the Future Fund this year should remind investors how easy it is to get wrong-footed with market dynamics changing so rapidly amid wars and tariff-fuelled uncertainty. During the December quarter the sovereign wealth fund's CIO Ben Samlid reduced the fund’s cash holdings by around $5 billion and cut back exposure to property and private equity, so it could pile on into the surging United States share market.

Fast forward to last week, and the $240 billion fund is now cautioning institutional investors about the underlying risks of foreign exchange exposure with geopolitical instability, courtesy of U.S. President Donald Trump's attempts to restructure the global trading system established after WWII.

‘US exceptionalism’ is over

During a recent Fiduciary Investors Symposium in the NSW Blue Mountains, Samlid inferred that Trump interference in markets is destabilising what has euphemistically been referred to as ‘U.S. exceptionalism’ – which revered America as unique and morally superior to other nations.

While Samlid addressed his institutional investors peers, his messages were no less relevant for mum and dad investors trying to play along at home.

What Samlid appears to be calling time on is the rewards that investors have received for sending significant capital flows to the U.S. where markets have performed strongly over past decades.

Underscoring his concerns is the waning appetite for the U.S. dollar, which over the past decade has simultaneously acted as a hedge during stints of significant volatility.

Samlid has joined a growing chorus of institutional investors who are concerned that the stability of the post-Bretton Woods II institutional framework may be fractured.

US dollar's reign could be over

One of the main planks of the Bretton Woods Agreement - which ushered in the post-WWII boom, relative economic stability and the international monetary system – was the replacement of the British pound sterling with the U.S. dollar as the world’s reserve currency.

What investors like Samlid are concerned about are the forces that appear to be threatening the U.S. dollar’s reign.

Two factors threatening to undermine the current status quo notes Samlid are China’s rapidly waning appetite for U.S. dollar assets and large foreign exchange U.S. dollar-denominated reserves in response to Donald Trump’s onerous tariffs.

“Is the global savings flywheel reversing? The U.S. has captured 70% of global savings – Europe, Japan, [and] the important surplus countries, Canada, Australia,” Samlid noted.

“I think China’s out. Many policies that have been announced or discussed make it more difficult for capital providers in all these countries.”

Fallout from ‘big, beautiful tax’

Samlid also flags the potential, albeit unlikely, fallout from section 899 of Trump’s “big, beautiful bill”, which at face value could hike taxes on Australian asset owners’ U.S. income to a maximum of 70%.

"Taken literally, it makes many asset classes in America very difficult to invest in,” Samlid said.

“… one interpretation of that section would make you very concerned and you would add a higher risk premia to U.S. investing.”

With all of this playing out, investors should watch closely for further evidence that the decades-long trend of countries investing their trade surpluses in U.S. assets is unraveling.

Added to these suspicions was the recent Taiwan dollar rally to record highs which sent Korean and Singapore currencies higher.

“We think FX is the most important lever in the portfolio,” said Samlid.

“It’s the least spoken about but the most important one. It changes your returns over time more than any, and it has more nasty trade-offs that you really have to think through than any of the other things that we do.”

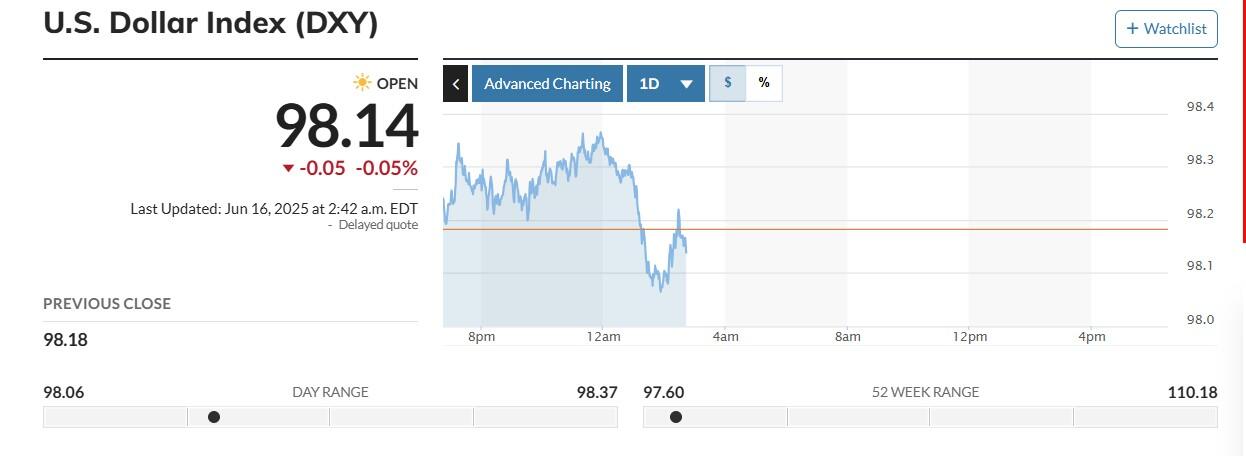

US Dollar Index

According to the U.S. Dollar Index (DXY), which tracks the greenback against a basket of other currencies, the U.S. dollar is down around 10% year-to-date against a basket of other currencies.

What accelerated the decline of the U.S. dollar was Trump’s aggressive unveiling of aggressive tariffs against dozens of countries.

Interestingly, times of volatility would typically send investors into the arms of the U.S. dollar and domiciled assets as a safe haven.

However, within the current environment, investors are recalculating the risks of staying overweight with U.S. assets.

Fuelling those fears are alarm bells that America may lose its status as a global reserve currency if other nations decide its currency and debt are no longer trustworthy.