Wall Street ended mixed on Tuesday (Wednesday AEST), with the S&P 500 eking out its 11th record close of the year as investors digested a fresh round of corporate earnings and new developments on the global trade front.

The Dow Jones Industrial Average climbed 179.4 points, or 0.4%, to 44,502.4, the S&P 500 rose just 4 points, or 0.1%, to close at a record 6,309.6.

Meanwhile, the Nasdaq Composite underperformed, shedding 81.5 points, or 0.4%, to finish at 20,892.7.

Semiconductor and artificial intelligence-related shares dragged on the tech-heavy index following a report in The Wall Street Journal that SoftBank and OpenAI’s ambitious US$500 billion AI project had encountered early-stage setbacks, prompting a scale-down in near-term plans.

Among notable movers, Nvidia declined 2.5%, Broadcom dropped 3.3%, and Taiwan Semiconductor Manufacturing fell 1.8%.

Elsewhere, several blue-chip stocks posted sharp losses after disappointing quarterly results. Lockheed Martin plunged 10.8% after second-quarter revenue missed expectations, and Philip Morris sank 8.4% on weaker-than-forecast revenue.

General Motors also declined 8.1% after taking a US$1.1 billion hit from tariffs, which weighed on its revenue performance.

Despite the weakness in tech and defence, the broader market was buoyed by a strong showing in the healthcare sector, which rose nearly 2% for the session. IQVIA led the gains with a 17.9% surge after beating both earnings and revenue estimates.

Investor focus remained firmly on second-quarter earnings reports, particularly in terms of how companies are addressing macroeconomic uncertainty, tariff impacts, and demand trends related to artificial intelligence.

The spotlight now turns to major upcoming results, with Alphabet and Tesla set to report after the bell on Wednesday. These are among the “Magnificent Seven” megacap tech firms expected to deliver outsized contributions to this earnings season’s overall growth.

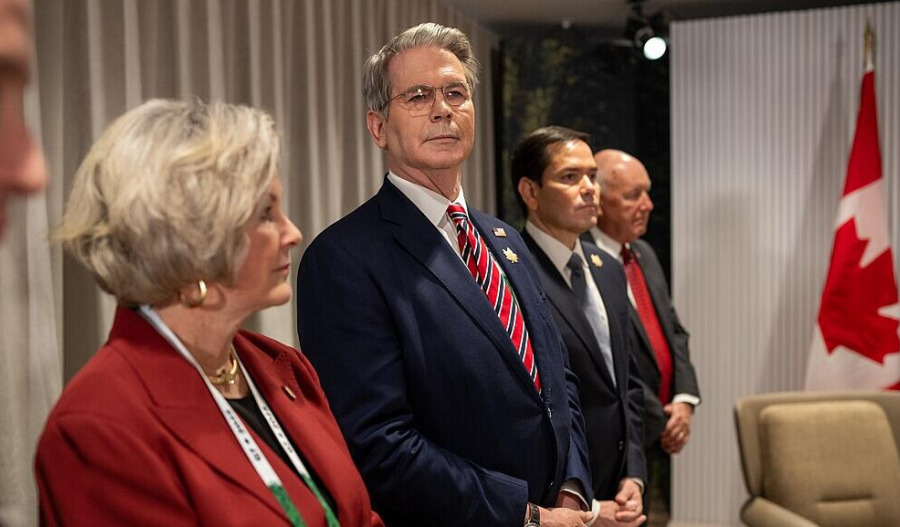

On the policy front, Treasury Secretary Scott Bessent said the U.S. is likely to extend a deadline to finalise trade talks with China, adding he will meet Chinese officials in Stockholm next week.

Meanwhile, President Donald Trump announced a fresh trade agreement with the Philippines, including a 19% tariff on imported goods.

On the bond markets, 10-year and 2-year Treasury rates eased 0.7% apiece to 4.348% and 3.833%, respectively.