Re-live Friday's live blog coverage of earnings season.

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Nintendo slumps, but projects big year for Switch 2

- Expedia income rises, misses revenue estimates amid soft travel demand

- News Corp posts minor revenue growth

- Mixed results from CloudFlare, Shopify

- REA, Macquarie, ConocoPhillips see solid profit increases

- SoftBank revises guidance upwards

_______________________________________________________________________________________

8:54 am (AEST):

Good morning! Harlan Ockey here to walk you through the day's earnings.

Starting off at the TYO, Nintendo (7974) has reported a slump in net sales, but forecasts a strong year ahead with the launch of its Switch 2 console.

Net sales in the year ending March 2025 were JP¥1.16 trillion, below ¥1.67 trillion the previous year.

Profit attributable to the company was JP¥278.8 billion, falling from ¥490.6 billion. Profit per share was ¥239.47, declining from ¥421.39 in the prior fiscal year.

The Nintendo Switch 2, a successor to 2017's Nintendo Switch, will be released on 5 June. Nintendo franchises like Pokémon and Mario Kart will also release new entries later in 2025.

Nintendo's full-year outlook for the fiscal year ending March 2026 projects sales of JP¥1.90 trillion, and profit attributable to the company of ¥300 billion. It expects 15 million Switch 2 consoles will be shipped, with original Switch sales declining by 58%.

9:15 am (AEST):

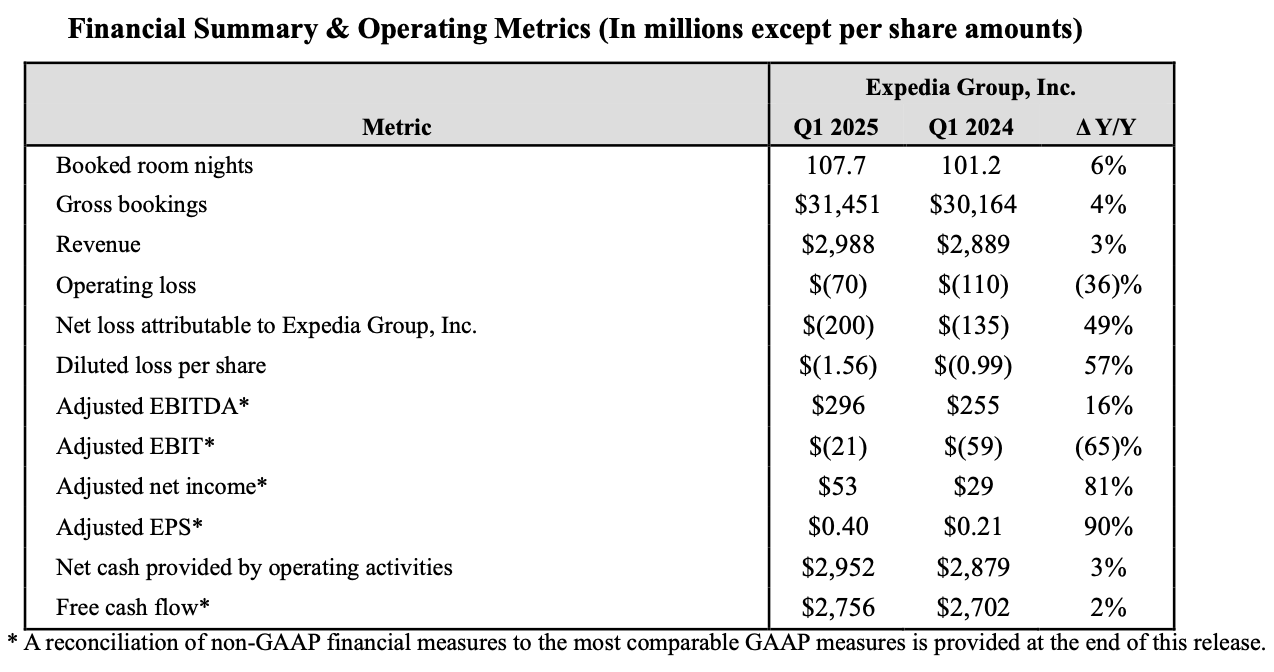

Moving to the NASDAQ, Expedia (EXPE) saw booked room nights and revenue increase last quarter.

Booked room nights were 107.7 million, up 6% year-over-year. This was driven by business-to-business bookings, which grew by 14% to 8.84 million.

Revenue was US$2.99 billion, rising 3%, but missing estimates of $3.01 billion.

Adjusted earnings per share were US$0.40, up 90%, and adjusted net income increased by 81% to $53 million.

“We posted first quarter bookings and revenue within our guidance range despite weaker than expected demand in the US, drove bottom-line meaningfully above our guidance, and made significant progress against our strategic priorities. Looking ahead, we are committed to continuing to deliver margin expansion while growing our top-line," said CEO Ariane Gorin.

Andrew Banks has the full story here.

9:32 am (AEST):

At the ASX (or NASDAQ), News Corporation (NWS) posted 1% revenue growth last quarter, largely driven by its circulations and subscriptions.

Total revenues were US$2.01 billion, up from $1.99 billion one year ago. Circulation and Subscription revenue, its largest segment, saw revenue grow by $21 million to $755 million.

Consumer and Real Estate also reported revenue growth, while Advertising and Other revenues declined.

Net income was US$137 million, rising from $42 million year-over-year.

The company's sale of Foxtel to DAZN also closed in April.

“The sustained strength of News Corp’s third quarter reflects the Company’s strategic transformation. We have pursued digital growth, realigned our assets, focused relentlessly on cost discipline and asserted the essential value of our intellectual property in a changing, challenging content world,” said CEO Robert Thomson.

“Dow Jones was a highlight of the quarter, achieving improved revenue and profit growth, including double-digit revenue growth in digital circulation and at both Risk and Compliance and Dow Jones Energy.”

Read Garry West's report here.

9:58 am (AEST):

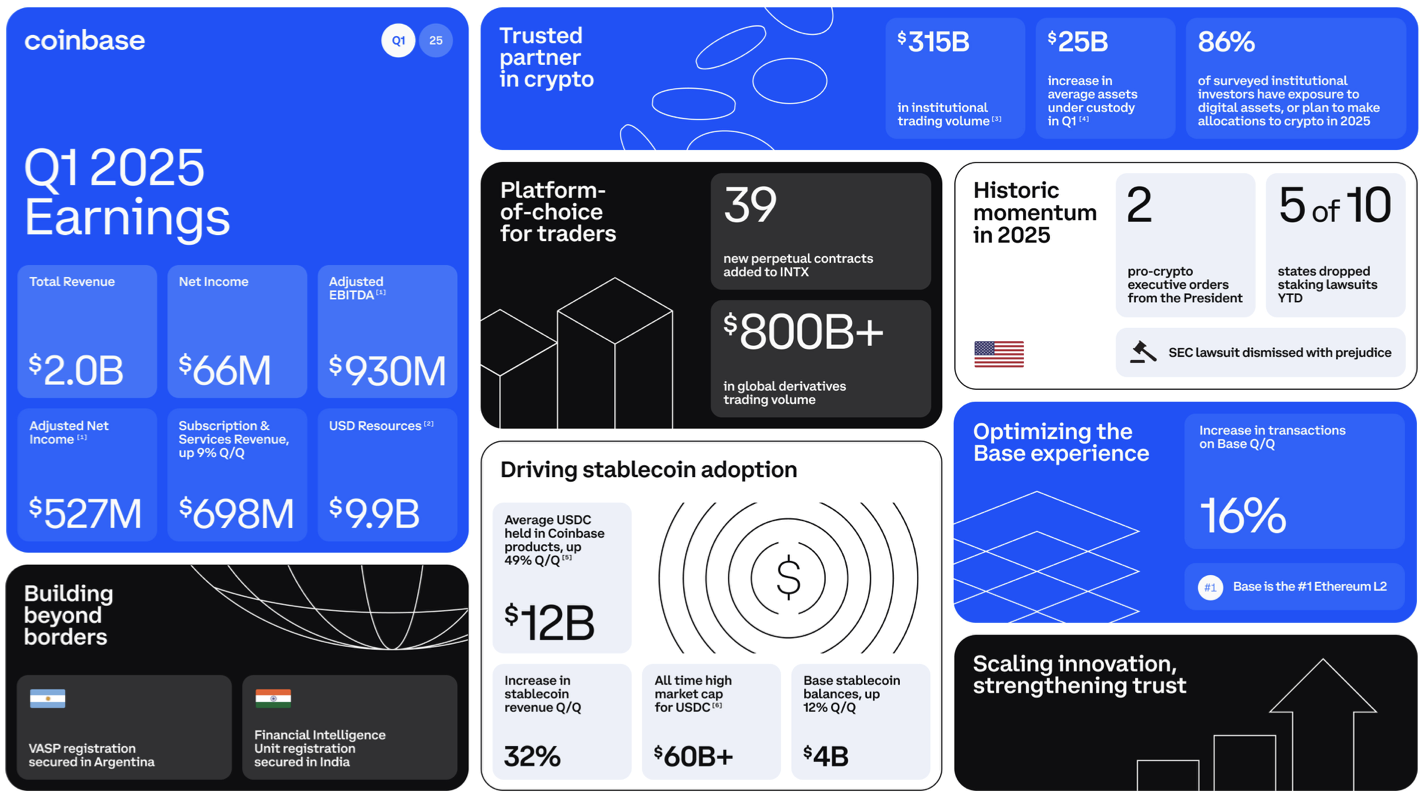

At the NASDAQ, Coinbase (COIN) missed estimates on revenue, despite growth.

Total revenue was US$2.03 billion, up from $1.64 billion year-over-year. This was below LSEG estimates of $2.12 billion.

Transaction revenue grew from US$1.08 billion to $1.26 billion, while Subscription and Services Revenue rose from $510.9 million to $698.1 million.

Adjusted diluted net earnings per share was US$1.94, down from $2.53 year-over-year. Total net income was $65.61 billion.

Its outlook next quarter includes Subscription and Services revenue of US$600-680 million. "Macro uncertainty, including around global trade policy, is impacting consumer sentiment and may contribute to softer crypto trading markets and lower asset prices as we enter the second quarter. We are very familiar with operating through uncertainty and are confident in our ability to maintain our long-term product roadmap and remain financially disciplined," according to the company.

10:15 am (AEST):

Back to the ASX, REA Group (REA) has reported double-digit percentage increases in revenue.and EBITDA.

Revenue last quarter was A$374 million last quarter, up 12% year-over-year. Australian revenue was $340 million, rising 11%.

In Australia, Residential Buy listings were flat nationally. Listings grew by 4% in Sydney, but fell 3% in Melbourne.

An average of 12.3 million users visited realestate.com.au each month last quarter, the company said, with a 6% year-over-year increase in active members.

REA India's revenue was up 28% year-over-year, meanwhile.

Operating EBITDA was A$199 million, rising 12%, with EBITDA increasing 15% to $193 million.

"REA delivered a strong third quarter result underpinned by double-digit yield growth as we continued to drive increased value for customers across our premium products. The first interest rate cut in 4 years, combined with expectations of more to come, spurred buyer demand and supported house price growth across the countr," said CEO Owen Wilson.

The company projects Australian listings growth of 1-2% across its 2025 fiscal year.

Andrew Banks has the full report.

11:12 am (AEST):

At the ASX, Macquarie Group (MQG) has beaten profit estimates.

Net profit across its fiscal year 2025 was A$3.72, rising 5% from the previous year and passing Visible Alpha estimates of $3.70 billion. Net profit last half was $2.10 billion, up 30% over the previous half.

“Against a backdrop of ongoing market and economic uncertainty, Macquarie’s client franchises remained resilient over the past year, delivering new business origination and underlying income growth, contributing to our history of unbroken profitability," said CEO Shemara Wikramanayake.

Its Banking and Financial services segment saw net profit grow by 11% last fiscal year to A$1.38 billion, while Commodities and Global Markets' profit fell by 12% to $2.83 billion.

Operating income in FY2025 was A$17.21 billion, up 2% over the previous year.

The company declined to offer a detailed outlook. “Macquarie remains well-positioned to deliver superior performance in the medium term with established, diverse income streams; deep expertise across diverse sectors in major markets with structural growth tailwinds; patient adjacent growth across new products and new markets; ongoing investment in our operating platform; a strong and conservative balance sheet; and a proven risk management framework and culture,” Wikramanayake said.

Read Garry West's full story here.

11:42 am (AEST):

Returning to the TYO, SoftBank (9434) has revised its FY2025 guidance upward after solid increases in revenue and income.

Revenue was JP¥6.54 trillion in the fiscal year ending March 2025, up 8% from the prior year.

Net income was JP¥526.1 billion, also rising 8%. Operating income was ¥989 billion, increasing by 13%.

The company posted growth in revenue and income across segments. Its Enterprise segment saw JP¥922.4 billion in revenue last fiscal year, rising by 27%.

SoftBank said it had reached 1 million net new subscribers last fiscal year, with its subscriptions now totalling 31.77 million.

The company said its Sarashina Mini large language model had been largely completed, with in-house trials and a commercial launch due later in 2025. It is also pursuing a joint venture with OpenAI, having led OpenAI's US$40 billion funding round last month.

Its FY2025 forecast projects revenue of JP¥6.70 billion, which a record high for the tenth consecutive year. This has been increased by ¥200 billion from previous estimates. SoftBank now expects net income of ¥540 billion, up ¥5 billion.

11:56 am (AEST):

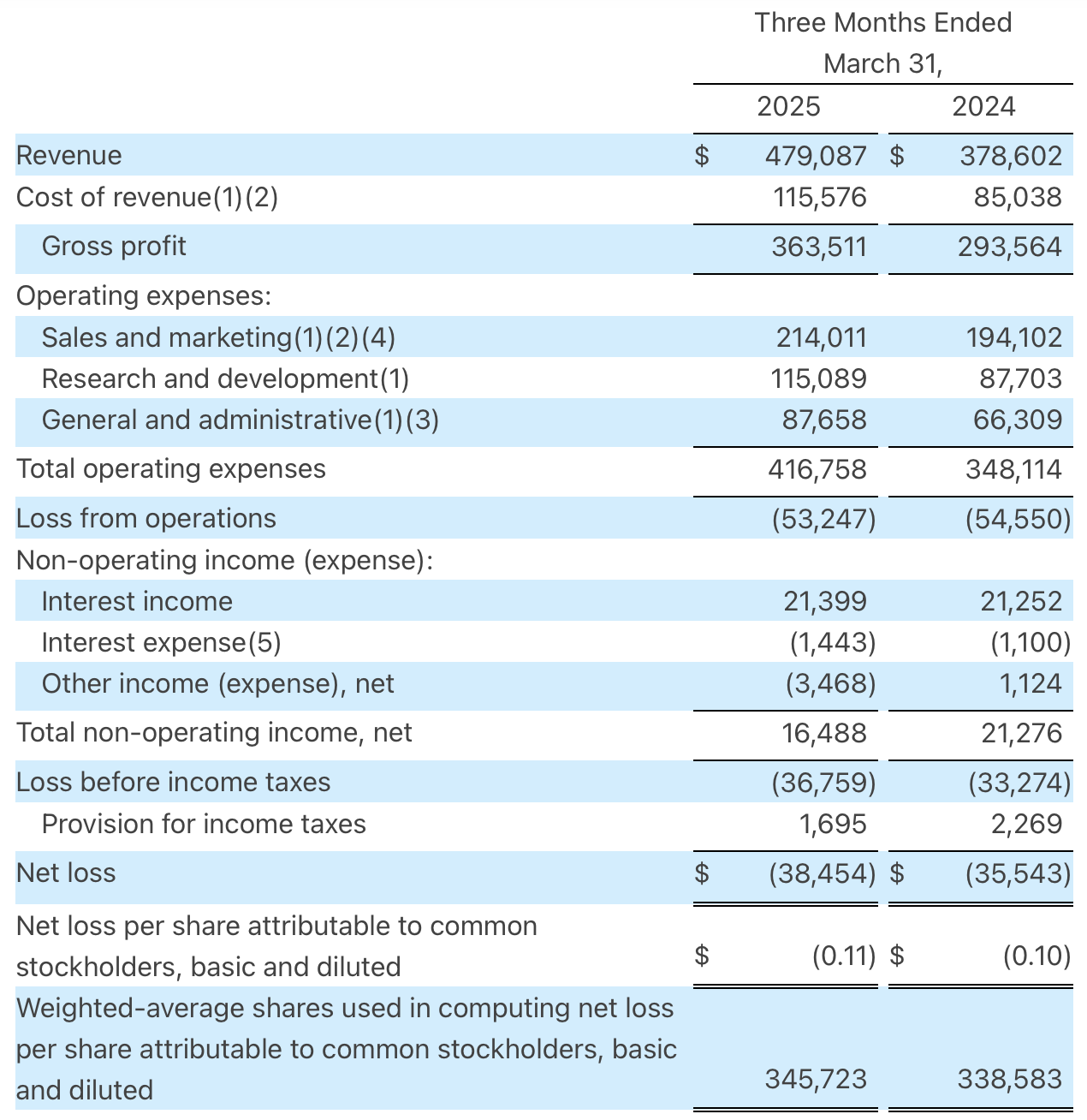

Over at the NYSE, Cloudflare (NET) saw revenue increase, but reported a net loss.

Revenue was US$479.1 million last quarter, up 27% year-over-year.

The company's net loss was US$38.45 million, below the previous year's loss of $35.54 million. It posted a loss per share of $0.11, while adjusted earnings per share were $0.16, in line with Zacks estimates.

Operating expenses also rose from US$348.1 million to $416.8 million year-over-year, driven by growth across sectors. Free cash flow was US$52.9 million, up from $35.6 million one year ago.

“We kicked off 2025 with confidence, momentum, and strong results. In Q1, we landed the largest contract in Cloudflare’s history, a more than $100 million deal driven by our Workers developer platform, and signed the longest-term SASE contract to date,” said CEO Matthew Prince. “We have the scale, the technology, and the team to capture the massive opportunity ahead of us — as evidenced by the size and the length of the deals we’re closing and the calibre of customers betting on Cloudflare."

Cloudflare's Q2 forecast projects revenue of US$500-501 million, with revenue of $2.090-2.094 billion across the year.

12:28 pm (AEST):

Back at the NASDAQ (and TSX), Shopify (SHOP) posted mixed results last quarter amid the looming impact of U.S. tariffs on e-commerce retailers.

Revenue was US$2.36 billion, up 27% year-over-year. Merchant Solutions revenue increased by $390 million to $1.74 billion, and Subscription Solutions revenue was up $109 million to $620 million.

Gross Merchandise volume was US$74.75 billion, above Q1 2024's $60.86 billion, but below StreetAccount estimates of $74.8 billion.

Gross profit rose from US$957 million to $1.17 billion year-over-year, while operating income grew from $86 million to $203 million.

Shopify reported a net loss of US682 million, however, lower than its net loss of $273 million one year ago. Excluding the impact of equity investments, net income was $226 million.

“Our Q1 results confirm two clear facts. First, we are delivering both growth and profitability at scale. Second, businesses perform better on Shopify, regardless of market conditions,” said Shopify president Harley Finkelstein, President of Shopify. “We built Shopify for times like these. We handle the complexity so merchants can focus on their customers. We ship products faster than anyone else, giving merchants the edge they need to succeed.”

Its forecast for Q2 projects year-over-year revenue percentage growth in the mid-twenties.

12:53 pm (AEST):

At the NYSE, ConocoPhillips (COP) bested estimates on earnings per share and revenue.

Revenue was US$17.1 billion last quarter, up from $14.48 billion one year ago, and beating Zacks projections by 3.37%.

Adjusted earnings per share were US$2.09, compared with $2.03 one year ago. This is above Zacks estimates of $2.06, and represents its third earnings per share surprise in the past four quarters.

Production last quarter was 2.39 million barrels of oil equivalent per day, up 487 thousand year-over-year. After adjusting for closed acquisitions and dispositions, production increased by 5%, the company said.

“ConocoPhillips continued to demonstrate strong execution in the first quarter, and we reduced our full-year capital and operating cost guidance,” said CEO Ryan Lance. “Amid a volatile macro environment, we remain confident in the competitive advantages provided by our differentiated portfolio, strong balance sheet and disciplined capital allocation framework that prioritizes returns on and of capital to shareholders.”

The company projects Q2 production will be 2.34-2.38 million barrels of oil equivalent per day.

Chloe will take it from here. Thanks for having me!

1:20 pm (AEST):

Chloe Jaenicke here to take you through the rest of the day.

Starting off, Monster Beverage Corporation's (NASDAQ: MNST) financial report fell below Wall Street expectations.

The company reported net sales of US$1.85 billion, falling short of the expected $1.95 billion and decreasing 2.3% from the same time last year.

The company said net sales were negatively impacted by bottle/distributor ordering patterns in the U.S. and EMEA, adverse changes in foreign exchange rates, adverse weather, one less selling day in the 2025 first quarter and uncertain economic conditions.

Chairman and co-CEO Rodney Sacks also pointed to low sales in the alcohol segment for the lower net sales.

“The Alcohol Brands segment continued to put negative pressure on our financial results,” he said.

“We remain focused on optimising our personnel and facilities to support the current demand of our Monster Brewing portfolio and innovation pipeline.”

Sales in the struggling alcoholic segment fell 38.1% to $34.7 million due the launch of the Nasty Beast® Hard Tea.

Monster also reported earnings per share of $0.45, almost on par with the estimated $0.46 and a slight jump from $0.42 in Q1 2024.

1:42 pm (AEST):

American health company, Kenvue Inc. (NYSE: KVUE) reported a 3.9% drop in net sales from the same time last year to US$3.74 million.

The decrease suggests a 1.2% fall in organic sales and a foreign currency headwind of 2.7%.

Despite the decline, the company still topped expectations of $3.68 billion.

The companies reported earnings per share of $0.24, also beating the predicted $0.23 and but fell from last year’s $0.28.

“In Q1, our teams executed our plans while continuing to navigate an evolving macro and consumer environment,” Chief Executive Officer Thibaut Mongon said.

“We are committed and focused on activating our brands while staying agile and flexible to accelerate sustainable, profitable growth.”

2:09 pm (AEST):

Pharmaceutical company McKesson Corporation (NYSE: MCK) has released earnings for the financial year ending 31 March 2025, reporting increases in both Q4 and the fiscal year.

In Q4, the company recorded a 19% rise in revenue to US$90.8 billion and its earnings per share rose by $3.99 to $10.01 from the same time last year.

As for the fiscal year, its revenue soared 16% to $359.1 billion and earnings per share also increased by $3.33 to $25.72.

“This marks another year of strong financial results, above our long-term targets, underpinned by operational execution against our strategic priorities, and disciplined and focused capital deployment,” CEO Brian Tyler said.

“The strength of our core pharmaceutical distribution business, expansion of our Oncology platform, and continued growth of our differentiated biopharma solutions businesses led to strong results.”

The company’s outlook for fiscal 2026 indicates an 11% to 14% rise in adjusted earnings per diluted share to $36.75 to $37.55.

“As we look ahead to fiscal 2026, we are well positioned to build on our operating momentum, accelerate growth through our strategic priorities, and target investments to accelerate growth and modernise the portfolio,” Tyler said.

2:32 pm (AEST):

Parent company of CNN and HBO, Warner Bros. Discovery (NASDAQ: WBD), reported revenues fell despite adding 5.3 million new streaming customers.

The company’s revenue fell by 9% to US$9 billion, which is also lower than the expected $9.61 billion.

It made a loss of $435 million, which is an improvement upon the $966 million lost in the same time last year.

Poor reception of some feature films, like Mickey 17 contributed to 18% of the fall in the company’s studio division to $2.3 billion, well below the predicted $2.85 billion. They have, however, found recent success with the Minecraft Movie and Sinners.

The company also saw streaming numbers grow to 122.3 million, causing streaming revenue to grow by 8% to $2.6 billion.

Much of their streaming growth came from overseas as it launched HBO Max in Australia earlier this year and in more than 70 countries in Europe and Asia throughout 2024.

3:05 pm (AEST):

Social media platform Pinterest (NYSE: PINS) has delivered 16% revenue growth in Q1 2025 and reached a record number of users.

The company’s revenue came to US$855 million, surpassing the $739 million in Q1 2024. Pinterest also beat analysts' expectations of $846.9 million

The platform's user base also jumped 10% year over year to 570 million global active users.

CEO Bill Ready said these are strong results and the business fundamentals put them in a strong position to continue healthy growth.

“As the macroeconomic and digital ad landscape evolves, our strategy and consistent execution has made Pinterest more resilient than ever,” Ready said.

“Our AI advancements are helping users take action and make more intentional shopping decisions.

“We’re driving performance for advertisers and winning market share, giving us a solid foundation for long-term, sustainable growth.”

3:25 pm (AEST):

ConocoPhillips (NYSE: COP) reported higher first Q1 2025 earnings and earnings per share than it did last year.

This year, its earnings came to US$2.8 billion or $2.23 per share, compared to $2.6 billion or $2.15 at the same time last year.

This also beats the Zacks Consensus Estimates of $2.09 per share.

Chairman and CEO Ryan Lance said this marks a strong first quarter in 2025.

“Amid a volatile macro environment, we remain confident in the competitive advantages provided by our differentiated portfolio, strong balance sheet and disciplined capital allocation framework that prioritises returns on and of capital to shareholders,” Lance said.

3:56 pm (AEST):

Video sharing platform Rumble (NASDAQ: RUM) reported revenue of US$23.7 million in Q1 2025, an increase of 34% from $17.7 million in the same quarter last year.

The company retained 87% retention post the 2024 U.S. general election, with 59 million monthly active users in Q1 2025 compared to 68 million in the first quarter of 2024.

Rumble chairman and CEO, Chris Pavlovski, said partnerships both in the U.S. and internationally have helped the company and there are plans to ensure Rumble keeps growing.

“Key partnerships with major brands like Netflix, Crypto.com, and Chevron marked early wins for Rumble advertising, while progress in the Rumble Cloud business included new government and sports vertical clients, such as El Salvador and the Tampa Bay Buccaneers,” he said.

“With these new announcements and developments on the sales front, we remain energised by the potential for this business.

“We also further advanced the Rumble Wallet, which we plan to release later this year, supporting our international expansion.”

4:23 pm (AEST):

Yelp (NYSE: YELP) has announced its earnings for Q1 2025, raising revenue and beating expectations.

Net revenue for the company increased by 8% year over year to US$359 million, surpassing the Zacks Consensus Estimate by 1.85%.

“Services revenue increased by 14% year over year in the first quarter, achieving the 16th consecutive quarter of double-digit growth, and we continued to see momentum in our product-led strategy,” Yelp co-founder and CEO, Jeremy Stoppelman said.

“We recently rolled out 15 new features and updates to enhance the consumer experience and help businesses manage their operations more efficiently.”

The company’s year-over-year adjusted EBITDA also grew.

“Adjusted EBITDA increased by 32% year over year to $85 million, $15 million above the high end of our outlook range and representing a four percentage point year-over-year improvement in our adjusted EBITDA margin,” Yelp's chief financial officer, David Schwarzbach said.

Yelp has adjusted its 2025 net revenue outlook fro 2025 to the range of $1.465 billion to $1.485 billion and plans to roll out a suite of new features.

“Looking ahead, we’re excited about the lineup of AI advancements on our roadmap that will further transform the Yelp experience and streamline operations for local businesses,” Stoppelman said.

“We believe that these efforts will unlock new opportunities for growth and enable us to deliver long-term value to our shareholders.”

That’s all for today! Thank you for following along, and please join us next time.