Re-live today's live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Microsoft, Qualcomm, Airbus, eBay, Barclay's soar past estimates

- Meta, Robinhood post major income increases

- Mercedes-Benz the latest automaker to withdraw guidance amid tariff pressures

- Crown Castle, MGM Resorts, Norwegian Cruise Line slump

- Amcor misses estimates as Berry Global merger completes

______________________________________________________________________________________

8:50 am (AEST):

Good morning! Harlan Ockey here to walk you through today's earnings.

Starting on the NASDAQ, Qualcomm (QCOM) has bested estimates on both revenue and earnings per share.

Revenue was US$10.84 billion, rising 15% year-over-year and surpassing LSEG projections of $10.66 billion. Diluted earnings per share increased 17% to $2.85, above $2.82 estimates.

The company's CDMA Technologies segment, which includes its chipsets, saw revenue grow by 18% to US$8.47 billion. Handsets represent the largest proportion of the segment's revenue, increasing by 12% to $6.92 billion.

Its Technology Licensing segment, which manages patents, posted $1.32 billion in revenue. This is roughly flat from one year ago.

“As we navigate the current macroeconomic and trade environment, we remain focused on the critical factors we can control – our leading technology roadmap, best-in-class product portfolio, strong customer relationships and operational efficiencies. Our top priorities remain executing our diversification strategy and investing in areas that drive long-term value," said CEO Cristiano Amon.

Qualcomm's guidance projects revenue in the US$9.9-10.7 billion range next quarter, with diluted earnings per share of $2.60-2.80. This is slightly above LSEG estimates of a $2.67 earnings per share midpoint, but below estimates of a $10.35 billion revenue midpoint.

The company does not expect the U.S.' tariff plans to directly impact the business due to its diversified supply chain, CFO Akash Palkhiwala said on an earnings call. However, tariffs might cause demand changes.

9:05 am (AEST):

Checking on Wall Street, the U.S. major benchmarks have closed after a tumultuous trading session. The Dow Jones Industrial Average closed at 40,669.4, up 0.4%, and the S&P 500 rose by 0.2% to close at 5,569. The NASDAQ Composite fell by 0.1% to 17,446.3.

The session saw major swings throughout the day, after the release of the U.S. Department of Commerce's gross domestic product report. The U.S.' GDP contracted by 0.3% last quarter, well below the projected 0.3% growth.

Read Oliver Gray's report on Wall Street's close here, and his article on the U.S.' GDP report here.

9:14 am (AEST):

Still on the NASDAQ, shares in Meta Platforms (META) jumped after it announced a 35% increase in net income for the first quarter (Q1) of the 2025 financial year.

Meta, the parent company of Facebook, Instagram and WhatsApp, said net income was US$16.664 billion in the three months ended 31 March, compared with $12.369 billion in the previous corresponding period. Diluted earnings per share (EPS) rose 37% to $6.43 as the operating margin widened to 41% from 38% and revenue increased 16% to $42.31 billion (19% on a constant currency basis).

“We've had a strong start to an important year, our community continues to grow and our business is performing very well," founder and CEO Mark Zuckerberg said in a press release.

The results were better than expected, with analysts forecasting EPS of US$5.23 per share on revenue of $41.34 billion, according to a poll by FactSet. Meta shares closed $5.44 (0.98%) at $549.00 on Wednesday (Thursday AEST), but climbed $26.30 (4.79%) to $575.30. This capitalises the company at $1.39 trillion in after-hours trading, once the result was announced.

Thank you to Garry West for that write-up — read his full story here.

9:29 am (AEST):

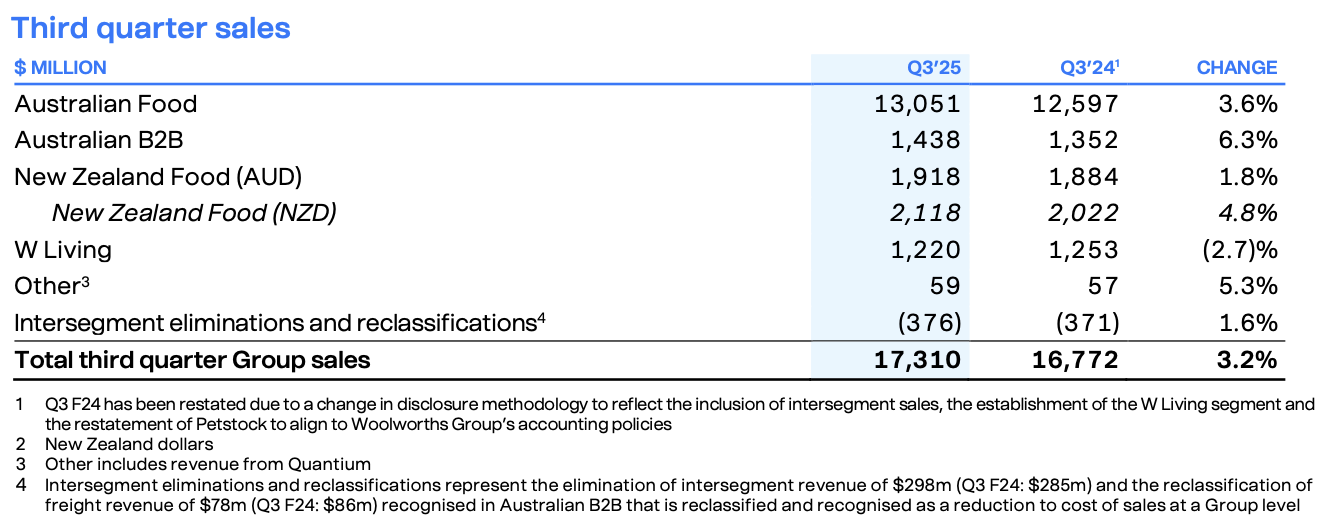

Turning to the ASX, Woolworths (WOW) has reported a 3.2% increase in sales to A$17.31 billion.

Australian food sales were up 3.6% to A$13.05 billion last quarter, while New Zealand food sales rose 1.8% to A$1.92 billion (NZ$2.12 billion). Woolworths Food Retail reported no change in average Australian prices last quarter.

W Living, which includes non-food retail businesses like Big W and Petstock, was the only segment to see a decline in sales, shrinking by 2.7%.

The company's Everyday Rewards app reported 10.3 million active members, rising from 9.7 million one year ago, with a 58.5% scan rate across transactions.

“With only two months until the end of our financial year, we remain focused on the priorities set out in February which include improving our retail fundamentals in value, availability and range, simplifying the way we work and unlocking the full potential of the Group,” said CEO Amanda Bardwell.

See Frankie Reid's full story here.

9:53 am (AEST):

Over in Frankfurt, Mercedes-Benz (MBG) has withdrawn its earnings guidance due to tariff-driven industry uncertainty.

Its diluted earnings per share last quarter were EU€1.74, falling 39.1% year-over-year.The company's net profit was EU€1.73 billion, down 42.8%.

Revenue was €33.22 billion, down by 7.4%. All segments saw revenue declines, with Vans posting the largest percentage drop at 16.6%.

Almost all geographical regions also posted a slump in revenue, except Other Markets outside Asia, North America, and Europe.

Mercedes-Benz's initial FY2025 guidance projected a slight drop in unit sales for both its Cars and Vans segments. The company now expects U.S. tariffs to impact its profit margin by as much as 300 basis points this year, and has withdrawn its guidance.

Volvo Cars also withdrew its guidance this week, while General Motors said it would reassess its outlook.

10:02 am (AEST):

Back to the NASDAQ, Microsoft (MSFT) has beaten estimates on all metrics. Revenue rose by 13% to US$70.1 billion last quarter, above estimates of $68.42 billion, while earnings per share were up 18% to $3.46.

Net income rose by 18% to US$25.8 billion, while operating income grew by 16% to $32 billion.

Cloud and AI products and services were the drivers of Microsoft’s record-beating Q3 FY25 quarter, as Azure’s growth in the cloud ecosystem continues to outperform.

Cloud revenue came in at $26.1 billion for the quarter, marking an 18% increase, while AI investments through tools such as Microsoft 365 Copilot were seen as key long-term growth drivers.

Microsoft shares surged 6.51% in intraday trading to US$421 per share at the time of writing.

Thank you to Cameron Drummond for the write-up — read his full story here.

10:19 am (AEST):

Markets update: the ASX is set to open lower after five days of gains, following a turbulent session on Wall Street.

The ASX closed up 0.7% at 8,126.2 on Wednesday.

Read Garry West's full report here.

10:27 am (AEST):

On the ASX, Amcor (AMC) has missed estimates on sales and earnings per share.

Sales last quarter were US$3.33 billion, below the $3.41 billion seen one year ago and missing Zacks' estimates by 4.37%.

GAAP diluted earnings per share were US$0.14, missing estimates of $0.19.

The company said today that its merger with Berry Global was now complete, projecting that this will lead to US$650 million in savings by the end of FY2028. “Today is a defining day for Amcor as we closed our transformational merger with Berry Global. Through this combination, Amcor has enhanced positions in attractive categories, a broader, more complete customer offering and expanded material science and innovation capabilities," said CEO Peter Konieczny.

Amcor's 2025 guidance expects adjusted earnings per share of US$0.72-74.

Read Mark Story's full report here.

11:07 am (AEST):

Back to Frankfurt, Volkswagen (VOW) has posted mixed results, with revenue rising while operating profit dropping.

Sales revenue was up by 2.8% year-over-year to EU€77.6 billion last quarter. Operating profit was €2.9 billion, compared with €4.6 billion one year ago. The company credited the decline to higher fixed costs and special effects costs of €1.1 billion.

The company sold 2.1 million vehicles, 0.9% above Q1 2024. While sales grew by 4% in Europe and 17% in South America, North America saw sales fall by 2% and 6% respectively.

“As expected, the Volkswagen Group experienced a mixed start to the fiscal year. Our cars are very well received,” said CFO Arno Amlitz.

"Given the current volatile global economic situation, it is even more important to focus on the levers within our control. This means complementing our great product range with a competitive cost base – so we can ensure to succeed also in rapidly changing global markets.”

Volkswagen's full-year 2025 guidance predicts sales revenue to increase by up to 5% over 2024's figure, though this projection does not include the impact of U.S. tariffs.

11:29 am (AEST):

In Paris, Airbus (AIR) reported major increases in revenue and operating profit last quarter. Revenue was up 6% to EU€13.54 billion, well above analyst estimates of €12.95 billion.

Operating profit was EU€624 million, rising 8% year-over-year. Earnings per share were €1.01, above Q1 2024's €0.76.

The company delivered 136 commercial aircraft across the quarter, including 106 A320s. Airbus received 204 net aircraft orders, compared with 170 in Q1 2024.

Its order backlog was 8,726 commercial aircraft at the end of March.

“Our Q1 results demonstrate the progress we are making on our priorities across the business. We are ramping up production in line with our plan but the delivery profile will be backloaded, reflecting the specific supply chain challenges we are facing this year," said CEO Guillaume Faury.

Its 2025 guidance projects around 820 commercial aircraft deliveries, though this does not include the impact of U.S. tariffs.

“We maintain the guidance that excludes tariffs which are adding complexity and remain uncertain in terms of implementation, scope and duration. We are closely monitoring and assessing the situation, but it is too early to quantify the impact today," said Faury.

Airbus also agreed this week to acquire several Spirit AeroSystems plants and services in the U.S., Northern Ireland, Scotland, Morocco, and France.

12:00 pm (AEST):

Chloe Jaenicke here to take over the blog for a bit.

On the NYSE, Caterpillar Inc. (CAT) revenues decreased from US$15.8 billion in Q1 2024 to $14.2 billion in the first quarter of 2025.

Caterpillar earned $2 billion or $4.20 per share for the quarter.

The company said this decrease was mainly due to lower sale volume of $1.1 billion and unfavourable price realisation of $250 million.

The company also said it anticipates the second quarter to be similar to prior year period but that tariffs may increase its second quarter costs by $350 million due to lack of first quarter demand.

12:12 pm (AEST):

Insurance company Allstate (NYSE: ALL) reported a revenue increase of 7.8% from the same time last year to US$16.5 billion for Q1 2025.

While their net income was down, Allstate Corporation CEO, chair and president Tom Wilson said this was offset by other factors.

“Net income was $566 million, lower than last year, as a record $3.3 billion of gross catastrophe losses were partially offset by $1.1 billion of reinsurance recoveries in the quarter,” Wilson said.

Adjusted net income was $949 million or $3.53 per share, which is a decrease from the prior year quarters $1.4 billion.

12:25 pm (AEST):

Metlife (NYSE: MET) has released its earnings reports announcing that it experienced growth across the board.

“We saw favourable underwriting, good volume growth and better variable investment income in the quarter,” Metlife CEO and president Michel Khalaf said.

“Our strong recurring cash flow generation provided us with the capacity to return US$1.8 billion to our shareholders in the quarter and in April increase our common dividend per share.”

The company reported that its net income increased 10% to $879 million and its premiums, fees and other revenues increased 14% to $13.6 billion.

It experienced the greatest growth in Group Benefits, with the adjusted earnings rising 29% to $367, primarily due to higher life underwriting margins.

12:42 pm (AEST):

Yum! Brands (NYSE: YUM) reported mixed results with revenues increasing but missing the forecast.

The company’s revenue grew 12% to US$1.79 billion, but this still missed the 1.85 billion forecast.

While many of the chains owned by Yum! Brands, including KFC and Taco Bell, saw global same-store sales increase, Pizza Hut’s sales decreased by 2%.

“Our twin growth engines led the way, with Taco Bell U.S. reporting a remarkable 9% same-store sales growth and KFC International accelerating same-store sales growth while generating 7% unit growth year-over-year,” Yum! Brands CEO David Gibbs said.

The company reported first quarter net income of $253 million, or 90 cents per share, which is a decrease from $314 million or $1.10 per share, in Q1 2024.

1:17 pm (AEST):

Thank you, Chloe! Harlan Ockey back with you now.

Still with the NYSE, Crown Castle (CCI) has reported a slide in revenue and earnings per share.

Site rental revenue was US$1.01 billion, down 36.3% year-over-year and below projections of $1.09 billion. Its Services revenue was $50 million, down 5.7% and beating estimates of $46.85 million.

Crown Castle's diluted loss per share was US$1.07, compared with positive earnings of $0.71 one year ago.

"We delivered solid operational and financial results in the first quarter, as a continuation of strong activity levels in the U.S. drove 5% organic growth in our tower business excluding the impact of Sprint Cancellations, positioning us well to meet our full year 2025 Outlook," said CEO Dan Schlanger.

The company's full-year 2025 outlook remains unchanged. It projects site rental revenues of US$3.99-4.03 billion and diluted earnings per share of $0.15-0.79.

1:50 pm (AEST):

Back at the NASDAQ, Robinhood (HOOD) saw total revenues surge by 50% year-over-year to US$927 million.

Transaction-based revenues rose by 77% to US$583 million, with cryptocurrencies revenue up 100%. Net interest revenues grew by 14% to $290 million.

Robinhood's net income was up 114% to US$336 million, while diluted earnings per share increased by 106% to $0.37.

Gold Subscribers increased by 1.5 million to reach 3.2 million.

“This quarter, we significantly accelerated product innovation across our key initiatives, highlighted by the announcement of Robinhood Strategies, Banking, and Cortex,” said CEO Vlad Tenev. “Customers have clearly responded — demonstrated by record-breaking net deposits, Robinhood Gold subscriptions, and options volume, as well as robust year-over-year growth in trading across all asset classes.”

The company's full-year outlook includes combined adjusted operating expenses and share-based compensation of US$2.085-2.185 billion, increasing slightly to accommodate $85 million of costs from its acquisition of TradePMR.

2:17 pm (AEST):

On the NASDAQ again, eBay (EBAY) saw revenue and earnings per share exceed estimates.

Revenue last quarter was US$2.59 billion, up 1.1% on a reported basis and surpassing Zacks estimates of $2.55 billion. Earnings per diluted share were US$1.38, above both Q1 2024's $1.25 and estimates of $1.34.

Its gross merchandise volume was US$18.8 billion, up 1% year-over-year.

eBay's buyers and sellers contributed more than US$46 million to the eBay for Charity program last quarter. The company also closed its acquisition of vehicle sale platform Caramel.

“eBay’s first quarter results were ahead of expectations, as we delivered our fourth consecutive quarter of positive GMV growth,” said CEO Jamie Iannone. “Our Focus Categories and geo-specific investments are driving momentum in the business, and we continue to innovate – leveraging Al to make our marketplace more efficient and intuitive for customers.”

The company's second-quarter outlook includes US$2.59-2.66 billion in revenue, with diluted earnings per share of $1.24-1.31.

2:50 pm (AEST):

At the LSE, Barclay's (BARC) beat estimates on revenue and profit.

Profit before tax was UK£2.7 billion, up 11% year-over-year and besting LSEG estimates of £2.49 billion. Earnings per share were £0.13.

Revenue was UK£7.7 billion, above estimates of £7.33 billion. Statutory return on tangible equity was 14%.

Its Investment Bank segment, the company's largest, saw UK£3.873 billion in revenue, up 16%.

"Our high quality, diversified businesses, together with proactive risk, capital and liquidity management and a robust balance sheet, position us well to support our customers and clients and deliver strong risk-adjusted returns in a wide range of macroeconomic scenarios," said CEO C.S. Venkatakrishnan.

Its 2025 guidance includes a return on tangible equity of around 11%.

3:29 pm (AEST):

Back at the NYSE, MGM Resorts (MGM) saw net revenue and income decline.

Revenues were US$4.3 billion, falling by 2% year-over-year, with the slide driven primarily by the Las Vegas Strip Resorts and MGM China.

In Las Vegas, revenue dropped by 3% due to a decrease in non-gaming revenues, as the Super Bowl was hosted in Las Vegas in Q1 2024. Room revenue for its Las Vegas Strip Resorts was US$750 million, down 9%, through casino revenue grew by 8% to $538 million.

Net income was US$149 million, well below Q1 2024's $217 million. Diluted earnings per share were $0.51, compared with $0.67 one year ago.

“MGM Resorts achieved strong first quarter results across our portfolio in the face of the well anticipated comparison to last year’s Super Bowl in Las Vegas, highlighted by a positive EBITDA performance at our BetMGM venture,” said CEO Bill Hornbuckle.

And at the NYSE again, Norwegian Cruise Line (NCLH) missed revenue and profit estimates last quarter.

Its total revenue was US$2.13 billion, down 3% year-over-year and below LSEG estimates of $2.15 billion.

Adjusted earnings per share were US$0.07, less than estimates of $0.09. Its adjusted EBITDA fell by 2% to $453 million, but remained above guidance.

“Looking ahead, our proven track record of long-term Net Yield growth, strong cost control, continued record guest satisfaction scores and guest repeat rates give us confidence about our future," said CEO Harry Sommer. "Thus, as we remain mindful of the evolving macroeconomic environment and despite recent volatility, we are maintaining our full year 2025 Adjusted EBITDA and Adjusted EPS guidance.”

Its full-year adjusted EBITDA guidance is approximately US$2.72 billion. Norwegian Cruise Line updated its 2025 net yield guidance to expect 2-3% growth, down from the previously projected 3%.

3:59 pm (AEST):

At the NASDAQ, KLA (KLAC) saw revenue grow by 30% year-over-year to US$3.06 billion, above the midpoint of its guidance range.

Its GAAP diluted earnings per share were US$8.16, also above its guidance midpoint. Non-GAAP gross margin was 63%.

KLA's Semiconductor Process Control segment, its largest, saw revenue rise to US$2.74 billion, up 31% year-over-year. Its Specialty Semiconductor Process and PCB & Component Inspection segments posted revenue growth of $20% and 26% respectively.

Taiwan and China represented the majority of its revenue by region, at 32% for Taiwan and 26% for China. Korea, Japan, and North America were its next-largest markets by revenue.

“KLA's March quarter results were above the midpoint of our guidance ranges and established a strong start to the calendar year. Though global trade dynamics are driving uncertainty across the global economy, to date, we have received no indications of demand changes from our customers for calendar year 2025,” said CEO Rick Wallace.

KLA's guidance for the next quarter projects revenue of US$3.075 billion, plus or minus $150 million, and GAAP diluted earnings per share of $8.28, plus or minus $0.78.

4:27 pm (AEST):

At the LSE, GSK (GSK) reported sales growth of 4% on a constant exchange rate basis to UK£7.5 billion.

Specialty Medicines, its largest segment, saw sales rise by 17% to UK£2.9 billion. Vaccines sales declined by 6% to £2.1 billion, while General Medicines sales remained stable at £2.5 billion.

Its core earnings per share were UK£0.45, up 5%.

The company expects five new products will be approved by U.S. regulators in 2025, following the approval of meningitis vaccine Penmenvy and urinary tract infection medication Blujepa.

"GSK continues to make strong progress, demonstrating the quality, strength and resilience of our portfolio. Specialty Medicines, our largest business, delivered strong sales contributions in the quarter and R&D progress continued, with two of the five FDA product approvals expected this year now secured, and the acquisition of a promising new oncology asset," said CEO Emma Walmsley.

The company completed its acquisition of biopharmaceutical company IDRx, which specialises in treatments for gastrointestinal cancers and tumours, last quarter.

GSK affirmed its 2025 full-year guidance, projecting turnover growth of 3-5% and core earnings per share growth of 6-8%.

That's all from me today. Thank you for joining us!