Re-live our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

-----------------------------------------------------------------------------------------------------------------------------------------------------

Summary

- Apple income and revenue up, but could be threatened by tariffs

- Eli Lilly, Airbnb, Mastercard, Motorola, CVS, EOG, Amgen surge past estimates

- Amazon beats estimates, issues light guidance amid tariff pressures

- Atlassian reports net loss, predicts slowing growth

- McDonald's, Shell income slumps

- Mitsubishi income drops, projects more declines ahead

_______________________________________________________________________________________

8:47 am (AEST):

Good morning! Harlan Ockey here with you today.

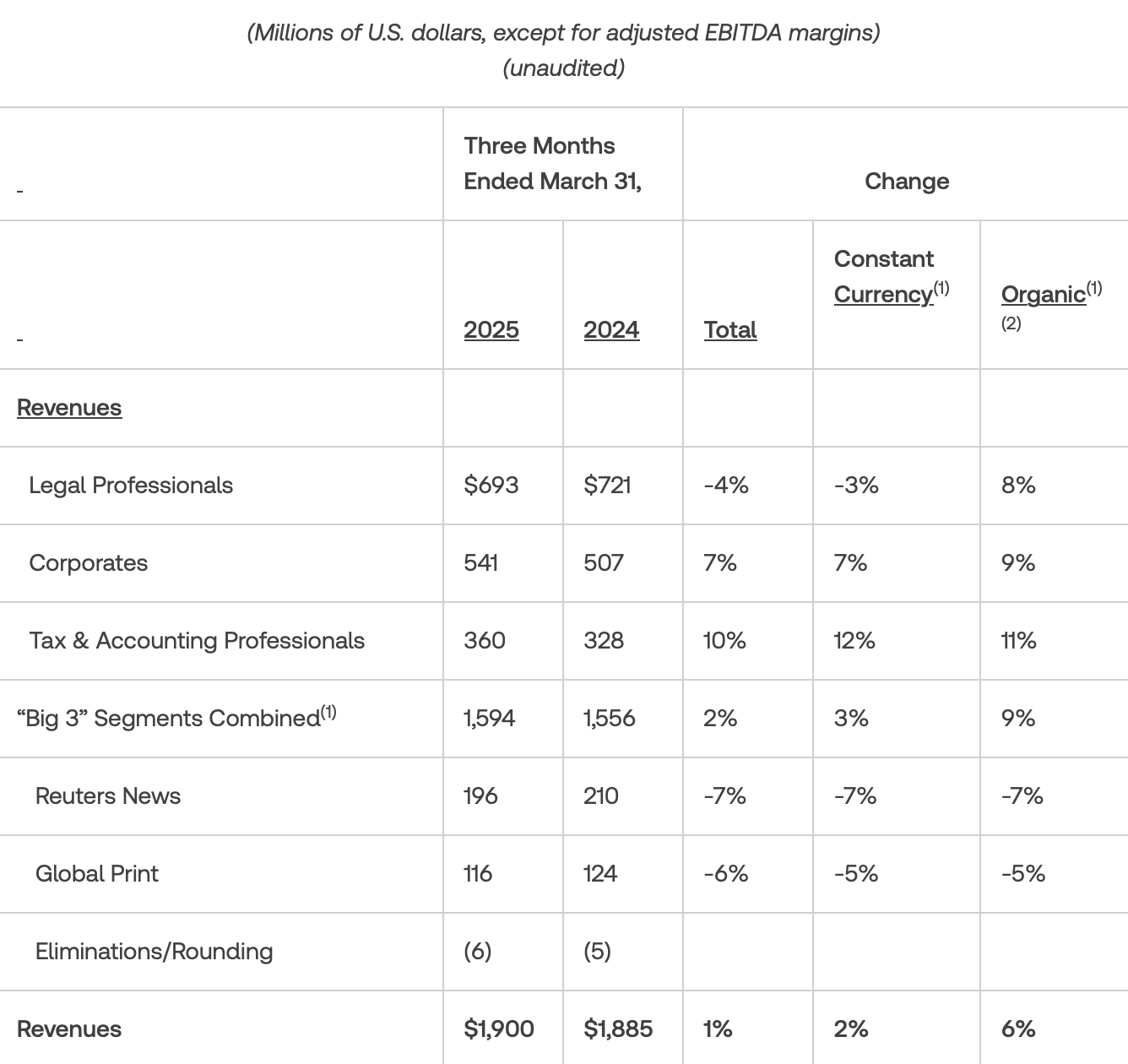

Starting off at the NASDAQ, Thomson Reuters (TRI) saw revenue and earnings per share both rise by 1% year-over-year.

Revenue last quarter was US$1.9 billion. Adjusted earnings per share were $1.12, above Q1 2024's $1.11 and surpassing Zacks estimates of $1.06.

Its Legal Professionals segment, the company's largest, reported revenue of US$693 million. This represents a 3% decline on a constant currency basis, and an 8% increase in organic growth.

Corporates and Tax & Accounting Professionals, its next-largest divisions, saw organic revenue growth of 9% and 11% respectively. Reuters News' revenue fell by 7% on both a constant currency and organic basis.

“We have delivered an encouraging start to 2025, underscored by a good financial performance and reaffirmed outlook, building on the momentum of the past year,” said CEO Steve Hasker. “We continue to invest heavily in innovation, and believe we are well positioned to help our customers harness the potential of content-driven technology and AI to navigate an increasingly complex and changing world.”

Thomson Reuters reaffirmed its full-year 2025 outlook, and projects second-quarter organic revenue growth of around 7%.

Read Andrew Banks' full report here.

9:06 am (AEST):

At the NYSE, Eli Lilly (LLY) beat estimates on both revenue and earnings per share.

Revenue was US$12.73 billion, rising 45% year-over-year and besting LSEG estimates of $12.67 billion. Non-U.S. revenue also rose by 49%, largely driven by sales of diabetes medication Mounjaro and weight loss treatment Zepbound.

Adjusted earnings per share were US$3.34, up 29% and above estimates of $3.02.

Sales of Mounjaro rose 113% to US$3.84 billion. Zepbound's sales increased by more than four times to reach $2.31 billion.

"Lilly had a solid start to the year, with 45% year-over-year revenue growth driven by strong sales of Mounjaro and Zepbound," said CEO David Ricks. "Our pipeline continued to deliver across key therapeutic areas, with product approvals in oncology and immunology, and the exciting success of our oral incretin, orforglipron, in the first of seven late-stage studies in diabetes and obesity.

"To support global demand for our newest medicines, we're accelerating our manufacturing investments, as underscored by our recent announcement to build four new facilities."

The company reaffirmed its 2025 revenue guidance of US$58-61 billion. This projection accounts for current U.S. tariff rates, the company said, but does not include additional proposed tariffs on pharmaceuticals.

Oliver Gray has the full report.

9:18 am (AEST):

Back to the NASDAQ, Apple (AAPL) estimated new United States tariffs will add US$900 million to third quarter costs, as it reported a 4.8% increase in net income for the second quarter of the 2025 financial year.

CEO Tim Cook said Apple saw "limited impact" from tariffs in Q2 as the company shifted supply chains and inventory, but for Q3 "assuming the current global tariff rates, policies and applications do not change for the balance of the quarter and no new tariffs are added, we estimate the impact to add $900 million to our cost.”

Cook was speaking on an earnings call after Apple reported net income of US$24.780 billion for the quarter ended 29 March 2025, compared with $23.636 billion in the previous corresponding period.

The world’s largest company, whose products include the iPhone, Mac, iPad, Apple Watch and AirPods, said diluted earnings per share rose 8% to $1.65 on revenue which grew 5% to $95.4 billion.

The board of directors declared a cash dividend of 26 cents per share, up 4% on the previous corresponding period.

“Today Apple is reporting strong quarterly results, including double-digit growth in Services,” CEO Tim Cook said in a press release.

The results were released after the close of trading in Apple shares, which had ended 82 cents (0.39%) higher at US$231.32 on Thursday, capitalising the company at $3.20 trillion. Although the results were better than expected, the share price dipped $8.57 (4.02%) to $204.75 in after-hours trading as investors focused on the tariff impact.

Thank you to Garry West for the write-up — read his full story here.

9:36 am (AEST):

Staying with the NASDAQ, Airbnb (ABNB) reported revenue of US$2.27 billion, rising 6% year-over-year and passing estimates of $2.26 billion.

Diluted earnings per share were US$0.24, above estimates of $0.23. Its net income was $154 million, lower than Q1 2024's $264 million.

Users booked 143.1 million nights and experiences through Airbnb, up 8% year-over-year. All regions saw positive growth in nights and experiences, with Latin America posting the largest percentage increase.

The company also said an updated app would roll out from 13 May, part of an effort to expand beyond short-term housing rentals.

"To expand beyond homes, we needed an app that could support entirely new offerings. So we spent the past few years rebuilding the Airbnb app on a new technology stack. With this new platform, we can innovate faster and introduce a range of new businesses in the years ahead."

Andrew Banks has the full story.

9:53 am (AEST):

And still at the NASDAQ, Atlassian (TEAM) saw revenue rise by 14% to US$1.19 billion last quarter.

The company posted a net loss of US$70.8 million, compared with net income of $12.8 million one year ago. Its operating loss was $12.5 million, with an income of $17.8 million seen one year ago.

Cloud revenue grew by 25% year-over-year to US$880.4 million, with its Data Center division's revenue rising by around $24 million to $388.5 million.

It reached 50,000 customers with more than US$10,000 in Cloud annualised recurring revenue, ending the quarter with 50,715.

Atlassian's outlook for next quarter includes total revenue of US$1.349-1.359 billion, with year-over-year cloud revenue growth of around 23%.

See Cameron Drummond's full article here.

10:15 am (AEST):

On the NASDAQ again, Amazon (AMZN) exceeded estimates on both earnings per share and revenue, but issued lighter-than-expected guidance amid the impact of U.S. tariffs.

Its revenue was US$155.7 billion, passing Bloomberg estimates of $155.1 billion. Earnings per share were $1.59, above estimates of $1.36.

Net income increased to US$17.1 billion, rising by almost $7 billion year-over-year. Operating income was $18.4 billion, compared with $15.3 billion one year ago.

While UBS analysts predict at least 50% of products sold on Amazon would be subject to U.S. tariffs, Amazon CEO Andy Jassy said he remains optimistic about the company's future. "Given our really broad selection, low pricing and speedy delivery, we have emerged from these uncertain eras with more relative market segment share than we started and better set up for the future," said Jassy on an earnings call. "I'm optimistic this could happen again."

Amazon had reportedly considered publicly listing tariff-related import charges on its products, with the company later saying this would have only applied to its Haul subsidiary. However, U.S. President Donald Trump called Amazon founder Jeff Bezos to discourage the move, the White House said this week.

The company also said that it plans to expand its rural delivery network in the U.S., aiming to triple the network's size by the end of 2026.

Amazon has projected its operating income next quarter will be US$13-17.5 billion, below analysts' estimates of $17.8 billion.

Read Cameron Drummond's full report here.

11:05 am (AEST):

Turning to the NYSE, Mastercard (MA) has bested estimates with double-digit percentage growth in revenue.

Revenue was US$7.25 billion, rising 17% year-over-year on a currency-neutral basis and passing Zacks estimates of $7.12 billion. Payment network net revenue grew by 16%, largely driven by 9% gross dollar volume growth and 15% cross-border volume growth.

Adjusted diluted earnings per share were US$3.73, up 16% on a currency-neutral basis. This is above estimates of $3.57.

“Our steady drumbeat of innovation continues," said CEO Michael Miebach. "We launched Mastercard Agent Pay, our new Agentic Payments Program, and will work with companies like Microsoft and OpenAI. And we announced a strategic partnership with Corpay to deliver an enhanced suite of corporate cross-border payment solutions.”

Mastercard Agent Pay, announced earlier this week, will integrate Mastercard payment infrastructure into artificial intelligence agents and chatbots. Agent Pay is produced in collaboration with Microsoft's Azure and Copilot AI services.

Mastercard upgraded its 2025 net revenue guidance to expect growth percentages in the low teens, above its previous projections of a low double-digit increase. Rival Visa also surpassed estimates this week, but reaffirmed its full-year outlook.

11:30 am (AEST):

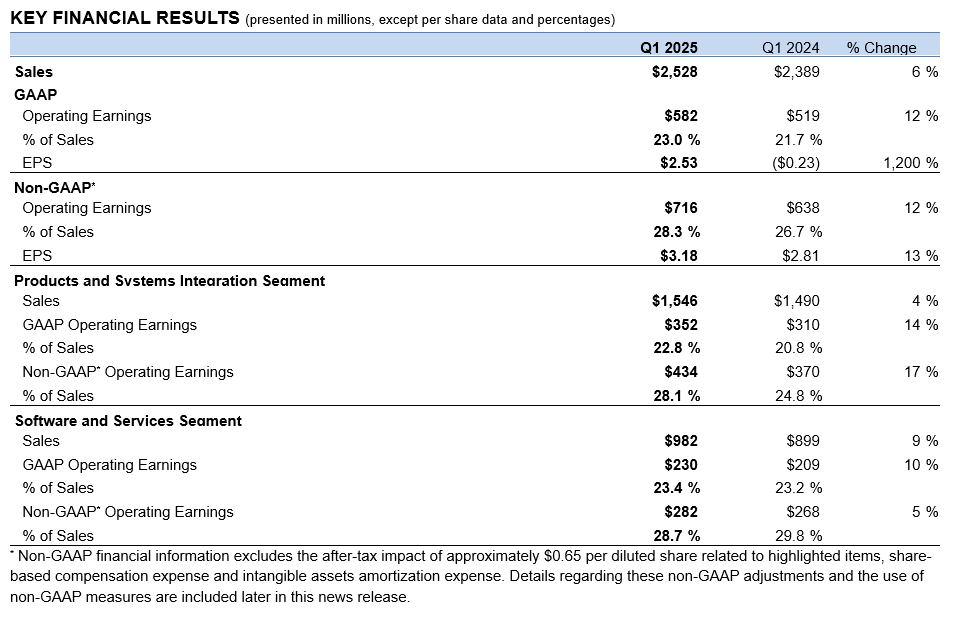

Staying on the NYSE, Motorola Solutions (MSI) saw revenue rise by 6% year-over-year to US$2.5 billion, beating Zacks estimates by 0.53%.

Its Products and Systems Integration division posted a 4% increase in revenue, reaching US$1.55 billion. Software and Services revenue was up 9% to $982 million.

Non-GAAP earnings per share were US$3.18, up 13% and above estimates of $3.01.

The company's overall backlog at the end of the quarter was US$14.1 billion, falling 2% year-over-year. While Products and Systems Integration's backlog fell by 22%, Software and Services' backlog rose by 8%.

"Q1 was an excellent start to the year, with record first-quarter sales, operating earnings and cash flow,” said CEO Greg Brown. “Our customers are continuing to prioritize investments in safety and security, which is driving our continued expectations for strong revenue, earnings and cash flow growth for the year.”

The company's guidance for next quarter projects revenue growth of around 4% year-over-year, and non-GAAP earnings per share of US$3.32-3.37. Motorola affirmed its previous full-year outlook, which included revenue growth of 5.5% and non-GAAP earnings per share of $14.64-14.74.

Motorola expects increased costs for materials and components this year due to U.S. tariffs, but predicts it will “substantially mitigate” their impacts.

11:47 am (AEST):

Frankie Reid back at the helm for the next hour!

Another one for NYSE, CVS Health (CVS) beat Wall Street estimates with their first quarter earnings report.

Alongside the report CVS also adjusted their full year guidance for 2025, raising the earnings per share expectations to a range of $6 to $6.20, up from $5.75 to $6.

Revenue landed at US$94.6 billion, against estimates of $93.6 billion, marking an increase of 7.0% compared to the prior year.

On Thursday when the report was released, the company's stock was up nearly 7% in premarket trading.

12:10 am (AEST):

EOG Resources (NYSE: EOG) came out ahead of estimates with quarterly earnings of $2.87 per share, beating the Zacks Consensus Estimate of $2.74 per share and comparing to earnings of $2.82 per share at the same time last year.

Over the last four quarters, the oil and gas company has exceeded EPS estimates four times.

EOG also posted revenues of US$5.67 billion for the quarter compared to $6.12 billion the same time last year, falling short of the Zacks Consensus Estimate by 2.75% and marking the fourth quarter of missing estimates.

EOG Resources' shares have declined approximately 10% since the beginning of the year.

12:25 pm (AEST):

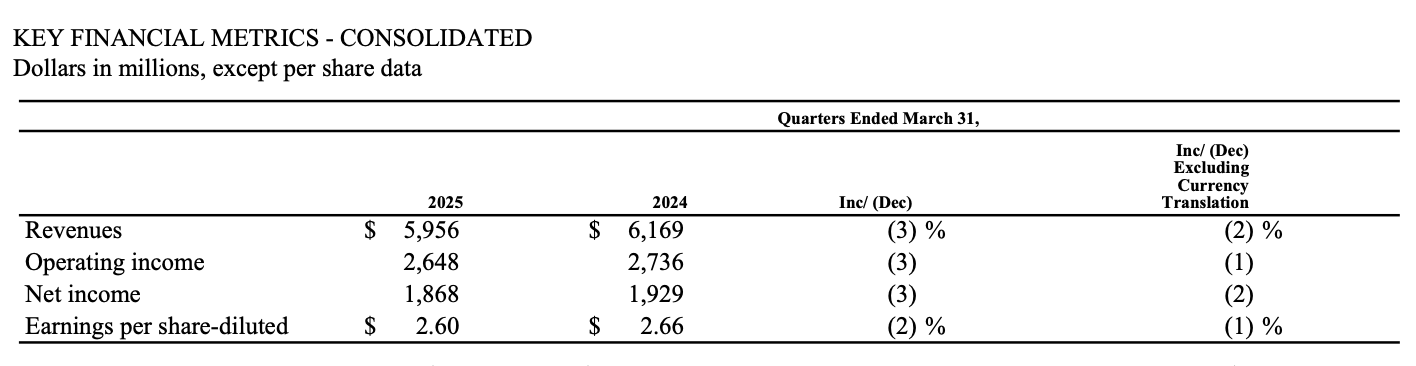

McDonald’s (NYSE: MCD) faced some of its worst conditions since 2020 in its latest earnings report for the quarter.

U.S. same-store sales fell by 3.6% during Q1, marking the worst fall in the fast food giant's home market during the second quarter of 2020 at the peak of the COVID pandemic, which saw a steep 8.7% drop.

Earnings per share narrowly beat estimates, coming in at $2.67 adjusted compared to the $2.66 expected.

Revenue fell short of predictions however, landing at US$5.96 billion vs. $6.09 billion expected.

Internationally the report noted mixed results across International Operated Markets, largely due to negative comparable sales in the U.K. and in International Developmental Licensed Markets, Japan and the Middle East pushed positive comparable sales.

"McDonald's has a 70-year legacy of innovation, leadership, and proven agility, all of which give us confidence in our ability to navigate even the toughest of market conditions and gain market share,” said CEO Chris Kempczinski on the company’s earnings conference call.

12:59 pm (AEST):

Thanks, Frankie! Harlan Ockey back with you for the afternoon.

Turning to the ASX, Corporate Travel Management (CTD) has revised its FY2025 outlook down by approximately 4% amid tariff turbulence.

The company's EBITDA will likely be around A$30 million lower than previously projected in its first half earnings in February, it said.

“In rest of World (ROW) ex Europe, broad economic and tariff uncertainty in North America and Asia has led to reductions in client activity, resulting in slower growth than expected during what is traditionally the busiest period of the year,” said Corporate Travel Management.

Its total transaction value in the 2025 fiscal year has so far surpassed A$1.6 billion, above its target of $1 billion, with around half generated in Europe. The company's client retention rate is currently 97%.

Read Garry West's full story here.

1:26 pm (AEST):

At the NASDAQ, Amgen (AMGN) beat estimates on revenue and earnings per share, with product sales surging.

Total revenue was US$8.15 billion, up 9% year-over-year and passing estimates of $8.05 billion. Non-GAAP earnings per share rose 24% to $4.90, above estimates of $4.25.

Amgen's product sales grew by 11%, with U.S. sales up 14%. Volume growth last quarter was 14%.

Its three main General Medicine treatments, high cholesterol treatment Repatha and post-menopausal osteoporosis drugs Evenity and Prolia, all saw double digit sales growth. Rare Disease leader Tepezza, used for thyroid eye disease, saw sales fall by 10%, while inflammation leader Tezspire and Oncology leader Blincyto posted 65% and 52% sales growth respectively.

"Demand for our products was strong globally in the first quarter. Ongoing new product launches and successful Phase 3 trial results for several products make us feel confident in our long-term growth prospects," said CEO Robert Bradway.

The company's full-year guidance projects total revenue of US$34.3-35.7 billion, with non-GAAP earnings per share of $20.00-21.20.

1:55 pm (AEST):

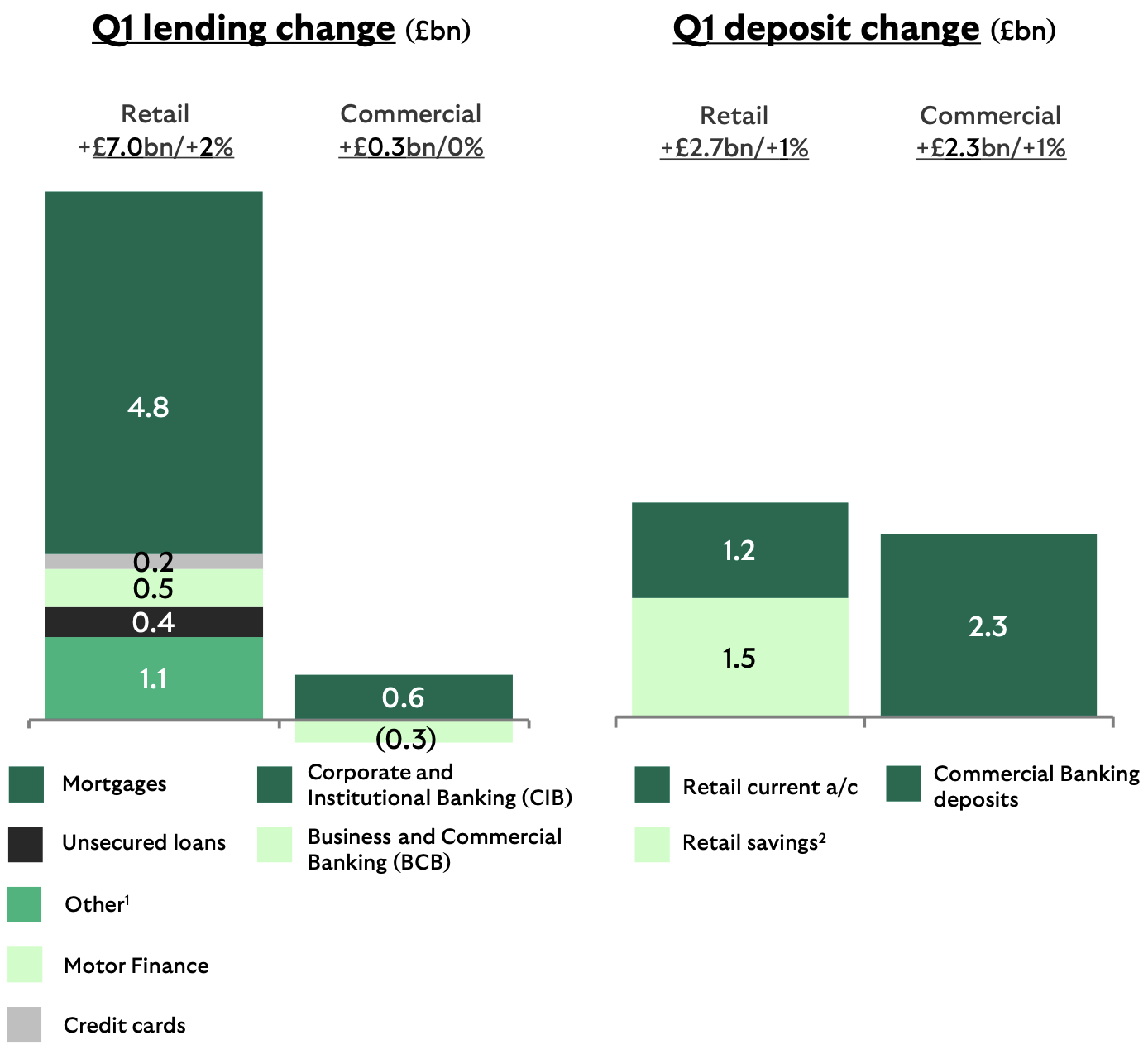

Moving to the LSE, Lloyds Banking Group (LYG) reported a slump in underlying profit, though net income grew.

Net income was UK£4.39 billion last quarter, rising 4% year-over-year, while net interest income was up 3% to £3.29 billion. Underlying profit dropped by 13% to £1.53 billion.

Earnings per share were stable at UK£0.017.

Lending grew by 4% year-over-year to UK£466.2 billion, while deposits were up 4% to £487.7 billion. Its return on tangible equity was 12.6% last quarter, and the company projects around 13.5% return on tangible equity for the remainder of 2025.

Lloyds reaffirmed its previous full-year outlook, which predicts net interest income of UK£13.5 billion. The company has currently allocated £100 million to accommodate the impact of U.S. tariffs.

2:17 pm (AEST):

At the NASDAQ, Linde (LIN) posted mixed results, with earnings per share beating estimates while sales remained flat.

Sales were US$8.11 billion, similar to Q1 2024. This is below Zacks estimates of $8.26 billion.

While sales in the Americas were up 3% year-over-year to US$3.67 billion, Asia Pacific and Europe, Middle East & Africa sales both declined by 3%.

Adjusted earnings per share were US$3.95, rising 5% year-over-year and passing estimates of $3.93.

“Looking forward, while we remain cautious on the economic outlook, I’m confident the Linde business model can continue to create shareholder value in any environment," said CEO Rajiv Lamba. The company projects adjusted diluted earnings per share of US$3.95-4.05 next quarter, with adjusted diluted earnings per share of $16.20-16.50 across 2025.

2:47 pm (AEST):

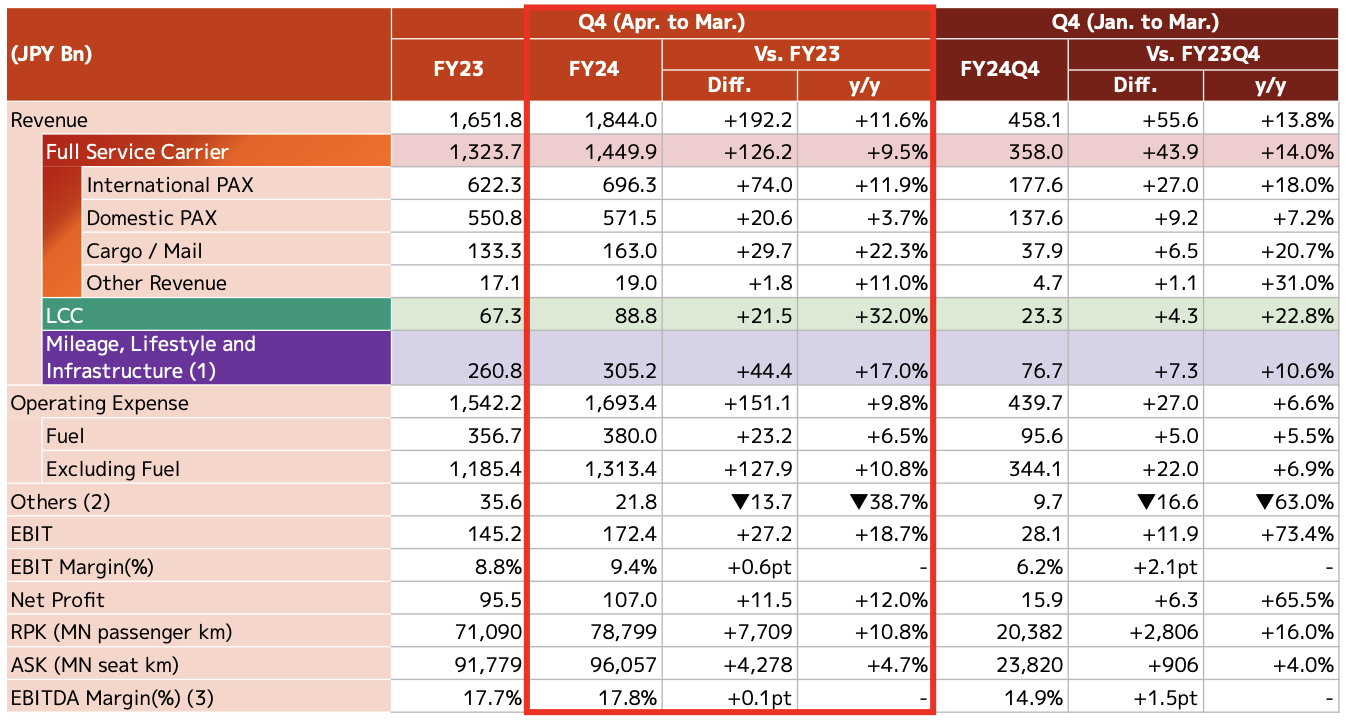

Now over to the TYO, Japan Airlines (9201) saw revenue grow to JP¥458.1 billion last quarter, up 13.8% year-over-year.

Its EBIT increased to JP¥28.1 billion, compared with the prior year's ¥16.2 billion. Net profit was ¥15.9 billion, up 65.5%.

International passenger revenue grew by 18% to JP¥177.6 billion, while domestic passengers rose by 7.2% to ¥137.6 billion. The airline carried 2.03 million international passengers last quarter, up 21.1%, and 9.23 million domestic passengers, up 9%.

Japan has experienced a major surge in tourism in recent years, with a record 36.8 million international visitors recorded in 2024.

Its full-year forecast for the next fiscal year includes international passenger revenue of JP¥715.0 billion across 7.96 million passengers. Expected domestic passenger revenue is ¥583 billion, with 36.37 million passengers.

2:55 pm (AEST):

In an ASX update, Block (XYZ) has seen CHESS Depositary Interests drop by 33%, after the company missed revenue and earnings per share estimates. Block also downgraded its guidance for the remainder of 2025.

Fellow payment company Zip Co (ZIP) also saw its share price fall by 7% in afternoon trading, despite upgrading its full-year guidance to include cash earnings of at least A$153 million.

Read Mark Story's full article here.

3:17 pm (AEST):

At the NYSE, Stryker (SYK) reported year-over-year reported net sales growth of 11.9%, reaching US$5.9 billion. Organic sales growth rose by 10.1%.

Reported earnings per share dropped by 17.6% to US$1.69, though adjusted earnings per share were up 13.6% to $2.84.

Its MedSurg and Neutrotechnology division saw net sales of US$3.5 billion, up 13.4%. Orthopaedics sales were $2.4 billion, rising 9.7%.

“Our 2024 momentum continued into the first quarter as we delivered double-digit organic sales growth and continued to expand adjusted operating margins,” said CEO Kevin Lobo. “We remain confident in our sales and earnings power for 2025, fueled by the strength of procedural volumes, demand for our capital products and our commercial execution.”

The company has raised its full-year guidance for organic net sales growth, and now projects a 8.5-9.5% increase. It predicts adjusted earnings per share will be US$13.20-13.45, lower than previous guidance. This is due to dilutive effects from its acquisition of Inari Medical, as well as offsetting an expected $200 million impact from U.S. tariffs.

3:57 pm (AEST):

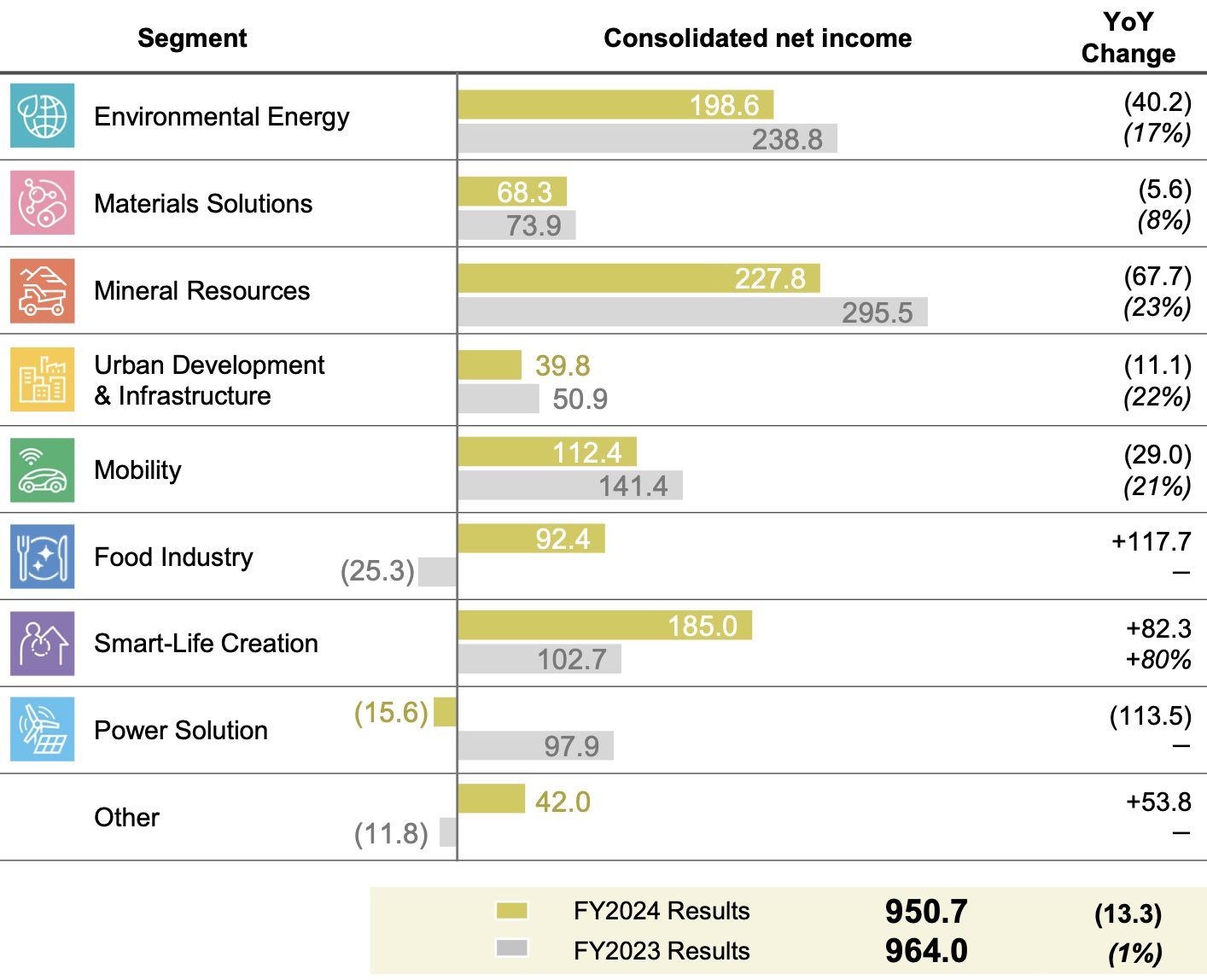

Back to the TYO, Mitsubishi Corporation (8058) posted JP¥18.62 trillion in revenue across the fiscal year ending March 2025, down ¥950 billion.

Gross profit last year was JP¥1.84 trillion, falling by ¥523.3 billion. Net income was ¥950.71 billion, down 1.4%, and diluted earnings per share rose by ¥13.43 to ¥235.80.

The company said the decline in revenue and profit was due to a drop in sales volume, as well as convenience store Lawson's transition into an equity method affiliate.

Mineral Resources, its largest segment by net profit, saw profits slide by JP¥67.7 billion to ¥227.8 billion, after its divestiture of two Australian steelmaking coal mines.

Food Industry and Smart-Life Creation were its only divisions to report an increase in net profit last fiscal year, growing by JP¥117.7 billion and ¥82.3 billion respectively.

Its guidance for the fiscal year ending March 2026 includes JP¥700 billion in net income, and projects Urban Development & Infrastructure and Power Solution will be its only segments to post net income growth.

4:24 pm (AEST):

At the LSE, Shell plc (SHEL) has reported a year-over-year decline in net income and production.

Net income was US$4.78 billion last quarter, below Q1 2024's $7.36 billion, though well above Q4 2024's 928 million. Adjusted earnings per share were $0.92, falling from $1.14 year-over-year.

According to Shell, the increase in income over Q4 is due to lower exploration well write-offs and lower operating expenses. Its net income also includes a US$500 million charge under the U.K.'s Energy Profits Levy.

Oil and gas production for sale was 2.84 million barrels of oil equivalent per day, down from 2.91 million year-over-year.

Its revenue also fell to US$69.23 billion, below Q1 2024's $72.48 billion and missing Zacks estimates of $79.9 billion. While its Integrated Gas, Corporate, and Renewables & Energy Solutions segments posted year-over-year revenue growth last quarter, Upstream, Marketing, and Chemicals & Products all saw revenue decline.

"Shell delivered another solid set of results in the first quarter of 2025. We further strengthened our leading LNG business by completing the acquisition of Pavilion Energy, and high-graded our portfolio with the completion of the Nigeria onshore and the Singapore Energy and Chemicals Park divestments," said CEO Wael Sawan.

The company said in March that it aimed to increase its natural gas sales by at least 4% each year until 2030, following a significant full-year drop in profit across 2024.

4:30 pm (AEST):

Looking ahead, Exxon Mobil (NYSE: XOM) and Chevron (NYSE: CVX) are expected to report their results tonight (AEST).

Exxon Mobil is projected to post earnings per share of US$1.74, per Zacks estimates. This would be a significant drop from the earnings per share of $2.06 seen in Q1 2024.

Chevron's earnings per share are estimated to be US$2.15, which would represent a 27% year-over-year decline.

Other major companies set to report in the coming hours include Cigna (NYSE: CI), Apollo Global Management (NYSE: APO), and DuPont de Nemours (NYSE: DD).

That's all from me today. Thank you for joining us this week!