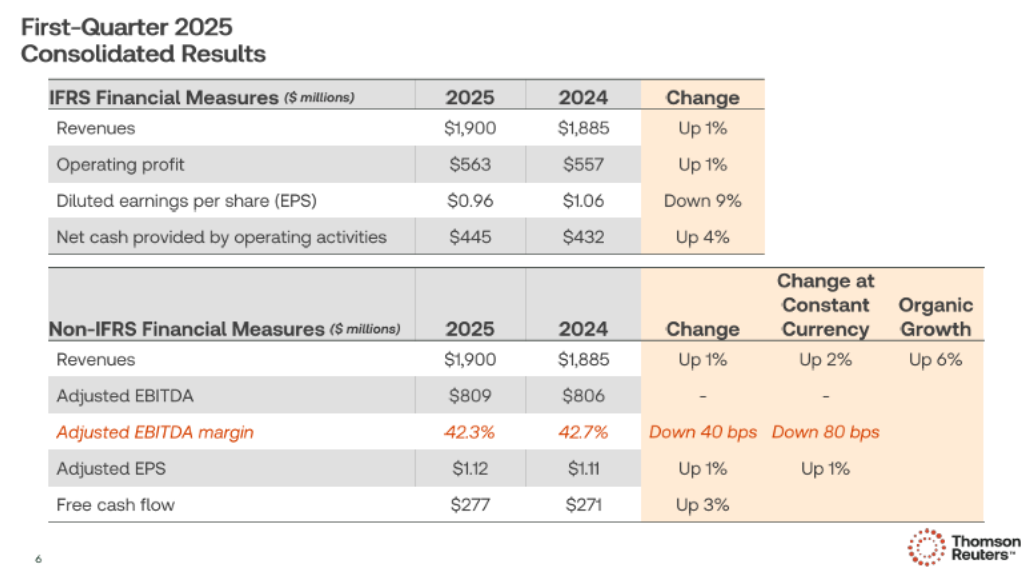

Canadian multinational Thomson Reuters today (Friday AEST) released its Q1 2025 earnings report ended March 31, 2025, which showed 6% organic revenue growth and 9% recurring revenue gains.

“We have delivered an encouraging start to 2025, underscored by a good financial performance and reaffirmed outlook, building on the momentum of the past year,” said Steve Hasker, President and CEO of Thomson Reuters. “We continue to invest heavily in innovation, and believe we are well positioned to help our customers harness the potential of content-driven technology and AI to navigate an increasingly complex and changing world.”

Hasker added, “As we look ahead, we remain committed to taking a balanced capital allocation approach, focusing on delivering sustained value creation through a long-term investment strategy.”

Thomson Reuters shares have been upgraded to an Overweight rating by Barclays analyst Manav Patnaik. The company's adjusted EPS of US$1.12 beat the analyst consensus estimate of $0.87. On average, analysts expected earnings per share of US$1.01, according to data from the London Stock Exchange Group.

- Strong Q1 growth, mixed revenue trends

Legal, corporate, and tax segments soared, while Reuters News experienced a 7% decline due to tough AI licensing comps. Adjusted EBITDA hit US$809 million, with a slight margin dip. - 2025 outlook stays on track

The company reaffirmed 7%-7.5% full-year organic growth, expecting the Big 3 segments to expand 9%. EBITDA margins are set to climb 75 bps to 39%, while free cash flow is projected at $1.9 billion. - AI-powered products fuel expansion

Double-digit growth products now make up 25% of revenue, up from 11% in 2019. AI innovations like CoCounsel, HighQ, Practical Law, and Indirect Tax tools are accelerating adoption. - Generative AI investments ramp up

The company poured $200M into AI development in 2024, launching CoCounsel Tax Audit Accounting and other AI-driven features. Expect continued focus on expert-guided workflows in 2025. - Recurring revenue insulates against uncertainty

Over 80% of revenue is recurring, shielding the business from macro volatility. Transactional revenue — 12% of the mix — remains predictable thanks to tax and audit cycles. - Government growth and AI integration

The Government segment grew 9%, fuelled by legal and risk products like Westlaw and CLEAR. Thomson Reuters sees AI-enhanced tools driving future efficiency and security improvements. - Acquisitions, dividends, and capital moves

The $600M SafeSend acquisition is smoothly integrating, strengthening tax workflows. A 10% dividend boost to $2.38 per share and a $1B bond paydown highlight disciplined capital management. - Reuters News faces AI revenue drop

Reuters News reported a 7% decline, impacted by $25M in AI licensing revenue in Q1 2024 that won’t repeat in 2025. The company remains open to future AI monetisation strategies.

At the time of writing, Thomson Reuters Corp's (NASDAQ: TRI) stock price was US$185.74, −$0.24 (0.13%), with a market cap of approximately $83.64 billion.

Related content