Young Australians are relying more on parents and grandparents to save money amid cost of living pressures.

Compare the Market found that one-in-six parents and grandparents helped purchase clothes, toys and essentials for their children and grandchildren in the past year.

The research also found 93.3% of parents and grandparents admit to supporting younger Australians, a sharp increase from 73.3% last year.

Compare the Market economic director, David Koch said the intergenerational wealth transfer is becoming a ‘third income’ to help younger Australians.

“Baby Boomers are often blamed by fuelling inflation with their spending. After all, we haven’t faced the same intense cost-of-living pressures that have made the ‘Great Australian Dream’ seemingly feel impossible today,” he said.

“But in fact, 93% of parents and grandparents now support their younger generations in some way to combat the rising cost of bills, groceries and other essentials – a 20% increase compared to last year.”

However, Koch also acknowledged that intergenerational wealth is a privilege that not everyone has access to.

“Intergenerational wealth is passed down to the lucky among us, we could see a widening gap between the haves and the have nots,” he said.

“That’s why it’s so important for governments to funnel the lion’s share of cost-of-living support to average Aussies that really need a leg up.”

Many also gift money (14.7%) and provide free care (13.7%). The most common way older Australians help the younger generation is through cooking for them (17.6%).

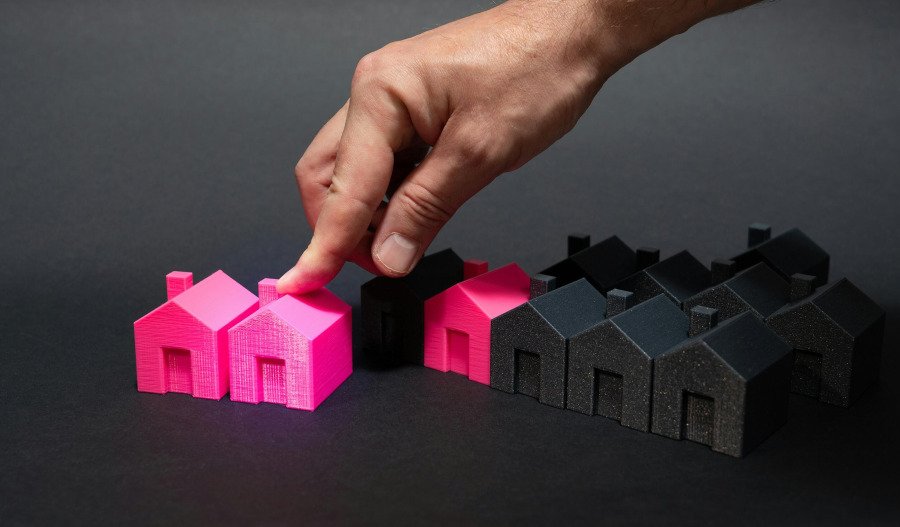

Only 3.7% of parents and grandparents reported contributing to property purchase, making it the least common way to help financially.

Despite this, another Compare the Market survey found that around a quarter of young Australians felt they wouldn’t be able to afford a house with the help of their parents or grandparents, while 42.3% of renters do not plan on buying a house altogether.