The financial services sector is on the brink of a major transformation, with private capital, active ETFs and tokenisation expected to drive significant disruption over the next 3-5 years, new analysis shows.

According to Deloitte’s 2025 Financial Services Industry Predictions report, one of the most notable trends is the rapid expansion of private capital investment among retail investors. Currently standing at US$2.4 trillion by 2030.

This growth, Deloitte says, will be fuelled by broader product availability and regulatory shifts that lower barriers to entry for individual investors.

While the private assets today are primarily held in interval funds managed by specialised firms, traditional investment managers are increasingly adopting familiar vehicles like mutual funds and ETFs to meet retail demand.

That includes BondBloxx Investment Management and Virtus Investment Partners, which both rolled out actively managed private credit ETFs in December last year.

State Street Global Advisors (SSGA) launched its own private credit ETF in February this year, offering exposure to both the public and private debt markets.

Deloitte says private capital allocations within mutual funds and ETFs could reach 15% of ‘illiquid investments’, to become a key driver of retail participation in private markets over the next five years.

The active ETF market is also set for explosive growth, with U.S. assets forecast to climb from US$856 billion in 2024 to US$11 trillion by 2035 - a whopping 13X increase.

This shift will be propelled by institutional and retail investors migrating from traditional mutual funds to active ETFs in search of greater flexibility and efficiency.

Token investment

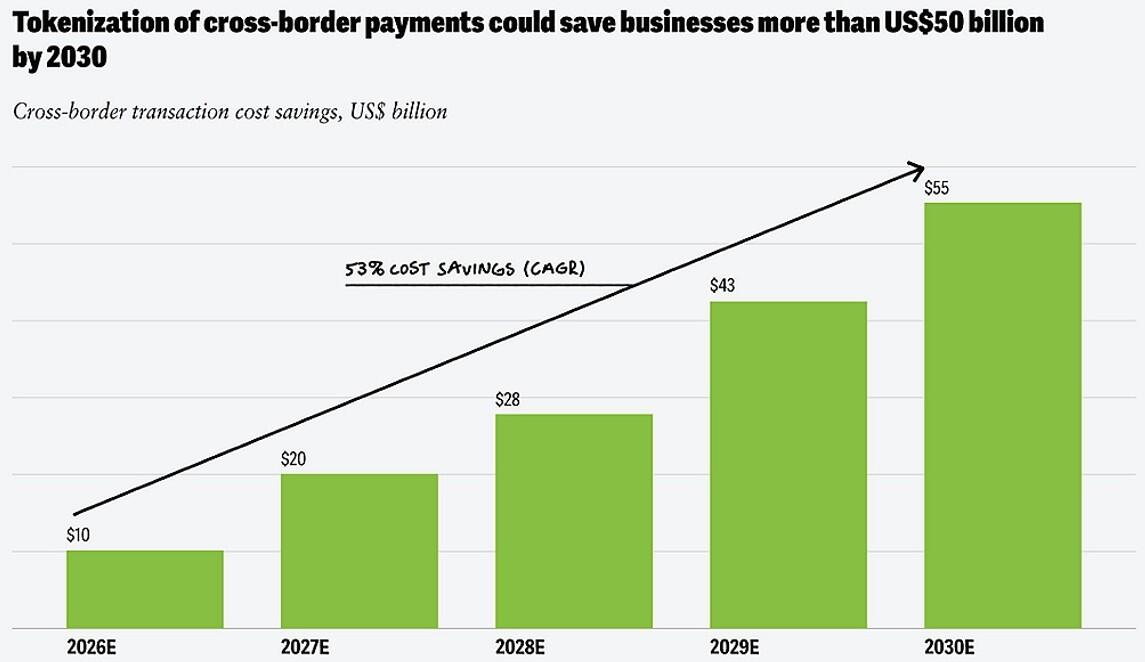

Meanwhile, tokenisation is emerging as a game-changer for cross-border payments.

Deloitte estimates that by 2030, 25% of large-value international transfers will be settled on tokenised currency platforms, slashing corporate transaction costs by 12.5% and saving businesses >US$50 billion per annum.

In the crypto space, ‘stablecoins’ are leading this charge, with regulatory tailwinds - including an executive order from Trump encouraging dollar-backed stablecoin development - likely to accelerate adoption among financial institutions.

“Stablecoins may offer a clear path forward for wholesale cross-border payments in the near term,” Deloitte said.

"President Trump has also called on federal agencies to spur the growth of "lawful and legitimate dollar-backed stablecoins" in a January executive order.

“These measures could foster widespread acceptance of stablecoins and accelerate banks' adoption of stablecoin-based payment solutions.”