With inflation [seemingly] under control, and the likelihood of at least another two Reserve Bank (RBA) rate cuts this year - taking the cash rate to 3.35% by the end of 2025 – ASX-listed real estate trusts (A-REITs) look well positioned to benefit.

After all, a fall in both debt costs and the risk-free rate should positively impact the valuations of A-REIT’s asset values.

With that in mind, Azzet provides investors with a two-part feature on the A-REITs sector.

While part one provides a timely overview of the sector and some insights into how it works, part two will drill down into individual stocks.

Part one: What are A-REITs

A-REITs are investment vehicles that let you buy an interest in a diversified and professionally managed portfolio of real estate assets listed on the ASX.

Two key benefits of buying into A-REITs is that they give you A) access to high-grade domestic and offshore real estate without requiring you to invest large amounts of capital and B) the ability to enter or exit any time you want (aka great liquidity).

In broad terms, there are two types of A-REITs: those that are externally managed (aka passive) and those that are stapled (aka active).

While there are certain tax benefits that come from being a [property] trust, there are strings attached. For example, to remain a trust there is a requirement for income earned during that year to be distributed [in the same year] to unitholders.

In simple terms, here’s how they work:

A pure A-REIT buys a property and gets tenants in to pay the rent. After all outgoings are paid, what’s left is distributed annually to unitholders equally.

Let’s look at what differentiates passive from staple A-REITs.

Firstly, when you buy a stapled security like Mirvac (ASX: MGR) or Stockland (ASX: SGP) what you’re actually buying is one unit in a trust and one share in a company. These are stapled together which means they can’t be divided.

While the trust has to distribute profit in the year it’s earned, that’s not the case with the company structure, which as an operating entity is entitled to retain as much of its after-tax profits as it wants to continue developing the business or put it elsewhere.

So with a stapled security investors get the best of both worlds.

When they announce a payment to unitholders, it’s typically a combination of an amount from the trust – on which the unitholder will have to pay tax - and an amount from the company on which tax has already been paid.

The structure of the A-REIT Index in Australia

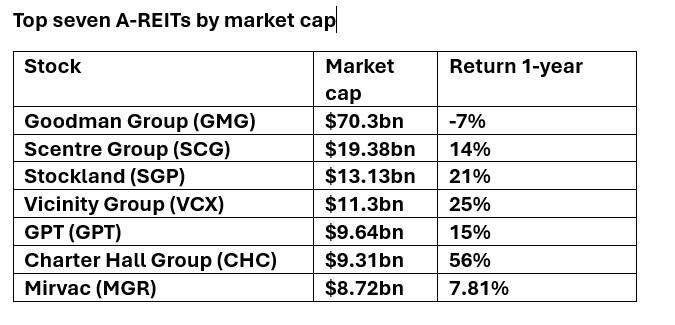

Not unlike Australia’s mining or banking sectors, the A-REIT 200 Index is also highly concentrated with the top 7 of the total 31 stocks (by market cap) accounting for 81.75% of the entire index by value.

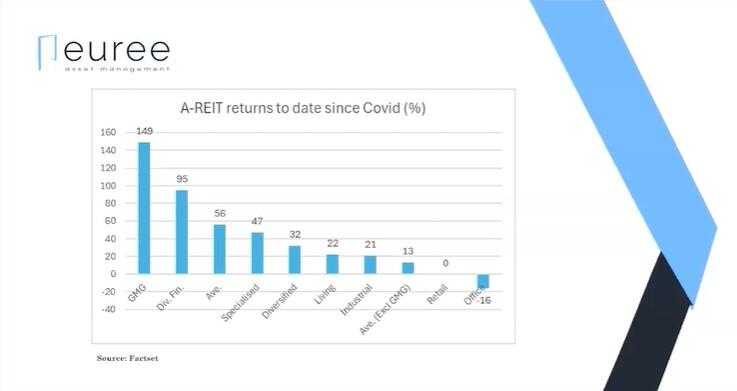

Given that Goodman Group (ASX: GMG) alone accounts for around 40% of the index, it’s easy to see what impact it has on the overall index, especially when it delivers negative returns.

Generally, from an equity exposure perspective, institutional investors don’t typically need exposure to the smaller A-REIT stocks within this sector and as such tend to concentrate on these top seven players.

Sector concentration

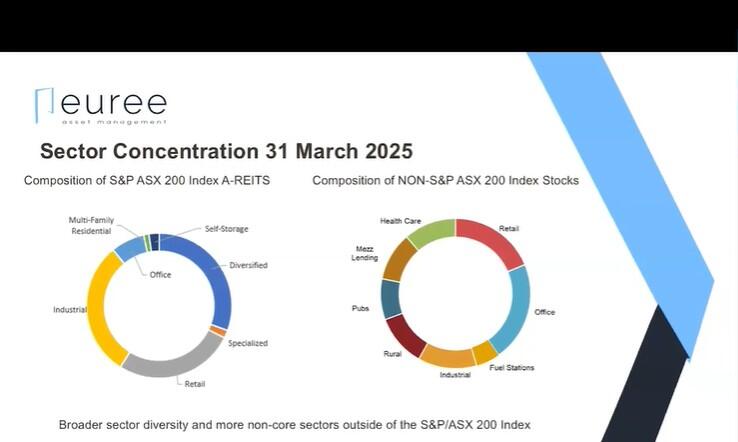

Given the size of the Goodman Group, it's easy to see why the composition of sectors held by A-REITs [on the ASX200 Index] tends to be dominated by industrial, retail and diversified sectors.

However, drill down into the non-ASX 200 A-REIT stocks and there is much greater exposure to some of the newer asset classes beyond the three traditional sectors - commercial, industrial and retail - into sub-sectors like rural, pubs, mezz lending, healthcare, and fuel stations.

Main benefits of investing in A-REITs

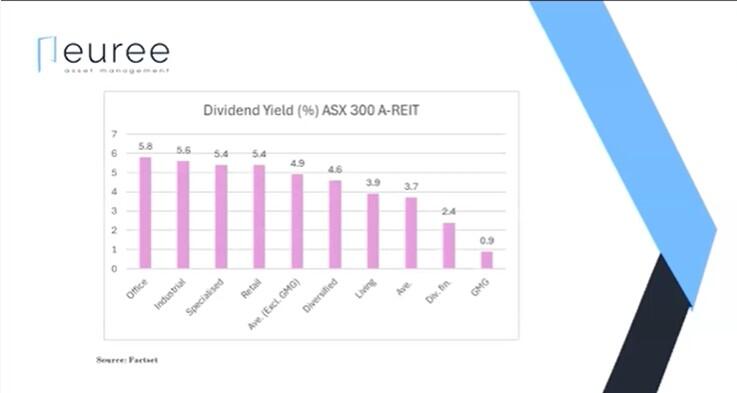

Diversification, liquidity, and low-entry access to these asset classes - with relatively little capital outlay - aside, the other key benefit of investing in A-REITs is yield.

Unlike residential property, where a low yield is typically offset by higher future capital gains, A-REITs tend to pay attractive yields.

What's in store for the sector?

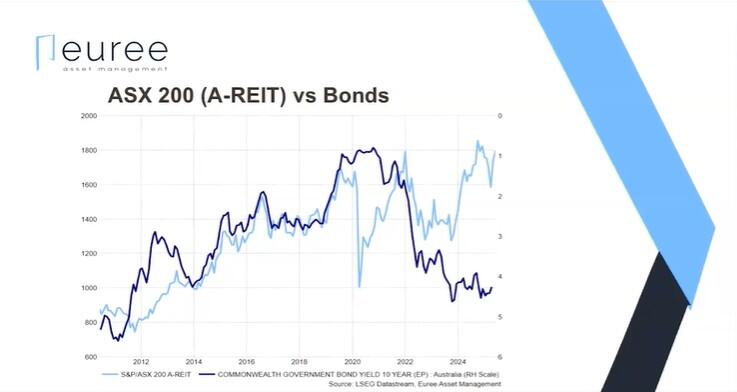

On a positive note, the S&P/ASX 200 Real Estate Index (XRE) has managed to bounce progressively higher since early February this year after the RBA announced its first rate cut since November 2020.

However, with the XRE trading roughly where it was in late December 2021, it’s clear to see that the sector still has a lot of lost ground to take make up - and this is where falling rates will definitely help.

Unlike the bond market, A-REITs will on go benefitting from falling rates later this year.

This has already started to play out over the last few months with the larger stocks within the sector already posting some strong gains.

More to come: Watch out for part-two next week which drills down into individual A-REIT stocks.