Inflation has eased more than expected, opening the door for rate cuts, Reserve Bank Australia data indicates.

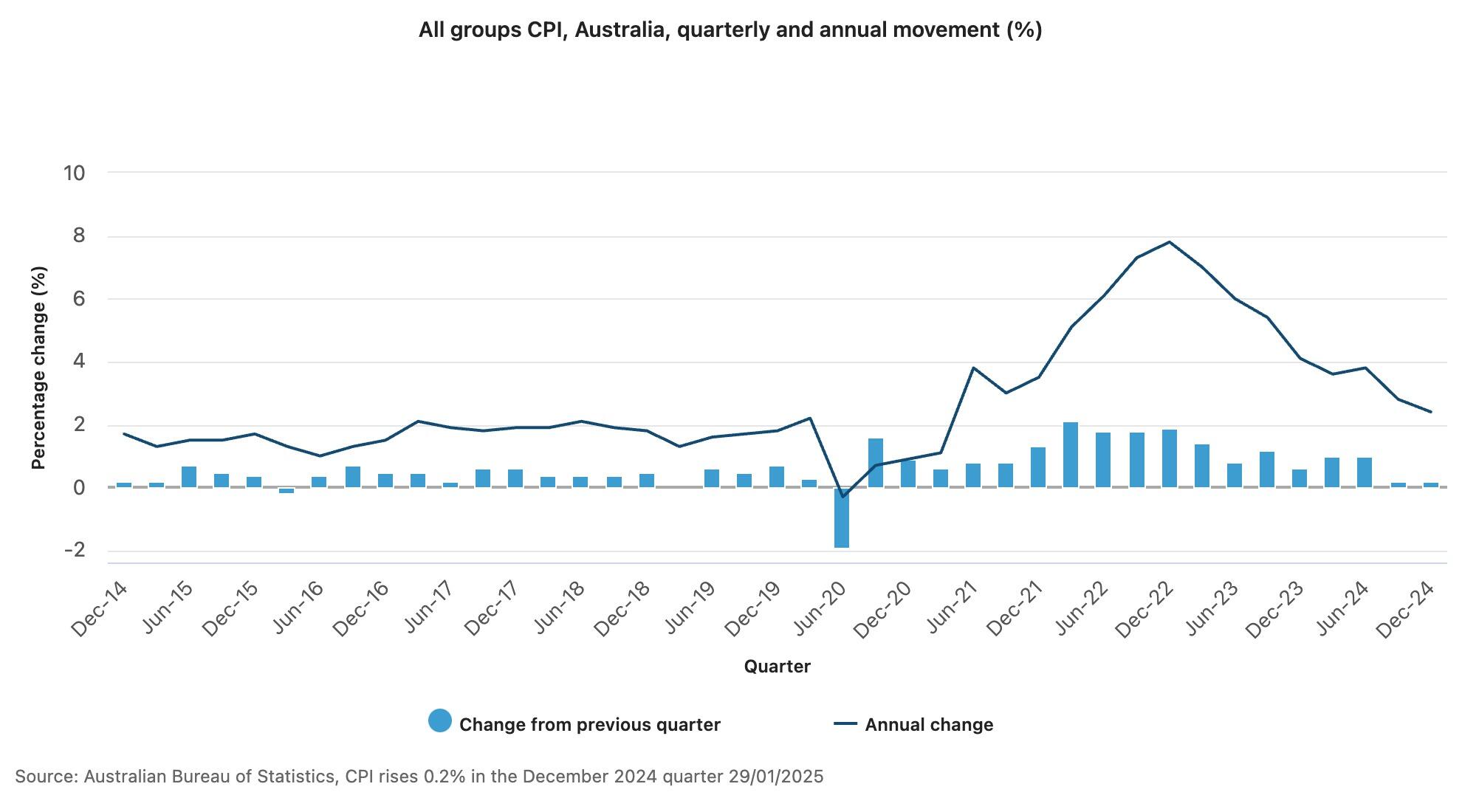

According to the RBA’s consumer price index, the consumer price index (CPI) rose 2,4% in 12 months to the December 2024 quarter, marking the lowest annual rise since March 2021 and the lowest quarterly rise (0.2%) since July 2020.

The most significant rises for Q4 2024 were recreation and culture (up 1.5%) and alcohol and tobacco (up 2.4%), with the overall rise partially offset by a decrease in housing (down 0.7%) and transport (down 0.7%).

This is set to give the RBA confidence to begin the rate-cutting cycle in February, with underlying inflation on track to return sustainably to the RBA’s 2-3% target.

“Overall, you can see that the rebates have had a big impact in terms of reducing the cost of living in certain areas, particularly around the housing and energy side of things,” Westpac senior economist, Justin Smirk said.

Westpac chief economist, Luci Ellis said the data points to earring cost of living pressures for Australians as inflation is now at its lowest annual rate since the start of 2022.

“The better-than-expected inflation data tilts the balance of probabilities back in February’s favour,” Westpac Chief Economist Luci Ellis said in a note.

“We have just enough evidence to conclude that disinflation has proceeded faster than the RBA expected, so the Board will have the required confidence to start the rate-cutting phase in February.”

The recent falls have been aided by electricity rebates and other cost-of-living relief measures offered by the federal government.

“The 2024-25 Commonwealth Energy Bill Relief Fund rebates led to a large fall in electricity prices this quarter,” Australian Bureau of Statistics (ABS) head of price statistics, Michelle Marquardt said.

“Without the rebates, electricity prices would have risen 0.2% this quarter.”

The annual price of trimmed mean inflation eased to 3.2% year-on-year in Q4, down from the 3.6% annual rise posted in the previous quarter.

Despite all signs pointing towards February rate cuts, the strength of the labour market means the timing could be extended to May, allowing the RBA more time to asses relevant economic indicators.

However, Bloomberg Economics economist, James McIntyre, is confident that the RBA will cut interest rates.

“The downside miss to the RBA’s projections will likely prompt the central bank to trim its inflation forecasts by enough to greenlight the beginning of its easing cycle despite recent robust labour market readings,” McIntyre said.