Analysts at the ANZ bank (ASX: ANZ) have finally broken ranks with their peers and flagged a 25-basis point rate cut to 4.1% when the Reserve Bank (RBA) meets on the first Tuesday of February.

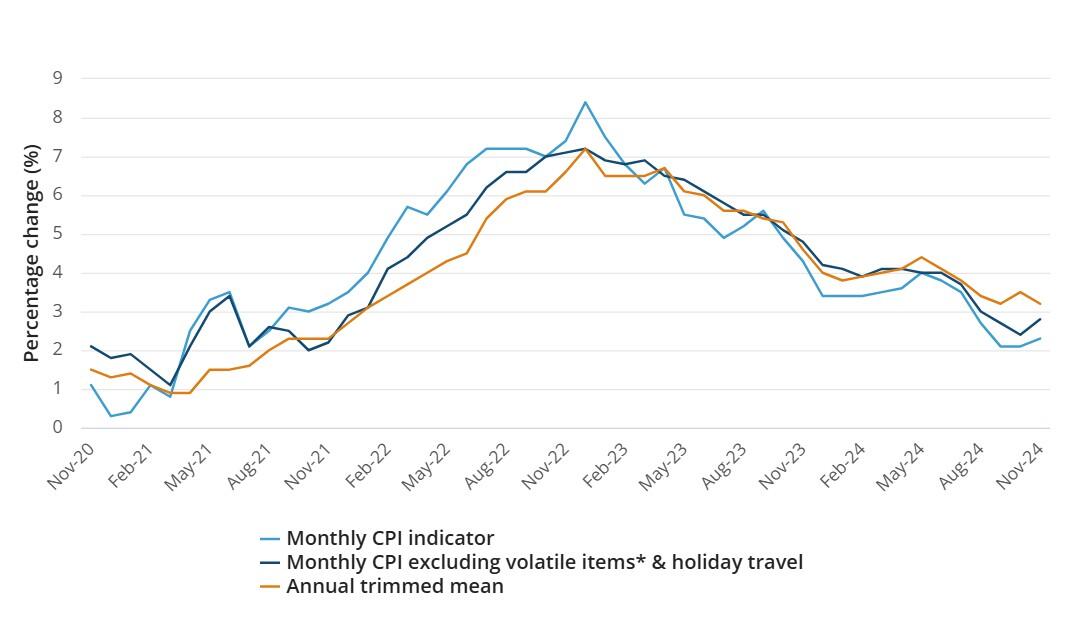

While there were no surprises in November - headline inflation (CPI) figures were up from 3.1% to 3.2% - most economists were more fixated on the trim mean (quarterly) numbers which were softer than the market expected.

As a result, ANZ has preempted the all-important 29 January ABS data release on the expectation that the quarter-on-quarter will come in 0.5% lower in the three months to December to.3.3%, just below the Reserve Bank’s (RBA) 3.4% forecast.

The significance of this result can’t be understated given that it would be the lowest result since the June quarter of 2021.

Most economists don’t expect the RBA to kick off the easing cycle until May, however, this may change within the next few weeks. Meanwhile, futures traders are pricing in a 75% chance of a February cut and are all-in on an April cut.

Up to four rate cuts in 2025

While AMP Capital economist Shane Oliver is agnostic to a rate cut in February, it would not surprise him if the RBA decided to move when it next meets 18 February. He told this masthead that such a move would be somewhat unprecedented for Australia in the lead up to a federal election.

On both occasions the RBA has moved rates before an election – 2007 and 2022 - they’ve gone up. Unsurprisingly, Oliver suspects a move in either February or April – or both – may signal to the market that the economy is pretty good, and by default boost Labor’s election prospects.

But regardless of whether the RBA moves in February or April, Oliver expects to see three to four rate cuts this year, taking the cash rate down to 3.35%.

“This would be good news for long-suffering mortgage holders and I’d expect banks to move on either the Friday or the Monday following the result,” Oliver told Azzet.

“The only problem for mortgage holders is that rates won’t drop to anywhere near pandemic levels in 2021.”

After three to four cuts, Oliver expects mortgage rates to revert back to around the 5% to 5.25% level.

Cuts now could be reckless

However, with inflation still lingering at current levels, Warren Hogan chief economic adviser at Judo Bank believes any rate cuts in the foreseeable future could be the most dangerous economic decision in 30 years.

Despite more favourable inflation results, Hogan is concerned that the RBA’s next move could be a knee-jerk reaction to mounting community and political pressure. Based on Hogan’s base case forecasts, the earliest rate cut would be around November this year.

“As an Australian, my concern is that it’s inflation and not interest rates that’s hurting the economy,” Hogan told Azzet.

To Hogan, it makes little sense why the RBA would move interest rates ahead of a new board line up in March.