In today’s unpredictable financial landscape, volatility is not just an occasional blip - it has become the norm.

As markets swing with economic shifts, political uncertainties, and global events, both traders and investors seek ways to protect their portfolios while still remaining engaged with potential gains.

One of the most effective tools to navigate this terrain is hedging. In essence, hedging is akin to purchasing an insurance policy for your investments: while it may not eliminate risk entirely, it can significantly reduce the potential for steep losses when markets turn adverse.

What Is Hedging?

At its core, hedging is a risk management strategy. It involves taking a position in an asset that will likely move inversely to another position you hold.

This counterbalancing move minimises the negative impact of adverse price movements on your overall portfolio.

For example, if you own stocks that might decline in value, you might hedge that risk by investing in an asset that tends to hold or appreciate during downturns.

The Broader Context: Why Hedge?

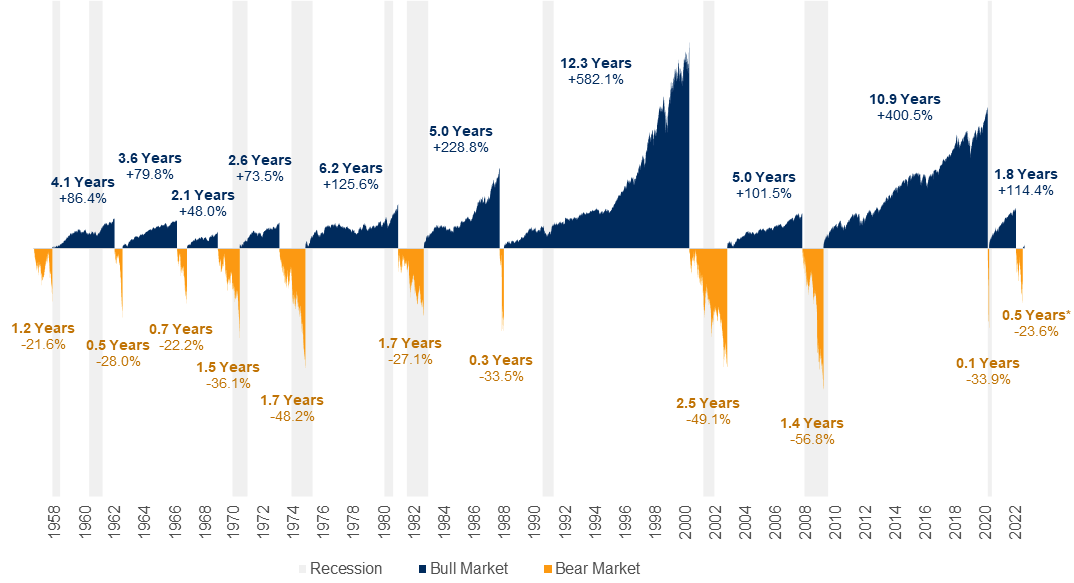

While many long-term investors prefer to ride out short-term fluctuations, hedging is particularly popular among short and mid-term traders, as well as market participants who require protection against adverse moves without exiting the market entirely.

Hedging becomes a crucial part of managing individual risks and overall uncertainty that comes with market participation.

As market volatility rises, the role of hedging transforms from a mere defensive tactic into a strategic advantage. This enables investors to stay exposed to market gains while mitigating downside risk.

Key Motivations Behind Hedging

Risk Reduction

The primary purpose of hedging is to minimise potential losses. By taking offsetting positions, investors can protect their portfolios from extreme fluctuations, ensuring that a downturn in one asset does not lead to catastrophic losses.

This is particularly critical during economic uncertainty or when market trends shift unexpectedly.

Maintaining Market Exposure

Rather than liquidating positions during periods of volatility, hedging allows investors to remain in the game. This means you can safeguard your portfolio while still participating in potential upside when the market recovers.

This dual approach is invaluable for those who want to be “in the market” at all times but require a safety net during turbulent periods.

Opportunistic Gains

Beyond just protection, hedging can also create opportunities. Some strategies, like strategic shorting or volatility trades, not only guard against losses but can also generate returns when executed properly.

This dual function makes hedging an appealing strategy for both risk-averse investors and those seeking to capture market inefficiencies.

Common Hedging Strategies

Let’s explore several straightforward defensive strategies that can be applied by individual investors and professional traders wishing to hedge their positions in the market. Each of these methods is designed to suit different risk profiles and market conditions.

Diversification

One of the simplest yet most effective hedging strategies is diversification. By spreading your investments across a variety of asset classes - stocks, bonds, real estate, commodities, and even alternative investments - you can mitigate the risk that a downturn in one segment will devastate your overall portfolio.

Diversification naturally acts as a hedge because factors influencing different asset classes are rarely perfectly correlated.

The idea is that while any single asset may be subject to volatility, a well-diversified portfolio can weather a range of market conditions more effectively.

Hedging with Contracts for Difference (CFDs)

Hedging with CFDs is a strategy to mitigate potential losses in an investment portfolio by taking an opposing position in a correlated asset.

This approach aims to offset adverse price movements, thereby reducing overall risk.

CFDs are financial derivatives that allow traders to speculate on the price movements of various assets without owning the underlying asset. By entering into a CFD, you agree to exchange the difference in the asset's price from the contract's opening to its closing.

This mechanism enables both long (buy) and short (sell) positions, providing flexibility in hedging strategies.

Consider you hold a portfolio of stocks and anticipate a short-term market downturn. Instead of liquidating your holdings, you can open short positions using CFDs on the same stocks or a relevant stock index.

If the market declines, the gains from your short CFD positions can offset the losses in your portfolio, effectively hedging your exposure.

Inverse ETFs and Managed Funds

Inverse ETFs are designed to move opposite a benchmark index. When the market declines, an inverse ETF is structured to help you compensate for losses in your primary investments.

Managed funds that incorporate hedging strategies might also utilise derivatives and other instruments to protect against downturns.

This strategy is particularly useful for investors who prefer a hands-off approach to hedging.

Instead of managing individual positions, you can invest in a fund that automatically adjusts its holdings to counter market declines.

These strategies are popular among those who want an accessible introduction to hedging without navigating derivatives trading.

BetaShares is the sole issuer offering ASX-traded Bear funds, with three options available:

- Australian Equities Bear Hedge Fund (ASX: BEAR): Seeks an unleveraged return negatively correlated to the Australian sharemarket, with a daily correlation between -90% and -110%.

- Australian Equities Strong Bear Hedge Fund (ASX: BBOZ): Aims for magnified negative returns on the Australian sharemarket, with a daily correlation between -200% and -275%.

- U.S. Equities Strong Bear Hedge Fund – Currency Hedged (ASX: BBUS): Targets amplified negative returns on the U.S. sharemarket, with a daily correlation between -200% and -275%.

Trading Safe Havens

Safe-haven assets are those that hold their value - or even appreciate - during times of economic stress.

Gold, for example, is widely recognised as both a safe haven and a hedge. When markets plunge or the U.S. dollar depreciates, gold prices often rise, providing a buffer against broader market losses.

Academic research, such as that by Baur and Lucey, underscores gold’s role as a premier hedge against stock market crashes, noting its consistent performance following market downturns.

Other safe-haven assets include government bonds and currencies which are viewed as stable.

Safe havens are straightforward: by holding assets that perform well in uncertain times, you reduce your portfolio’s overall volatility and protect your capital.

Conclusion: Balancing Risk and Reward

Financial hedging is much more than a safety net - it’s a strategic tool that can help investors and traders navigate the inherent uncertainties of the market.

Whether through the use of inverse ETFs, CFDs, safe-haven assets, or old-school diversification, the underlying goal remains the same: to protect your portfolio while still taking advantage of potential market gains.

As you consider incorporating hedging into your investment strategy, remember that it is not about eliminating risk entirely.

Instead, it is about managing that risk effectively, ensuring that short-term volatility does not derail your long-term financial objectives.

Ultimately, embracing a thoughtful hedging strategy can empower you to face market uncertainty with confidence. This will transform potential setbacks into opportunities for growth and learning.

By balancing risk and reward, you safeguard your investments and position yourself to thrive in an ever-changing financial world.