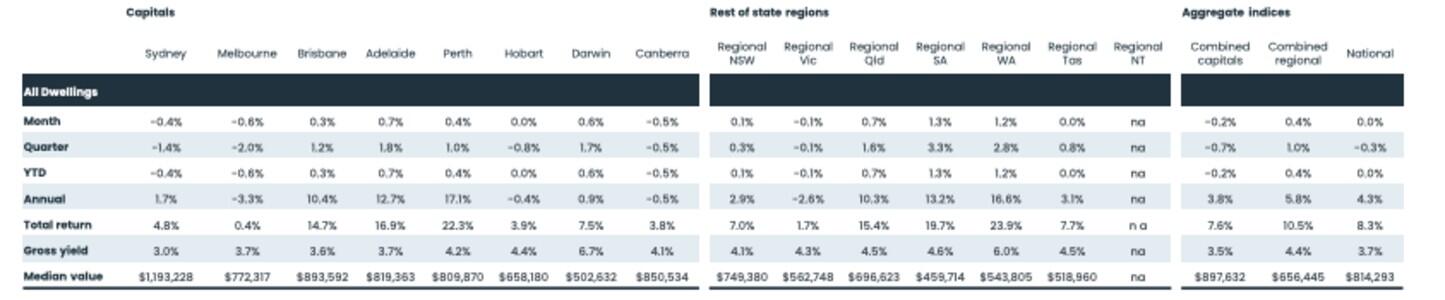

Dwelling prices across regional Australia rose a record 0.4% in January.

According to CoreLogic research, while regional areas experienced a sharp increase in dwelling values, capital cities held steady, falling 0.2%.

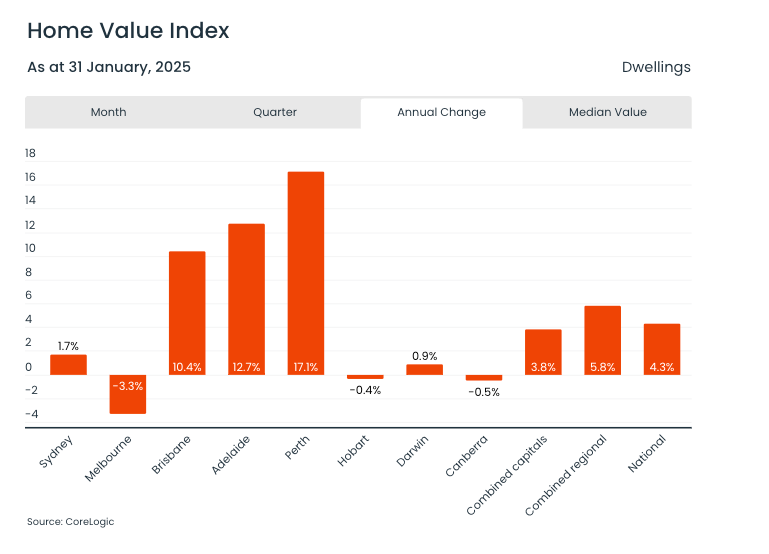

The cities that experienced the sharpest declines were Melbourne (-0.6%), the ACT (-0.5%) and Sydney (-0.4%) with Hobart values remaining steady.

While Perth and Brisbane continue to record home value growth, there has been a clear and steady loss of momentum.

Adelaide led the capitals with growth of 4.8% over the last six months. CoreLogic’s research director, Tim Lawless said Perth records a slower rate than Brisbane and Adelaide over the rolling quarter.

“In the June quarter of 2024, growth in Perth home values was 7.1%, easing back to just 1.0% growth in the three months to January,” Lawless said.

While growth in national home values held steady in January, there has been 4.3% growth since this time last year. Three capital cities, Melbourne, the ACT and Hobart, all showed declines while Sydney (1.7%) showed the largest annual gain since June 2023.

Despite experiencing a slowing growth trend, the aggregate ‘combined regionals’ index shows regional housing markets have been recording stronger monthly growth trends than capital cities.

Lawless said a key factor in this is hybrid working arrangements. The ABS reported that 36.3% of employed people work from home which is down from COVID highs, but above the 32.1% reported in 2019.

“Regional markets seem to be benefitting from a second wind of internal migration, along with an affordability advantage in some markets, and what looks to be some permanence in hybrid working arrangements across some occupations and industries,” Lawless said.

CoreLogic’s national Home Value Index (HVI) is now down 0.3% from record highs in October last year.

Lawless said the likelihood of a significant growth cycle over the coming year remains low.

"Low mortgage rates and a subsequent lift in borrowing capacity as well as an undersupply of newly built housing could be setting the foundations for a relatively shallow housing downturn,” Lawless said.

“But the easing cycle for interest rates is likely to be a gradual one, and we also have the ongoing headwinds of affordability constraints, normalising population growth and generally soft economic conditions to contend with.

Sydney has the highest median dwelling price at A$1,193,228 and the national median dwelling price is $814,293.

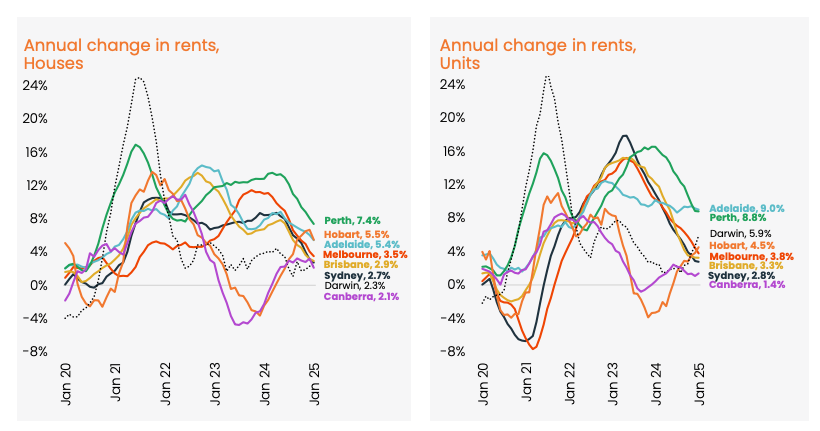

The six-month trend of rental growth has also turned negative in both Melbourne (-0.4%) and Sydney (-0.6%), with all other capital cities recording a clear slowdown in rental growth, with overseas migration and larger households easing demand.

“Finally, renters are seeing some relief after a period of extreme rental growth,” Lawless said.

“Over the past five years capital city rents have surged by 37%. The previous five-year period saw rents rise by just 5%.”