It is one of the most highly-waited, widely-read and well-respected investment publications each year.

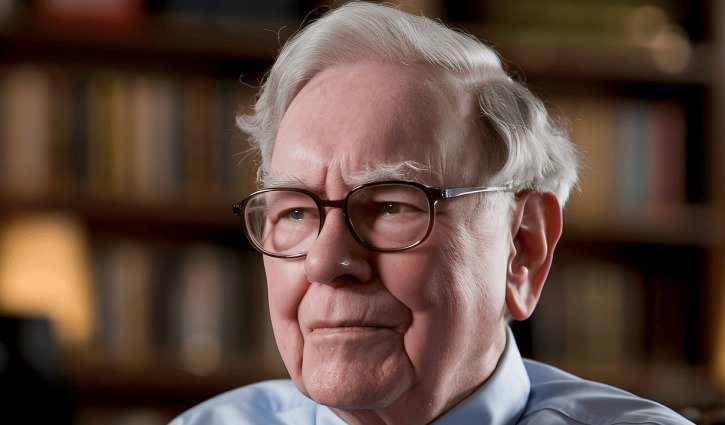

Since 1965, Warren Buffett has been writing a letter to shareholders of Berkshire Hathway Inc, the American insurance and investment conglomerate he heads at the age of 94.

Had Buffett not been as successful as he is, arguably the world’s most famous investor and one of its wealthiest people with a net worth of about US$150 billion (A$234 billion), it may not have attained the status it has.

The letter, which carries a copyright, is near the front of the company’s 2024 annual report, a 150 document which is black and white but for the navy front cover.

This year’s letter includes stories about:

- investment and hiring mistakes

- a “remarkable businessman” who died last year

- reinvesting profits, rather than paying dividends, for all but one year since 1965

- the record tax payments from reinvesting to generate taxable income

- the investment philosophy

- Berkshire Hathaway’s role in enabling America’s capitalist system, and

- his 91-year-old sister using a walking cane to stop men “hitting” on her.

Buffett said Berkshire Hathaway would continue to invest most of its funds in equities, although some people viewed its cash position as “extraordinary”.

The company’s insurance and other businesses had $318.0 billion of cash, cash equivalents and U.S. Treasury Bills, net of payables for unsettled purchases, at 31 December 2024, up 97% from $161.3 billion a year earlier.

The other businesses are involved in utilities and energy, freight rail transportation, manufacturing, services and retailing activities.

“That preference won’t change. While our ownership in marketable equities moved downward last year from $354 billion to $272 billion, the value of our non-quoted controlled equities increased somewhat and remains far greater than the value of the marketable portfolio,” he wrote in the letter.

“Berkshire shareholders can rest assured that we will forever deploy a substantial majority of their money in equities – mostly American equities although many of these will have international operations of significance.

“Berkshire will never prefer ownership of cash-equivalent assets over the ownership of good businesses, whether controlled or only partially owned.”

Buffett also wrote about the company’s property casualty insurance, increased Japanese investments, and the annual shareholders meeting to be held on 3 May in Omaha, Nebraska.

As for declaring its only cash dividend of 10 cents per share on 3 January, 1967, he said: “I can’t remember why I suggested this action to Berkshire’s board of directors. Now it seems like a bad dream.”