Goldman Sachs Group has reported a 22% increase in net earnings for the second quarter (Q2) of the 2025 financial year (FY25) as investment banking and equity revenue surged.

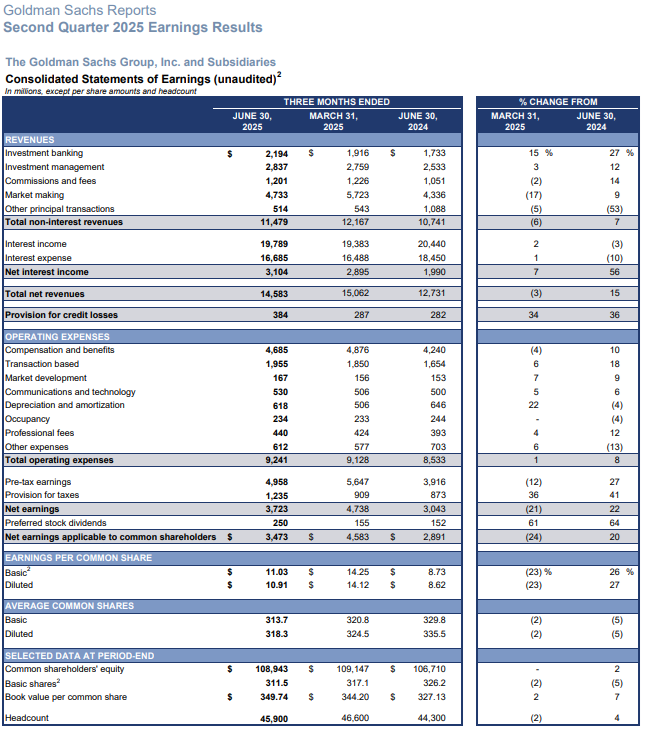

The investment bank said net earnings rose to US$3.72 billion (A$4.68 billion) in the three months to 30 June 2025 from $3.04 billion in the previous corresponding period (pcp).

Diluted earnings per share (EPS) surged 27% to $10.91 as net revenues lifted 15% to $14.58 billion due to a 24% increase in Global Banking & Markets revenue, partially offset by a 3% reduction in Asset & Wealth Management revenue.

Annualised return on average common shareholders’ equity (ROE) was 12.8% for the second quarter and 14.8% for the first half of FY25.

In the six months to 30 June, net income rose 18% to $8.46 billion and diluted EPS jumped 24% to 25.07 cents on net revenue which increased 10% to $29.65 billion, compared with the pcp.

Goldman Sachs said net revenue grew 26% from investment banking due to significantly higher advisory fees, 36% from equities as a result of intermediation and financing and 9% from fixed income, currency and commodities (FICC) despite significantly lower mortgage and commodities revenues.

Chairman and CEO David Solomon said the strong results reflected healthy client activity levels across Goldman Sachs’ businesses, differentiated franchise positions and its people's talent and commitment.

“At this time, the economy and markets are generally responding positively to the evolving policy environment,” Solomon said in a press release.

“But as developments rarely unfold in a straight line, we remain very focused on risk management.

“Given the strategic decisions and investments we’ve made, we continue to believe that the firm is well positioned to perform for our shareholders.”

Solomon said the deal-making environment had been remarkably resilient and although activity was slower in the first half of the quarter, merger and acquisition volumes for the year to date were 30% higher and 15% greater than the comparable five-year average.

"The higher investment banking backlog suggests potential for strong deal flow in coming quarters," CFRA Research Director Kenneth Leon was quoted in a Reuters story as saying.

Solomon said although the quarterly performance was quite strong it should not be interpreted to mean every quarter would be this strong.

Q2 EPS of $10.91 beat the average analyst estimate of $9.59 while revenue of $14.58 billion was above the consensus estimate of $13.51 billion.

Goldman Sachs shares (NYSE: GS) closed $6.31 or 0.90% higher at $708.82 on Wednesday (Thursday AEST), capitalising the company at $217.5 billion, before easing to $707.30 in after-hours trading.