In another effort to curb the country's housing crisis, the Australian Government has announced it will ban foreign investors from buying established homes and curb land banking practices for at least two years.

The ban’s purpose is for Australians to be able to buy homes that would have otherwise been foreign owned and is part of the Albanese Government’s $32 billion Homes for Australia plan that kicked off on July 1 last year.

Foreign purchases far outweigh sales

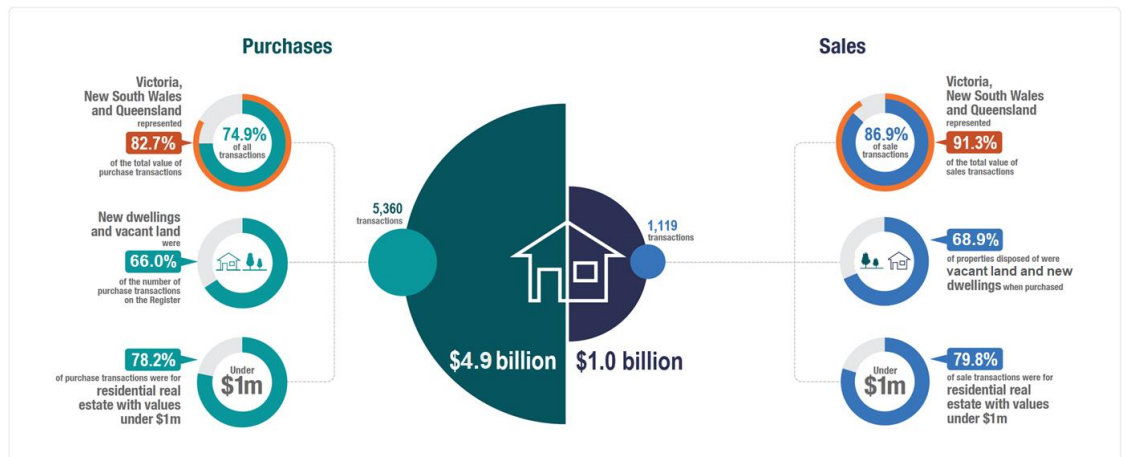

According to the Foreign Investment Review Board (FIRB), during FY23 there were 5,360 residential real estate purchases with foreign ownership, valued at $4.9 billion, with the lion's share in NSW, Victoria and Queensland.

Meanwhile, residential sales transactions were just 1,119, valued at $1 billion.

Freeing up the market

The Albanese government will also stop foreign land banking - the art of buying up large blocks of undeveloped land on the cheap and waiting until it becomes highly sought after - usually due to urban sprawl.

Leaving these large swathes of land undeveloped can actually slow an area’s value increase and market changes can significantly impact returns on investment.

“Alongside the temporary ban on foreign purchases of established dwellings, we will tackle land banking by foreign investors," O’Neil said.

“We’re cracking down on land banking by foreign investors to free up land to build more homes more quickly.”

Foreign investors are subject to development conditions when acquiring vacant land in Australia to ensure that it is put to productive use within reasonable timeframes.

Foreign ownership tweaks

Federal Housing Minister Clare O’Neil says the government is coming at the housing challenge from every responsible angle.

“This is all about easing pressure on our housing market at the same time as we build more homes,” O’Neil said.

“These initiatives are a small but important part of our already big and broad housing agenda which is focused on boosting supply and helping more people into homes.

“We’re banning foreign purchases of established dwellings will be banned from April 1 2025 - March 31 2027, upon when a review will be undertaken to determine whether it should be extended beyond that point.”

Until now, foreign investors have generally been barred from buying existing property except in limited circumstances, such as when they come to live here for work or study.

When the changes come into effect, foreign investors (including temporary residents and foreign‑owned companies) will no longer be able to purchase an established dwelling in Australia while the ban is in place unless an exception applies.

“We will also bolster the Australian Taxation Office’s (ATO) foreign investment compliance team to enforce the ban and enhance screening of foreign investment proposals relating to residential property by providing $5.7 million over 4 years from 2025–26,” O’Neil said.

“This will ensure that the ban and exemptions are complied with and tough enforcement action is taken for any non‑compliance.”

The Government is providing ATO and Treasury $8.9 million over four years from 2025–26 and $1.9 million annually from FY30 to implement an audit program and enhance their compliance approach to target land banking by foreign investors.