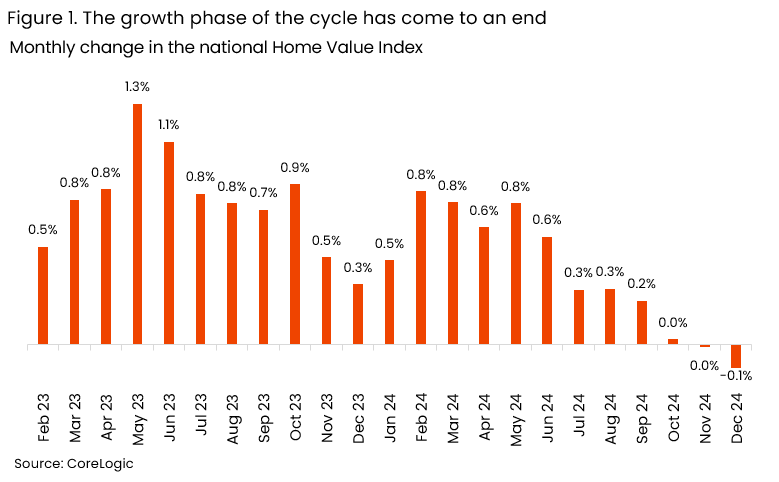

For the first time in two years Australian house prices have officially swung into the negative with a 0.1% decline in December, according to fresh data from CoreLogic.

On the back of a solid 21 months of growth that pushed national house values up 14.3%, CoreLogic’s Home Value Index (HVI) has finally recorded declines.

After peaking in October, the HVI steadied in November (-0.01%) and recorded a 0.1% decline in December last year.

The brakes are being put on housing demand, CoreLogic Head of Research Eliza Owen says, due to a growing gap between income, borrowing capacity and home values - exacerbated by slowing economic growth and ‘higher-for-longer’ interest rates.

“The start of a cyclical downturn is unsurprising, as monthly home value growth has slowed since June 2024,” Owen says.

There have been other market shifts to factor in too.

Total listings levels across the country finished 2024 5% higher than a year ago and selling times rose through the December quarter, up to 33 days from 28 days a year ago.

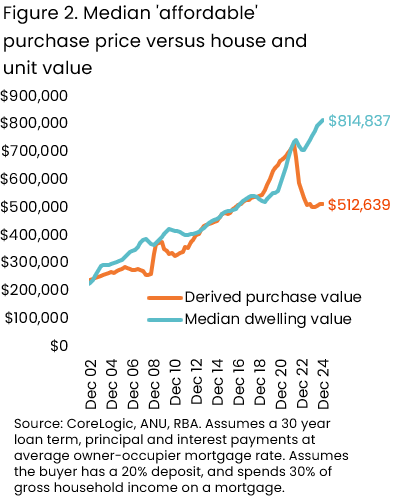

Owen says one way to look at the divergence from growth trends is to consider an 'affordable' purchase price for the median income household in Australia.

That’s calculated on 30% of before-tax income spent on a mortgage, assuming current interest rates and a 20% deposit.

The differences are stark. The derived affordable price would be $513,000, while the national median dwelling value sits at $815,000.

Owens says historically these gaps converge as housing values drop or purchasing capacity improves through higher incomes or lower interest rates.

“For nearly two years, this gap may have been sustained by buyers less affected by interest rates, such as those using resale profits or higher-income buyers," CoreLogic's research head notes.

“Some buyers may have been willing to accept higher housing costs in the short term, on the expectation that interest rates would fall.

“However, as lower interest rates have not materialised, housing demand from these buyers may also be waning.”

Is it time to worry?

A cyclical downswing is likely for early 2025 but it may not be large, as the largest recorded decline in the national HVI was only 7.7% from October 1982 to March 1983.

“At the national level, home value declines tend to be shorter and smaller than periods of increase," Owen says.

“Another reason this could be a relatively small market downturn is the tailwinds for property demand in 2025.

“Growth in real incomes may support more buyer demand as inflation moderates, and a reduction in interest rates would boost borrowing capacity.”