Australia’s technology companies reported mixed results today, with Aussie Broadband excelling, while NextDC and Nuix saw a slowdown in profits.

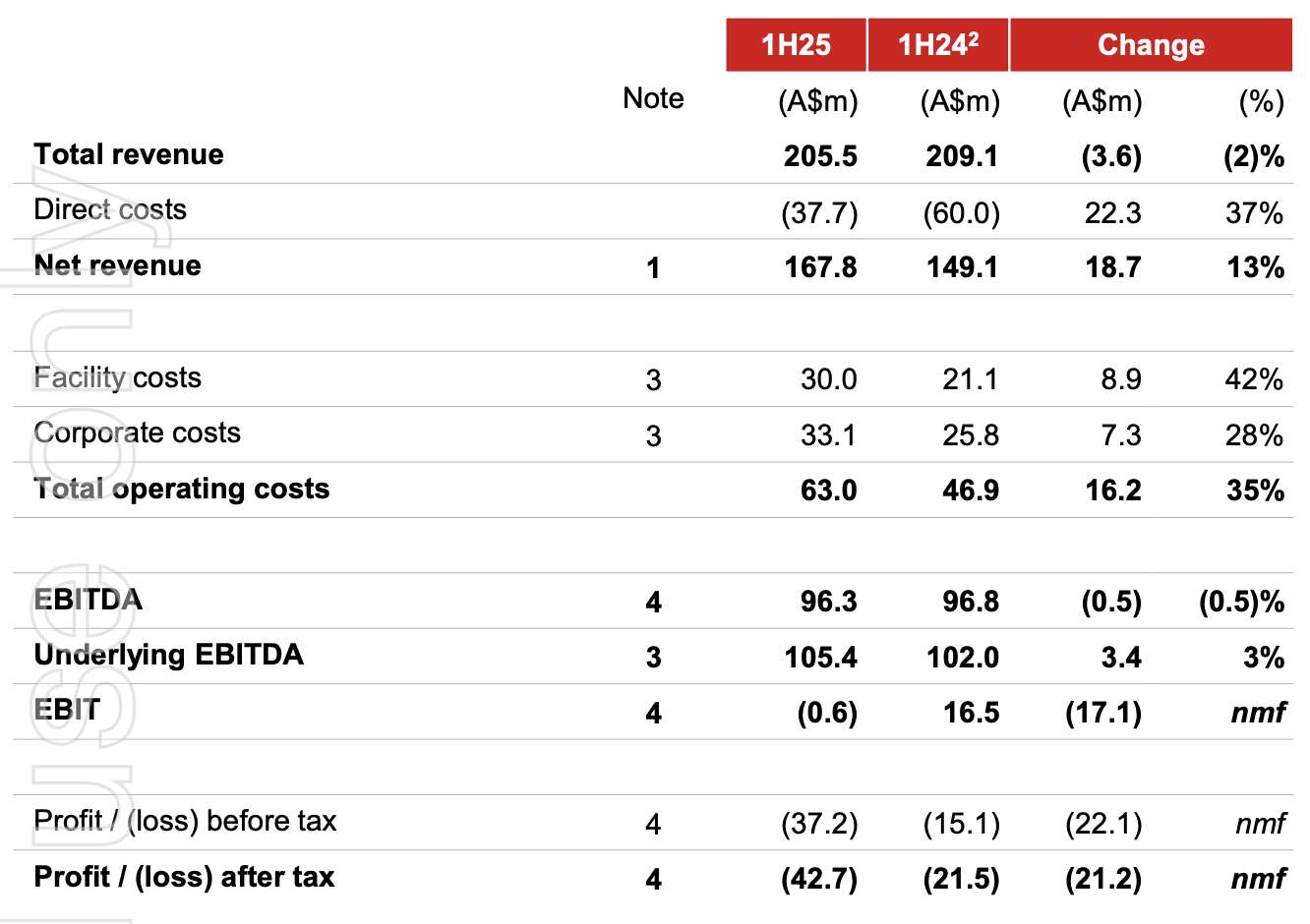

NextDC (ASX: NXT) posted a 13% year-over-year increase in net revenue last half, rising to $167.8 million. Total revenue fell by 2% to $205.5 million, however.

The company saw a loss after tax of $42.7 million, down from 1H FY2024’s $21.2 million.

Its guidance for the full fiscal year remains unchanged, with projected net revenue in the $340-350 million range.

“As the adoption of technologies like generative AI accelerates, NextDC is uniquely positioned to meet the growing demands of the Hyperscalers, our ICT partners and our Enterprise and Government customers,” said CEO Craig Scroggie.

The company also said it would introduce a growth incentive plan for its CEO, executive leadership team, and a select group of senior management.

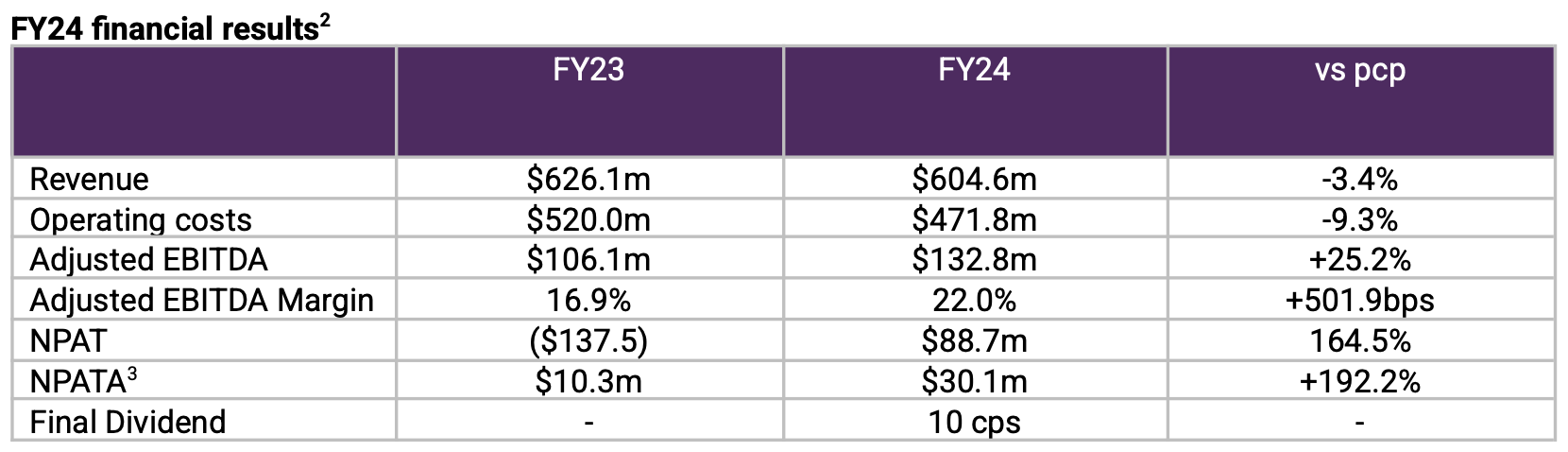

Iress (ASX: IRE) posted revenue across 2024 of $604.6 million, falling from the prior year’s $626.1 million.

Statutory net profit after tax was $88.7 million, compared with a loss of $137.5 million in 2023. Adjusted EBITDA was 132.8 million, up 25.2%.

Iress’ final dividend is $0.10 per share.

The company’s full-year 2025 guidance includes an adjusted EBITDA of $127-135 million.

“Although our formal transformation program is now complete, we remain committed to delivering further operating leverage while we develop new growth vectors in our core markets. Iress is now a simpler, leaner organisation with a more efficient cost base and stronger balance sheet that provides both capacity and flexibility,” said CEO Marcus Price.

Iress sold its superannuation division to Apex Group in January, concluding its effort to streamline its operations.

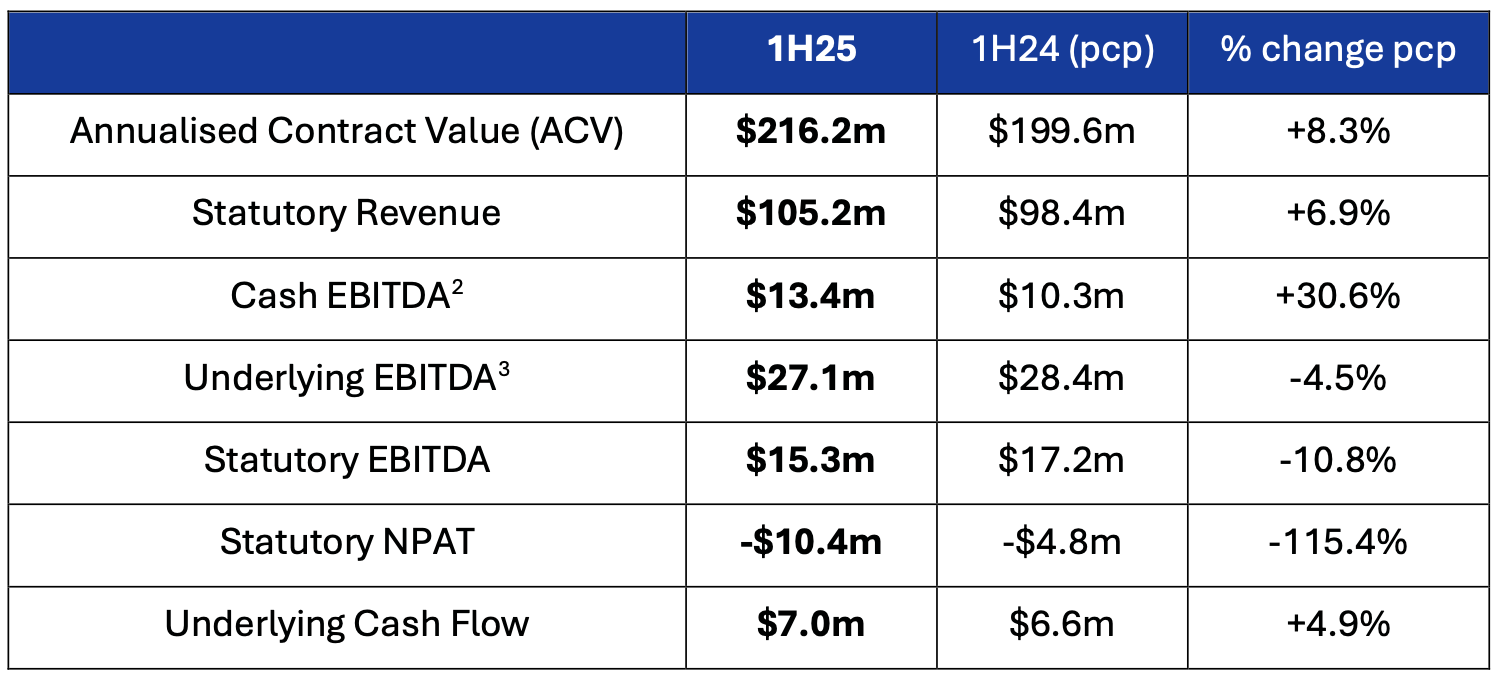

Nuix (ASX: NXL) saw revenue of $105.2 million last half, rising 6.9% year-over-year.

Its net loss after tax was $10.4 million, dropping from a net loss of $4.8 million year-over-year.

Underlying EBITDA fell by 4.5% to $27.1 million, while underlying cash flow grew by 4.9% to $7 million.

“Nuix is deliberately targeting larger, more enterprise-style contracts, offering larger customers significant value realisation through further investment in innovation,” said CEO Jonathan Rubinsztein.

“In the short term, this shift towards more complex and higher-value contracts has meant the lengthening of the procurement cycle for some customers, with some pipeline deals shifting from the first half to the second half.”

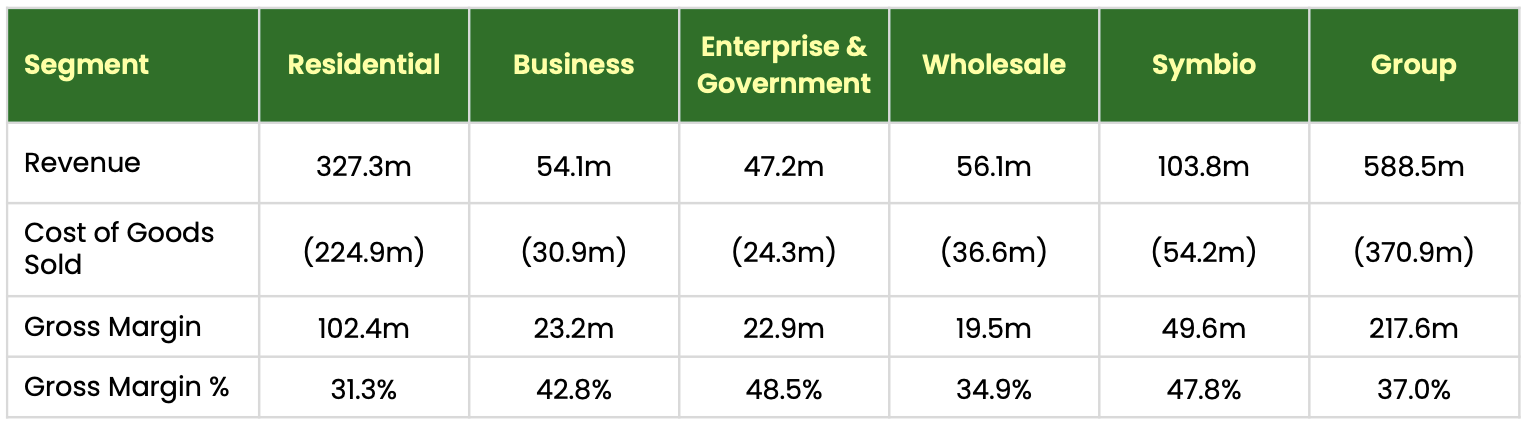

Lastly, Aussie Broadband (ASX: ABB) reported revenue grew by 6.8% year-over-year last half, reaching $588.5 million.

Its underlying EBITDA was $65.8 million, an increase of 8.9%. Total broadband connections were 727,951 at the end of last quarter, up 12.5% year-over-year.

The company has upgraded its underlying EBITDA guidance for the full fiscal year to $133-138 million. Previous guidance was $125-135 million.

“The financial performance of the Group has been aided by a focus on cost management with key advancements in efficiency and productivity,” said managing director Phillip Britt.

Aussie Broadband declared a fully franked interim ordinary dividend of $0.016 per share.

Its share price is $3.89 at time of writing, up 1.57% over its previous close.

Looking ahead, DroneShield (ASX: DRO) is projected to release its audited results in the coming hours. According to its preliminary estimates last month, total revenue in 2024 was $57.5 million, growing 6.3% year-over-year.

DroneShield registered with the United States and Australian governments under AUKUS last week, allowing the company to export its technologies to the U.S. and United Kingdom without an export licence.