Adairs (ASX: ADH) reported strong half-year financial results for the period ending December 2024.

For the first half of FY25, driven by a 6.6% increase in comparable sales, the homewares retailer saw significant growth from both its Adairs and Mocka brands, with strategic leadership changes and operational improvements contributing to increased efficiency and customer satisfaction.

The implementation of a new warehouse management system and a strategic expansion of stores in Australia are expected to bolster future growth.

The company says it is well-positioned for continued success with a focus on enhancing brand awareness and expanding product distribution, as evidenced by Mocka’s trials with a major retailer and the planned opening of its first standalone store.

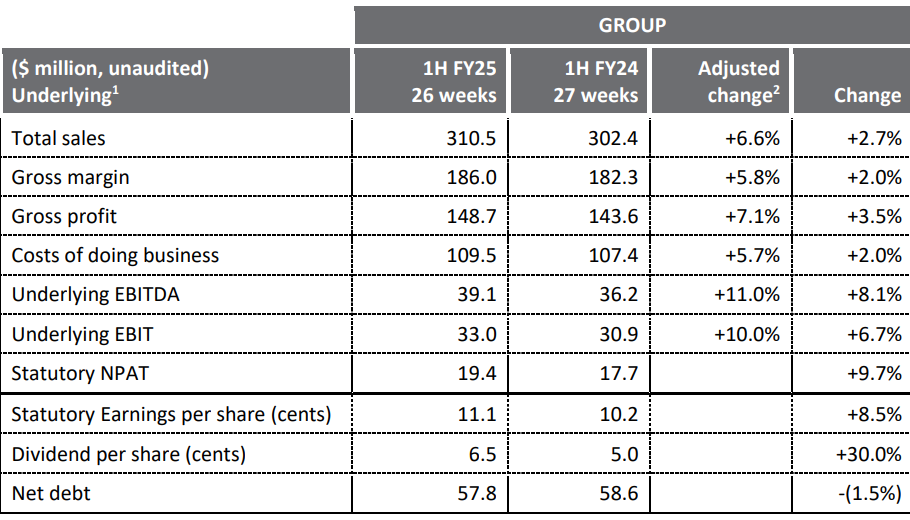

Adairs reported a 2.7% increase in total sales and a 9.7% rise in net profit compared to the previous year. The company announced a 6.5 cent interim dividend, with plans for a dividend reinvestment program offering a 1.5% discount, highlighting a positive financial performance and strategic shareholder engagement.

Meanwhile, Lovisa (ASX: LOV) has announced a rise in revenue to the tune of $405 million, but net profit fell under expectations.

This comes as the discount jewellery retailer is facing a class action lawsuit from former employees.

Net profit growth was expected at 15% to $61.5 million but instead came in at a 6.5% rise of $56.9 million.

Despite store sales only seeing a 0.1% uptick, Lovisa has plans to open more, along with an expanded online presence.

During the first half of the fiscal year it has already opened 25 new stores in Europe and 11 new stores across the United States and South America, with a total store count of 956, with plans open in its 50th market this week with its first store in Zambia.

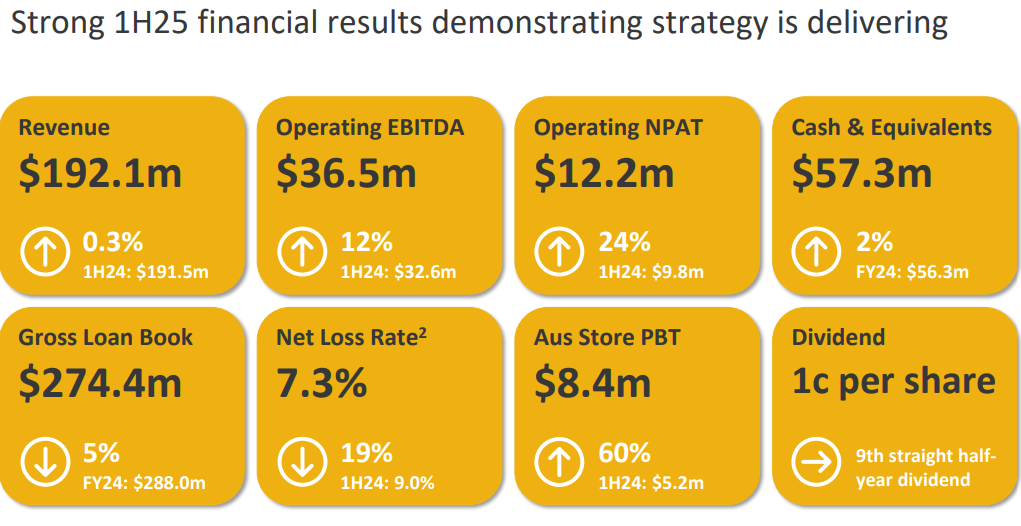

Up next, Cash Converters (ASX: CCV) announced stable revenue in its financial results for the first half of 2025, and a 24% rise in net profit.

The company has been focusing on transitioning its loan portfolio to lower-cost lending solutions, improving credit quality, and expanding its luxury retail offerings.

The successful launch of a luxury-only store in Bondi Junction and strong store performance in Australia and the UK have contributed to its robust earnings growth.

The strategic acquisition of franchise stores in both regions is expected to further enhance its market position and earnings potential.

In entertainment, EVT Limited, (ASX: EVT) parent company for Event Cinemas and Rydges Hotel, beat expectations for half yearly profit by an impressive 83%.

Normalised profit after tax was reported at $31.5 million, up 8.3% year on year, and 83% ahead of consensus forecasts of $17 million.

The strong result saw a subsequent jump in shares to the tune of 11.95% (at 12:30 pm AEDT).

Its entertainment segment also had a record breaking December with a 25.3% for cinema admissions in Australia and a 123.1% increase in earnings for that month.

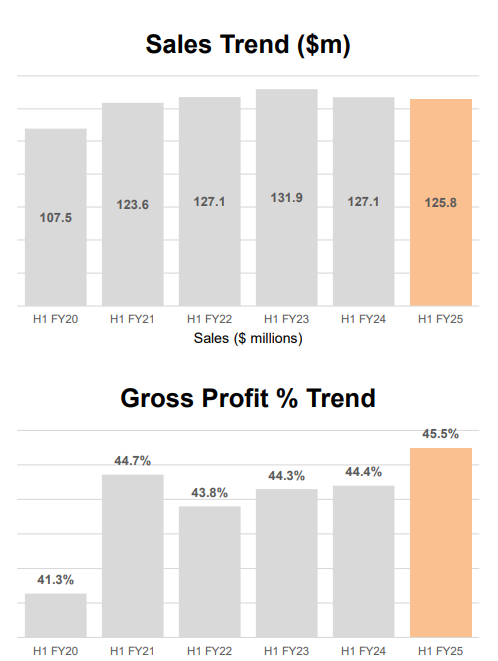

And finally, Shaver Shop (ASX: SSG) reported a slight decline in revenue and net profit for H1 FY25.

Although revenue was down by 1% and net profit fell by 3.5% compared to the year before, it still announced a 100% franked interim dividend of 4.8 cents per share.

This comes after recent reports from analysts that investors in the grooming and hair removal retailer had seen tidy returns of 197% over the last five years.

The announcement report still noted that Shaver Shop had “maintained sales well above pre-COVID levels” and achieved a record 45.5% gross profit margin.